NEW YORK’s all-important November auction season begins this week, when hundreds of Impressionist, modern and contemporary artworks — many valued at $1 million or more — are set to hit the auction block at Christie’s, Sotheby’s, and Phillips. The three houses’ sales are expected to total roughly $1.9 billion to $2.5 billion.

The sales come on the heels of a torrent of material that hit the market in Europe and Asia earlier this fall, often to mixed responses. A grim October sales week in Hong Kong was followed by mediocre results in London. Paris presented a pleasant bright spot, but art market insiders seem to agree that the success of the New York sales season is more an open question than usual. “The market is obviously down,” says Alex Rotter, the chairman of Christie’s 20th century and 21st century art department. “Do I want to say that? No. Do I have to say it to be believable? Yes.”

DEMAND FOR SUPPLY

Because an auction house is at essence a middleman serving as a bridge between buyer and seller, in a down market the houses can be caught in a Catch-22. “Our market is always dictated by the supply,” says Jean-Paul Engelen, Americas president at Phillips. But unless heirs are selling works they’ve inherited from a relative’s estate, or someone is in financial straits, people are less likely to consign their art if they can’t be reasonably certain that it will sell.

One way around this is for an auction house to offer a guarantee that a work will sell for a minimum price, effectively purchasing it before the auction. If no one bids past that minimum when the work hits the auction block, the auction house — or a third party that has guaranteed the work — owns it; if it fetches more than the agreed-upon price, the guarantor gets a percentage of the upside. “More people are electing to take guarantees,” says Brooke Lampley, Sotheby’s global chairman and head of global fine art. She suggests that sellers think of this as an insurance policy. “They should” take a guarantee if it’s offered, she continues. “That’s my advice right now.”

Still, not every work is something an auction house or third party wants to guarantee, and not every seller wants to give away part of the potential profit. So, auction houses might cajole sellers to lower the minimum amount a work can sell for, which is known as the reserve price. “We’re really in a situation where sellers’ expectations are as great as they’ve ever been, and there’s downward pressure from buyers,” Ms. Lampley continues. “I think it’s a positive occasion to address auction strategy with consignors and encourage them to make things enticing — and try to get as many bids as possible.”

LOWER PRICES

Many sellers seem to have done this, so — for the first time in years — comparative deals can be found at the November auctions.

“You’ll see in our sale that some of the prices are already reflective of a slightly different market environment if the consignors were really listening,” Mr. Rotter says. “The ones who wanted to engage are willing to have a real discussion: Should they sell their stocks that are 30% down — or their painting that might also be 20% or 30% down — but still [for]much more than they paid for it?”

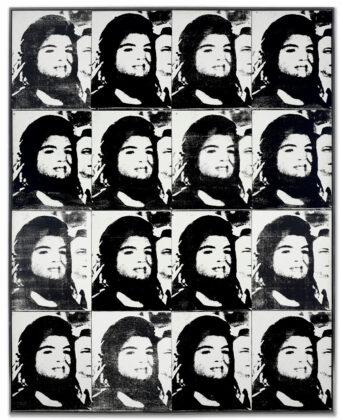

Mr. Rotter points to a Warhol from 1964, Sixteen Jackies. A similar Sixteen Jackies sold two years ago at the Macklowe sale at Sotheby’s for about $34 million. The forthcoming work at Christie’s has a low estimate of $25 million, about 25% less. (Estimates do not include auction house fees known as premiums; totals do.) A superb work by Francis Bacon, “which in my opinion is a $70-million painting in a healthy upmarket, is priced at about $50 million,” Mr. Rotter says.

Similarly at Phillips, a Hero painting by Georg Baselitz from 1966 is estimated at $6 million to $8 million, “which is a conservative estimate,” Mr. Engelen says. “The record is $9 million, which is why I’m confident that it will sell.”

MAJOR LOTS

Not everything carries a bargain-basement estimate. Sotheby’s has a particularly glittering lineup, starting with a single-owner sale on Nov. 8 featuring works owned by the late arts patron Emily Fisher Landau. Leading that sale will be a Picasso from 1932, which the auction house has priced in excess of $120 million. Sotheby’s will also sell a series of major, if slightly more esoteric pieces from the estate of the late collector Chara Schreyer, which includes a hanging work by Lee Bontecou estimated to sell from $600,000 to $800,000 and a 1984 deep basin sink by Robert Gober that carries a $2 million to $3 million estimate. There are other super-high-priced lots on offer: A self-portrait by Jean-Michel Basquiat is expected to sell for $40 million to $60 million.

Hardly slacking, Christie’s will sell art from the estate of music executive Jerry Moss (the M in A&M Records), including an exceedingly rare painting by Frida Kahlo, from 1928, estimated from $8 million to $12 million. Its 20th century evening sale is filled, in particular, with a series of world-class works including a painting from Magritte’s L’empire des lumieres series, estimated at $25 million to $35 million, and Diebenkorn’s Recollections of a Visit to Leningrad, from 1965, which carries an estimate exceeding $25 million.

Even Phillips, normally a showcase for canvases whose paint has barely dried, seems to have moved firmly into trophy territory. “This season, we’re much more blue-chip than cutting-edge,” says Ms. Engelen. The first half of the Phillips evening sale will feature major pieces consigned by the Triton Collection Foundation. Included is a double-sided painting by Léger, which carries an estimate from $15 million to $20 million, and a striking Dubuffet, from 1967, estimated from $4 million to $6 million.

This stellar lineup of lots — some in the same families for decades — has auction house leadership expressing confidence in this season’s success.

“We always say that the art market is resilient in all climates, because many of the opportunities we present are quite literally irreplaceable,” Ms. Lampley says. “That’s real, and it’s what keeps the art market healthy in more challenging economic moments.” — Bloomberg