(Part 5 of a series)

As discussed in this column last Tuesday, the Philippines was the fastest-growing among the top 40 largest economies in the world in Q1-Q3 of 2023. We need to sustain this growth as economies that heavily pivoted to decarbonization and “climatism” (the belief that human use of fossil fuels destroys the Earth’s climate) are either crawling (below 1% growth) or contracting, especially the United Kingdom, France, Italy, Germany, and Sweden.

This piece will cover two energy topics: pricing and revenues of the only remaining private monopoly nationwide, the National Grid Corp. of the Philippines (NGCP), and the endless push for more intermittent wind and solar power due to the “climatism” lobby.

ERC REVIEW OF NGCP REVENUES

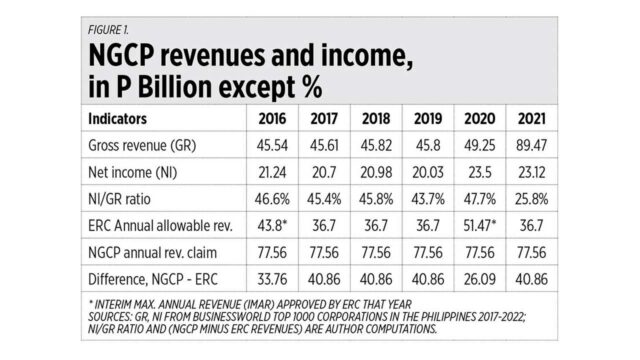

Last week, the Energy Regulatory Commission (ERC) released the preliminary results of its ongoing review of the performance of the NGCP for the Fourth Regulatory Period (4th RP) 2016-2022. The ERC ruled that the total allowable revenues for Phase 1 of 4th RP is P183.49 billion, or an average of P36.7 billion/year. This is way below the NGCP’s claims of P387.80 billion for Phase 1, or an average of P77.56 billion/year, which is larger than the interim Maximum Annual Revenue (iMAR) of P51.47 billion for 2020 initially granted by ERC to the NGCP in a March 2022 issuance.

In simple terms, with the huge difference between the ERC-approved annual revenues and the NGCP claims of annual revenues, the NGCP is possibly over-charging its customers — say, instead of collecting only P0.50/kwh in transmission charges, it is collecting something like P0.80/kwh or higher. So the consumers are worse off, while the NGCP and friends are better off.

The ERC has disallowed many expenses that the NGCP has passed on to consumers such as, for 2016-2020, P1.46 billion for public relations and corporate social responsibility (CSR); P943 million for COVID prevention donations, P800 million for representation and entertainment, etc.

See these reports in BusinessWorld: “ERC caps NGCP allowable revenue at P36.7B annually, well below amount sought by grid” (Nov. 8), and “NGCP says expenses disallowed by ERC are ‘legitimate business costs’” (Nov. 9).

The NGCP’s mandate is to provide Filipinos “safe, efficient, and affordable electricity,” meaning a secure and stable grid so that households and enterprises can avoid blackouts and high electricity prices. A beautiful and direct mandate that it should stick to it. If the NGCP wants to donate to COVID prevention, or do CSR on, say, “climate catastrophe” prevention, these are outside its mandate and should not be billed to customers. It can dig from its huge annual profit (see the Table on this page) to finance these non-mandated functions and expenses.

I again checked the BusinessWorld Top 1000 Corporations, which uses financial statements submitted to the Securities and Exchange Commission yearly. I computed the net income/gross revenue ratio, then compared the ERC-approved vs. NGCP-claimed revenues.

These are huge differences, P26 billion to P41 billion/year. That implies that the transmission charge that we pay is perhaps double what it should be. If proven to be correct, that is a stronger reason to demonopolize grid transmission. Monopoly very often leads to abuse of power. At the very least, the NGCP should cut its transmission charge by removing all expenses unrelated to its mandate which are billed to the consumers nationwide.

‘DECLIMATISM’ OF ECONOMIC AND ENERGY POLICIES

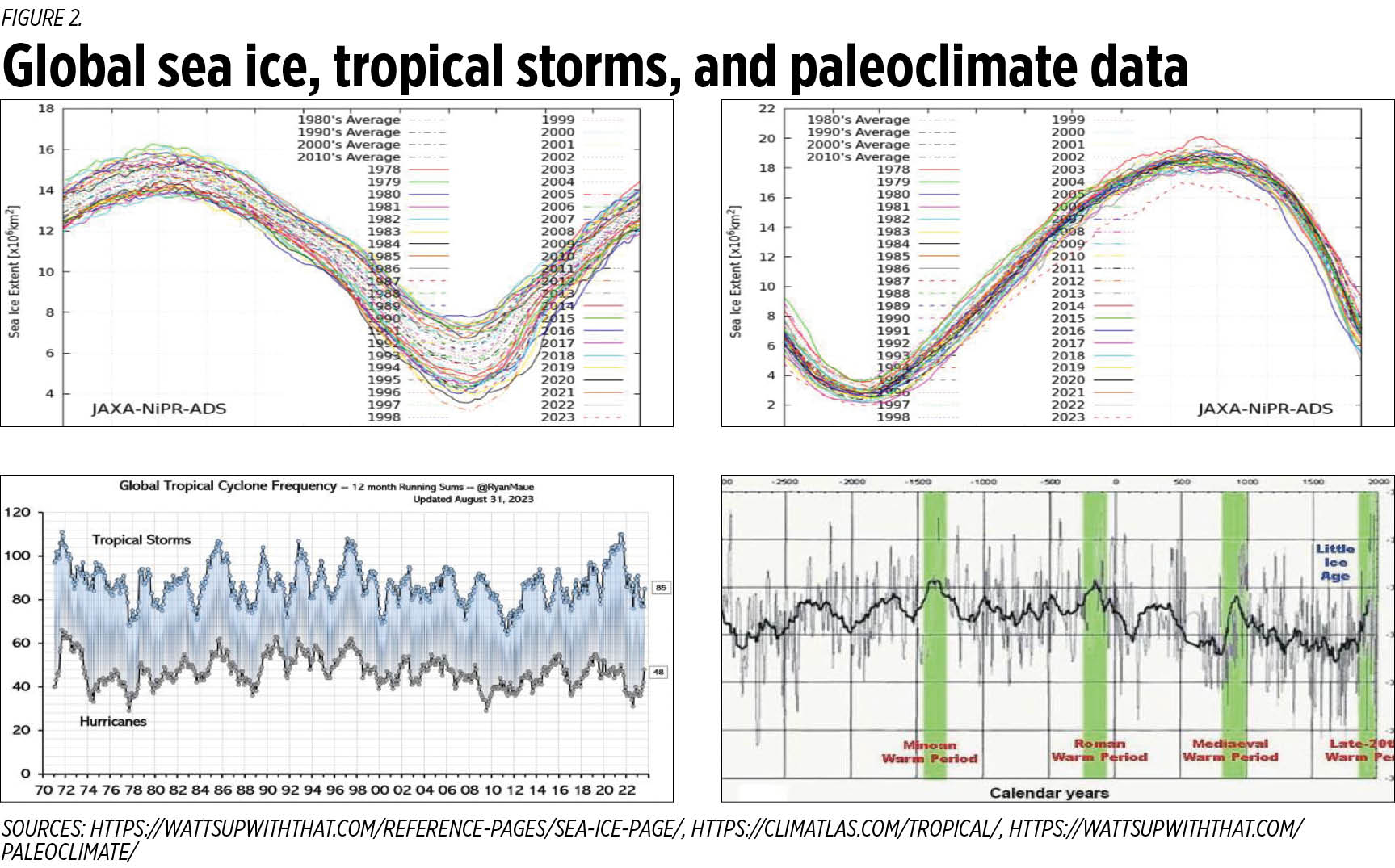

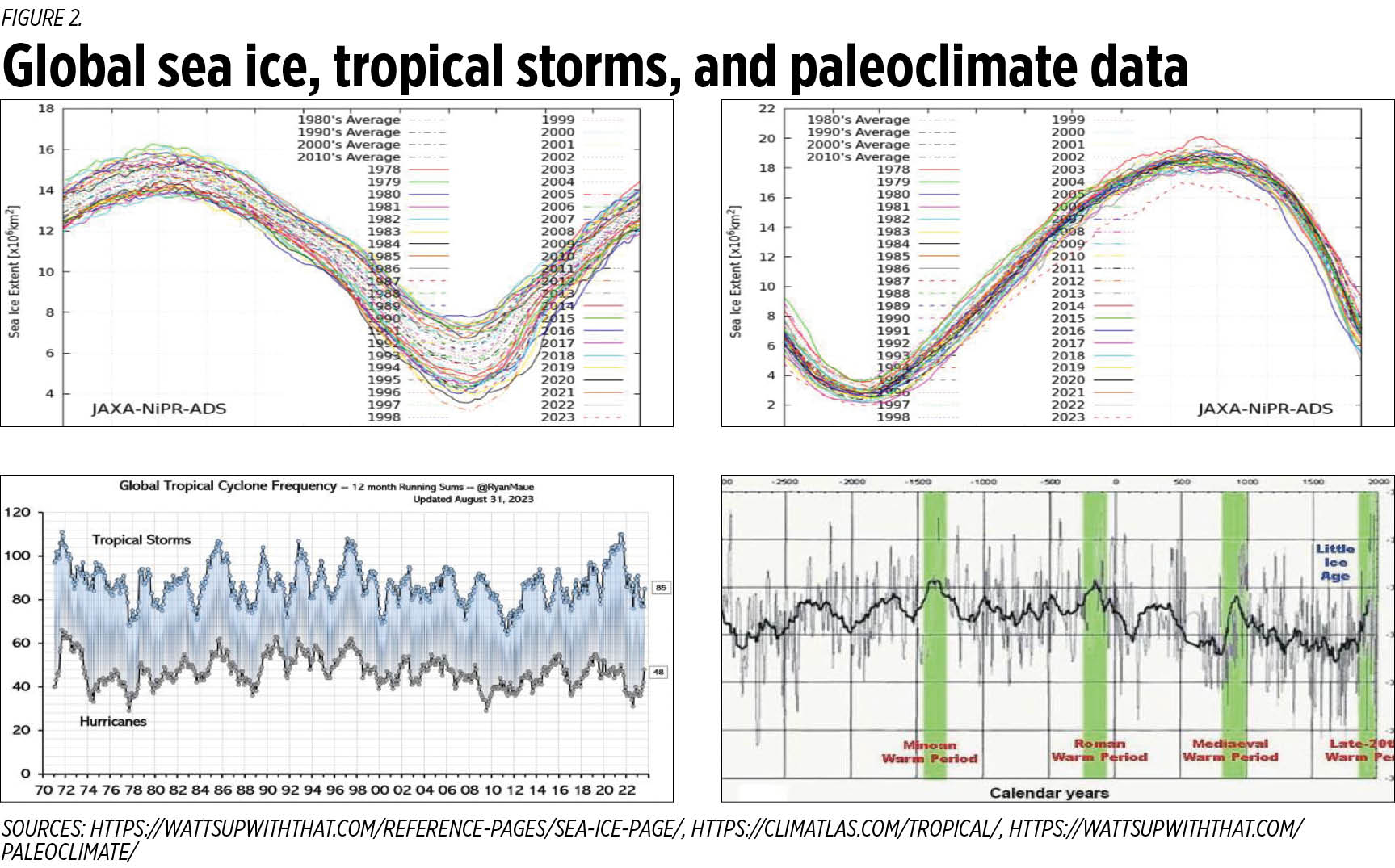

I have to present some updated data (among other existing scientific data) that show that there are no such things as “sea ice melting fast and drowning islands,” or “storms are getting stronger, more frequent,” or the classic “unprecedented global warming.”

The four charts on this page, clockwise from top left, show the amount of Arctic sea ice from 1978 to November 2023, the Antarctica ice levels in the same period, global paleoclimate data over the last 4,000 years, and the monthly count of global tropical storms from 1971 to August 2023.

The Arctic and Antarctica in natural sea ice melt-grow cycle. Global storms high-low storms cycle. And there is a global warming-cooling cycle over every few decades or even centuries, like the “Little ice age” cooling between the Medieval warm period and Modern warm period.

Global warming has many precedents since planet Earth was born some 4.5 billion years ago and thus, the term “unprecedented” warming is false and dishonest. And all these are natural cycles: a warming-cooling climate cycle, an ice melt-grow cycle, high-low storms cycle, water evaporation-condensation cycle, the El Niño-La Niña cycle, wet-dry season cycle, and so on.

All are nature-made cycles, not “man-made catastrophes” that will require more government/UN “solutions” like reducing or killing fossil fuel plants and pivoting to intermittent, unreliable wind-solar power, new reliance on batteries, and additional energy costs. There is no climate crisis, no climate emergency, to justify these deindustrialization, degrowth policies.

CONGRATULATIONS

On a side note, I want to congratulate my sister’s office — the Alas Oplas & Co. CPAs (AOC) — on their 33rd anniversary this week. Marycris Oplas is the CEO and founding partner of AOC, an independent member of BKR International. She is the first woman, and the first person from the Asia-Pacific region to be the Chairperson of BKR International, a top 10 global accounting association with over 145 member firms in 585 cities across 81 countries. Before that, she was the Chairperson of BKR in the Asia-Pacific region, then Vice-Chair of BKR worldwide.

We are five siblings in the family, she is the third and I am the fourth, and she is the only one among us five who did not work in government (I worked at the House of Representatives from 1991-1999), and she has been the single longest supporter of Minimal Government Thinkers for nearly two decades now. By the way, my think tank advocates less or limited government, not zero government. Congratulations, AOC. Congratulations, ‘tol.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com