Economic basis of net zero is zero

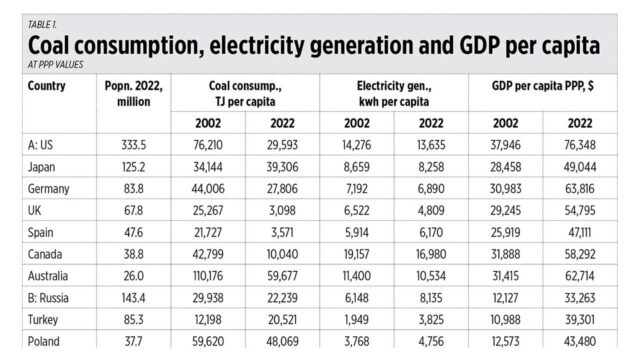

We go straight to the numbers. I constructed two tables that accompany this piece. The first shows that in Group A countries that have fast “decarbonization” and are weaning themselves away from coal consumption measured in terajoules (TJ) per person from 2002 to 2022 or over two decades, their overall electricity generation either flatlines or declines. Then their GDP per capita at purchasing power parity (PPP) values over two decades have expanded by two times at most.

Group B countries are Europeans that have high coal consumption plus South Africa. Their coal use per capita has either declined or increased a bit, their overall electricity generation increased (except South Africa) and their per capita GDP has doubled or tripled.

The Group C countries are in Asia. They all have expanded their coal consumption per capita, their electricity generation has doubled or quadrupled (except Pakistan), and their per capita GDP has expanded up to five times (See Table 1).

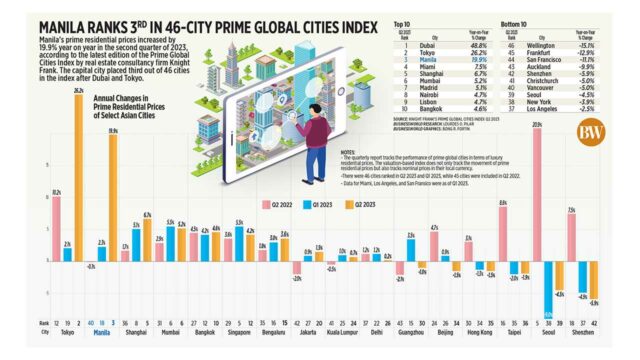

Next table shows countries that have had huge expansions in wind plus solar from 2007 to 2022 or over 15 years. Then I compare their GDP growth during the 10 years before 2007 and 10 years before 2022. There are many reasons why a country’s economic performance is good or bad, and the quality of power generation (coming from stable and conventional sources vs intermittent sources) and electricity prices are among the important contributors.

Group A countries have had a high jump in solar + wind use and have shown growth deceleration.

Group B countries in Asia showed little expansion in solar + wind use (except Japan and China) and they showed high average GDP growth (See Table 2).

The wild pursuit of “net zero” and decarbonization has no economic basis for developing countries that need to create more jobs, more businesses, and more streetlights. Dark streets at night — which lead to more road accidents, more crimes like stabbing, abduction, and murder — are fatal today, not 50 or 100 years from now.

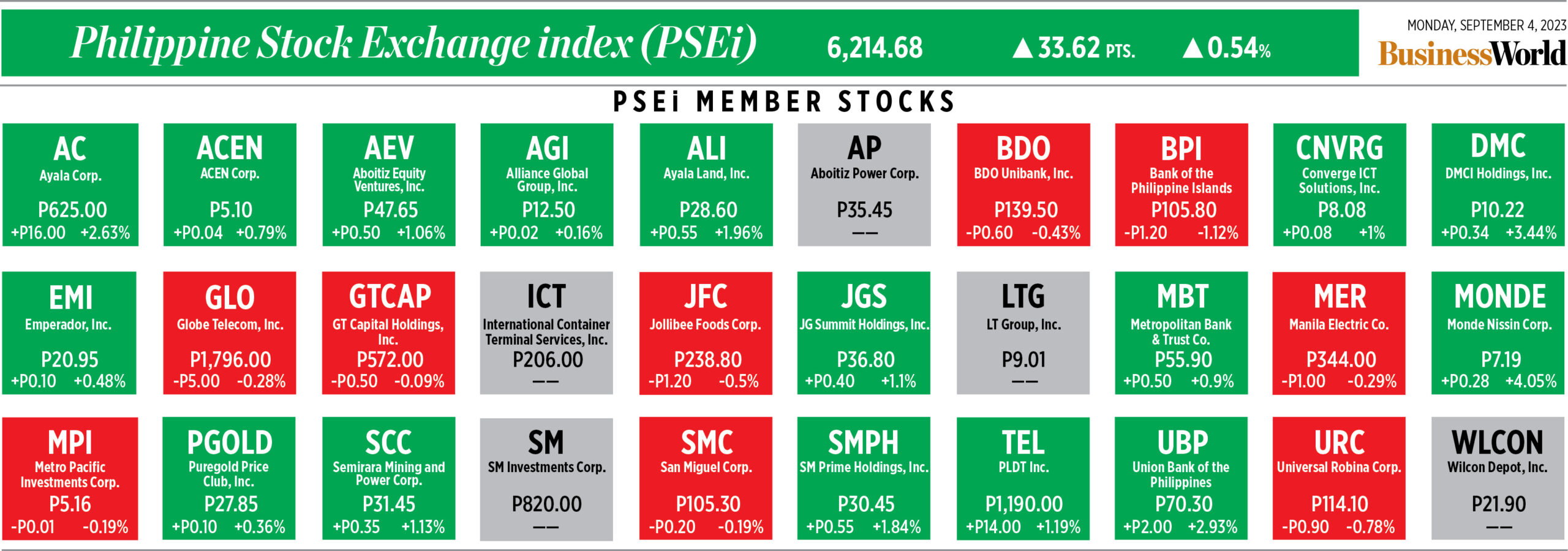

Meanwhile, here are some recent developments in the Philippines energy sector as reported in BusinessWorld and mostly written by Sheldeen Joy Talavera: “ERC extends suspension of FIT-All collection” (Aug. 22), “FIT-All collection freeze not seen affecting RE developers” (Aug. 27), “EPIRA changes should focus on tax — Congress think tank” (Aug. 28), “Coal-fired capacity for retirement in clean-energy shift seen at 5,000 MW” (Aug. 30), “Energy infra enhancements, streamlined permits seen attracting more investment” (Aug. 31), “Energy dep’t awards 77 offshore wind contracts” (Aug. 31), “ERC grants Meralco-PEDC move to end supply deal” (Sept. 1), and, “Further consultation needed on gas-power quota for Luzon grid” (Sept. 3).

The Department of Energy plan to retire more coal capacity is dangerous and anti-growth. As shown by the numbers in the tables, more coal use leads to more electricity generation and higher GDP per capita income. In contrast, adding more intermittent solar + wind share to the grid means a decline or the flatlining of electricity generation and per capita income.

We should prioritize our national agenda — more sustained growth, more job creation, more electricity for rising demand from households and industry. The global agenda of global ecological central planning should take a backseat.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers.