On March 20, voting 228-8-2, the House of Representatives passed Resolution of Both Houses No. 7 (RBH7), proposing amendments to the economic provisions of the 1987 Constitution. RBH7 wants to lift foreign equity restrictions on educational facilities, public utilities, and advertising firms.

According to House Speaker Martin Romualdez, the amendments are the “last piece in the puzzle of investment measures” the administration has been taking “to sustain our economic growth, create more job and income opportunities, and in general, make life better for Filipinos.” The Speaker also said that the proposed amendments “are necessary but not enough” to entice foreign investments.

What the Speaker said to advance RBH7 is but an opinion that is not guided by thorough investigation and rigorous analysis. We explain why this is so.

In order to do sound economic policy reform, especially when such reform entails a highly political process of amending the Constitution, we propose that the discussion be anchored on growth diagnostics, an analytical framework and approach to determine the principal critical factors that obstruct investments. The growth diagnostics approach, (popularized by Ricardo Hausmann, Dani Rodrik, and Andrés Velasco) is now used by mainstream economists, including those from the multilateral institutions, as a practicable alternative to the failed Washington Consensus of the 1990s.

The growth diagnostics approach aims to narrow the policy priorities by determining through a decision tree which low levels of investments mainly obstruct growth and which constraints to investments are the most binding. There will always be constraints, but what matters is distinguishing between the binding and non-binding constraints and focusing on the binding ones.

Government has limited political capital and operational capacity. It is therefore sensible for the administration to use its scarce political resources to pursue a narrow set of policies and interventions that will address the binding constraints within a given period.

Addressing the most binding constraints and doing a focused intervention will have a larger impact than an exhausting effort of simultaneously and immediately removing all constraints and consequently pursuing a long list of reforms.

To quote Hausmann et al. (“Growth Diagnostics,” March 2005), a growth and investment strategy must have a “sense of priorities” and targeting the most binding constraints “is likely to provide the biggest bang for the reform buck.”

If we assess the current proposal to do Charter change (Cha-cha) through the growth diagnostics framework, we can conclude that the Philippine Constitution’s foreign equity restrictions on educational facilities, public utilities, and advertising firms are not binding constraints at all.

Take public utilities. During the Rodrigo Duterte administration, legislation was passed that amended the Public Service Act, which allows up to 100% foreign ownership of public services like telecommunications, airports, railways, and expressways. That is to say, the amended Public Service Act has hurdled the restriction on foreign ownership of public services.

In recent years, too, other restrictions on foreign ownership and impediments to foreign investments have been removed without Charter change but through legislation. Notably, the 18th Congress passed the Retail Trade Liberalization Act, the Foreign Investment Act, and the Ease of Doing Business Act.

Further, Bernardo Villegas, an economics professor and member of the Constitutional Commission that drafted the 1987 Charter, notes that we cannot expect investments in education, media, and advertising to be “intensive.” After all, in the age of globalization and rapid technological changes exemplified by artificial intelligence (AI), foreign education, media and advertising entities can deeply penetrate the Philippine market without having investments in physical presence or facilities.

In short, while the Constitution’s economic restrictions are constraints, they are not binding constraints on investments.

So, what are the binding constraints at this point? Doing the growth diagnostics, we identify the following:

The fiscal space has narrowed. Despite the success of tax reforms done in previous administrations, the government understandably had to borrow heavily and incur a high level of deficit spending during the pandemic. It is time to unwind the deficit and reduce the debt burden.

Similarly, the government is faced with higher expenditures to develop pandemic resiliency, strengthen universal healthcare, transition to green energy and technology, and sustain infrastructure building, among others.

The fiscal consolidation together with the demand for bigger public investments will entail new sources of revenues and hence higher or new taxes even as the government rationalizes spending and improves tax administration.

A main driver of rising government spending is the overgenerous and unsustainable pension system of the military and uniformed personnel. Former Finance Secretary Ben Diokno said in March 2023: “If this goes on, there will be a fiscal collapse.”

Sadly, the Ferdinand Marcos, Jr. administration has stalled on both tax reforms and the reform of the pension system of the military and uniformed personnel.

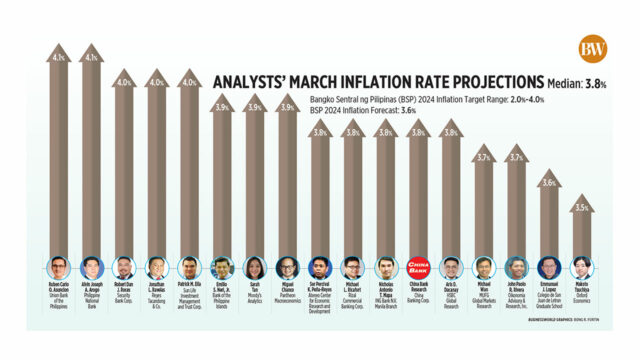

Another binding constraint where there is consensus among economists and investors is the persistently high inflation, specifically food inflation. The administration must undertake huge tasks to stabilize prices. These include augmenting and at the same time diversifying the budget for agriculture, overhauling the systems and operations of the Department of Agriculture (DA), and putting in place a no-nonsense trade policy that will ensure adequate food supply to the masses and provide cheaper agriculture inputs to food producers. All this goes hand in hand with crafting policies and implementing programs for the long-term productivity and competitiveness of the agricultural sector.

Within the past two years, our fiscal space has continued to narrow in the aftermath of pandemic borrowing, inflation has remained elevated, reforms are being rolled back, and no significant revenue-enhancing bill has been passed.

The current problems of fiscal fragility and high food inflation also stem from the administration’s drift in governance and the lack of a clear, coherent, and focused economic program.

Learned persons have cited other major obstructions to investments, which are much bigger than the Constitution’s economic restrictions. The serious problems include inefficient and inadequate infrastructure, unstable energy supply leading to the high cost of electricity, red tape and corruption, poor quality of institutions, and weak rule of law.

So, when Cha-cha proponents argue that the proposed amendments “are necessary but not enough” to attract foreign direct investments (FDI), they are resorting to propaganda rhetoric to exaggerate how necessary their claim is. But by acknowledging that the proposed amendments are not enough, the proponents are implicitly admitting that bigger problems hound Philippine growth and investments. They cannot guarantee that the amendments will trigger an investment bonanza; hence, they make the qualification “not enough.” If and when the Cha-cha fails to attract huge investments (likely, if the real binding constraints are not addressed) they will have this condition (“not enough”) as a convenient way out.

A common thread regarding the critical constraints cited above is a policy drift, or arguably a policy vacuum, which has caused uncertainty and unpredictability. Such deters investors, both foreign and local.

In truth, the attempt to have Cha-cha is fueling the uncertainty. Heed what Florian Gotten, the representative of the European Chamber of Commerce of the Philippines said: “I have to be honest. We got some calls from some of our members following the news and the political debate about how this might unfold or in which direction it could actually move, so there is some uncertainty out there.” Mr. Gotten likewise said that businessmen are already happy with the amended Public Service Act (see above). In his words: “This law has been finally amended… it has really contributed to the attractiveness of the Philippines among the foreign investors.”

The uncertainty is exacerbated by the people’s opposition to any kind of Cha-cha. According to the March 2024 Pulse Asia survey results, 88% of Filipinos are against amending the Constitution now, while 74% of Filipinos said the Constitution “should not be amended now or any other time.” If the administration were to hold its planned plebiscite to ratify proposed changes to the Constitution it would lose by a resounding margin.

That is precisely the point we are driving at. The government is squandering its political capital on a Cha-cha that is divisive and distracting, that is not a binding constraint and that has little impact on investor confidence. Rather, the government should focus on the bigger problems that we have identified earlier as the real binding constraints in the current environment.

Pia Rodrigo is strategic communications officer and FILOMENO S. STA. ANA III coordinates the Action for Economic Reforms.

www.aer.ph