On food inflation, agriculture spending, and last year’s SONA

Yesterday, President Ferdinand R. Marcos, Jr. gave his third State of the Nation Address (SONA) in Congress. As this piece was submitted several hours before the SONA, I will discuss it in the next two columns.

In SONA 2023, the President said that “the biggest problem that we encountered was inflation.” He discussed many measures taken to help address it, from monetary to energy to agriculture policies.

Here are some of the trade and agriculture measures, with numbers, that the President mentioned in his 2023 SONA: 7,000+ KADIWA stores rolled out nationwide; giving away 28,000+ modern agricultural machines; giving away 50+ million sacks of rice seeds, one million sacks of corn seeds, and various vegetable seeds; and 100,000+ coconut saplings planted in nearly 10,000 hectares. All seeds and saplings were modern, hybrid, high quality varieties.

There were also fuel and fertilizer discount vouchers; fertilizer donations from China; 600+ kilometers of additional farm to market roads (FMRs) built; irrigation for 49,000+ hectares of farms; almost 4,000 additional fabrication labs, production and cold storage facilities; and 24,000+ multi-species hatcheries built for fishery production and expansion.

The government also gave away 70,000+ land titles to agrarian reform beneficiaries (ARBs), the release of the new Agrarian Emancipation Act, and some P57 billion in ARB debt was waived.

Those are huge measures by the government to address high inflation. The question is, after a year, have they succeeded in bringing down overall inflation, and particularly food inflation?

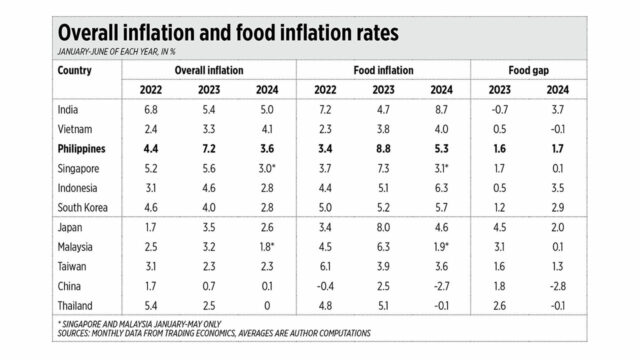

Comparing the first halves of 2023 and 2024, it seems that the answer is “yes.” In 2023, the Philippines had the highest overall inflation rate among the major Asian economies, and the highest food inflation. Then the overall inflation declined from 7.2% in 2023 to 3.6% in 2024; food inflation also declined, from 8.8% in 2023 to 5.3% in 2024. “Base effect” has a contributing factor here aside from the government’s considerable agriculture freebies for farmers.

But one emerging trend in many countries, including the Philippines, is that food inflation is higher than overall inflation and that is bad news because it affects the poor more than the middle and upper classes. In 2023-2024, our food inflation rates were higher by 1.6 and 1.7 percentage points than overall inflation.

So, if we compare our situation with, say, Vietnam, we see that their overall inflation rate of 4.1% this year is higher than the Philippines’ 3.6%, but their food inflation is lower by -0.1 percentage point (see the table).

The three largest rice exporters in the world are India, Thailand, and Vietnam. And the three top rice importers in the world are the Philippines, China, and Indonesia (according to statista). This year, India and Indonesia have the highest food inflation rates at 8.7% and 6.3% respectively, while China and Thailand have had contractions of -2.7% and -0.1% respectively in food inflation.

The reduction in the tariff on imported rice will obviously have a positive effect on reducing domestic rice prices, so it was a good move by the economic team. Tax revenues will decline but this will be more than compensated for by the decline in inflation.

I think many of the freebies given away by the government to farmers cooperatives and similar organizations did not translate to lower prices for consumers.

I observed that the government gave away big tractors that cost between P1.5-2 million each to certain farmer cooperatives in rice farming villages and barangays in western Pangasinan. Since the cooperatives had zero capex — they got the tractors for free — they only have to shoulder operating expenses like diesel and the regular maintenance of the machines. Thus, the cooperatives’ tractor rental rate should be lower than private tractor rental. So, if the prevailing private tractor rental rate is P3,200/hectare, the cooperatives’ rental rate should be lower, say, P2,500/hectare. Then the farmers will have larger revenues and savings and can cut the price of their harvest which will benefit the consumers and help reduce food inflation.

From what I heard and observed in those rice farming villages, the cooperatives’ officers (some of whom are non-farmers but rather the neighbors and friends of leaders) would meet and eat in fast food chains whereas before they would meet in public places in the barrio. The tractors’ revenues are not plowed back into the maintenance of the machines but are instead spent somewhere else. Soon the cooperatives’ tractors would be in bad condition.

I propose that the revenues from the tariffs on imported rice and agriculture should be used to either build more, wider and longer, cemented rural roads; or to reduce public debt and reduce the annual interest payment. This is instead of the government buying those expensive machines that benefit coop officers and their friends more than the average farmer and consumer.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.