AS chair of the ASEAN+3 Macroeconomic Research Office (AMRO) Advisory Panel, we will be moderating one of the two sessions in the forthcoming 2nd ASEAN+3 Economic Cooperation and Financial Stability Forum in Kanazawa, Japan next week. While Session 1 will focus on Macroeconomic Situation and Prospects: Disruptors and Stabilizers, we will be moderating Session 2 on Soaring Debt and Financial Stress: Implications for ASEAN+3’s Financial Stability.

Our session note indicates that non-financial debt has steadily risen in the ASEAN+3 economies since the Global Financial Crisis. AMRO calculates that the region’s total debt-to-GDP ratio, and this includes corporate, household, and public debt, exceeded those of the advanced economies in the mid-2010s and worsened by the pandemic, peaked at 325% of GDP. By the end of 2022, the ratio somewhat eased to 299% of GDP. Corporate debt to GDP ratio alone accounted for 140% while household debt has been rapidly rising, both of which closely approximate those in advanced economies.

What about public debt?

Public debt-to-GDP ratio has been markedly increasing in the plus-3 economies while those in the ASEAN economies have remained elevated above pre-pandemic levels. What adds risk to this problematic situation is that monetary conditions continue to be tight with the central banks’ efforts to arrest inflation in the context of a more uncertain and more volatile global economic outlook. Debt financing is crucial to sustaining resilient growth which, in turn, strengthens the countries’ capacity to service their accumulated debts. If public debt becomes excessive, debt financing becomes unsustainable. Fiscal space is reduced. Governments need to establish safeguards to ensure fiscal sustainability, that good balance between public revenues and expenditure; and financial stability, that orderly functioning of financial markets and institutions.

What about the situation in the Philippines today?

A few days ago, the broadsheets bannered the Philippines’ Sukuk bond offering, described as benchmark-sized with maturity of 5.5 years, dollar denominated amounting to at least $500 million. These Islamic bonds are Shari’ah-compliant in that they bear no interest, no uncertainty, and are not funding prohibited goods and services.

In short, the country is now expanding its creditor base to include Islamic investments.

There are other equally substantial loans this year.

In the latter part of September, the Republic raised $611.2 million via an auction of its second onshore retail dollar bonds, oversubscribed at $632 million. But last year’s first retail dollar bond offering under President Ferdinand Marcos, Jr. of $7.4 billion with a coupon of 5.75% and due in 2028 was many times larger. That alone translates into around P420 billion in additional public debt.

Multilateral lenders have also been extending loans to the Republic. In October, the Asian Development Bank approved a $300-million loan to help expand Filipinos’ access to financial services under the “Inclusive Finance Development Program.” This will be funding policy reforms to enhance financial inclusion in the country by improving the country’s financial infrastructure.

The Republic is also actively seeking additional loans from the World Bank. We eyed a $500-million loan to support the rehabilitation of schools affected by natural calamities like floods and earthquakes as well as the efforts for disaster preparedness. Being one of the most vulnerable to climate change, the Philippines also aims to strengthen its ability to rehabilitate disaster-hit school in various areas in the country. This is expected to be approved by the second quarter of 2024.

While we are borrowing to cover disaster risks to school buildings and facilities, no less than the Finance Secretary announced in October the medium-term Philippine borrowings from the same Washington-based financial institution. It was disclosed that some 20 pipeline loans amounting to $5.677 billion would be signed between the Republic and the World Bank.

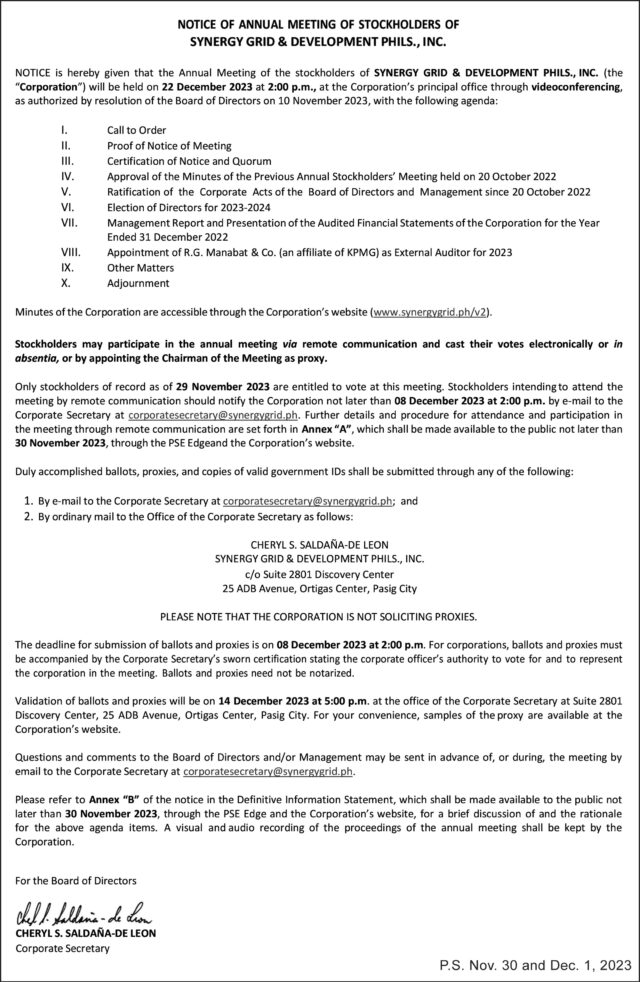

Take note that among those sectors to be covered are in the same areas of digital transformation, disaster risk management, climate, transportation and energy, among others, that some previous loans or some allocations from the national budget itself are about to finance or may have already funded. Extra due diligence should be taken by both the National Economic and Development Authority (NEDA) and the Bangko Sentral ng Pilipinas (BSP), the two public agencies tasked to assess and approve proposed foreign loans.

Take note that as announced after the meeting, the country has another 18 ongoing loans with the same lender worth $5.701 billion. Is this debt frenzy?

Finally, take note that Finance Secretary Benjamin Diokno, the major proponent of the Maharlika Investment Fund (MIF) worth only about $2 billion, also talked with his counterparts in various Japanese financial institutions about the possible opportunities for public-private partnerships (PPP), infrastructure flagship projects, and sustainable finance instruments. So, after all, there seems to be an alternative to the MIF and actual borrowings, and that is to leverage on PPP.

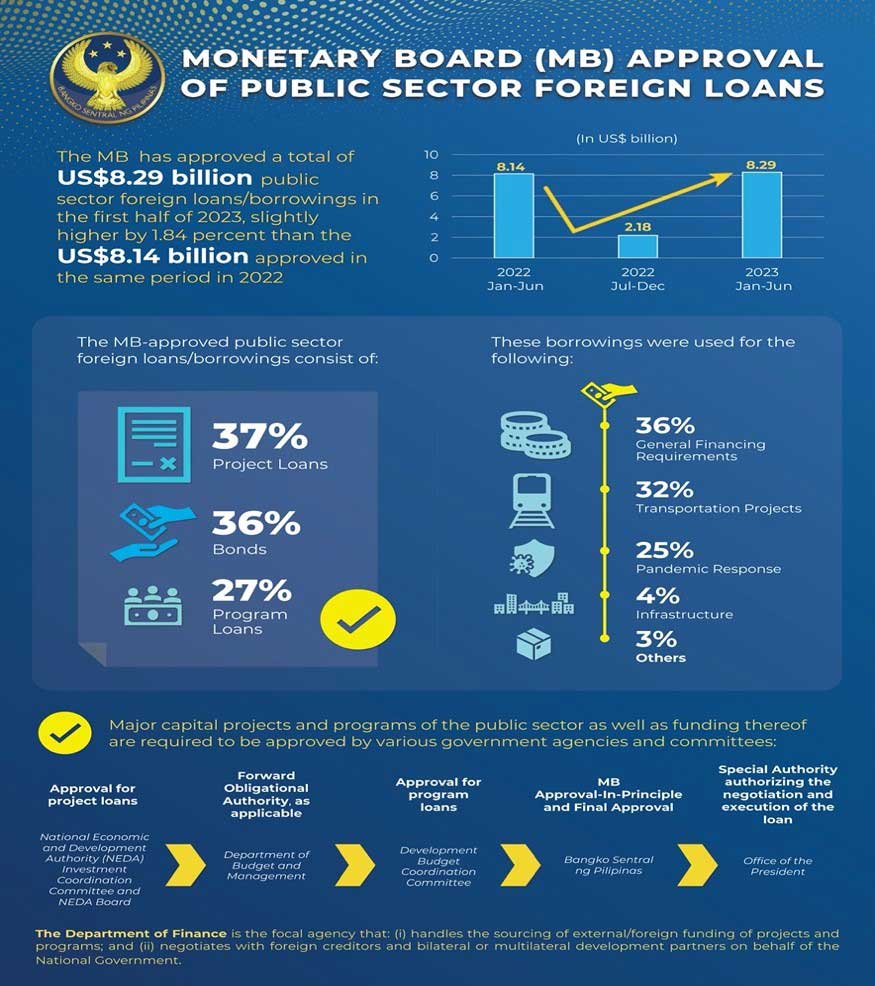

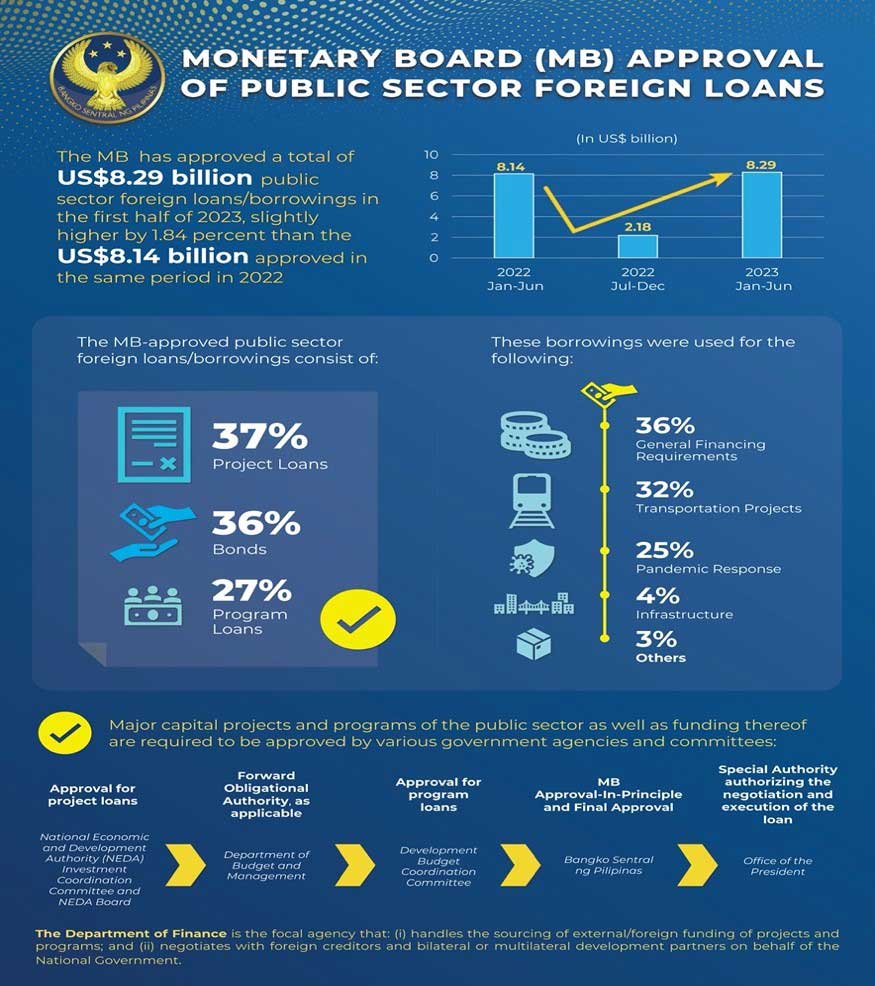

We see the bigger, and concerning, picture if we consult the BSP’s regular semestral report on public sector loans with final approval. In the first half of the year, the Monetary Board approved a total of $8.29 billion in public sector foreign borrowings, either through project or program loans, or bond offerings. This is easily P470 billion. Symptomatic of the financing needs of the large fiscal deficit, 36% are for general financing requirements, 32% for transport projects, 25% for pandemic response, 4% for infrastructure, and 3% for other purposes.

It is strange to see that until today when we are told that the pandemic is behind us, we continue to incur loans related to it. These loans must be referring to the ADB loan worth $500 million for the post-COVID-19 Business and Employment Recovery Program, the $500-million loan from the Asian Infrastructure Investment Bank, also for the same Program. But months ago, we also read about the $750-million World Bank loan to fund the First Sustainable Recovery Development Policy Loan. As a first approximation, if we add up these three pandemic-response borrowings, we are talking here of $1.750 billion or about P100 billion, more than a third of the budget of the Department of Health.

We are convinced that our authorities do ensure the matching of the deficit with the financial flows from borrowings. One thing we cannot be very confident about is whether the components of those program and policy loans are consistent with the actual program of action of the loan proponents themselves, and whether such program of action adheres to the broad national development plan. Loans should remain demand-driven.

While the recent $734 million loan of the monetary authorities and those of the other government financial institutions and corporations are not included in the outstanding debt of the National Government (NG), whether domestic or foreign, NG debt by itself casts some shadow on the prospects of growth. Before the pandemic, NG debt at end-2019 stood at only P7.7 trillion or 39.6% of GDP. In 2022, three years later, our indebtedness ballooned to P13.4 trillion, or a three-year increase of nearly P6 trillion to about 61% of GDP. As of end-September 2023, the level further bloated to P14.3 trillion or around 60% of GDP.

This increasing debt trend is not unique to the Philippines especially in the wake of the pandemic, and there is nothing patently wrong with borrowing per se. But the pandemic and its mismanagement actually caused the fiscal deficit in the next three years to explode to 7.6%, 8.6%, and 7.3% to their respective GDPs. For the first three quarters of 2023, the fiscal deficit to GDP ratio remained big at 5.7%. In normal times, the ratio averaged only around 2-3% of GDP.

But higher debt is worrisome because of the corresponding debt servicing obligations. And we are now feeling the torment of big indebtedness.

Before the pandemic, we used to pay P500 billion: P361 billion in interest and P139 billion in principal payment. That is about the authorized capital of the MIF and 10% of the annual budget which could have easily funded infrastructure and social services. Last year, we paid P503 billion in interest and P197 billion in principal payment, or a total of P700 billion.

As Dr. Dan Villanueva and Dr. Roberto Mariano concluded in the chapter on external debt, adjustment and growth, of our book Economic Adjustment and Growth (Theory and Practice), 2023, reliance on foreign borrowings has limits particularly when interest rates and risk spreads are rising. In terms of policy, fiscal adjustment and promotion of private saving are crucial in the long run. Excessive borrowings depress long-run welfare.

With all the downgrades of the country’s growth forecasts this year and the next two years, as well as the rapid increase of government debt, it is arguable whether the current magnitudes of indebtedness could hold for long. It was therefore correct for Congress to delete any item in the budget that is confidential, it is more correct to do away with any space for possible plunder of public money. Nobody wants to again suffer the debt trap of the 1980s and 1990s.

Diwa C. Guinigundo is the former deputy governor for the Monetary and Economics Sector, the Bangko Sentral ng Pilipinas (BSP). He served the BSP for 41 years. In 2001-2003, he was alternate executive director at the International Monetary Fund in Washington, DC. He is the senior pastor of the Fullness of Christ International Ministries in Mandaluyong.