Vince McMahon resigns from TKO, WWE over sex assault lawsuit

VINCE MCMAHON resigned from wrestling giant TKO Group and the subsidiary World Wrestling Entertainment (WWE) that he founded, over a lawsuit accusing him of sexual assault and trafficking, which he said he will fight, the company said on Friday.

“I have decided to resign from my executive chairmanship and the TKO board of directors, effective immediately,” McMahon said in a statement released by TKO.

The suit by a former employee, filed on Thursday in federal court in Connecticut, accuses McMahon, WWE, and another executive of “physical and emotional abuse, sexual assault and trafficking at WWE,” and seeks unspecified costs and damages.

McMahon denied the allegations in the statement, saying, “I intend to vigorously defend myself against these baseless accusations, and look forward to clearing my name.”

WWE President Nick Khan wrote in a memo to employees that McMahon “will no longer have a role with TKO Group Holdings or WWE.”

McMahon had retired from WWE in 2022 amid allegations of misconduct and paid $17.4 million to the company to cover costs related to an investigation into that case. He returned in January 2023.

The powerhouse behind the wrestling entertainment company, McMahon transformed it from a regional player in a highly fragmented industry of the 1980s to a global giant, with about $1 billion in revenue in 2021.

He used scripted matches, celebrity wrestlers, and glitz to make the brand more acceptable to television audiences, and created the concept of pay-per-view matches for bigger events such as “WrestleMania” to build its revenue base.

TKO was formed last year when McMahon forged a deal between WWE and Endeavor Group-owned mixed martial arts franchise UFC. — Reuters

Projects granted green-lane certificates valued at P1.2T

THE Board of Investments (BoI) said on Monday that 36 projects have been approved for green lane services since the passage of the Executive Order (EO) No. 18 in February, with the projects valued at a combined P1.2 trillion.

The BoI said 23 projects worth P498.91 billion were approved last year, while the remaining P697.98 billion were approved this year.

The list includes the P22-billion floating solar project of Fuego Renewable Energy Corp. (FREC) in Nueva Ecija.

“This is the fourth green lane certificate in our portfolio, and we have experienced responsiveness from government agencies and institutions in our various permitting needs,” FREC President Aristotle Natividad said in a statement.

“With this latest green lane endorsement, we expect to achieve the same results and materialize our project at the soonest,” he added.

According to the investment promotion agency, FREC is set to build the Pantabangan Floating Solar Power Plant which is a 464-megawatt alternating current (MWac) floating solar photovoltaic project.

Its other three projects that were endorsed for green lane services are the 137.48-MWac Ubay Power Plant under Ubay Solar Corp., the 175.29-MWac Barotac Viejo Solar Power Project under Magallanes Solar Energy Corp., and the 59.84-MWac Gamu Solar Power Plant under Intramuros Solar Energy Corp.

FREC’s recently-endorsed project which will rise on the surface of Pantabangan Lake is scheduled for commissioning in 2025, with its energy output contracted for export to the National Grid.

“Notably, the project site is located within the Pantabangan-Carranglan Watershed Forest Reserve. The location of the transmission lines and other facilities onshore will fall under the protected area or watershed classification,” the BoI said.

The project is expected to generate 2,000 temporary and permanent direct jobs in its construction, commissioning, operations and maintenance.

EO 18, approved on Feb. 24, established green lanes within government agencies which will expedite the process of granting permits and licenses through the One-Stop Action Center for Strategic Investments (OSACSI).

OSACSI issues endorsement letters to the Department of Energy, National Government agencies, and local government units, which designate projects as strategic, which will in turn ensure processing times fall within the periods prescribed in EO 18. — Justine Irish D. Tabile

Cancer, diabetes, hypertension, TB drugs added to BIR’s VAT-exempt list

THE Bureau of Internal Revenue (BIR) said it updated the list of drugs exempt from value-added tax (VAT) to include treatments for cancer, diabetes, and hypertension.

In a memorandum circular, the BIR said other such medicines treat kidney disease, mental illness and tuberculosis (TB), as classified by the Food and Drug Administration (FDA).

The update also features the removal of one hypertension drug from the list.

According to the circular, two medicines for cancer were added to the VAT-exempt list — Panitumumab and Fulvestrant.

It also added five diabetes medicines: Teneligliptin (as hydrobromide hydrate), Sitagliptin (as phosphate monohydrate) + Metformin Hydrochloride; Sitagliptin (50mg); Sitagliptin (100mg); and Metformin Hydrochloride.

It also included Atorvastatin Calcium and Atorvastatin + Fenofibrate, which are medicines for high cholesterol.

Also joining the VAT-exempt list are the hypertension drugs Clonidine hydrochloride in solution for injection and in tablet form; as well as Lisinopril as dihydrate in 5mg, 10mg, and 20mg tablets.

Medicines for kidney disease included Mannitol; Tolvaptan in 15mg and 30mg tablets; and Alpha Ketoanalogues + Essential Amino Acids.

It also added one medicine for mental illness, Desvenlafaxine (as succinate monohydrate) and two for tuberculosis, Bedaquiline (as Fumarate) and Isoniazid + Pyridoxine Hydrochloride.

Meanwhile, it removed from the VAT-exempt list Macitentan, a hypertension treatment.

The updated list will take effect upon the issuance of a FDA advisory, the BIR added. — Luisa Maria Jacinta C. Jocson

Small-bank MSME loans counted as reserves estimated at P6.7B

SMALL BANKS lent around P6.71 billion to micro, small, and medium enterprises (MSMEs) as of November, with the loans counting as an alternative form of compliance with reserve requirements, the Bangko Sentral ng Pilipinas (BSP) said.

The BSP in a report said other segments of the industry, like rural and cooperative banks, designated P12.4 million in such loans as compliance with the reserve requirements.

“Banks’ availment of the BSP’s relief measure on the use of new or refinanced loans to MSMEs and eligible large enterprises as alternative compliance with the reserve requirements (RR) declined,” the central bank said.

“This is in view of the lapse of the temporary relief measure on alternative RR compliance, particularly for U/KBs (universal and commercial banks) effective 01 July 2023,” it said.

During the coronavirus pandemic, the central bank allowed banks to count their loans to MSMEs and pandemic-hit large enterprises as part of their compliance with reserve requirements.

The relief measure expired last year, but small lenders can still count their loans to MSMEs and LEs as alternative compliance with reserve requirements until they are fully paid, but not later than Dec. 31, 2025.

In 2022, banks lent P493.5 billion to MSMEs as alternative compliance. This was 6.6% higher than the P463.1 billion a year prior.

Universal and commercial banks extended P390.9 billion in loans to MSMEs, while rural and cooperative banks lent P52.7 billion. — Keisha B. Ta-asan

PEZA in agreement to promote IP protections in economic zones

THE Intellectual Property Office of the Philippines (IPOPHL) said it signed a deal with the Philippine Economic Zone Authority (PEZA) to draft plans for promoting intellectual property (IP) protection to investors in the special economic zones (SEZs).

In a statement, IPOPHL said that the memorandum of understanding it signed with PEZA will help ensure IP is respected especially in the innovative activities performed within SEZs.

“By underlining the importance of protecting and enforcing IP rights in these areas, current and potential companies and investors can do business in the Philippines knowing their IP assets are in safe hands,” IPOPHL Director General Rowel S. Barba said.

Under the partnership, the two parties plan to incorporate IP into the investment promotion agency’s goals by training its officials and staff.

“(This MoU) can simplify our procedures to make it easy for our locators — those particularly applying for patents and trademarks. From our end, we would also look into inputs from our investors,” PEZA Director General Tereso O. Panga said.

PEZA estimates actual direct exports from ecozones of $54.24 billion as of October. It added that locators directly employ 1.85 million workers.

In 2023, PEZA booked P175.71 billion worth of investments across 233 approved projects.

It currently oversees 422 economic zones hosting 4,352 locators.

According to IPOPHL, the Philippines remains an attractive investment destination since its exclusion from the European Commission’s IP watchlist in 2020 and the US Trade Representative’s Special 301 Report in 2013.

“We want to boost the confidence of foreign direct investors where PEZA is a key player. As such, our goal here is to assure investors that the Philippines is a suitable and secure destination with a strong IP system where investments are protected,” Mr. Barba said. — Justine Irish D. Tabile

How BEPS Pillar 2 impacts taxation of Philippine entities of MNEs

TECHNOLOGY is making the world smaller. More countries are linked and interconnected in trade relations, particularly in digital trade, which the Organisation for Economic Co-operation and Development (OECD) Global Trade Forum highlighted would continue to grow, representing around 25% of total trade as of 2020. Likewise, the World Trade Statistical Review reported that digitally delivered services traded within Asia accounted for 43.2% of the continent’s total trade in 2021.

UNDERSTANDING THE FUNDAMENTALS OF BEPS

A global initiative, led by the OECD and the G20 countries, was formed in 2015 to address base erosion and profit shifting (BEPS). As defined by the OECD guidelines, BEPS refers to tax planning strategies used by multinational enterprises (MNEs) that potentially take advantage of gaps and mismatches in differing tax rules across countries, resulting in tax avoidance where tax bases are eroded through deductible disbursements or where profits are artificially shifted to low or zero-tax jurisdictions with little or no economic activity.

With the rise of digitalization in the economy, the BEPS framework has continuously evolved to address the corresponding rise of global tax challenges through the development of a two-pillar approach that aims to create coherence and transparency in the application of international tax rules.

In 2021, the two-pillar approach, known as BEPS 2.0, was created as an update to the BEPS framework, which focuses on ensuring that profits are taxed where economic activities take place and value is created, upholding fairer and more equitable taxing rights across countries.

Based on OECD guidelines, Pillar 1 has two main components: Amount A and Amount B. Amount A relates to the reallocation of portions of profits of the related parties of a MNE group, more than an agreed baseline, to market jurisdictions where the MNE group has customers, regardless of the taxable presence in that jurisdiction. Amount B, on the other hand, relates to the setting of a standardized basis of renumeration, aligned with the arm’s length principle, for in-country baseline marketing and distribution activities performed by related party distributors for the respective MNE group.

Pillar 2, similarly, has two main components: the global anti-base erosion (GloBE) rules and the subject-to-tax rule (STTR). GloBE rules refer to the imposition of a global minimum tax of 15% on the income arising from each jurisdiction where the MNE group operates. STTR, on the other hand, refers to the imposition of a globally agreed minimum tax rate of 9% on certain related party payments, such as interest and royalties of an MNE group, under agreed tax treaty benefits.

Between the two pillars, Pillar 2 is in the process of being implemented by a number of countries. Under the GloBE rules, the OECD has recommended that the income inclusion rule (IIR) and qualified domestic minimum top-up tax (QDMTT) become effective in 2024, while the undertaxed profits rule (UTPR) becomes effective in 2025. Meanwhile, STTR, being a treaty-based rule, can only be implemented through bilateral negotiations and amendments to individual tax treaties or as part of a multilateral convention.

UNDERSTANDING THE FUNDAMENTALS OF PILLAR 2

Following OECD guidelines, MNEs with consolidated group revenue exceeding €750 million (approximately P45 billion) in at least two out of the last four years are required to pay a top-up tax on excess profits in any jurisdiction in which the effective tax rate (ETR) for the jurisdiction is below a 15% minimum rate. Collectively, such entities are called in-scope MNEs. Government entities, international organizations, non-profit organizations, and entities operating in pension, investment, real estate fund, and international shipping activities of MNEs are excluded from the coverage for Pillar 2.

Applying the GloBE rules, the IIR will impose an additional tax on the ultimate parent company of an in-scope MNE group when a foreign subsidiary of an in-scope MNE group is effectively taxed at a rate lower than 15%. In cases where the ultimate parent of an in-scope MNE group is in a jurisdiction that has not yet implemented Pillar 2, the UTPR is applied, which allocates the right to impose a top-up tax from the ultimate parent to the subsidiaries of an in-scope MNE group, located in different jurisdictions that have implemented Pillar 2.

QDMTT, consequently, impacts where the top-up tax is to be paid, as it allows any top-up tax from Pillar 2 to be collected in the domestic jurisdiction of the subsidiary, whose income tax rate is lower than 15%, rather than another entity of an in-scope MNE group in a foreign jurisdiction.

STTR, on the other hand, is a tax treaty provision to be added in certain double-taxation treaty countries that allows the payor, known as the Source State, to recapture some of the taxing rights on outbound related party income payments, where the income is taxed under the payee, known as the Residence State, at a rate less than 9%. The covered income of STTR includes income payments pertaining to business profits, interest, royalties, and other income, excluding income from international shipping and air transport.

THE PHILIPPINE IMPACT OF PILLAR 2

The Philippines has yet to adopt the OECD guidelines for Pillar 2. On November 2023, it nevertheless took a major step in joining the OECD/G20 Inclusive Framework on BEPS with its current 145 member countries, affirming BEPS actions in addressing the challenges posed by the digital economy.

Several countries have begun enacting laws to implement Pillar 2 beginning in 2024. Per the Philippine Statics Authority, four of the top trading partners of the Philippines — Japan, South Korea, the Netherlands, and Germany — have enforced laws effective 2024 and 2025, while others, such as Hong Kong, Singapore, and Thailand, have draft legislation in place.

Philippine entities of in-scope MNEs are either subject to the regular corporate income tax of 20% or 25%, depending on the level of net taxable income and total assets, or to the preferential income tax rates such as the income tax holiday or the 5% gross income tax. As such, under the GloBE rules, those subject to preferential income tax rates may lead to the lowering of the ETR of an in-scope MNE group. Since most of the ultimate parent companies of in-scope MNEs are located outside the Philippines, the collection of the top-up tax will be effectively earned by foreign tax jurisdictions. This means that the tax savings arising from the lower income tax rate of a subsidiary in the Philippines of an in-scope MNE group will be offset by the top-up tax, which will be paid by the ultimate parent company, located in a foreign tax jurisdiction. Further, for the Philippines to benefit from the GloBE rules, implementing the QDMTT, which allows the domestic tax authority to collect the top-up tax, will be an advantage to the BIR but will effectively offset any income tax benefits granted by existing domestic tax rules such as the CREATE Act.

Under the STTR, interest and royalties are often subject to withholding tax rates that are above 9%. For instance, under the Japan-Philippine tax treaty, income payments for interest are subject to 10%, while royalties are subject to 10% or 15%. As such, STTR might not be as widely applicable for income payments between related parties in an in-scope MNE group where the Philippines is the Source State.

Clearly, if the Philippines implements Pillar 2 in the coming years, there is a need to rethink the current Philippine tax laws to balance the inflow of foreign investments in the Philippines with the tax implications of Pillar 2. As of 2024, the Board of Investments targets foreign investment approvals of around P1.3 trillion to P1.5 trillion, after achieving a target of roughly P1.2 trillion in 2023. To continue the momentum of achieving the target year on year, with an annual increase of 10%, creating well-thought-out domestic tax rules that maximize tax collection under Pillar 2 while boosting the attractiveness of the Philippines as a viable investment destination can be challenging for various stakeholders.

Considerations such as the following, as laid out in OECD reports, might need a systematic, comprehensive analysis in localizing the implementation of Pillar 2 in the Philippines:

• Differences in the revenue and expense recognition following the accounting and tax rules of different jurisdictions of in-scope MNEs in computing the GloBE income (e.g., timing and permanent differences)

• Treatment of deferred tax arising from timing differences of in-scope MNEs, as part of covered taxes in computing ETR

• Identification and quantification of non-arm’s length transactions within the in-scope MNEs

• Capturing of the taxable profits from digital economies, including the recognition of intangible assets as profit drivers in highly digitalized businesses

• Application of tax credits to reduce the tax liabilities arising from top-up tax on in-scope MNEs

• Availability of information, skills, and other resources in complying with the required income calculations and compliance filings

• Identification of the proper tax authority in auditing the top-up tax calculations of in-scope MNEs

Truly, the Philippine entities of in-scope MNEs are at the crossroads of the impact of Pillar 2, paving new interpretations to the current tax rules and new revenue sources for tax collection.

Let’s Talk TP is an offshoot of Let’s Talk Tax, a weekly newspaper column of P&A Grant Thornton that aims to keep the public informed of various developments in taxation. This article is not intended to be a substitute for competent professional advice.

Sheena Marie Daño is a director of Tax Advisory & Compliance division at the Davao office of P&A Grant Thornton. P&A Grant Thornton is one of the leading audits, tax, advisory, and outsourcing firms in the Philippines, with 29 Partners and more than 1000 staff members.

Tweet us: GrantThorntonPH

Facebook: P&A Grant Thornton

pagrantthornton@ph.gt.com

www.grantthornton.com.ph

Stocks retreat on hawkish BSP before GDP data

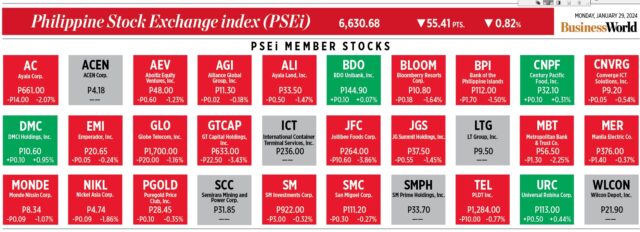

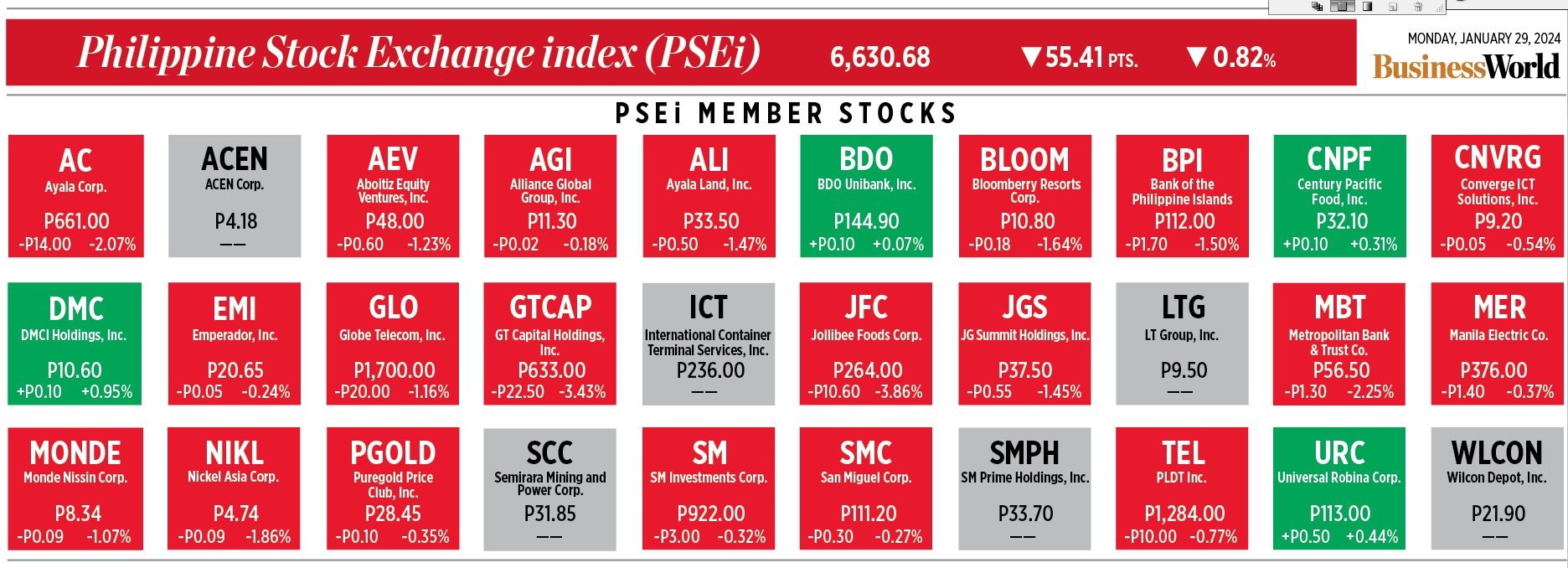

PHILIPPINE SHARES dropped on Monday following hawkish comments from the Bangko Sentral ng Pilipinas (BSP) governor and ahead of the release of the latest Philippine gross domestic product (GDP) data.

The Philippine Stock Exchange index (PSEi) fell by 55.41 points or 0.82% to close at 6,630.68 on Monday, while the broader all shares index declined by 20.90 points or 0.59% to end at 3,487.71.

“The sentiment was further dampened by the statement of the Bangko Sentral ng Pilipinas, saying that a strong economic growth would give them more room to tighten their policies,” Philstocks Financial, Inc. Research Analyst Claire T. Alviar said in a Viber message.

“The local bourse took some gains from last week’s gain, dropping by 55.41 points while awaiting the release of the Philippine fourth-quarter gross domestic product growth data this week,” she added.

BSP Governor Eli M. Remolona, Jr. said during an annual reception for the banking community last week that they are unlikely to ease their policy stance this semester and remain ready to deliver more rate hikes if needed, es-pecially if data show economic growth picked up in the last quarter of 2023.

The BSP hiked borrowing costs by 450 bps from May 2022 to October 2023, bringing the policy rate to a 16-year high of 6.5%.

Meanwhile, fourth quarter and full-year 2023 Philippine GDP data will be released on Wednesday.

A BusinessWorld poll of 20 economists yielded a median estimate of 5.7% for fourth quarter GDP growth. If realized, this would be slower than the 5.9% expansion in the third quarter and the 7.1% growth in the same period in 2022.

For 2023, economic growth likely averaged 5.5%, the same poll showed, missing the government’s 6-7% target. This is also below the 7.6% expansion in 2022 and the slowest since the 9.5% contraction in 2020.

The PSEi declined ahead of the US Federal Reserve’s policy meeting, First Metro Investment Corp. Head of Research Cristina S. Ulang added in a Viber message.

The Fed is widely expected to keep benchmark rates at the 5.25-5.5% range for a fourth straight meeting during its Jan. 30-31 review.

All sectoral indices closed lower on Monday. Mining and oil sank by 122.03 points or 1.32% to 9,123.20; holding firms went down by 58.93 points or 0.92% to 6,336.08; property dropped by 25.72 points or 0.88% to 2,872.46; industrials decreased by 78.35 points or 0.86% to 9,015.33; financials retreated by 16.28 points or 0.85% to 1,890.67; and services lost 7.37 points or 0.46% to end at 1,595.24.

Value turnover fell to P4.22 billion on Monday with 303.36 million issues changing hands from the P13.58 billion with 2.88 billion shares seen on Friday.

Decliners beat advancers, 103 against 64, while 61 names closed unchanged.

Net foreign buying declined to P459.98 million on Monday from the P696.35 million seen on Friday. — R.M.D. Ochave

Peso inches up on US PCE report

THE PESO rose against the dollar on Monday as soft US inflation data supported expectations of policy easing by the US Federal Reserve this year.

The local unit closed at P56.27 per dollar on Monday, strengthening by two centavos from its P56.29 finish on Friday, Bankers Association of the Philippines data showed.

The peso opened Monday’s session weaker at P56.40 against the dollar. Its intraday best was at P56.26, while its worst showing was at P56.54 versus the greenback.

Dollars exchanged went down to $1.17 billion on Monday from $1.38 billion on Friday.

“The peso appreciated as the softer-than-expected US PCE (personal consumption expenditures) inflation supported views of Fed policy rate cuts this year,” a trader said in an e-mail.

US prices rose marginally in December, keeping the annual increase in inflation below 3% for a third straight month, bolstering expectations that the Federal Reserve will start cutting interest rates this year, Reuters reported.

The PCE price index increased 0.2% last month after dropping 0.1% in November, the Commerce department’s Bureau of Economic Analysis said. Food prices rose 0.1% and the cost of energy products increased 0.3%

In the 12 months through December, the PCE price index advanced 2.6%, matching November’s gain. The inflation readings were in line with economists’ expectations.

Excluding the volatile food and energy components, the PCE price index climbed 0.2% after rising 0.1% in November. The so-called core PCE price index increased 2.9% year on year, the smallest gain since March 2021, after rising 3.2% in November.

The Fed tracks the PCE price measures for its 2% inflation target. Monthly inflation readings of 0.2% over time are necessary to bring inflation back to target.

The US central bank raised borrowing costs by a cumulative 525 basis points from March 2022 to July 2023 to the 5.25-5.5% range.

The peso was also supported by comments from the Bangko Sentral ng Pilipinas (BSP) chief that stronger gross domestic product (GDP) growth in the fourth quarter of 2023 could give them room to hike rates if needed, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

BSP Governor Eli M. Remolona, Jr. said on Friday that they are unlikely to ease their policy stance this semester and remain ready to deliver more rate hikes if needed, especially if data show economic growth picked up in the last quarter of 2023. The BSP hiked borrowing costs by 450 bps from May 2022 to October 2023, bringing the policy rate to a 16-year high of 6.5%.Fourth-quarter and full-year 2023 Philippine GDP data will be released on Wednesday.

For Tuesday, the trader said the peso could weaken anew ahead of the GDP data release. The trader sees the peso moving between P56.15 and P56.40 per dollar, while Mr. Ricafort expects it to range from P56.20 to P56.40. — AMCS with Reuters

Marcos hits back at Duterte after drug tirade

By Kyle Aristophere T. Atienza and Beatriz Marie D. Cruz Reporters

PHILIPPINE President Ferdinand R. Marcos, Jr. struck back on Monday at his predecessor Rodrigo R. Duterte, who called him a “drug addict,” saying the firebrand leader’s fentanyl use could have affected his judgment.

“I think it’s the fentanyl,” Mr. Marcos told reporters shortly before leaving for Vietnam in response to claims made by Mr. Duterte on Sunday while speaking at a rally in his hometown Davao against moves to amend the country’s Constitution.

When asked about the drug use accusations and the call for him to step down, Mr. Marcos said the former president “has been taking the drug for a very long time now… After five, six years, it has to affect him.”

In 2016, Mr. Duterte admitted he used to take the highly addictive synthetic opioid fentanyl for pain relief after a motorcyle accident. “I hope his doctors take better care of him,” Mr. Marcos said.

Mr. Duterte also said Mr. Marcos was on the drug agency’s so called “narco-list” that was submitted to him when he was still mayor of Davao city, a charge that the Philippine Drug Enforcement Agency vehemently denied.

House Speaker and presidential cousin Martin G. Romualdez urged Mr. Duterte to show proof about his drug allegations.

“The current discourse between the two warring factions is definitely not helping the community of people who use drugs who have historically been bearing the brunt of public stigma,” medical doctor RJ Naguit, who heads the Youth for Mental Health Coalition, Inc., said in a Viber message.

“Their statements, which seem to use drug use as political bullets, further divert the public discourse away from conversations that center on public health interventions and other ways to support people whose lives involve drugs,” he added.

“Pharmaceutical fentanyl is a synthetic opioid approved for treating severe pain, typically advanced cancer pain,” according to the US Centers for Disease Control and Prevention.

Anthony Borja, who teaches political science at De La Salle University, said the exchange between Mr. Marcos and the Duterte father-and-son tandem “can be construed not only as intense yet petty, but also as something situated between contradictory tendencies of family and professionalism in politics.”

“This is considering how Imee Marcos and Sara Duterte are trying to stay away from the fray by focusing on policy issues,” he said via Messenger chat.

Their supporters can either condemn them for not taking a clear stand in defense of their family members, or appreciate their efforts to stay above the mudslinging, he said.

‘CLIENTELIST ALLIANCE’

Meanwhile, the House of Representatives affirmed its “strong and unqualified support” for President Ferdinand R. Marcos, Jr. through a resolution after Mr. Duterte’s tirade.

During a political rally in Davao City on Sunday, city Mayor Sebastian Z. Duterte, son of the ex-President, urged Mr. Marcos to step down.

Deputy Speaker and Quezon Rep. David C. Suarez called the younger Mr. Duterte’s remarks “totally disrespectful of the man given the position that he holds.”

During the Davao rally, Mr. Duterte accused Mr. Romualdez and First Lady Liza Araneta-Marcos of being behind the push to amend the 1987 Constitution through a people’s initiative.

The anti-Charter change rally, which was also attended by presidential sister Senator Maria Imelda “Imee” Marcos, happened on the same day the government held a rally in Manila to launch its brand of governance called “Bagong Pilipinas” (New Philippines), which was attended by Vice President Sara Duterte-Carpio. She also attended the Davao rally later.

The quarrel between Mr. Marcos and the Dutertes were all “on their families” and not about the issues facing ordinary Filipinos, Jean Encinas-Franco, who teaches political science at the University of the Philippines, said in a Facebook Messenger chat.

“These are all consistent with how clientelist the alliance is — it favors each other, zero policy honesty and invokes tribalist/traditional Filipino values,” Hansley A. Juliano, a political science lecturer at the Ateneo de Manila University, said via Messenger chat.

In a statement, the Speaker said he’s stumped by the seemingly conflicted stance of Mr. Duterte in moves to amend the Charter, noting that the tough-talking leader had based his entire presidential campaign on a shift to a parliamentary form of government.

The Commission on Elections (Comelec) on Monday suspended all proceedings related to a people’s initiative for constitutional changes.

House leaders declared their support for Resolution of Both Houses 6 filed in the Senate, which proposes amendments to the Charter’s economic provisions.

The Senate resolution was authored by Senate President Juan Miguel F. Zubiri and Senators Loren Legarda and Juan Edgardo Angara.

The House’s collaboration with the Senate is a “shared commitment to nurturing an economic landscape that is dynamic, inclusive and forward-thinking, ensuring that prosperity reaches every corner of our nation,” the political party leaders in the House said in their joint manifesto.

Last week, the 24-member Senate issued a statement against the people’s initiative, saying it is “ridiculous” for the Senate to have a “dispensable and diluted role” in the “Cha-cha” push.

Also on Monday, Mr. Zubiri said the President is set to ask the House to repeal its push to amend the Constitution through a people’s initiative.

“The President is set to appeal to the House of Representatives and the other initiators of the people’s initiative to stop this,” he told the plenary.

Presidential Communications Office chief Cheloy Velicaria-Garafil did not immediately reply to a Viber message seeking comment.

“The President expressed the need to protect the bicameral nature of Congress, which upholds the system of checks and balances within the legislative branch,” he said a privilege speech. — with Reuters

Sea cooperation a bedrock of Vietnam visit — Marcos

PHILIPPINE President Ferdinand R. Marcos, Jr. on Monday said talks on maritime cooperation between his country and Vietnam would be one of the cornerstones of a strategic partnership between the two.

“We hope to strengthen this aspect during my visit to promote peace and stability in our region,” he said in a statement before leaving for Hanoi for a two-day state visit.

The President is expected to meet Vietnam’s top officials and work on agreements on coast guard cooperation and rice supply. Vietnam is a major rice exporter, and the Philippines is one of the world’s biggest importers of the grain.

Mr. Marcos said he hopes his visit would bring their relations to greater heights and “usher in a new era of friendship and cooperation,” with talks on trade, investment, education and tourism, as well as “regional and multilateral issues of concern.”

Vietnam and the Philippines have overlapping claims in the South China Sea, but have generally friendly relations compared with the heightened tensions between Manila and Beijing over disputed waters.

Ties between the Philippines and China have deteriorated this past year, coinciding with a tougher stand by Manila and overtures by Mr. Marcos to forge stronger military relations with the United States.

The South China Sea, a conduit for more than $3 trillion in annual ship-borne commerce, is claimed almost entirely by China via a U-shaped line policed by its vast coast guard fleet that cuts into the exclusive economic zones of Vietnam, the Philippines, Malaysia, Brunei and Indonesia.

In 2016, the Permanent Court of Arbitration in the Hague said China’s claims were illegal, a decision Beijing has rejected.

“The plane carrying President Marcos and the First Lady arrived at around 3:05 p.m. (Vietnam time) at the Noi Bai International Airport where they were warmly welcomed by the Vietnamese officials,” the presidential palace said in a statement.

Mr. Marcos will visit Vingroup Co. later in the day to deepen the Philippines’ engagement with them. It is Vietnam’s largest private company with a market capitalization of $21.1. billion as of April 2023 through its unit VinFast, which is valued at $15 billion.

VinFast plans to sell and launch its electric vehicles (EVs) in the Philippines through a dealership business in April to test the local market first as it expressed its intention to engage in the manufacture and assembly of CKD EVs.

Several Philippine private sector leaders would join the President during the meeting, the palace said.

Bernard B. Espeña, who teaches international relations at the Polytechnic University of the Philippines, earlier said the Philippine Coast Guard (PCG) should also boost maritime cooperation with other Southeast Asian nations other than Vietnam amid the slow development in the push for a code of conduct (CoC) in the South China Sea.

A possible cooperation deal between the Philippine Coast Guard (PCG) and its Vietnamese counterpart, which they have been working on since 2018 and is expected to be sealed this month, could be an “informal model” for the proposed South China Sea code of conduct, he said.

Mr. Espeña said the lack of operational models for a legally binding instrument has delayed the approval of the code of conduct.

The Philippine Coast Guard on Jan. 23 gave a “comprehensive briefing” to Vietnamese officials, including Vietnam’s Standing Deputy Minister of Foreign Affairs Nguyen Minh Vu and Ambassador to the Philippines Lai Thai Binh, on Manila’s maritime security operations in the South China Sea. —

The two countries also sought to advance a memorandum of understanding between the PCG and its Vietnamese counterpart, which they have been working on since 2018.

Mr. Marcos, 66, said during his visit to the United States last year his government was seeking to set up a separate code of conduct with Vietnam and Malaysia.

The Philippine leader cited the slow progress of the code between China and ASEAN members.

After the Philippines’ push for a separate code of conduct, China warned that any departure from the Declaration on Conduct of the Parties in the South China Sea, which provided the framework for the regional code, would be void.

Vietnam was said to be the “last man standing” in the South China Sea conundrum when the Philippines pivoted to China during the previous administration.

Hanoi conducted major expansion activities such as dredging and landfill work at most of its South China Sea outposts in 2022. — with Reuters

ICC arrest warrants may take time — human rights lawyers

IT WOULD probably take time for the International Criminal Court (ICC) to issue arrest warrants against Philippine state officials connected to President Rodrigo R. Duterte’s deadly drug war, according to human rights lawyers.

“We expect warrants to be issued, but we will not pressure the ICC within timelines,” Maria Kristina C. Conti, National Union of Peoples’ Lawyers (NUPL) National Capital Region secretary general who lawyers for several victims of the drug war, said in an e-mail.

“We are well aware of the quantum of evidence necessary to proceed with the formal trial and we prefer investigators to focus on the quality of information,” she added.

On Jan. 23, Philippine President Ferdinand R. Marcos, Jr. said ICC investigators would be allowed to come to the Philippines as “ordinary people,” but his government would not help in the probe.

“The Philippine government will not lift a finger to help any investigation that the ICC conducts,” he told reporters.

The Department of Justice said last week said the international tribunal had yet to inform them of its investigators’ visit, adding that the government is not legally bound to cooperate with the investigation.

In an X message to BusinessWorld on Jan. 24, iDefend human rights group said it has been submitting evidence to the ICC since it reopened its probe in January.

“iDefend hopes to participate in any way at the trial stage through the victims’ participation processes with our potential legal counsel,” it said.

The group reiterated that cooperating with the ICC would not violate Philippine sovereignty, adding that it would affirm the country’s commitment to prevent human rights abuses.

In January last year, the ICC pre-trial chamber resumed its investigation into killings and so-called crimes against humanity under former Mr. Duterte’s drug war, saying it was not satisfied with Philippine efforts to probe the deaths.

Philippine Solicitor General Menardo I. Guevarra in July said Philippine officials who could face arrest would likely hire their own defense lawyers. The solicitor general would only represent the state at the ICC hearings, he added.

In November, Mr. Marcos said the government was considering rejoining the ICC. He had ruled out cooperation, saying the probe violates Philippine sovereignty given the country’s fully functioning justice system.

Mr. Duterte canceled Philippine membership in the ICC in 2018 amid criticisms that his government had systematically murdered drug suspects in police raids. It took effect a year later.

The tribunal, which tries people charged with crimes against humanity, genocide, war crimes and aggression, was also set to probe vigilante-style killings in Davao City when he was still its vice mayor and mayor.

“President Marcos should rethink his position and listen to the clamor for investigation from the victims and the public,” NUPL Secretary-General Josalee S. Deinla said in a Viber message. “Under the Rome Statute, states that were once parties to ICC continue to have an obligation to cooperate with investigations initiated prior to their withdrawal.”

The United Nations Human Rights Committee has said the Philippines should comply with international human rights mechanisms and cooperate with the ICC’s drug war probe.

The Philippine government estimates that at least 6,117 drug dealers were killed in police operations. Human rights groups say as many as 30,000 drug suspects died. — John Victor D. Ordoñez