By Katherine K. Chan, Reporter

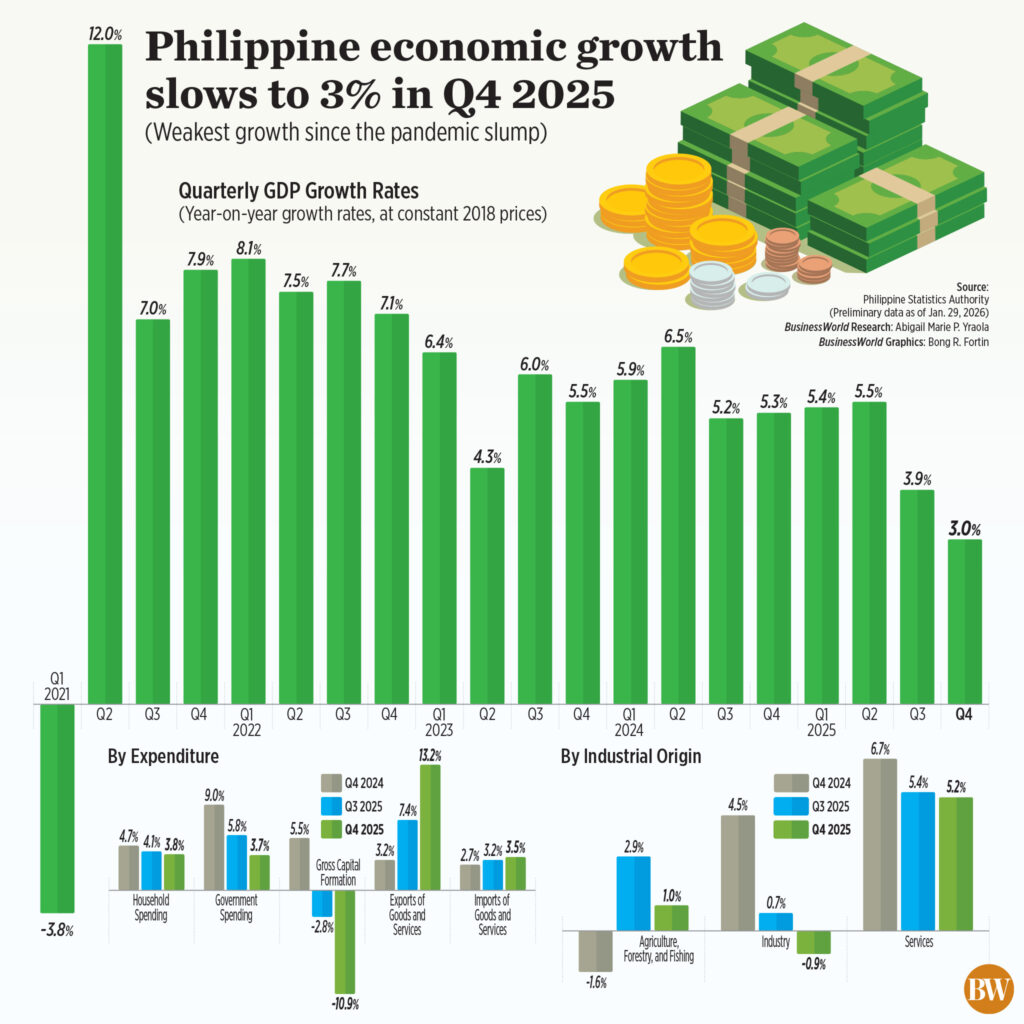

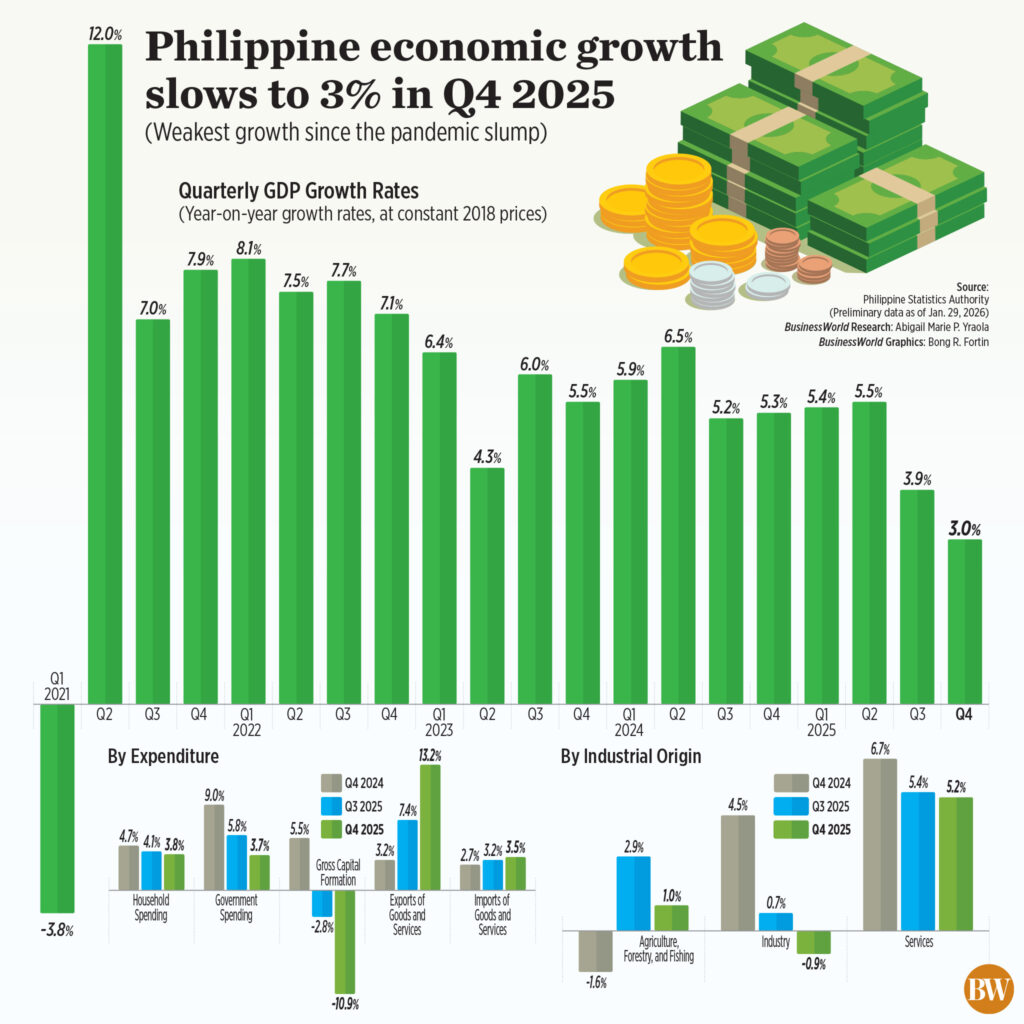

PHILIPPINE economic growth sharply slowed to a post-pandemic low in the fourth quarter of 2025 as the flood control scandal continued to weigh on government spending, investments and consumer spending, dragging full-year expansion below target for the third straight year.

The Philippine Statistics Authority (PSA) reported on Thursday that the fourth-quarter gross domestic product (GDP) expanded by 3%, from 5.3% in the fourth quarter of 2024 and the revised 3.9% print in the third quarter of 2025.

The slowdown came as a surprise as the fourth quarter is typically a strong period for growth, thanks to holiday spending. The latest print stands out as the weakest fourth-quarter performance in five years or since the 8.2% contraction in the fourth quarter of 2020.

Excluding the pandemic period, it was the worst quarterly growth rate in 16 years or since the 1.8% in the fourth quarter of 2009, but matched the 3% in the third quarter of 2011.

On a seasonally adjusted quarter-on-quarter basis, the economy grew by 0.6%.

In 2025, the economy expanded by 4.4%, much weaker than the 5.7% growth in 2024.

This was the weakest pace in five years or when GDP declined by 9.5% in 2020. Excluding the pandemic, it was the slowest growth since the 3.9% expansion in 2011.

The full-year average also fell below the Development Budget Coordination Committee’s (DBCC) 5.5%-6.5% goal.

The latest growth likewise turned out weaker than market expectations, as a BusinessWorld poll of 18 economists last week yielded a median estimate of 4.2% for the October-to-December period and 4.8% for 2025.

Economy Secretary Arsenio M. Balisacan said the slower growth reflected the impact of adverse weather on economic activity and the corruption scandal on consumer and investor sentiment.

“Admittedly, the flood control corruption scandal also weighed on business and consumer confidence. These challenges unfolded alongside lingering global economic uncertainties,” he said during a briefing on Thursday.

Mr. Balisacan, who earlier expected full-year growth to come in at 4.8-5%, said he did not expect such a “sharp” slowdown. However, he said economic managers had expected there would be consequences for the reforms that were put in place in the aftermath of the graft scandal.

“It cannot be business as usual. Because otherwise, we may have growth this year, or last year, growth may be higher, but with corruption all over the place, or in infrastructure. That (growth) would not be expected to last. We would better have a slowdown, correct the problems, and build the trust of our people in the government,” Mr. Balisacan said.

A scandal linking government officials, lawmakers and private contractors to multibillion-peso corruption in flood control projects had dragged government spending and household consumption since the third quarter last year.

WEAK CONSUMPTION

In the fourth quarter, household consumption, which accounts for over 70% of the country’s GDP, rose by 3.8%, slowing from 4.7% a year ago and 4.1% in the third quarter. This was the slowest household spending growth since the -4.8% seen in the first quarter of 2021.

For the full-year, consumption growth slowed to 4.6% from 4.9% in 2024.

Meanwhile, government spending grew by 3.7% in the fourth quarter, weakening from 9% in the same period in 2024 and 5.8% in the third quarter. It was also the slowest since 2.6% in the first quarter of 2024.

Of the total, state expenditures in construction declined by 41.9% during the last three months of 2025, as the government increased scrutiny over infrastructure projects.

In 2025, government spending grew by 9.1%, faster than 7.3% in the previous year.

Mr. Balisacan said the government’s catch-up plan could help boost public spending, particularly construction, in the first quarter.

“The release of the approval of the budget for 2026 was delayed a bit,” he added. “And so that could also have a negative effect on spending, particularly for public construction.”

PSA data also showed that the country’s gross capital formation, the investment component of the economy, declined by 10.9% in the fourth quarter, the biggest drop since early 2021. This was a steeper decline than the -2.8% in the third quarter and a reversal from the 5.5% growth in the fourth quarter of 2024.

For 2025, investments fell by 2.1%.

BETTER EXPORTS

Meanwhile, exports growth provided some relief for the economy as it climbed by 13.2% in the fourth quarter, from 3.2% a year earlier and 7.4% in the third quarter. For the entire year, exports grew by an annual 8.1%.

Imports, meanwhile, expanded by 3.5% in the October-to-December period, from 2.7% in the previous year and 3.2% in the previous quarter, bringing its full-year growth to 5.1%.

The government forecasts goods exports and services exports to rise by 2% and 5%, respectively, this year.

According to the PSA, the agriculture, forestry, and fishing (AFF) sector posted 1% growth in the fourth quarter, while services expanded by 5.2%. However, the industry sector saw a 0.9% contraction in the fourth quarter.

In 2025, the AFF, services and industry sectors grew by 3.1%, 5.9%, and 1.5%, respectively.

National Statistician Claire Dennis S. Mapa said wholesale and retail trade and repair of motor vehicles and motorcycles were the top contributors to the country’s expansion.

Meanwhile, the Philippines’ gross national income went up by 3.9% in the fourth quarter. By yearend, it rose by 6.1%, easing from 7.7% in 2024.

The country’s net primary income likewise increased by 10.9% in the October-to-December period, bringing the 2025 average to 19.1%. This slowed from 26.6% in the prior year.

DELAYED RECOVERY

Meanwhile, Mr. Balisacan said the country’s chances for an early rebound might now be lower.

“(W)e see 2026 as a rally point for us,” he said. “And with all these developments taking place and our chairmanship of the ASEAN (Association of Southeast Asian Nations), it should be able to turn the corners around and get the economy back on its track as early as the… second quarter of this year.”

He noted that the lingering effects of the corruption mess and the delayed approval of the 2026 budget could prevent the economy from recovering in the first quarter of the year.

“We don’t expect that growth will recover to its peak in the first quarter because we expect some still lingering effects of those measures, especially that the budget for this year was released or was approved late,” he said.

On Jan. 5, President Ferdinand R. Marcos, Jr. signed the 2026 General Appropriations Act, allotting a P6.793-trillion budget for the government.

Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco said the economic lags experienced in the fourth quarter may continue to spill over to the country’s near-term growth prospects.

“All this weakness looks set to bleed into the early part of this year, as we’ve yet to see any bottoming-out in government infrastructure spending in the monthly numbers, while surveyed expansion plans in the private sector continue to roll over sharply,” Mr. Chanco said in an e-mailed note.

The outlook for the Philippine economy remains dim, especially if persisting governance issues will be left unresolved, ANZ Research Chief Economist for Southeast Asia and India Sanjay Mathur noted.

“Looking forward, growth is likely to remain weak until governance-related issues are resolved, and public spending begins to improve,” he said in a report. “While support from net exports will likely be sustained over the next few months due to the AI (artificial intelligence)-related technology cycle, its overall impact will be limited.”

Meanwhile, Chinabank Research said the economy’s underperformance in the fourth quarter calls for a more urgent implementation of reforms, adding that the global uncertainties endanger the country’s external position.

“This underscores the need to further weather-proof the economy and quickly rebuild public confidence to support domestic demand, especially since the external front faces persisting headwinds from a highly uncertain and volatile global environment,” it said.

This year, the DBCC is targeting 5%-6% GDP growth.

![solar-panels-[MICHAEL-WILSON-UNSPLASH]](https://www.bworldonline.com/wp-content/uploads/2024/12/solar-panels-MICHAEL-WILSON-UNSPLASH-640x427.jpg)