PHL vehicle sales growth slows in March

By Justine Irish D. Tabile, Reporter

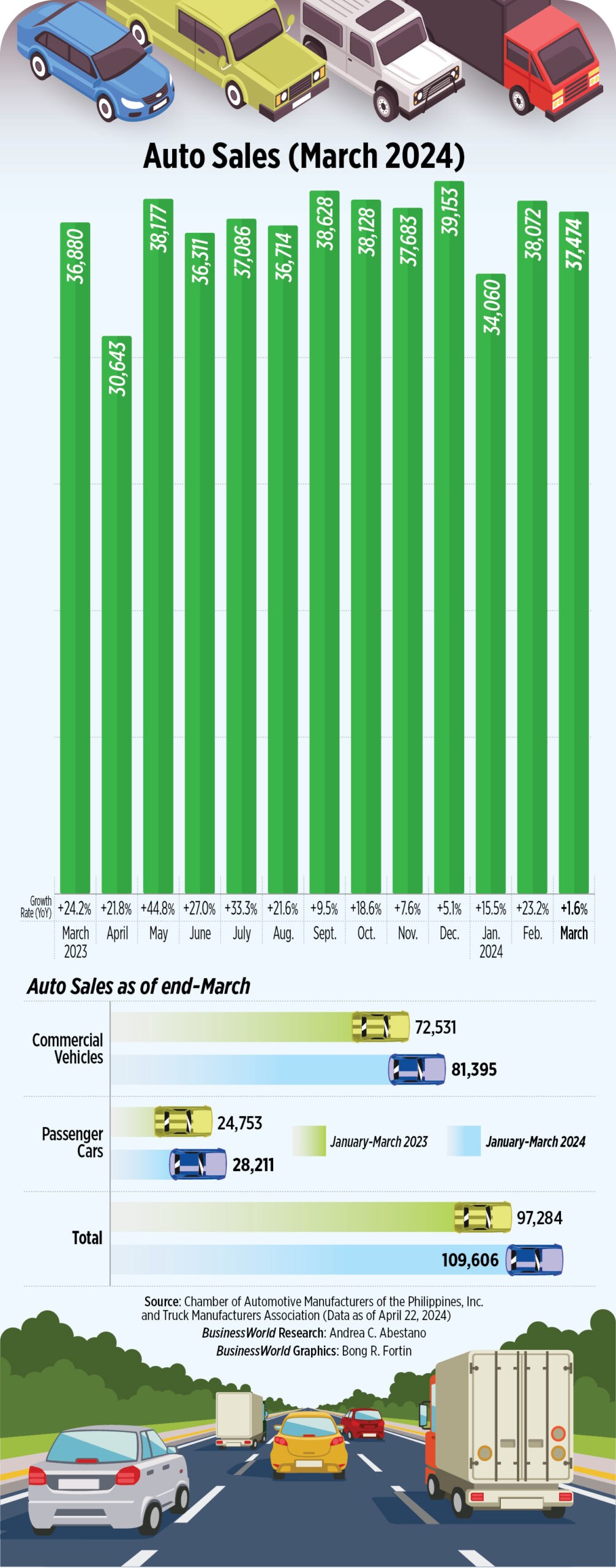

PHILIPPINE AUTOMOTIVE sales rose by 1.6% to 37,474 units in March, the slowest in over two years amid elevated interest rates, an industry report showed.

A joint report by the Chamber of Automotive Manufacturers of the Philippines, Inc. (CAMPI) and Truck Manufacturers Association (TMA) showed that car sales went up from 36,880 units a year earlier.

This was the slowest sales growth since the 7.3% decline in February 2022.

Month on month, sales declined by 1.6% from 38,072 units in February.

Commercial vehicles continued to drive the industry’s performance in March, as sales went up by 2% to 27,347 units from a year earlier. They accounted for 73% of the total sales.

However, sales of commercial vehicles declined by 3.8% from a month earlier.

Asian utility vehicle (AUV) sales rose by 23.4% to 6,421, the only commercial vehicle segment that posted annual growth. Month on month, AUV sales inched up by 1%.

Light commercial vehicle sales slipped by 2.6% to 20,101, while sales of light trucks fell by 1.3% to 447. Sales of medium trucks dropped by 17.8% to 333 units, while heavy truck sales plunged by 61.5% to 45.

Month on month sales of light commercial vehicles, light and heavy trucks also fell by 5.3%, 13.4% and 26.2%, respectively.

On the other hand, sales of medium trucks grew by 27.6% month on month.

In March, passenger car sales inched up by 0.7% to 10,127 units from a year ago. Month on month, sales of passenger cars went up by 5.1%.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said the slower year-on-year growth was due to higher base effects.

“The slower year-on-year growth in vehicle sales at low single-digit levels was due to higher base or denominator effects,” Mr. Ricafort said.

“Higher inflation and interest rates that increased borrowing and financing costs, including for auto loans, also started to slow demand,” he added.

The Bangko Sentral ng Pilipinas (BSP) has kept its benchmark rate steady at a near 17-year high of 6.5% since October 2023 to tame inflation.

Inflation accelerated to 3.7% in March from 3.4% in February.

Q1 SALES UP BY 13%

For the first quarter, vehicle sales grew by 12.7% year on year to 109,606 units.

Commercial vehicle sales rose by 12.2% to 81,395, while passenger car sales jumped by 14% to 28,211 in the January-to-March period.

“Year-to-date sales performance was driven by sustained demand for new vehicles, supported by overall supply improvement,” CAMPI President Rommel R. Gutierrez said in a statement.

“Our first-quarter performance keeps us on track to achieve our 2024 target,” he added.

For 2024, CAMPI gave a conservative sales forecast of 468,300 units. However, the group expects sales to reach 500,000 as the ninth Philippine International Motor Show is held in the second half.

As of end-March, Toyota Motor Philippines Corp. remained the market leader with a 45.3% share as its sales rose by 9.9% to 49,667 units.

Mitsubishi Motors Philippines Corp. ranked second with a market share of 19%, as it posted a 17.5% increase in sales to 20,867 units in January to March.

In third spot was Nissan Philippines, Inc., whose sales increased by 23.7% to 7,909 units.

Rounding out the top five were Ford Motor Co. Phils., Inc., which saw a 27.8% increase to 7,531 units, and Suzuki Phils., Inc., whose sales declined by 1.9% to 4,395 units.

Mr. Ricafort said the double-digit sales growth in the first-quarter sales is “a good signal for the further recovery of the Philippine economy, as well as the country’s favorable demographics.”

“In recent months, the Philippines has had one of the highest growth rates for both vehicle sales and vehicle production in ASEAN (Association of Southeast Asian Nations), consistent with the fact that the country has one of the fastest economic growth in ASEAN,” he added.

Data from the ASEAN Automotive Federation showed that Philippine motor vehicle output grew by 20.9% to 22,379 units in the January-to-February period from 18,510 last year. It was the second-fastest growth and faster than the 11.2% contraction in the region.