There have been plenty of reports and articles recently about tobacco smuggling and vapes. See these stories in BusinessWorld alone: “Lawmaker wants bill curbing illicit tobacco trade prioritized” (May 27), “Illegal tobacco trade eating government revenues away — BIR” (May 29), “Health department says vape products not a safer alternative to cigarettes” (May 30), “P10.2-M cigarettes seized in Sulu” (June 2), “Economic sabotage bill may deter tobacco smuggling, JTI says” (June 3), “BIR gets tough on vape stamps” (June 4).

Even Yellow Pad, another opinion column in this paper, has taken a strong anti-illicit trade position with their recent pieces, “Support the BIR, strengthen the law to fight illicit trade” (May 27) and “Protecting key provisions of the Anti-Illicit Tobacco Trade Bill” (June 3).

Even the most rabid advocates and lobbyists for higher tobacco taxes are now alarmed, publicly or silently, at the huge drop in tobacco tax revenues as the tax rate keeps increasing.

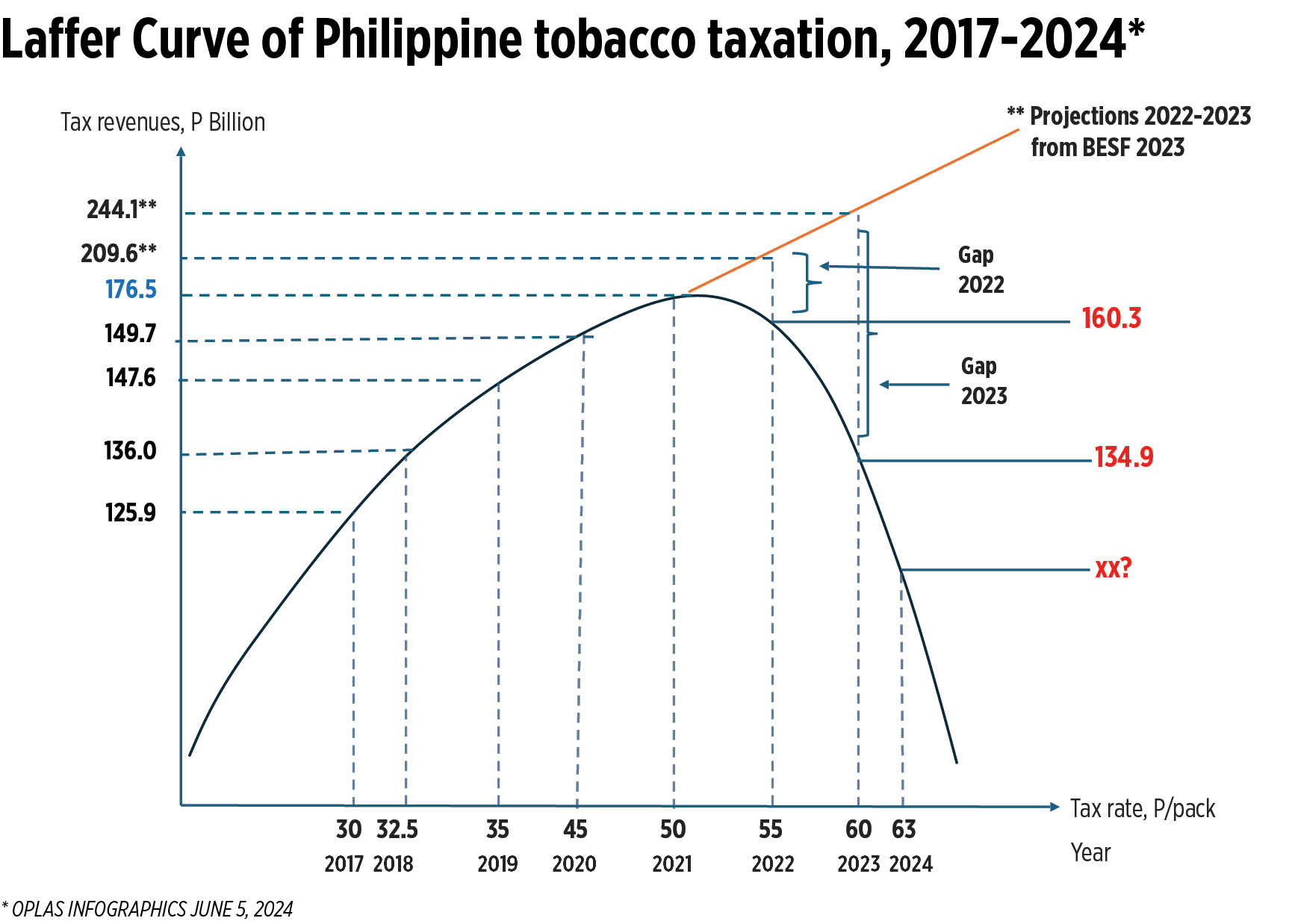

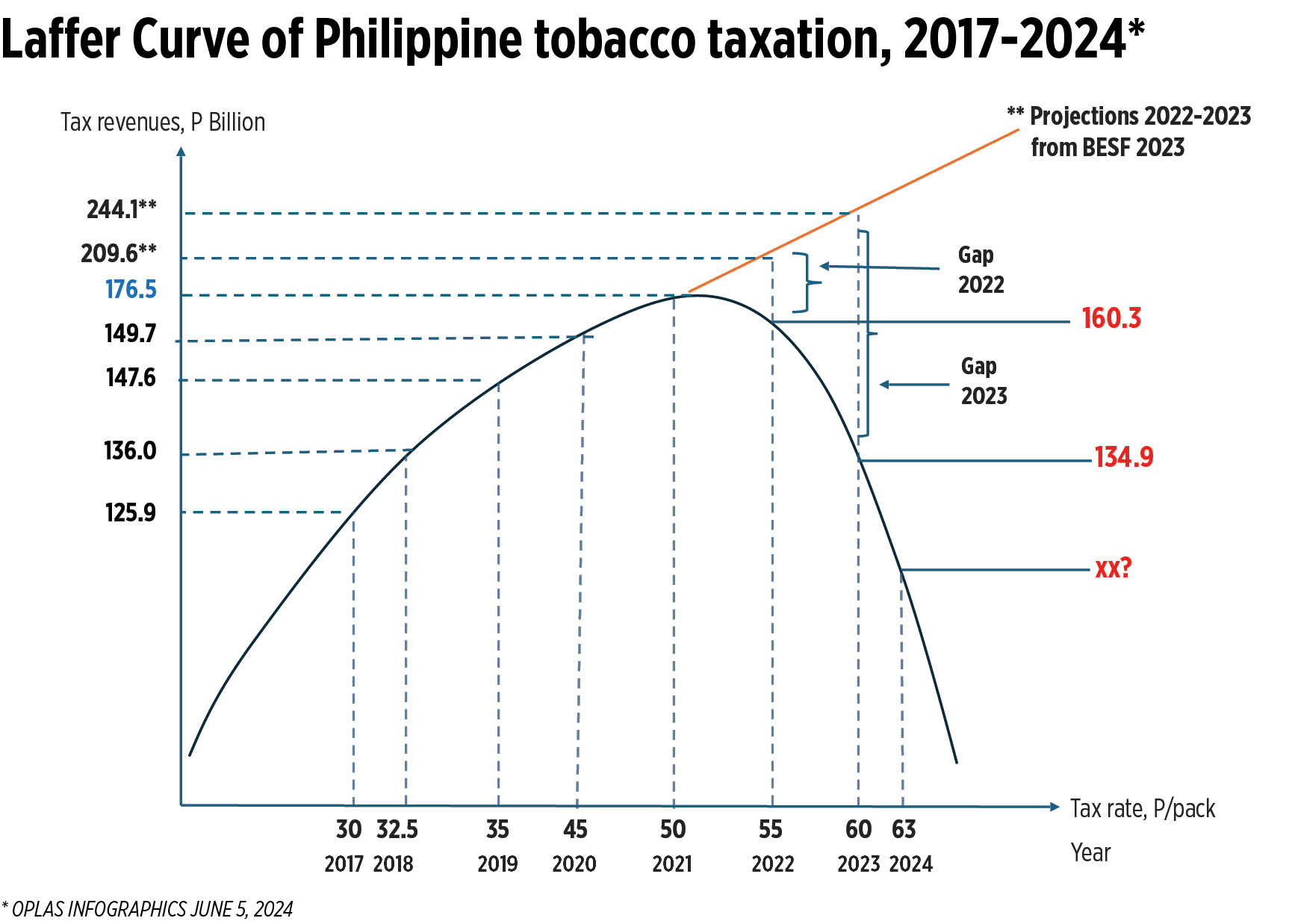

So here is a follow up and update of the chart I made in this column last year, “The Laffer Curve of Philippine tobacco taxation” (May 22, 2023).

The Laffer Curve is an economic concept and theory developed by American economist Arthur Laffer and it shows the changing pattern between tax rates and tax revenue: Initially as tax rates increase, tax revenues also increase. After a certain optimal point, as the tax rate continues to increase, tax revenues begin to decline.

At a tobacco tax rate of P30/pack in 2017, the tax revenue was P125.9 billion. At P32.50/pack in 2018, revenue was P136 billion; at P35/pack in 2019, revenue was P147.6 billion; at P45/pack in 2020, it was P149.7 billion; and at P50/pack in 2021, it was P176.5 billion.

Then things literally went south.

At a tobacco tax rate of P55/pack in 2022, tax revenue was P160.3 billion or a P16.2 billion decline from 2021; at P60/pack in 2023, it was just P134.9 billion or a P25.4 billion decline from 2022 and a P41.6 billion decline from 2021. Horrible.

Meanwhile, the target tobacco tax revenues for 2022 based on the Budget of Expenditures and Sources of Financing (BESF 2023, published in August 2022) was P209.6 billion and yet the actual revenue was only P160.3 billion or a P49.3 billion gap; the target for 2023, also from the BESF 2023, was P244.1 billion and yet actual revenue was only P134.9 billion or P109.2 billion gap (see the accompanying chart).

BESF 2024 (published in August 2023) recognized the problem of high illicit tobacco trade and it revised the tax revenue target for 2023 downward to P169.8 billion, yet the actual revenue was P134.9 billion, a gap of P34.9 billion. The target revenue for 2024, also under BESF 2024, is P185.3 billion, even lower than the target for 2022 of P209.6 billion under BESF 2023. The most recent tobacco revenue target by the Bureau of Internal Revenue (BIR) for 2024 is P152.4 billion, P33 billion lower than the target in BESF 2024.

I believe that even this new BIR target of P152 billion will not be attained this year. At a tax rate of P60/pack in 2023, the revenue was only P135 billion, so imagine the revenue decline at a tax rate of P63/pack in 2024. I think the likely tobacco tax revenue this year will be in the vicinity of P120 billion, which is lower than the revenues in 2017 of P126 billion.

So, the estimate by the Chairperson of the House Committee on Ways and Means, Representative Joey Salceda, of P60 billion/year in revenue losses from the illicit trade in tobacco alone is realistic, not exaggerated.

There was a forum last week, May 28, on “Navigating the Tobacco and Tobacco Alternative Markets: Championing Economic Growth and Consumer Protection and Safety.” It was held at the Asian Institute of Management Conference Center in Makati City and organized by an NGO, Bantay Konsyumer, Kuryente Kalsada (BK3).

The speakers were Dr. Ronald Holmes, President of Pulse Asia; Venus Gaticales, Chief of the BIR’s Excise Large Taxpayers Field Operations Division; Amanda Nograles, Assistant Secretary and Supervising Head of the Consumer Protection Group of the Department of Trade and Industry (DTI); and myself. The opening remarks were given by Karry Sison, Convenor of BK3. The host and moderator was Tricia Terada.

Dr. Holmes showed one result of their survey last year about consumer awareness of the illicit trade in tobacco and alternatives. Ms. Gaticales talked about the measures adopted by the BIR and other agencies to control illicit trade. Ms. Nograles talked about protecting product and brand quality from illegal and smuggled products.

I gave a nine-slides presentation. The title of my talk was “The P60-B/year question: Who benefits from higher tobacco taxation?” In my opening slide, I put this interesting quote:

“And if you examine our tax collection spreadsheet through the years, there is one entry common in all eras, and that is the heavy reliance on sin taxes. So much so that in 1912, when we were already under American rule, alcohol and tobacco combined for almost P9 million of total revenue take of P31 million. In short, vices financed the virtues of democracy the Americans were preaching.” — Department of Finance Secretary Ralph G. Recto, “Secretary’s Hour Toast Remarks” (April 30, 2024)

And these were the concluding notes in my presentation.

1. The Laffer Curve of tobacco taxation is real, not fictional or imaginary. The higher the tax rate, the lower the tax revenues. The optimal tax rate based on 2022 and 2023 tobacco excise tax collection seems to be P50/pack.

2. Newton’s 3rd law of motion: For every action there is an equal opposite reaction. Applied in public finance: For every increase in taxes there is an equal opposite distortion and tax evasion.

3. The idea that one needs “high tobacco taxation to reduce smoking” is a failed narrative. Recall the statement of Mr. Recto on the high reliance on sin taxes in 1912, where P9 million of the year’s total revenues of P31 million, or 29% of the total, came from the alcohol and tobacco tax. This is a huge percentage, yet one may assume that smoking and drinking continued despite the tax.

4. The major beneficiaries of high tobacco taxation are the smugglers, criminals, terrorists, and their protectors in government. The availability of more illicit tobacco means people are smoking more (cheap, illegal) tobacco, not less. This is actually happening.

5. The reliance on the alcohol-tobacco tax to fund universal healthcare (UHC) implies that the Health department, the World Health Organization, and health activists are thankful that there are more drinkers and smokers of legal products.

6. To avoid this irony and conflict of advocacy, there should be no earmarking of the “sin tax” for UHC. All revenues from the “sin tax” should go to the overall fund, and UHC should be funded from that general fund, and compete with other sectors.

7. What to do? See the four measures suggested by BIR Commissioner Romeo Lumagui, Jr., plus my two additional proposals in 2023.

I refer to the four BIR proposals: improved border controls, enhancement of intelligence networks among the country’s law enforcement agencies, comprehensive legal framework on trade of products in “brick-and-mortar” stores and e-commerce platforms, and strict enforcement of applicable laws and regulations against illicit trade and new anti-illicit trade legislation.

My two additional proposals in 2023 were: One, freeze the tobacco excise tax rate to between P50 to P55/pack. Reduce the price gap between legitimate tobacco — the cheapest then was P120/pack (P60 of which was excise tax alone) vs smuggled tobacco’s price of only P40/pack. And, two, partially peg the annual budget of law enforcement agencies like the Philippine National Police, the Philippine Coast Guard, and the National Bureau of Investigation on collections of excise tax, especially on tobacco products. If excise tax collections flat line or decline, these agencies’ budgets that come from those taxes will be affected — an incentive for them to strictly enforce laws against illicit trade.

I continue to advocate for those two proposals. We need better tax administration; we need additional revenue from existing tax laws to reduce the huge public debt and reduce the huge annual interest payment alone. We need to go back to collecting P176 billion from the tobacco tax alone, not P135 billion, not P120 billion as the tax rate increases yearly.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com