By Justine Irish D. Tabile, Reporter

NESTLÉ Philippines, Inc. said it set aside P6 billion to expand factory capacity and improve their efficiency.

At a media event on Tuesday, Nestlé Philippines Chief Executive Officer Kais Marzouki said that the investment plans are part of the P18.1 billion earmarked for the Philippines for the 2019-2027 period.

“What you see here over the last few years and a few years going forward is really a constant investment of P2 billion every year,” Mr. Marzouki said.

“This is to increase our capacities, to improve our technologies, to make our factories more efficient, and to respond to increasing demand,” he added.

He said the investments are geared toward better addressing the Philippine market’s nutrition, health, and wellness needs.

Citing issues like child nutrition, Mr. Marzouki said: “60% of what we sell addresses micronutrient deficiencies because many of our products are fortified.”

“All our factories need to be upgraded constantly, and that’s really what our investments are about,” he added.

On Monday, Nestlé was at the Taguig Integrated School for its Nestlé Wellness Campus experience.

Since 2012, the company has been staging Nestlé Wellness Campus events with the Department of Education (DepEd) to teach public school children and parents the importance of sound nutrition and proper health habits.

“Today we cover 26,000 schools. We cover half of all the children from Grade 1 to Grade 6… Every year we increase (the scope of the program) in partnership with the DepEd,” he said.

“We are already in eight regions. The idea is to eventually cover all the regions in the Philippines,” he added.

The investment plan also addresses major sustainability problems in the Philippines.

Laurent Freixe, Nestlé’s global chief executive officer, said that the company has been helping coffee farmers apply regenerative practices, using renewable electricity in their manufacturing facilities, and collecting plastic packaging to promote circularity.

“I think (the Philippines is) one of the best markets we have in terms of engagement end-to-end,” he added.

According to Mr. Marzouki, Nestlé was the first FMCG (fast-moving consumer goods) company to become plastic-neutral in the Philippines.

“That means that we take back as much as we put out in packaging. That’s 24,000 tons every year,” he added.

Mr. Freixe described the Philippines as a big market population-wise, comparable to Mexico and exceeding any European country.

“It’s one of the most promising countries in terms of economic growth… with the population growing, it’s one of the most promising markets we’ve got in the world,” he said.

“(The Philippines) is the sixth biggest market for the group in terms of turnover,” he added.

In 2023, Nestlé Philippines booked P169 billion in revenue. The company has yet to release results for 2024.

Mr. Marzouki said that the average annual revenue growth for Nestlé Philippines’ is around 5%.

According to Mr. Freixe, in the Philippines, “we believe in the cold coffee space… And I think there is a know-how there and many initiatives.”

“We also believe in the potential of pet food, which is still a relatively small category but has huge potential,” he added. The group controls the Purina brand of pet food.

The top 4 Nestlé brands in the Philippines are Nescafé, Bear Brand, Milo, and Maggi, Mr. Marzouki said.

“All our products are specially formulated for Filipino consumers and made in the Philippines. All of them have a different profiles than any other product in the rest of the world because they’re made specifically for the Filipino taste,” he said.

“Our ambition is to grow more big brands and to go into more consumer occasions to better serve our consumers. So our existing categories would have innovation, and we’ll also go into new categories,” he added.

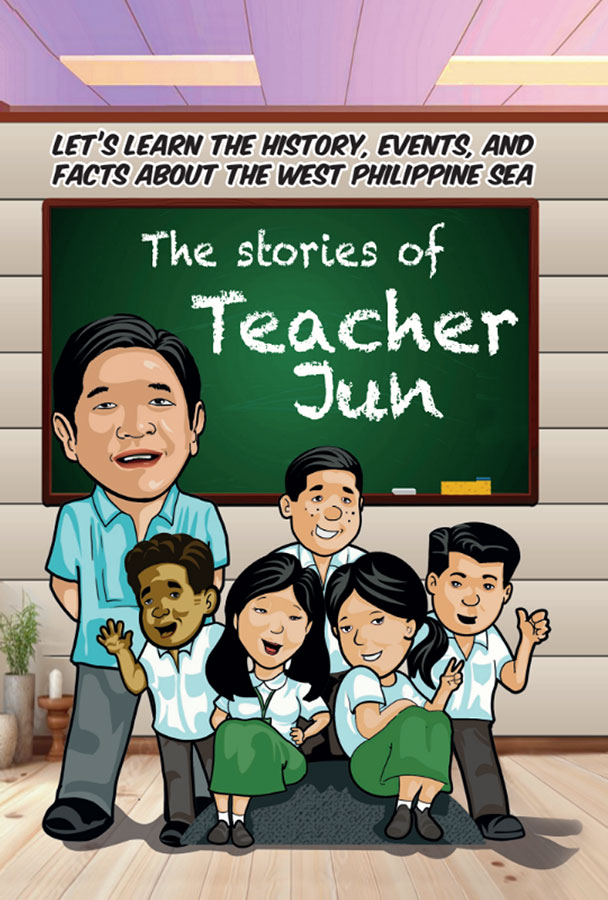

THE Philippines launched a comic book on Friday in its fight against what it called distorted narratives about maritime rights in the West Philippine Sea, a disputed area in the South China Sea, a move which drew criticism from China.

THE Philippines launched a comic book on Friday in its fight against what it called distorted narratives about maritime rights in the West Philippine Sea, a disputed area in the South China Sea, a move which drew criticism from China.