Overcoming economic challenges under a proactive leadership

The Bangko Sentral ng Pilipinas (BSP) persists in aiming to promote and maintain a strong financial system while supporting sustainable and inclusive economic growth.

Since assuming office in July 2023, the leadership of Bangko Sentral ng Pilipinas (BSP) under Governor Eli Remolona, Jr. has brought about significant policy developments and achievements to this regard, shaping the financial and economic landscape of the Philippines.

Particularly, the governor has steered the BSP towards digitalization, financial stability, and sustainability in the financial sector.

Path towards economic recovery and resilience

During the meeting of the Monetary Board on the Monetary Policy Stance on December 2023, Mr. Remolona and the Monetary Board decided to maintain the current policy interest rate at 6.50% for the target reverse repurchase (RRP) rate, as well as the current interest rates on the overnight deposit facility at 6.00% and overnight lending facility at 7.00%.

The decision was driven by the need to keep monetary policy settings sufficiently tight to allow inflation expectations to settle more firmly within the government’s target range. Through the BSP’s inflation-targeting framework, headline inflation has been brought down to 3.9% as of December 2023, from a high of 8.7% in January 2023.

Furthermore, the balance of risks to the inflation outlook remained significantly skewed to the upside from 2023 through 2025, with the latest risk-adjusted inflation forecast for 2024 had declined to 4.2% from 4.4% in the previous meeting.

In April 2024, inflation increased slightly from 3.7% in March to 3.8%, primarily due to a higher year-on-year rise in the prices of food and non-alcoholic beverages. The increase in food inflation was driven by higher prices for vegetables and fish, which had shown negative inflation readings in March.

At the same time, non-food inflation remained relatively stable, as higher gasoline and diesel prices, reflecting the rise in international crude oil prices in April, were balanced out by lower inflation in important categories such as housing, water, electricity, gas, and other fuels, as well as restaurants and accommodation services.

On a month-on-month seasonally adjusted basis, headline inflation slowed down to 0.2% in April from 0.3% in March.

According to the BSP, inflation is likely to remain elevated in the coming months due to the continued impact of supply shocks on food prices and the rise in global oil prices.

As a result, Mr. Remolona emphasized the importance of maintaining adequately tight monetary policy settings until inflation expectations were firmly anchored and inflation had reverted to the target range.

Despite the challenges posed by global economic headwinds and tighter financial conditions, the BSP has remained committed to steering the Philippine economy towards sustained growth and stability.

In the first quarter of 2024, the gross domestic product (GDP) posted a year-on-year growth of 5.7%, although slightly below the government’s target range of 6%-7%. Demand indicators, such as the manufacturing sector’s capacity utilization and the composite purchasing managers’ index, suggest that the economy is still expanding.

On the other hand, preliminary data showed that outstanding loans of universal and commercial banks, net of reverse repurchase placements with the BSP, increased by 7.2% year on year, slightly lower from the 7.7% in July. On a month-on-month seasonally adjusted basis, outstanding universal and commercial bank loans, net of RRPs, grew by 0.6%.

Consumer loans to residents remained relatively steady at 22.7% in August compared to 22.6% in July, driven by growth in credit card and motor vehicle loans, while outstanding loans to non-residents increased by 7.8% in August, up from 6.2% in the previous month.

Meanwhile, the BSP, through the Financial Stability Coordination Council (FSCC), has approved a comprehensive set of measures to bolster the resilience of the Philippine financial system. These initiatives are designed to enhance communication, strengthen capital and contingent markets, and improve risk assessment tools and data management to proactively mitigate potential systemic risks.

The FSCC believes that current market behavior in 2024 is aligned with a “risk on” stance which will nurture more economic activity. Mr. Remolona expects an increase in the funding requirements of corporations during this “risk on” phase.

In a statement, the FSCC chairman and BSP governor stated that “an active corporate bond market will benefit financial market stakeholders by widening access to funding for all credit categories of borrowers, expand opportunities for investors of different risk appetite, and better manage risks for all.”

The Philippines’ gross international reserves (GIR) have remained at healthy levels throughout 2024, providing a strong buffer against external shocks. According to data from the BSP, the GIR settled at $102.7 billion as of the end of February 2024. This figure increased to $104 billion by the end of March 2024.

The GIR level represents over 7.7 months’ worth of imports of goods and payments of services and primary income, which is well above the conventional adequacy threshold of three months. The reserves are also about 6.1 times the country’s short-term external debt based on original maturity, and 3.7 times based on residual maturity.

The rise in the GIR level was due to various factors, including the National Government’s net foreign currency deposits with the BSP, as well as the upward valuation adjustments in the value of the BSP’s gold holdings because of the increase in international gold prices. The central bank’s net income from its overseas investments also contributed to the growth in reserves.

With healthy GIR levels, the country is better positioned to address potential external vulnerabilities and maintain confidence in the management of the country’s external obligations.

Strengthening the financial system

Mr. Remolona emphasized the need to ensure the Philippine banking system remains healthy, with strong balance sheets, profitable operations, and sound performance indicators. With the support of the banking community and other stakeholders, the central bank aims to build on its legacy as a source of stability for the economy.

The Financial Sector Forum (FSF), composed of the BSP, Securities and Exchange Commission (SEC), Insurance Commission (IC) and Philippine Deposit Insurance Corp. (PDIC), continues to coordinate and exchange information for effective financial sector regulation while respecting each agency’s mandate.

As the new chairman of the FSF, the key areas under his leadership will include financial conglomerate supervision, sustainable finance, information exchange, financial technology, and consumer protection and education. Furthermore, the introduction of a local sustainable finance taxonomy for climate change mitigation and adaptation further highlight the BSP’s commitment to sustainability and green finance.

Meanwhile, Mr. Remolona has also highlighted the BSP’s sustainability initiative, emphasizing the need to infuse it with an inclusion perspective. The goal is to ensure the entire financial system supports an inclusive adaptation program, so the burden of transition does not fall on the most vulnerable segments of society.

The BSP governor also expressed his support in micro, small, and medium enterprises (MSMEs). With MSMEs accounting for 99.6% of business establishments, 36% of gross value-added, and 65% of total employment in the country, the BSP targets to encourage inclusive growth and financial resilience for the sector through the National Strategy for Financial Inclusion 2022-2028.

Digitalization and financial inclusion

Parallel to the BSP’s financial inclusion mandate, the central bank is harnessing digital technology to empower traditionally underbanked sectors.

During the Philippine Economic Briefing (PEB) on Dec. 11, 2023, Mr. Remolona highlighted key initiatives the BSP is pursuing to digitalize the financial sector, such as open finance, digital banking, and regulatory sandbox.

Open Finance Framework enables established banks to work with application programming interfaces (APIs) to connect with other financial services and integrate them into their systems.

Part of the BSP’s three-year Open Finance Roadmap 2021-2024, which emphasizes capacity-building, industry-accepted standards and a robust regulatory framework, the framework can help reduce transaction costs and enable the customization of products to meet evolving customer needs.

The BSP has also recently introduced a framework for “digital banks” as a separate classification of banks. The aim is to improve the efficiency of delivering financial products and services and expand their reach to unserved and underserved market segments.

However, the BSP governor has acknowledged that digital banks are encountering challenges with their online lending activities. According to him, it seems “very hard to make loans online” and “very hard to collect on loans online” in the Philippine context.

In response, the BSP is currently limiting the number of digital banking licenses to six, enabling the central bank to closely monitor the industry and consider whether to open up the market to more players with different business models.

Meanwhile, the BSP has established Regulatory Sandbox Framework to foster responsible innovation and promote the development of an inclusive digital financial ecosystem.

Mr. Remolona said, “We want to make sure that this digitalization will result in better and more products that respond to the needs of clients, help them manage their finances, and enable them to seize economic opportunities.”

The BSP also pushes for greater financial inclusivity, including advocating for more banks to remove fees on small-value digital transfers under P1,000. In fact, the central bank considers digital payments as the “gateway to financial inclusion” as online platforms can ease more Filipinos into the financial system.

In a statement, Mr. Remolona emphasized the importance of a proactive and collaborative approach to economic stewardship through innovation and resilience to ensuring sustainable economic growth and financial stability in the Philippines.

“I hope that through the initiatives which we will put into play in collaboration with the banking industry, the BSP will be able to contribute to a brighter and better future for our countrymen,” he added. — Mhicole A. Moral

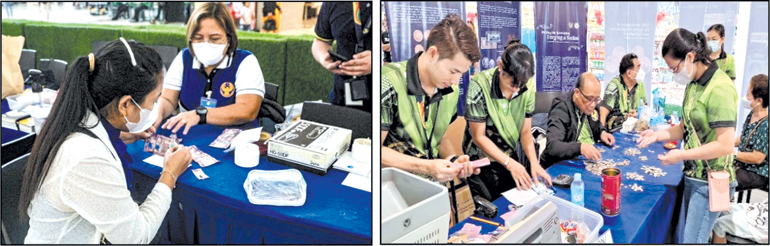

Paleng-QR Ph Plus Program is a program that promotes the adoption of digital payments in public markets and other business establishments, particularly of small and medium enterprises.

Paleng-QR Ph Plus Program is a program that promotes the adoption of digital payments in public markets and other business establishments, particularly of small and medium enterprises.