President Ferdinand R. Marcos, Jr. delivered his third State of the Nation Address (SONA) last Monday at the Batasan Pambansa. Some energy topics that he mentioned in all his SONAs — 2022, 2023, and 2024 — were the push for more renewable energy, the role of Malampaya gas, and power transmission development towards a “Unified Philippine Grid.” See his statements below:

From SONA 2022: “Furthermore, we must examine the entire system of transmission and distribution for the purpose of finding ways to lower the price of energy to the consumer.

“We must expand the network of our transmission lines while examining schemes to improve the operation of our electrical cooperatives.”

From SONA 2023: “We finally have a Unified National Grid, with the interconnection of the Luzon, Visayas, and Mindanao grids. The ‘One Grid, One Market’ will enable more efficient transfers and more competitive pricing of electricity throughout the country.

“However, 68 grid connections are much delayed, according to the ERC’s count. We are conducting a performance review of our private concessionaire, the National Grid Corporation of the Philippines (NGCP). We look to NGCP to complete all of its deliverables, starting with the vital Mindanao-Visayas and Cebu-Negros-Panay interconnections.”

From SONA 2024: “Running through Bataan, Pampanga, and Bulacan, the newly inaugurated Mariveles-Hermosa-San Jose transmission line will further strengthen the reliability of the Luzon power grid.

“In the Visayas, all stages of the Cebu-Negros-Panay backbone project have likewise been completed… And just last week, the Dumanjug-Corella Line of the Cebu-Bohol Interconnection Project was energized, enabling the transfer of power between Cebu and Bohol.

“The energization of the Mindanao-Visayas Interconnection is a defining moment not only for the power sector but for the entire country. Finally, we have connected the power grids of all three major island groups.”

The NGCP has finally delivered all three important interconnection projects. Thank you, NGCP. Please keep expanding and strengthening the transmission system to accommodate more big baseload plants, secondarily, the intermittent renewables.

Emmanuel V. Rubio — the new President and Chief Executive Officer (CEO) of Meralco PowerGen Corp. (MGen), and also immediate past President and CEO of Aboitiz Power (AP) — praised the President for his SONA, saying that, “It is notable that the government is closely working with NGCP in completing the critical transmission lines to ensure that major baseload plants and areas where we have surplus supply like Mindanao, can evacuate needed power to areas where the supply often is critical.

“I am also in support of the President’s endorsement of amending EPIRA for the purpose of updating certain provisions to ensure that they are aligned with current trends in terms of technology and energy mix. Certain issues, like how grid limits are calculated and capped, should be revisited given the influx of solar capacities and the need for scale in developing LNG to Power facilities and eventually, nuclear.”

Last week the Department of Energy (DoE) released a draft of the “Philippine Nuclear Energy Program (PNEP) 2024-2050: A Roadmap Towards Clean Energy.”

President Marcos Jr. advocated nuclear energy development early on. In his 2022 SONA he said, “I believe also it is time to re-examine our strategy towards building nuclear power plants in the Philippines. We will comply of course with the International Atomic Energy Agency (IAEA) regulations for nuclear power plants as they have been strengthened after Fukushima. In the area of nuclear power, there have been new technologies developed that allow smaller scale modular nuclear plants and other derivations thereof.”

In the draft PNEP, the DoE said that, “The use of nuclear energy for power generation is in support of meeting the electricity requirements for the forecasted economic growth under the Philippine Energy Plan (PEP) 2023-2050, consistent with the Philippine Development Plan (PDP) 2017–2040.”

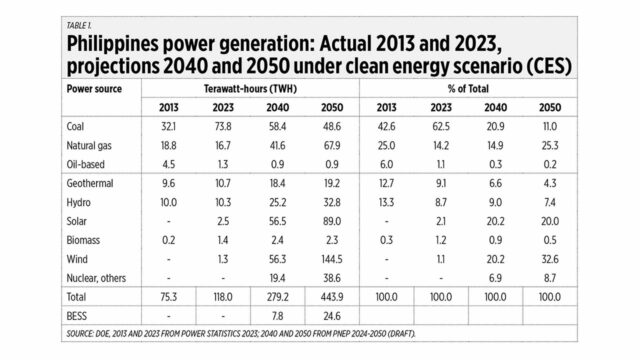

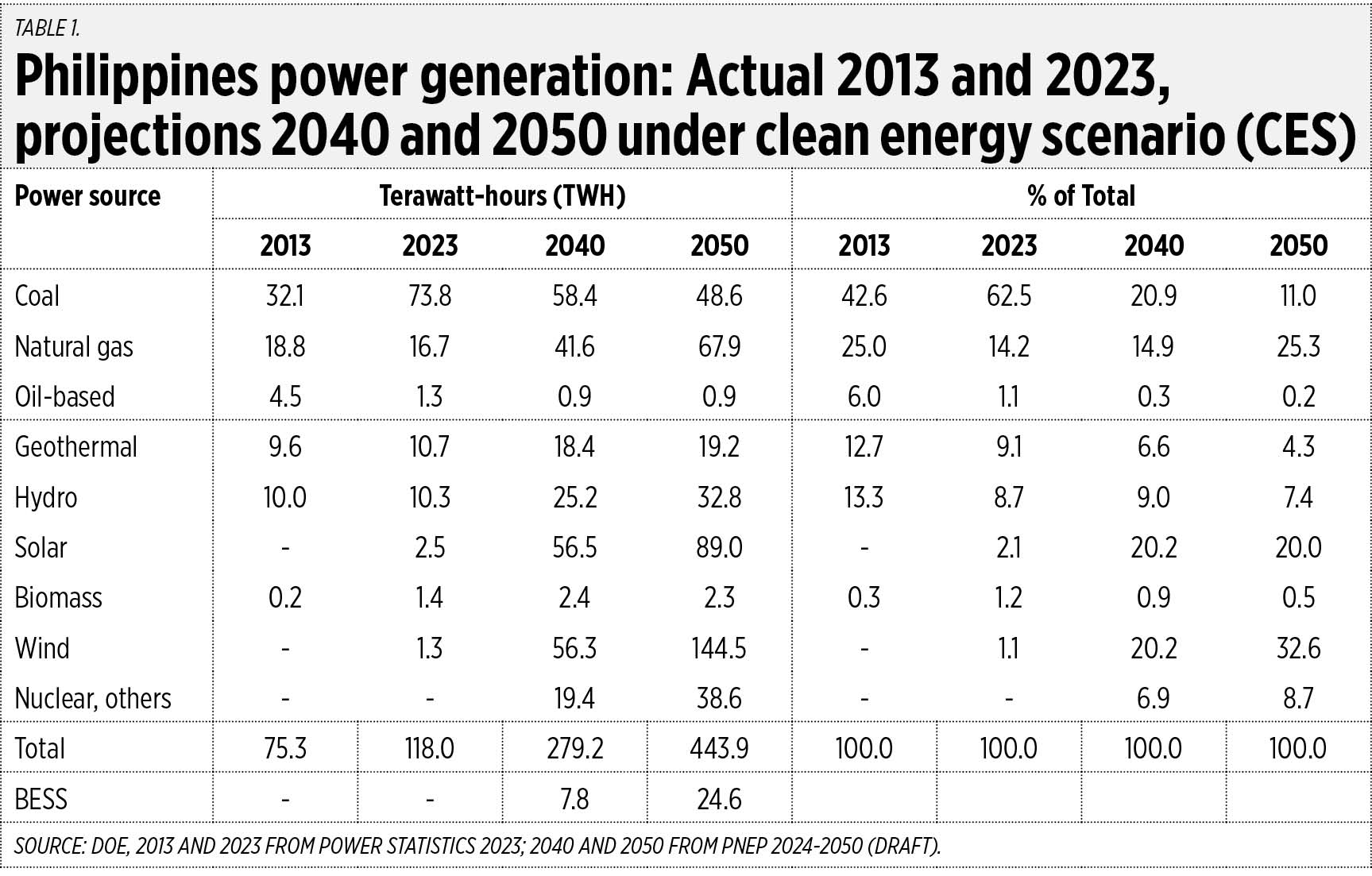

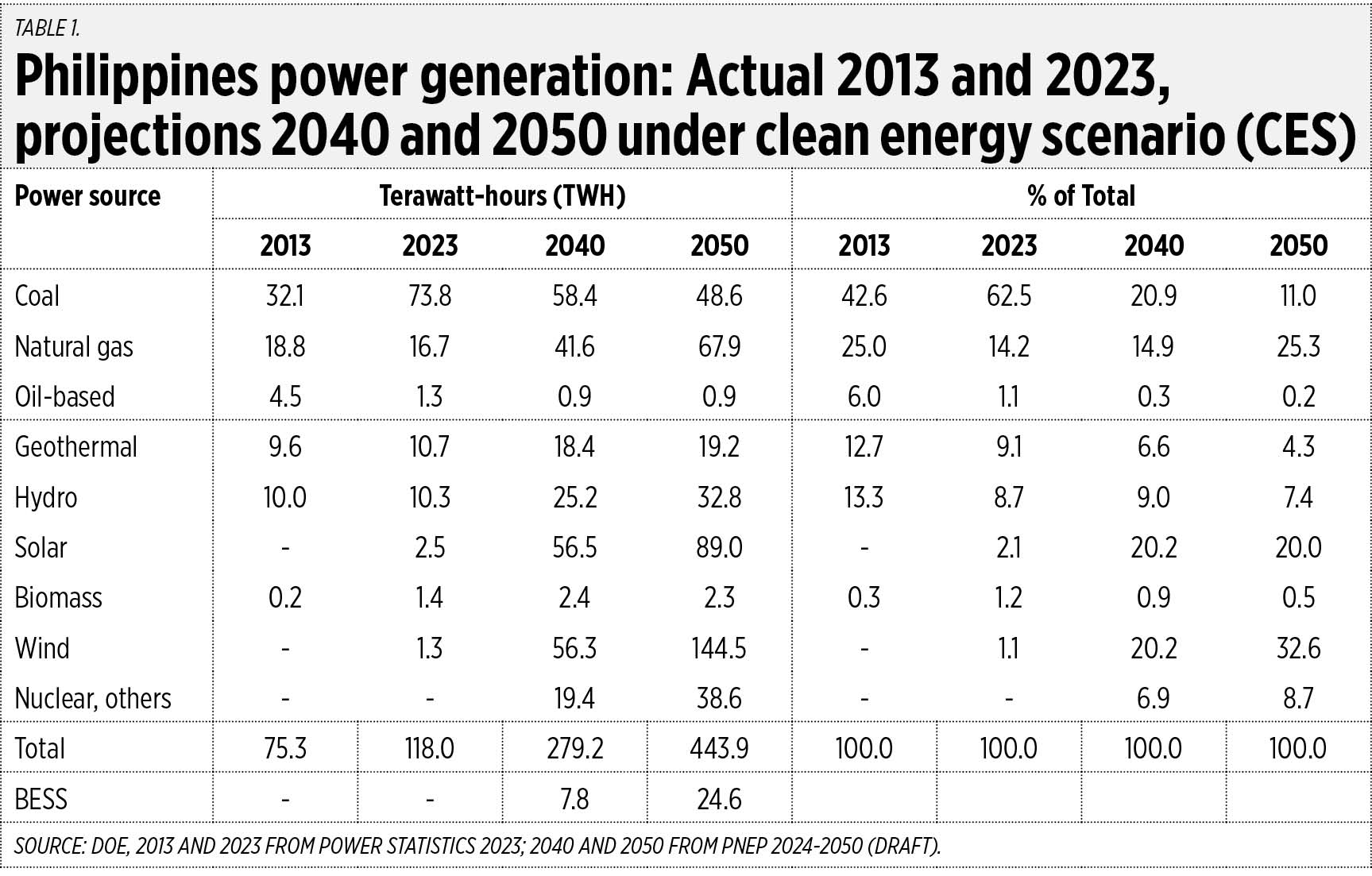

The PNEP actually showed that the main target of the DoE and PEP is wind and solar power generation. The power generation targets by 2050 are: wind 144 terawatt-hours (TWh), solar 89 TWh, natural gas (including LNG) 68 TWh. The percentage share of coal will decline from 62% of total generation in 2023 to only 11% by 2050 while the share of wind will jump from 1% in 2023 to 33% of the total in 2050. Nuclear and others are to rise from zero to 9% by 2050 (see Table 1).

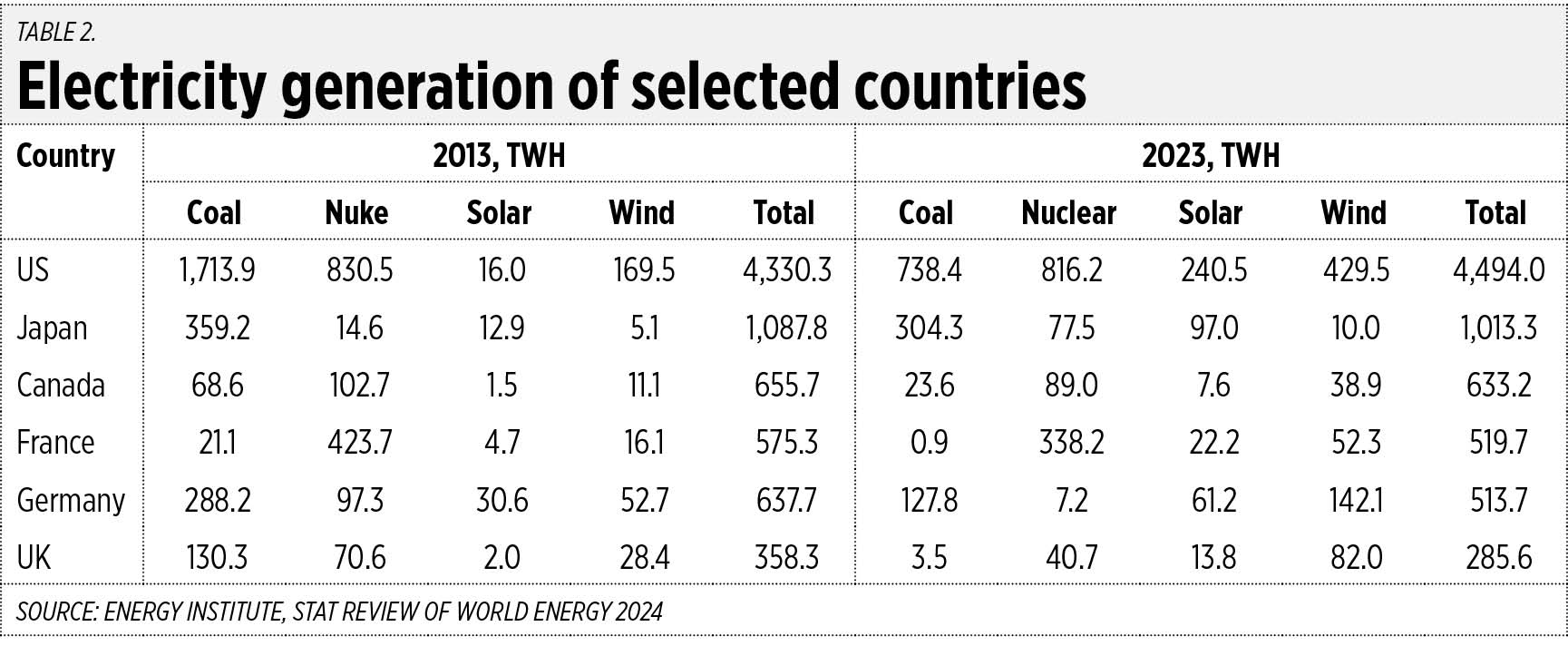

I am not enthusiastic over having intermittent solar and wind as the dominant energy source – it is projected that they will provide 53% of the Philippines’ total power generation by 2050. The experience of rich countries showed that when they jumped fast into solar-wind, plus reduced their coal and nuclear capacity, this led to a significant slowdown in growth, even degrowth, as is currently experienced by Germany, the UK, and Japan.

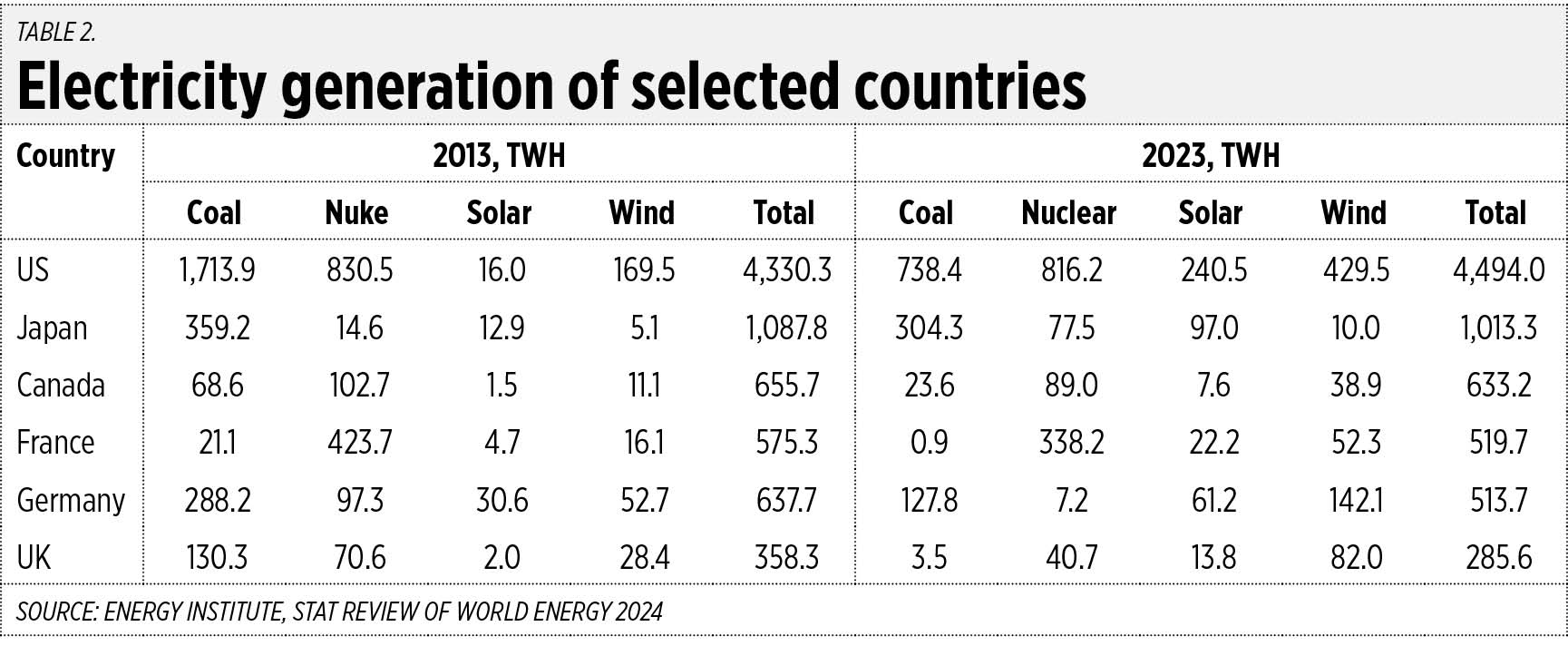

In one decade — from 2013 to 2023 — there was a big decline in coal generation in the US, Canada, Germany, the UK, France and Japan. And a big jump in their solar and wind generation (see Table 2).

The average gross domestic product growth from 2016-2023 in these countries were: US 2.2%, Canada 1.7%, the UK 1.3%, France 1.2%, Germany 1%, and Japan 0.5%. These were not the growth rates of these countries in earlier decades when they were not preoccupied with decarbonization and net zero.

Also last week, on July 18, two NGOs — Sanlakas and Power for People Coalition (P4P) — said they filed a case against DoE Secretary Raphael Lotilla before the Ombudsman for “violating” the coal moratorium and favoring AP where he was once a member of the board.” This is in relation to AP’s expansion of Therma Visayas Inc. (TVI) coal Unit 3 in Toledo City, Cebu.

The DoE released a statement that same day clarifying that the “Coal Moratorium Policy issued in December 2020 is not a total ban, does not cover existing and operational coal-fired power generation facilities as well as any coal-fired power considered committed power projects; existing power plant complexes which already have firm expansion plans and existing land site provisions; and indicative power projects with substantial accomplishments, particularly with signed and notarized land acquisition or lease agreement for the projects, and with approved permits or resolution from local government units and the Regional Development Council where the power plants will be located.”

Secretary Lotilla is correct in saying that, “Diversification of energy sources is critical to energy security. Unfortunately, we get pilloried for favoring solar and wind over coal and get charged for favoring coal over renewable energy. This leaves us with a reassuring feeling that we are getting the damn thing right.”

I concur with the clarifications by the DoE and the statement by Secretary Lotilla.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com

PRIVATE and public organizations are currently collecting donations for those affected by the heavy rains brought by Typhoon Carina and the monsoon.

PRIVATE and public organizations are currently collecting donations for those affected by the heavy rains brought by Typhoon Carina and the monsoon.