POLICYMAKERS should consider simplifying the income tax regime via a flat, with top earners currently a disproportionate burden, possibly jeopardizing fiscal stability, according to a House of Representatives think-tank.

In a report, the Congressional Policy and Budget Research Department (CPBRD) said legislators could explore changes to the income tax system, saying that the Tax Reform for Acceleration and Inclusion (TRAIN) Law is overburdening top earners, with the effect of narrowing the tax base.

It recommended a 10% or 15% flat tax for those earning more than P250,000 a year to simplify the tax code and make it more fair to taxpayers.

“The income tax base became narrower after the passage of the TRAIN Law,” the report’s authors, David Joseph Emmanuel Barua Yap, Jr., Edrei Y. Udaundo, and Jubels C. Santos wrote.

“Policymakers are enjoined to explore alternative tax structures, such as a flat tax that simplifies compliance or a shift toward consumption-based taxation that broadens the revenue base,” they added.

The TRAIN Law, signed by former President Rodrigo R. Duterte in December 2017, sought to rationalize the tax system by exempting individuals earning less than P250,000 annually from income taxes. It also imposed excise taxes on sweetened beverages and raised duties on petroleum, automobiles, tobacco, and other goods to offset foregone revenue.

“The changes to income tax brackets and income tax rates resulted in major shifts in the distribution of the income tax burden,” the think tank said.

While top earners already bore the majority of the income tax burden prior to the TRAIN Law, its passage has further increased their share, according to the CPBRD.

The tax share of top earners — with earnings of at least P1.35 million in 2017 — amounted to 72.4% (P183 billion), according to Bureau of Internal Revenue (BIR) data cited in the paper.

By 2023, those earning P1.43 million or more accounted for 88.1% (P258 billion).

“These figures suggest that recent improvements in income tax revenue in recent years came largely from top income earners,” the think tank said. “The continued narrowing of the tax base, in turn, suggests that the growth prospects of income tax revenue may be constrained as overall performance relies on a small portion of income taxpayers.”

“The large burden placed on the top income earners increases the vulnerability of revenue streams to shocks,” it added.

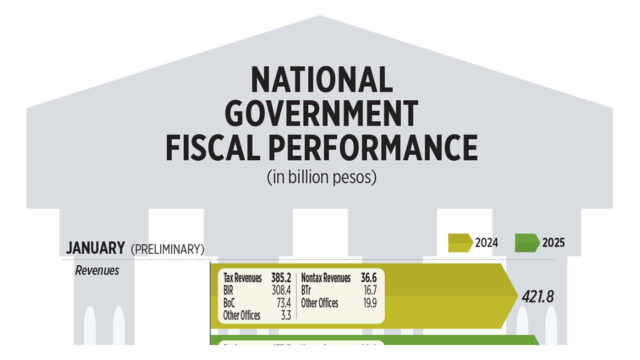

Income taxes account for 10% to 12% of the National Government’s revenue, according to the CPBRD report.

Implementing a 10% flat tax could yield the government P152 billion, while a 15% rate could generate P227 billion, according to CPBRD estimates based on 2023 BIR data.

Policymakers should also look at reorienting the tax structure towards consumption, either by increasing the value-added tax (VAT) rate or introducing new and targeted excise taxes.

“Shifting the tax burden from income to consumption incentivizes savings and investment by allowing taxpayers to retain their full earnings upfront and taxing them only when they spend,” the CPBRD said.

“This has the potential to further stimulate economic growth by encouraging capital accumulation,” it added.

Increasing the VAT rate to 14% from 12% could raise P168 billion in revenue, the report added.

The impact of consumption-based taxes could be cushioned for “low-income individuals” by exempting basic goods from rate increases or by offering discounts on their purchases similar to the current senior citizen discount system, the CPBRD said.

Legislators should also make the national budget more cost-efficient by cutting down on “wasteful and questionable spending practices.”

The government should explore “right sizing” the bureaucracy to trim spending, the report added. “A modest downsizing effort would compensate for — a large part of the expected revenue losses from the removal of income taxes.”

A 10% reduction in government payroll could generate P160 billion in savings — equivalent to half of the 2023 income tax take, the CPBRD said. — Kenneth Christiane L. Basilio