McDonald’s Philippines MBraces all with ‘Love Ko All’ campaign

McDonald’s Philippines is painting the town [and its restaurants], with rainbow colors this Pride Month. Going beyond its iconic arches, McDonald’s is celebrating diversity and inclusivity with special meal deals, informative podcasts, and activations in various Pride events. Since 2021, Love Ko All has been the brand’s Pride platform which highlights that no matter who you are, you are welcome at McDonald’s.

Rainbow Arches and Beyond

Kicking off the celebration is the transformation of one of its flagship restaurants in the country, McDonald’s McKinley West store’s golden arches into rainbow arches, a symbol of Pride and acceptance. Underscoring the path towards inclusivity are also the MBrace Lanes at participating stores in Tagaytay Delos Reyes, Quezon Avenue Ligaya, and California Garden Square. Take a snap and share it on social using the #LoveKoAll.

Expanding its participation in Pride marches across the country, McDonald’s is setting up tents with photo booths and offering exclusive merch, creating opportunities for both allies and potential LGBTQ+ employees to join their team.

Pride March Events

June 15, 2024: Mandaue Pride March at Mandaue Pride Heritage Plaza

June 22, 2024: Love Laban 2 Everyone Pride Festival at Quezon City Memorial Circle

June 29, 2024: Kahilwayan Pride March at Villanueva Municipal Hall, Misamis Oriental

“Love Ko All” Podcast

This year, it is taking on a unique initiative as McDonald partners with Bekenemen Productions to launch the “Love Ko All” podcast. This two-episode video podcast will feature discussions with key opinion leaders in the queer community to talk about topics like representation, self-acceptance, and safe spaces in the workplace. The podcast will be available on YouTube and Spotify starting June 19. Listen in through this link https://bit.ly/BekenemenPodcastLoveKoAllSpotify.

A Message of Love and Unity

“At McDonald’s, we believe that everyone should be welcome and accepted for who they are, and who they love,” said Adi Hernandez, McDonald’s Philippines AVP for Corporate Relations and Impact. “This Pride Month, we are here once again to demonstrate our support to the LGBTQIA++ community. We believe in the importance of celebrating and embracing love in all forms as we aspire that our message of inclusivity and acceptance will be an inspiration for all our crew and customers.”

Customers are encouraged to share their Pride celebration on social media using #LoveKoAll. For more information, visit the McDonald’s Philippines Facebook Page.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.

PHL wholesale, NCR retail price growth slower in May

Wholesale price growth in the country and retail price growth in the National Capital Region (NCR) both eased to multiyear lows in May amid base effects, the Philippine Statistics Authority (PSA) reported on Friday.

Preliminary data from the PSA showed the country’s general wholesale price index (GWPI) inched up by 2.3% year on year that month, significantly lower than the 5% a year earlier and the 2.6% in April.

May’s reading was the slowest in almost three years or since the 2.2% recorded in June 2021.

Year to date, GWPI averaged 2.8%, lower than the 5.5% a year ago.

Meanwhile, in a separate release, the general retail price index (GRPI) in Metro Manila eased to 2%, lower than the 4.9% a year earlier and 2.1% in April.

The current level was the slowest in more than two years or since the 1.9% growth in January 2022.

In the five months to May, GRPI increased by an average of 2.1%, cooling down from 5.8% logged a year earlier.

“This year-on-year decrease likely reflects a high inflation base from 2023, potentially lower global commodity prices, and improving supply chain,” Robert Dan J. Roces, chief economist at Security Bank Corp. said in a Viber message.

The PSA attributed the downtrend of the GWPI in miscellaneous manufactured articles, which slowed to 0.3% year on year in May from 2% in April.

This was followed by beverages and tobacco (3.1% in May from 4.4% in April), crude materials inedible except fuels (4.2% from 8.4%) and chemicals including animal and vegetable oils and fats (2% from 2.3%).

Other commodities that logged slower growth were manufactured goods classified chiefly by materials (1.1% from 1.6%) and machinery and transport equipment (0.4% from 0.5%).

Bulk prices growth in the three major island groups ended mixed in May.

Wholesale price growth in Luzon went up by 2.2%, easing from 2.4% in April and 4.9% in May last year.

In the Visayas, GWPI likewise slowed to 5.6% in May, significantly lower from 6.7% in April and 3.9% in May 2023.

On the other hand, price growth in Mindanao grew by 1.9% against 1.1% in April but still lower than the 5.7% a year earlier.

Meanwhile, the slowdown in GRPI in Metro Manila was primarily caused by the heavily weighted food index at 2.5% during the period from 2.6% in April, the PSA said.

The same following commodity groups dragged the retail price growth in NCR: beverages and tobacco (3% from 3.7%), crude materials inedible except fuels (0.6% from 0.8%), chemicals, including animal and vegetable oils and fats (2.2% from 2.5%) and manufactured goods classified chiefly by materials (1.3% from 1.4%).

Mr. Roces said that the slowdown is expected to persist in June with year year-on-year growth rates potentially even lower than the reported figures.

“Predicting the full year’s trend requires further data, but the current data suggests a significantly cooler pricing environment compared to 2023,” Mr. Roces said. — Abigail Marie P. Yraola

Horizon Land tops off second tower of Siena Tower in Marikina

Horizon Land, the smart value brand of Federal Land, Inc., celebrated another milestone with the topping off ceremony of the second tower of Siena Towers. This marked a pivotal moment in its dedication to providing practical and sensible homes in prime locations for Filipino families.

“The completion of Siena Towers – Tower 2 is an important milestone for Horizon Land. This construction milestone underscored Horizon Land’s dedication to staying on target for timely delivery and unit handover, ensuring that families can soon enjoy modern living spaces designed with their needs in mind,” said Mr. John Frederick Cabato, Horizon Land Property Development Corporation General Manager.

A modern take on the town of Siena, Italy, where rural charm and progress abound, Siena Towers in Marikina offers safe and family-friendly homes designed to meet the essential needs of Filipino families. Siena Towers – Tower 2 is at its preselling stage to provide fresh new inventory to homebuyers and investors who see high investment potential in practical and affordable developments in prime areas.

To learn more about Siena Towers, join the Horizon Land’s Tahanan Grand Open House on June 29, 2024 (Saturday) from 11 am to 7 pm at Le Pavillon in Met Park, Manila Bay Area. Exclusive to this Grand Open House event, Siena Towers property investors can get as much as P1.6 million worth of discounts or freebies.

Visit www.horizonland.ph or email hello@horizonland.ph.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.

China’s Xi calls for ‘bridges’ amid trade, diplomatic frictions

BEIJING – Chinese President Xi Jinping on Friday called for the building of “bridges” in the global economy, as Beijing grapples with economic and security disputes with its neighbors and trading partners around the world.

China will never leave the road of peaceful development, Mr. Xi said at a conference commemorating China’s guiding principles for foreign affairs first formulated 70 years ago.

China will also not become a “strong” state that would try to dominate others, Mr. Xi told conference attendees that included former Myanmar President Thein Sein and former General Secretary of the Vietnamese Communist Party Nong Duc Manh.

“Facing the history of peace or war, prosperity or unity or confrontation, more than ever before, we need to carry forward the spirit and connotation of the Five Principles of Peaceful Coexistence,” Mr. Xi said.

The Five Principles first appeared in a 1952 pact reached with regional rival India over their Himalayan border. Even so, Indian officials were absent from the front row of the audience reserved for guests of honor.

Since the 1950s, China’s ruling Communist Party has gone from not being recognized by the United Nations to boasting the biggest diplomatic footprint in the world and presiding over the second-biggest economy.

Beijing now signals a desire that other countries see it as a diplomatic heavyweight, even as other countries accuse it of economic coercion and unfair competition.

After China brokered an unexpected detente between Iran and Saudi Arabia last year, Wang Yi, China’s top diplomat, said the country would continue to play a constructive role in handling global hotspot issues.

But Beijing’s unwillingness to condemn Russia‘s invasion of Ukraine and pursuit of a “no-limits partnership” with Moscow present hurdles to that ambition and saw China skip a summit on a peace conference in Switzerland earlier this month.

Rising tensions between China and the Philippines in the South China Sea, where Vietnam also has claims, have also led US officials to remind Beijing that the mutual defense treaty obligations it has with the Philippines are ironclad.

China’s trade ties with the European Union have also come under strain as the 27-state bloc plans to impose additional tariffs on Chinese-made electric vehicles, potentially opening up a new front in the West’s tariff war with Beijing which began with Washington’s initial import duties in 2018.

The EU accuses China of flooding its market with cheap EVs produced by Chinese automakers that have benefited from heavy state subsidies.

“In the era of economic globalization, what we need is not to create chasms of division, but to build bridges of communication, and not raise the iron curtain of confrontation but to pave the way of cooperation,” Mr. Xi said.

China passes new rural collective law to protect farmers’ land rights

BEIJING – China passed a law on Friday to better protect farmers’ land rights and support the development of village collectives, aiming to bolster the country’s ailing rural economy and achieve food security, state media reported.

While all farmland in China is state-owned, farmers have decades-long land lease rights that are exercised on their behalf by collectives, which have been criticized for not giving farmers a sufficient voice.

The new Rural Collective Economic Organizations Law, which will take effect on May 1, 2025, defines the role of rural collectives and will give farmers oversight of the collectives.

It aims to safeguard the rights of the collective and its members and encourages fiscal and taxation measures to strengthen the development of the rural collective economy, Xinhua reported.

Currently, villagers can in theory decide to apply to sell off or develop land. In practice, however, state officials usually decide. And hoping to win investment or other economic gains, they often override the wishes of farmers.

Farmers have argued that the current system gives state officials too much power to take land for little or no compensation. Land grabs have been a cause of social unrest in the past. – Reuters

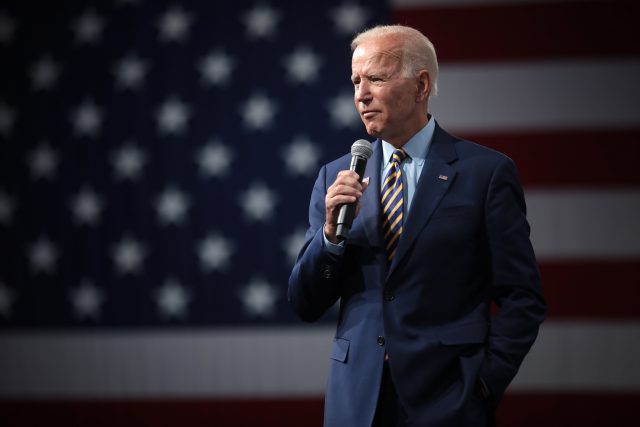

A ‘disaster’: Biden’s shaky start in debate with Trump rattles Democrats

US President Joe Biden’s supporters had hoped Thursday night’s debate would erase worries that the 81-year-old was too old to serve another term, but his hoarse voice and at times tentative performance against Republican rival Donald Trump did the opposite.

Mr. Biden and Trump, 78, both have faced concerns about their age and fitness in the run-up to the Nov. 5 election, but they have weighed more heavily on Biden.

On Thursday, with his voice hoarse from a cold, Mr. Biden hurried through some of his talking points on the debate stage, stumbled over some answers and trailed off during others.

About halfway through the debate, a Democratic strategist who worked on Biden’s 2020 campaign called it a “disaster.”

Mr. Trump unleashed a barrage of criticisms including well-worn falsehoods like migrants carrying out a crime wave and that Democrats support infanticide. Early in the debate, Mr. Biden paused as he was making a point about Medicare and tax reform and seemed to lose his train of thought.

Tax reform would create money to help “strengthen our healthcare system, making sure that we’re able to make every single solitary person eligible for what I was able to do with the, with the COVID, excuse me, with dealing with everything we had to do with,” Mr. Biden said, pausing. “We finally beat Medicare.”

Mr. Trump jabbed Mr. Biden for being incoherent, saying at one point: “I really don’t know what he said at the end of that sentence. I don’t think he knows what he said.”

“Biden’s not talking in a measured way, and looks like he’s searching for words,” said Ray La Raja, a political science professor at the University of Massachusetts Amherst.

Ahead of the debate, Mr. Biden confined himself to nearly a week of “debate camp” with top advisers at the Camp David presidential retreat in the mountains of western Maryland, an indication of how important his campaign considered Thursday night. It didn’t reflect on his performance, critics said.

“Trump is Trump, every word out of his mouth is bullshit. But Biden sounds old. And lost. And that’s going to matter more than anything. So far, this is an absolute nightmare for Biden,” Joe Walsh, a former 2020 Republican presidential candidate who has been critical of Mr. Trump, said on X. – Reuters

Philippines, Japan foreign and defence ministers to meet July 8 in Manila

MANILA – The Philippines and Japan will hold a 2+2 foreign and defense ministerial meeting in Manila on July 8 to discuss regional defense and security matters, Manila’s foreign ministry said on Friday, amid increasing tensions in the South China Sea.

Japanese Foreign Minister Yoko Kamikawa and Defense Minister Minoru Kihara will meet with their Philippine counterparts, Enrique Manalo and Gilberto Teodoro Jr, the foreign ministry said in a statement.

“The four ministers are expected to discuss bilateral and defense and security issues affecting the region, and exchange views on regional and international issues,” the ministry said.

The 2+2 Foreign and Defense Ministers Meeting is the highest consultative mechanism between the Philippines and Japan. The first 2+2 meeting was held in 2022 in Tokyo.

The meeting comes as the Philippines and Japan are negotiating a reciprocal access agreement (RAA) that would allow their respective militaries to visit each other’s soil.

The Philippines has been ramping up its ties with neighbors and other countries to counter what it describes as China’s growing aggression in the South China.

In February 2023, Philippine President Ferdinand Marcos Jr. and Japanese Prime Minister Fumio Kishida agreed in Tokyo that their militaries would cooperate on disaster relief, a deal that paved the way for RAA negotiations with Japan. – Reuters

Fujifilm once struggled to sell cameras. Now, it can’t keep up with demand

TOKYO – For years, Japan’s Fujifilm pivoted away from its legacy camera business to focus on healthcare. But thanks in large part to the TikTok crowd, its retro-themed X100 digital cameras are now a roaring success, boosting its bottom line.

Fujifilm is struggling to meet demand for the $1,599 camera, prized by young 20-something social media fans for its looks and high-end functions.

The X100V model was so popular that in the fiscal year ended in March, it was the imaging division, which includes cameras, that was the biggest contributor to the company’s record-high profit – the unit accounted for 37% of operating profit in fiscal 2023, versus 27% the year before.

After it sold out last year, the company increased production in China to double the launch volume for the VI that debuted in March, said Yujiro Igarashi, manager of Fujifilm’s professional imaging group. He declined to give details about the production increase, or unit sales.

“We found that the orders far exceeded our forecast,” Mr. Igarashi said. “In that sense, I was surprised that although we doubled our preparations, it still came up short.”

Founded 90 years ago, Fujifilm competed against film industry leader Kodak for decades before finally overtaking it in sales in 2001. But the triumph proved short-lived, as the film industry soon collapsed and digital cameras became a standard feature in mobile phones.

To survive, Fujifilm tapped its expertise in film chemicals to shift into healthcare applications, a strategy also adopted by domestic competitors Canon and Olympus. Fujifilm didn’t give up on its cameras, but it cut 5,000 jobs in its film division and moved most production to China the following year.

During the COVID years, Fujifilm doubled down on antiviral pills and vaccine operations, but now the cameras have put it back into the spotlight.

The company projects imaging sales growth to slow to 2.2% in fiscal 2024 from 14.5%, while operating profits in the segment are expected to dip 1.9%, estimates analysts say are conservative at best.

“We see downside risk to guidance for healthcare and business innovation, but major upside for imaging,” wrote Jefferies analyst Masahiro Nakanomyo in June 6 report.

SAY CHEESE

The X100 was born in 2011 in an attempt to rescue Fujifilm’s professional grade camera division, but its appeal is rooted in nostalgia, camera enthusiasts say.

“The look of it was pretty revolutionary, which is ironic, because it’s just mimicking a film camera,” said Mark Condon, founder of the camera equipment site Shotkit.

A key concept in retro tech is “friction”, where the user is joined with the product through physical touch and interaction, according to Tokyo-based culture writer W. David Marx.

“Smartphones make it so easy to take photos that photos have been devalued,” said Mr. Marx, author of “Status and Culture”.

“By having physical cameras again, and having to develop film etc., it adds back friction, which adds back a sense of value to casual photo taking.”

As travel restarted after the pandemic, demand for cameras shot up, and influencers on Instagram, TikTok and other social media sites turned the X100 into a status symbol.

“It is important to have a good looking camera that inspires you to want to take it out and shoot with it,” said Benjamin Lee, who goes by @itchban on TikTok where he has more than 600,000 followers. “The X100 series is basically a fashion accessory you wear, on top of being a great camera.”

Availability remains a problem.

Second-hand X100s sell for multiples of their list price on auction sites and there are online message boards for fans waiting for orders.

Fujifilm chief executive Teiichi Goto hinted last month he was happy to keep supply tight, pointing to Germany’s Leica brand cameras as a model for maintaining premium value.

“It would be quite unfortunate to manufacture too much and lower the price,” Mr. Goto said at the company’s year-end earnings presentation on May 9.

But the long waitlists and steep prices may drive customers to competitors, such as Canon’s G7X and Ricoh’s GR series, influencer Lee said. This week, Ricoh also announced the launch of its first film camera in about 20 years, the Pentax 17.

Imaging group manager Mr. Igarashi acknowledged that production volumes were a hurdle, but the design and complexity of the X100 make it hard to manufacture at scale.

“We’re trying really hard to increase the number of people, the number of production lines, and so on, but it’s not taking off as quickly as you would think,” he said. – Reuters

Evaluating current prospects of the Philippine economy

By Bjorn Biel M. Beltran, Special Features and Content Assistant Editor

Though the Philippine economy remained robust in the face of global headwinds last year, for many, expectations had been tempered regarding its prospects. For the whole year, gross domestic product (GDP) growth was recorded at 5.6%, failing to meet the lower end of the government’s annual target of 6%. If the historic decline of 9.5% in 2020-pandemic year were to be discounted, 2023 was the slowest growth the economy has had since 2011.

The sentiment bled up to the first quarter of 2024, with the Bangko Sentral ng Pilipinas (BSP) noting that business sentiment in the country turned less upbeat as the overall confidence index (CI) declined to 33.1% from 35.9% in Q4 2023.

“This is reflective of the combined decrease in the percentage of optimists and increase in the percentage of pessimists. The Q1 2024 CI turned less buoyant due mainly to the firms’ concerns over the: (a) post-holiday decline in demand for goods and services, and slowdown in business activities, (b) persistent inflationary pressures stemming from higher food and oil prices, and its impact on the economy, (c) stiff competition, and (d) adverse effects of a strong El Niño event in 2024 on the agriculture sector,” the central bank said in a statement in April.

Cautious optimism seems to be the play for many, as the BSP noted that in the second quarter of 2024, businesses are expecting better prospects in general as the confidence index jumped to 48.1% from 38.2% in the last survey of 2023. More demand for products and services, more project completions due to a better business environment, seasonal boosts in tourism and fisheries, expansions, and lower inflation are all reasons behind this confidence.

Looking further ahead to the next year, the outlook is also much brighter, with the confidence index rising to 60.8% from 54%. This upbeat sentiment is driven by expectations of steady high demand, favorable economic conditions, continued low inflation, business expansions, and lower interest rates.

For the financial industry, banks in particular, opportunities are simmering just below the surface. Global credit ratings agency Fitch Ratings has recently revised the Philippine banking sector’s outlook to improving from neutral, with the firm expecting banks to be able to preserve their record-high net interest margins for longer due to a delay in policy rate cuts.

“This, coupled with a sustained rise in higher-yielding consumer lending and rollout of key infrastructure projects, is likely to buoy banks’ revenue prospects for the rest of 2024. Meanwhile, we believe the extension in higher interest rates will have a manageable impact on the sector’s asset quality given the resilient economy, with Fitch projecting GDP growth of 5.8% in 2024,” the agency said.

Development Bank of the Philippines (DBP) President and Chief Executive Officer Michael O. de Jesus held the same sentiment, saying in an interview that the Marcos administration’s ambitious infrastructure spending plans for the year, including a significant allocation of P1.5 trillion for 2024, highlight the banking sector’s role in financing vital projects such as transportation networks and utilities.

“These investments not only stimulate economic growth but also drive demand for financial services, ranging from project financing to construction loans. Additionally, supporting the expanding manufacturing sector, which recorded robust growth drive by electronics and food products, allows banks to facilitate growth through tailored financial solutions like working capital and expansion loans,” he told BusinessWorld.

Other sectors are also emerging as promising investment opportunities for Philippine banks, such as renewable energy, manufacturing, and the time-tested IT-BPM industry.

“Initiatives in renewable energy, aiming for a substantial share in the power generation mix by 2030 and 2040, offer banks stable investment prospects in solar, wind, and hydroelectric projects, aligning with global trends towards sustainable finance,” he said.

“The dynamic IT-BPM sector, forecasted to grow annually by 7%-8%, presents banks with opportunities to finance technological advancements and expansion initiatives. By offering specialized financial products and services tailored to the sector’s needs, banks can harness this growth momentum to foster innovation and cater to evolving market demands.”

Digital-driven momentum

Another factor playing to the financial industry’s favor is the considerable momentum the Philippines has gathered with regards to its digitalization efforts. Driven by the significant mobile phone and internet penetration among the Filipino population, alongside the rise of digital payment and e-wallet platforms, financial services are more accessible than ever, allowing the unbanked and underbanked to conduct transactions without traditional bank accounts.

“Banks like DBP are actively leveraging digital innovation to expand reach and cater to underserved segments through mobile apps, partnerships with fintechs for solutions like e-wallets, digital lending, and remittances. However, the urban-rural digital divide persists, with many rural areas lacking reliable connectivity and infrastructure,” Mr. de Jesus said.

“Continued efforts in digital literacy, financial education, and collaboration between banks, fintechs, and government are needed to bridge gaps and ensure that inclusive financial services reach the remote communities. While progress has been made, further innovation is required for truly inclusive financial digitalization across the country,” he added, particularly regarding improvements to mobile internet and telecommunications infrastructure for the most remote and far-flung communities of the country.

Banking at a turning point

While significant challenges remain ahead of the Philippine financial industry, such as the sustained high interest rate of 6.5% to curb inflation, heightened geopolitical tensions, and weak growth in economies like China impacting global commodity prices and export-oriented industries, Mr. de Jesus pointed out that the industry itself is at a turning point.

“In the next five years, the Philippine financial industry is set to undergo significant evolution drive by technological advancements and changing consumer behaviors. Digital banking will emerge as a pivotal capability for financial institutions, enhancing customer experience and operational efficiency. As customers increasingly demand for seamless and accessible banking services, the industry will intensify its digital transformation efforts, leveraging technology to remain competitive and meet evolving expectations,” he said.

Technologies will continue to disrupt and leave lasting effects. Generative AI, for instance, can transform financial services by improving customer interactions and backend operations, personalizing customer experiences and streamlining processes like fraud detection and risk management in digital payments. Additionally, there is a growing focus on sustainable finance, driven by regulatory demands and increased consumer awareness. Banks are now incorporating environmental, social, and governance (ESG) criteria into their operations and products, aligning with global trends and creating opportunities for innovation through responsible investing and green financial products.

“Thus, the Philippine financial industry’s trajectory over the next five years will be defined by its embrace of digitalization, the transformative potential of AI technologies, and a commitment to sustainable finance. Banks that adeptly navigate these shifts will not only enhance their market position but also contribute positively to economic growth and societal development in the Philippines.”

DBCC proposes P6.35-trillion budget for 2025

THE Development Budget Coordination Committee (DBCC) is proposing a P6.352-trillion national budget for 2025, a 10% increase from this year’s P5.768-trillion budget.

The National Government’s (NG) spending plan for 2025 is equivalent to 22% of gross domestic product.

“We will present it to the full Cabinet on July 2 and to Congress on July 29. That’s one week after the State of the Nation Address (July 22),” Budget Secretary Amenah F. Pangandaman said in a media briefing.

In April, the DBCC had projected a P6.2-trillion budget for 2025.

The DBM said the government needs a bigger budget to fund the midterm elections in May, noting that the allowances for election volunteers.

The teaching allowance was also increased to P10,000 from P5,000 under the recently signed Republic Act No. 11997 or the Kabalikat sa Pagtuturo Act, hence the need to increase next year’s spending, Ms. Pangandaman said.

Also included in next year’s budget is the expansion of the Pantawid Pamilyang Pilipino Program (4Ps) to include a first 1,000-day grant for beneficiaries who are pregnant, lactating with two-year old children.

Ms. Pangandaman attributed the increase in the budget to the higher National Tax Allotment (NTA) collections after the pandemic.

NTAs are the 40% share of the NG from three years back, which means collections for next year are based on government revenues in 2022.

Local government units are expected to receive P1.034 trillion in NTAs for next year, the DBM said earlier.

Sectors that are expected to receive higher allocations include education, health, social protection, agriculture, infrastructure, digitalization, and climate-related projects, the Budget chief said.

“In evaluating the agencies’ budget proposals for fiscal year 2025, DBM considered several factors such as the availability of fiscal space, implementation-readiness of programs and projects, agency absorptive capacity, and alignment with expenditure directions,” the DBCC said in a separate statement.

Programs under the three-year Rolling Infrastructure Program, Information Systems Strategic Plan, and the Program Convergence Budgeting were also given budget priority, it added. –– BMDC

BSP stands pat, signals rate cut in Aug.

By Luisa Maria Jacinta C. Jocson, Reporter

THE BANGKO SENTRAL ng Pilipinas (BSP) kept interest rates steady for a sixth straight meeting on Thursday but signaled that a rate cut at its next meeting in August is “somewhat more likely than before,” with up to 50 basis points (bps) in easing likely this year.

The Monetary Board on Thursday left its target reverse repurchase rate unchanged at 6.5%, the highest in over 17 years. This was in line with the expectations of all 15 analysts in a BusinessWorld poll last week.

Interest rates on the overnight deposit and lending facilities were also maintained at 6% and 7%, respectively.

Mr. Remolona said he expects inflation to further ease in the second semester with the implementation of lower tariffs on rice.

“The balance of risks to the inflation outlook has shifted to the downside for 2024 and 2025 due largely to the impact of lower import tariffs on rice under Executive Order (EO) No. 62,” he said at a press briefing.

“If sustained, an improvement in the inflation outlook would allow more scope to consider a less restrictive monetary policy stance.”

President Ferdinand R. Marcos, Jr. earlier this month signed EO 62 which slashed tariffs on rice imports to 15% until 2028 to tame rice prices.

Mr. Remolona said that inflation is “moving closer” to the midpoint of its 2-4% target, adding that expectations are still well-anchored.

The central bank slashed its risk-adjusted inflation forecast for this year to 3.1% from 3.8% previously. It also cut its risk-adjusted estimate for 2025 to 3.1% from 3.7% earlier.

Meanwhile, it lowered its average baseline inflation forecast for 2024 and 2025 to 3.3% and 3.1%, respectively, from 3.5% and 3.3%, previously.

“Nonetheless, higher prices of food items other than rice, transport charges, and electricity rates continue to pose upside risks to inflation,” Mr. Remolona said. “Meanwhile, prospects for domestic output growth remain in line with medium-term trends amid favorable labor market conditions and strong net exports.”

He said the Monetary Board is “on track” to cut rates when it next meets on Aug. 15. This will likely be ahead of the US Federal Reserve which earlier signaled it may start easing in December.

“Last time I said we’re still hawkish, but less so. We’re basically in the same position now. Somewhat more dovish than before,” Mr. Remolona said.

The BSP could cut rates by 25 basis points (bps) in the third quarter and by another 25 bps in the fourth quarter, he added.

The Monetary Board’s Aug. 15 review is its only meeting in the third quarter. Meanwhile, its last two reviews for the year will be held in the fourth quarter and are scheduled on Oct. 17 and Dec. 19.

TOO EARLY TO CUT?

Analysts noted the more dovish signals from the BSP compared with its previous meetings.

“Tellingly, the read-out this time didn’t contain any language about how policy needs to be ‘sufficiently tight,’ saying instead that an improvement in the inflation outlook going forward would allow for some scope for policy to be ‘less restrictive,’” Pantheon Chief Emerging Asia Economist Miguel Chanco said in an e-mail note.

HSBC economist for ASEAN (Association of Southeast Asian Nations) Aris D. Dacanay in a note said that the BSP’s tone is “perhaps slightly more dovish, not closing the possibility of it cutting ahead of the Fed.”

“We even think the BSP was even more confident than last time, reflecting the fact that monetary policy in the Philippines may be becoming more independent from the Fed, even if partially,” he added.

However, Mr. Dacanay said that August may still be too soon to loosen policy reins.

“We do not think inflation will be soft enough by the August meeting with the rice tariff rate cut needing time to work its way in reducing prices,” Mr. Dacanay said.

ANZ Research said in a report that it may be too early to cut rates as inflation is still hovering near the upper bound of the 2-4% target as “upside risks from food prices continue to linger.”

ANZ said it expects the central bank to start cutting rates in early 2025, “if inflation consistently moves towards the midpoint of the official target range in the first quarter of 2024.”

Meanwhile, Mr. Chanco still expects that the BSP will cut by 25 bps in August, in line with the BSP’s outlook.

“Our core view still is that the Board will start a gradual normalization of policy in August with a 25-bp rate cut, following this on with similar-sized reductions in the October and December meetings,” he added.

PESO INTERVENTION

Meanwhile, Mr. Remolona said the central bank is “occasionally” intervening in the peso.

“We’ve been watching the peso. We don’t want it to depreciate too sharply. We occasionally intervene. I think today (Thursday) we did intervene. We don’t want it to depreciate too sharply,” Mr. Remolona said.

The peso closed at P58.75 per dollar on Thursday, strengthening by 11 centavos from its P58.86 finish on Wednesday. Its close on Wednesday was its weakest finish in over 20 months.

However, Mr. Remolona said that the peso’s effect on inflation is “not very large.”

“We think the pass-through, which is what we call the effect of depreciation on inflation, is estimated at 0.036 percentage points (ppt) per one percent depreciation (of the) peso. Since the beginning of the year, the peso has depreciated by 5.7%. So, 5.7% against 0.036 ppt, that adds up to a total of about 0.2% in inflation.”

Mr. Remolona said that the central bank is active in intervening when it “senses stress in the market.”

“But mostly we come in to slow down the tendency of the peso to depreciate sharply. We don’t come in every day,” he added.

The Development Budget Coordination Committee on Thursday raised its foreign exchange rate assumption to a range of P56-P58 this year, a higher band than its P55-P57 range previously.