Outpour of support for 75,000+ Filipinos: DigiPlus Interactive and BingoPlus Foundation strengthen community resilience for typhoon season

In response to the devastating impact of Typhoon Carina on Metro Manila and parts of Luzon, DigiPlus Interactive, through its social development arm, BingoPlus Foundation, mobilized significant resources to support affected communities and strengthen resilience in barangays amidst the typhoon season ahead.

In coordination with the Department of Social Welfare and Development (DSWD), the Foundation distributed essential goods to 15,160 households in NCR and affected provinces or an estimated 75,800 individuals. “Digibuddy” employee volunteers joined in repacking activities and distribution of relief goods in barangays across Marikina, Valenzuela, Navotas, Rizal, Bulacan and Pampanga.

The Foundation further provided rice and milk to the DSWD Pag-Abot Center and other shelters for abandoned children and elderly, in support of 787 homeless individuals rescued and housed in halfway homes. These initiatives align with the Foundation’s advocacy pillar focused on Community Resilience.

In the days leading up to Typhoon Carina, BingoPlus Foundation’s Barangay Bigayan efforts centered on bolstering the resilience of vulnerable communities. In Bulacan, a total of 610 residents in Norzagaray, including members of the nomadic Dumagat community, received a rainwater catchment tank and household water filtration systems, in partnership with Waves 4 Water. The initiative aimed to empower barangays with sustainable access to clean water amidst the impact of climate change.

Furthermore, the children of Dike Adwas Elementary School received emergency go bags and disaster preparedness training in a fun and engaging way through the donation of “Masters of Disaster” learning game sets designed by the Asia Society for Social Improvement and Sustainable Transformation. These efforts underscore the companies’ commitment to not only provide immediate relief but also to invest in long-term resilience and disaster preparedness.

The ongoing support aligns with the P10-million commitment made during BingoPlus Day in Cebu, which continues to assist affected Filipinos in their recovery. DigiPlus Interactive and BingoPlus Foundation are actively engaging with public and private partners to rehabilitate livelihoods impacted by the typhoon and to enhance disaster response capabilities in vulnerable communities.

As the country anticipates more typhoons in the months ahead, DigiPlus Interactive and BingoPlus Foundation remain dedicated to building a stronger, more resilient Philippines.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.

NG debt hits P15.7 trillion

By Beatriz Marie D. Cruz, Reporter

THE NATIONAL Government’s (NG) outstanding debt hit a fresh high of P15.69 trillion as of end-July amid an increase in domestic and external borrowings, the Bureau of the Treasury (BTr) said.

Data from the BTr on Tuesday showed that the NG’s debt level rose by 1.33% as of end-July from P15.48 trillion as of end-June.

“The NG’s debt portfolio has increased by P206.49 billion or 1.3% from the end-June 2024 level, primarily driven by the net issuance of both domestic and external debt,” the BTr said in a press release.

Year on year, outstanding debt jumped by 10.15% from P14.24 trillion as of end-July 2023.

Year on year, outstanding debt jumped by 10.15% from P14.24 trillion as of end-July 2023.

The debt stock as of end-July already represents 97.71% of the P16.06-trillion total debt projection by yearend, according to the latest Budget of Expenditures and Sources of Financing data.

More than half (68.54%) of the debt came from domestic sources, while the rest (31.46%) came from foreign sources, the BTr said.

Domestic debt as of end-July rose by 1.7% to P10.75 trillion from P10.57 trillion last month. Year on year, it jumped by 9.6% from P9.81 trillion in July 2023.

“The rise in domestic debt was mainly due to the P180.52-billion net issuance of government securities, although partially tempered by the P0.49-billion downward revaluation effect of peso appreciation on US dollar-denominated domestic securities,” the BTr said.

The peso closed at P58.488 at the end of July, strengthening by 17 centavos from P58.659 at end-June.

Government securities accounted for nearly all of domestic debt at P10.752 trillion, according to BTr data.

On the other hand, external debt inched up by 0.54% to P4.94 trillion as of end-July from P4.91 trillion at the end of June. Year on year, foreign debt increased by 11.4% from P4.43 trillion.

“The rise in external debt can be attributed to the net availments of project loans of P5.25 billion and third-currency upward revaluation of P35.44 billion, albeit partially attenuated by the P14.23-billion impact of peso appreciation against the US dollar,” the Treasury bureau said.

External debt is comprised of P2.32 trillion in loans and P2.62 trillion in government securities. The latter consisted of P2.22 trillion in US dollar bonds, P218.49 billion in euro bonds, P67.32 billion in Japanese yen bonds, P58.49 billion in Islamic certificates and P54.77 billion in peso global bonds.

As of end-July, the NG’s guaranteed obligations edged up by 0.3% to P344.79 billion from P343.65 billion as of end-June.

“The rise in NG guarantees was mainly due to the P3.57-billion effect of third-currency adjustments against the US dollar which outweighed the P1.96-billion reduction from domestic and external net repayments as well as the P0.47-billion downward revaluation brought about by peso appreciation,” the BTr said.

Year on year, guaranteed obligations declined by 5.1% from P363.39 billion.

Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc., said NG debt levels will continue to increase but at a slower pace.

“Now that we are not in an emergency situation… we expect the debt levels to still rise but at a slower pace… especially that we are on the cusp of the start of monetary easing cycle of the US Federal Reserve, while the Bangko Sentral ng Pilipinas (BSP) has already began its cuts,” he said in a Viber message.

Last month, the Monetary Board reduced interest rates by 25 basis points (bps), bringing the benchmark rate to 6.25%. The central bank is also likely to cut rates by another 25 bps in the fourth quarter, BSP Governor Eli M. Remolona, Jr. has said.

The US Federal Reserve is also widely expected to begin cutting rates this month.

Jonathan L. Ravelas, senior adviser at professional service firm Reyes Tacandong & Co., said the government must minimize “unnecessary expenses” to manage debt.

In a Viber message, he said the government should also fast-track infrastructure spending to attract investments.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said the government’s intensified tax collections and other fiscal reform measures would also help narrow the NG’s budget deficit and slow the rise in debt.

“New and higher taxes could be a final option if inflation eases further in an effort to bring down the NG debt-to-GDP ratio to below the international threshold of 60%, alongside faster GDP growth,” he said via Viber.

The NG’s debt-to-GDP ratio, or the ratio between how much a country owes and how much its economy produces to pay off debt, stood at 60.9% as of end-June.

This is still above the 60% threshold deemed manageable by multilateral lenders for developing economies. The government expects the debt-to-GDP ratio to end the year at 60.6%.

The government’s borrowing program for this year is set at P2.57 trillion, with P1.92 trillion from domestic sources and P646.08 billion from foreign sources.

Analysts see improving foreign investment outlook for PHL

By Luisa Maria Jacinta C. Jocson, Reporter

LOWER INTEREST RATES will help drive the entry of more foreign direct and portfolio investments into the Philippines, analysts said.

“The outlook for foreign direct investment (FDI) and foreign portfolio investment (FPI) in the Philippines appears promising, with current trends suggesting the country could meet or potentially exceed the Bangko Sentral ng Pilipinas’ (BSP) targets,” Security Bank Corp. Chief Economist Robert Dan J. Roces said in a Viber message.

The BSP expects to record FDI net inflows of $9.5 billion this year. For foreign portfolio investments, it forecasts $3.1 billion in net inflows by yearend.

“The BSP’s forecast for the year sounds reasonable, as it wouldn’t be too far a stretch, with that sort of level of annual FDI coming into the Philippines almost consistently over this period, barring the coronavirus-hit year in 2020,” Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco said in an e-mail.

In the January-to-May period, FDI net inflows jumped by 15.8% year on year to $4.024 billion, data from the BSP showed.

Meanwhile, short-term foreign investments yielded a net inflow of $1.46 billion in the January-July period, surging from the $157.3-million net inflows in the same period a year ago.

FDIs are considered long-term investments, while portfolio investments or “hot money” are seen as more fickle due to the ease by which these funds enter and leave the economy.

Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc., said the BSP’s investment targets are doable amid easing interest rates.

“Offering attractive rates will be the key. All around will be declining key rates, thus, offering sensible investments now will lock in gains for prospective investors. I would like to believe that there is time,” he added.

Mr. Roces said the further reduction in policy rates this year and next year “should stimulate investment activity, particularly for FDI, by making borrowing more attractive.”

At its August meeting, the Monetary Board cut rates for the first time in nearly four years or since November 2020. It reduced borrowing costs by 25 basis points (bps), bringing the benchmark rate to 6.25% from the previous over 17-year high of 6.5%.

The central bank could also deliver another 25-bp rate hike in the fourth quarter, BSP Governor Eli M. Remolona, Jr. said earlier.

The US Federal Reserve is expected to start its easing cycle later this month, which also bodes well for investor sentiment, analysts said.

“The biggest catalyst for FDI and FPI into the country is the expected series of Fed rate cuts that could be matched locally, thereby leading to improvements in global investments, trade, and other economic activities,” Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

Apart from reduced borrowing costs, analysts said that the country’s strong macroeconomic indicators will help attract more investments.

“Key drivers for achieving these targets include sustained economic fundamentals, political stability, an improved regulatory environment, ongoing infrastructure developments, and the country’s competitive advantages in sectors like BPO (business process outsourcing) and manufacturing,” Mr. Roces said.

Mr. Asuncion said investors are likely to be attracted to the Philippines because of its upbeat economic growth.

“If foreign investors see real opportunity in investing in the Philippines, I do not think it will be a huge problem getting these investors on board,” he added.

The Philippine economy grew by 6.3% in the second quarter, marking the fastest growth in five quarters or since the 6.4% in the first quarter of 2023.

On the other hand, Leonardo A. Lanzona, Jr., an economics professor at the Ateneo de Manila University, said that lower borrowing costs may favor short-term investments over long-term ones.

“The low interest rates of BSP can stimulate economic activity. However, this can only boost short-term investments as borrowing becomes cheaper,” he said in an e-mail.

“It can depress long-term investments if the returns on longer-term projects are deemed insufficient relative to the risks.”

Mr. Chanco also cited risks to this investment outlook, noting the country’s “policy stasis.”

“The Philippines’ nearest neighbors and biggest competitors remain quite aggressive in their pursuit of more open trade borders and a better infrastructure environment for businesses, something that the Philippines is still struggling with,” he added.

The government’s policies may also benefit short-term investments, Mr. Lanzona said.

“Also, the government implements policies or incentives that encourage immediate spending or investment, such as tax breaks or stimulus checks. These policies can boost short-term investments but may not have the same impact on long-term projects that require sustained funding and are subject to continuous risks,” he said.

Mr. Ricafort also noted that the investment targets remain achievable, barring any further geopolitical risks.

“However, global economic conditions and exchange rate stability will also play crucial roles. While the current trajectory remains positive, risks such as geopolitical uncertainties and domestic policy changes will have an impact on these projections,” Mr. Roces said.

Mr. Ricafort also noted that the country’s improving credit rating outlook will also support foreign investment growth by boosting the confidence of international investors and creditors.

Japan-based Rating and Investment Information, Inc. last month upgraded the Philippines’ investment grade rating to “A-.”

The country also secured an “A-” rating from the Japan Credit Rating Agency but has yet to secure an “A” rating from the “big three” credit raters.

The Philippines currently holds a “Baa2” rating from Moody’s Ratings, “BBB” from Fitch Ratings, and “BBB+” from S&P Global Ratings.

The government is targeting to achieve an “A” rating by the end of the Marcos administration.

Faster consumption key to PHL hitting 2024 growth target, says S&P Global

FASTER PRIVATE CONSUMPTION will be crucial for the Philippine economy to hit its growth target this year, S&P Global Ratings said.

S&P Global economist for Asia-Pacific Vishrut Rana said Philippine gross domestic product (GDP) is projected to expand by 5.8% this year.

“The key swing factor for the rest of the year is whether private consumption comes back online or whether it remains slightly weak and that will ultimately determine whether the economy can hit the 6% growth mark. For the moment, we have 5.8%. There’s some upside risk to that number,” he said in a webinar on Tuesday.

Philippine GDP expanded by 6.3% in the second quarter, bringing first-half growth to 6%.

To meet the lower end of the government’s 6-7% target, the economy must expand by at least an average of 6% in the second half of 2024.

Domestic demand is expected to support the growth outlook of the Philippines and the rest of Southeast Asia, S&P Global said.

“What we observe is the domestic demand in the region is holding up pretty well. Generally speaking, private consumption and investment are both doing relatively okay,” Mr. Rana said.

“This is particularly relevant given that we’ve seen tighter monetary policy over the past couple of years, and that has not slowed down domestic demand as much as feared earlier.”

However, Mr. Rana cited risks to this outlook, such as a global slowdown.

“In particular, if global growth turns out to be weaker than expected, then we could see a deterioration in Southeast Asia’s growth outlook driven by weakness in manufacturing and trade,” he said.

He noted that growth in the Philippines has been driven by the public sector.

“In the Philippines, what we observe is that it’s the public sector that’s holding up growth. We see public spending remaining very strong. Investment activity is strong. On the other hand, private consumption growth is slightly weaker,” he said.

Second-quarter GDP growth was primarily driven by gross capital formation, which expanded by 11.5%. Government spending also grew by 10.7%, a turnaround from its 7.1% contraction a year earlier.

On the other hand, household final consumption rose by 4.6% year on year in the second quarter, slowing from the 5.5% growth a year ago. Private consumption typically accounts for over 70% of the economy.

“Sectorally speaking, some of the service sectors continue to perform relatively well. We see some weakness in manufacturing, which is holding back the economy somewhat,” Mr. Rana added.

For 2025, S&P Global sees Philippine growth expanding by 6.1% due to an “improvement largely based on gradually recovering domestic demand and also a normalization of monetary policy going forward,” he said.

Meanwhile, S&P Global said that inflation is not a “major risk” at the moment for the Philippines and the rest of the region.

“We did see an uptick in the latest inflation reading… so there was an acceleration, it was largely driven by food. However, if you look at core inflation, that is still under the 3% mark,” Mr. Rana said.

Headline inflation likely settled at 3.7% in August, according to the median estimate yielded from a BusinessWorld poll of 15 analysts. If realized, this would be slower than the nine-month high of 4.4% in July and the 5.3% clip in the same month a year ago.

The BSP earlier said that the spike in July inflation was expected and only temporary, with inflation expected to return to within the 2-4% target band from August onwards.

“Accordingly, central banks in the region are also likely to be cutting interest rates. So we expect BSP to cut further. (The BSP is) likely to lower the interest rates, but also at the same time, not so sharply that the currency is affected,” Mr. Rana said.

BSP Governor Eli M. Remolona, Jr. earlier said that the central bank can cut rates by another 25 basis points (bps) in the fourth quarter. This after the Monetary Board delivered a 25-bp rate cut at its meeting last month, bringing the key rate to 6.25%.

Meanwhile, Mr. Rana said Southeast Asian currencies are expected to remain “relatively stable” for the rest of the year, “assuming no surprises to our Fed rate outlook.”

S&P expects the US Federal Reserve to deliver two rate cuts this year, one in September and another towards the end of the year.

“What we’ve seen over the last month is significant strength in global currencies, but particularly Southeast Asia currencies against the US dollar. We’ve seen appreciation in the range of between one and a half to 3% against the dollar or several currencies,” he said.

“The peso also appreciated over that time period. This is based on expectations of easing out of the US Fed. The pace of easing will determine the currency outlook as well,” he added.

The peso closed at P56.61 against the greenback on Tuesday, weakening by 23 centavos from its P56.38 finish on Monday. The local currency was previously trading at the P57-58 per dollar level in the past months.

The peso is expected to range from P56 to P58 this year, according to latest Development Budget Coordination Committee data. — Luisa Maria Jacinta C. Jocson

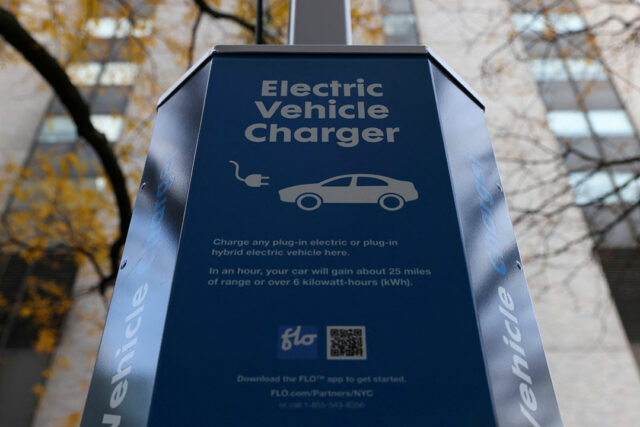

Executive order on EV incentives eyed by yearend

A PROPOSED executive order (EO) on the Electric Vehicle (EV) Incentive Strategy will likely be endorsed to the office of President Ferdinand R. Marcos, Jr. by the end of the year, an Energy department official said.

“We are still hopeful that it (the EO) comes out. So, definitely in next year’s Comprehensive Roadmap for the EV Industry (CREVI), the EV Incentive Strategy will be in place,” Patrick T. Aquino, director of the Energy Utilization Management Bureau at the Department of Energy (DoE), said on the sidelines of the pre-event conference of the 12th Philippine Electric Vehicle Summit (PEVS).

The proposed EV Incentive Strategy is expected to result in the manufacture of around four million EVs in the country in the next 10 years.

The strategy involves fiscal and non-fiscal incentives for consumers such as purchase subsidies in the form of direct financial rebates or discounts, tax credits, value-added tax exemption or reduction, and fuel cost savings through special electricity rates for EV charging.

It also proposes incentives for homeowners who will install EV charging infrastructure at their residences, as well as trade-in bonuses for vehicle owners. Also proposed are rental subsidies for consumers who rent EVs.

Mr. Aquino said the strategy is important to ensure the country can attract more EV manufacturers.

“There are no additional players, which is why it is very important for us to come out and craft the EV Incentive Strategy… which will be a Comprehensive Automotive Resurgence Strategy (CARS)-like program, which is why it will also be supported by funding,” he said.

“Similar to CARS, at certain volumes, they will get some assistance, so that is what we can expect from there,” he added.

Mr. Aquino said the program may possibly cover two- or three-wheelers and special-purpose vehicles, which are the platform types that can be used as jeepneys or ambulances.

“I think for the commercial and the passenger-type, we have missed the boat already,” he added.

The Department of Trade and Industry (DTI) is set to do consultations for the draft EO for the EVIS this month or in October.

Mr. Aquino said they will make sure the EVIS will avoid the “pitfalls” seen in the CARS program. In terms of threshold, he said the EVIS have lower requirements compared to the CARS program.

Meanwhile, Mr. Aquino said that the DoE is also set to release the updated CREVI within the month.

“I think it’s going to be just touch-ups reflecting the developments that we’ve had since 2023 and then what we’re seeing right now,” he added.

EV ADOPTION

Adoption of EVs in the country is on track to hit targets, Mr. Aquino said.

“When we started off with the passage of the law, there’s just literally a handful of EVs that you can purchase. Now, there’s a lot of new vehicles coming in the market,” he said.

The government’s decision to expand the coverage of Executive Order No. 12 to include tax breaks for electric motorcycles (e-motorcycles), electric bicycles (e-bicycles) and hybrid EVs is driving the industry’s growth.

“The Filipino consumer now has more options to electrify. When I say electrify, it covers pure battery EVs, plug-in hybrids, hybrid EVs, and light EVs. So, there’s more options for the consumers,” he said.

To further drive adoption, he said the DoE is also looking at mandating gasoline stations to put up charging stations.

“As you see, in terms of either sales or registrations, we’ve not yet reached a critical mass… so we have to also be mindful of the business implications of a mandate,” he added.

Under the Electric Vehicle Industry Development Act (EVIDA), gas stations that will not put up charging stations may face penalties and fines.

Asked about providing more incentives for consumers, he said prices of EVs have actually gone down so there is no need to implement such incentives.

“I think if you take a look at the cost of the vehicles right now, it has gone down substantially. In fact, because of the cost, the government might start requiring pure EV purchases starting in 2026,” he said.

“Essentially, we’ll just require everybody to go buy electric, whether it’s hybrid EVs, plug-in hybrid EVs, or battery EVs,” he added.

According to the Electric Vehicle Association of the Philippines (EVAP), sales of battery EVs reached 811 in the first four months, while sales of hybrid EVs and plug-in hybrid EVs were at 248 and 13, respectively.

Meanwhile, EV sales last year totaled 1,359 for battery EVs and 6,156 for hybrid EVs.

EVAP President Edmund A. Araga said that he is banking on the 12th PEVS, which will be held from Oct. 24 to 26, to spur further adoption of EVs.

“The 12th PEVS is designed to further ignite a powerful call to action for a transformative shift in transportation and mobility,” he said. — Justine Irish D. Tabile

An interesting spin on Philippine colonial history

FOR writer and podcaster Lio Mangubat, fascinating yet less well-known tidbits of history had always been the driving force behind his many endeavors, be it a magazine article or an episode of his podcast The Colonial Dept.

He was therefore pleasantly surprised when Singapore-based Faction Press’ publisher Chye Shu Wen reached out to him and suggested compiling all the research and writing he had done for various articles and podcast episodes into a nonfiction book. Thus Silk, Silver, Spices, Slaves: Lost Tales from the Philippine Colonial Period, 1565-1946 was born.

The book features 13 essays on episodes of history that were not taught in school, from Mexican fighter pilots flying dangerous missions over the Philippines during World War II, to the importation of talented Filipino orchestras and bands in Shanghai, to American occupiers falling victim to a mysterious illness called “Philippinitis.”

Silk, Silver, Spices, Slaves was first launched in July, is included in the top reads at the Kinokuniya bookstore in Singapore. It is now available in the Philippines at the independent bookstore Everything’s Fine in Makati City.

“I love that I’m in Kinokuniya, but this is a book about the Philippines, written by a Filipino, and I’m proud of that. We need more of these kinds of books in our reading diet,” Mr. Mangubat said at an Aug. 31 talk at Everything’s Fine.

“My main consideration is that I really wanted to make history accessible, entertaining, something fun to read,” he said. “You get immersed in another world, and it’s a world that actually happened. It transports you.”

FASCINATING FACTS

Silk, Silver, Spices, Slaves tackles a wide range of topics, some peculiar and others a marvel to ponder.

One chapter talks about how baseball was once the most popular sport in the Philippines, which Mr. Mangubat first discussed on his podcast and later adapted into the book.

“To think that we have a very huge and strong basketball culture here now when, less than a hundred years ago, it was another sport capturing the imagination of Filipinos!” he said.

The chapter follows an all-Filipino baseball team (unfortunately named the Brownies for, well, obvious reasons) and their tour of America, where they played exhibition games. It culminates with a match where they face off with the all-black team.

Mr. Mangubat said at the talk that one of his favorite chapters is on his interview with Filipino-American author Albert Samaha, whose book Concepcion traced the story of his ancestors. On Mr. Samaha’s mother’s side, he is descended from Maguindanao sultans, while on his father’s side, he is descended from the family of Andres Bonifacio.

“There’s a line in it where his great-grandparents met in a schoolhouse in Mindanao, and the way he wrote it was that there was an American flag fluttering above the daughter of sultans and the son of revolutionaries, and they fell in love. And I thought, wow, that is such a great encapsulation of the colonial era, of the Philippines,” said Mr. Mangubat.

He invited the author to guest on his podcast, but the book goes even further by describing Mr. Samaha in detail, bringing him to life for the reader.

SOUTHEAST ASIAN VOICES

Faction Press’ Ms. Chye explained that, while they are new in publishing, the need for more Southeast Asian voices in literature around the world is a pressing one that must be addressed.

“The fact that the book is doing well in Kinokuniya shows that people want to read more about our region, our history,” she told BusinessWorld. “We want to uplift the voices of Asian authors from different parts of the globe.”

Mr. Mangubat added that he hopes historical nonfiction as a genre isn’t relegated to something academic. “There are lots of history books but, for casual readers, they can be intimidating. A book like this is not geared towards the academe or someone writing a thesis, but towards the average Filipino who can walk into a store and fall in love with history,” he said.

History professor Micah R. Perez from the University of the Philippines, whom Mr. Mangubat consulted for the project, said that Silk, Silver, Spices, Slaves approaches history like it’s an interesting story to tell friends.

An inspiration for Mr. Mangubat was David Grant, who wrote the historical novels Lost City of Z, based on British explorers finding ancient cities in the Amazon, and Killers of the Flower Moon, based on the Osage tribe murders and the founding of the FBI, both of which have been made into films.

“These books showed me you can make history very entertaining. Grant zeroed in on a specific topic and expanded it into a novel, connecting dots along the way. If I had the time, I would want to write a book like that, but I can only manage a chapter per topic,” he said.

While various university and independent presses have published similar types of books over the years, Mr. Mangubat told BusinessWorld that having a plethora of these on the market will build a strong readership of Filipinos interested in history.

“I wish that more of it will continue to get published, and that more of it will be available to many more people.” — Brontë H. Lacsamana

Love’s leaps and bounds

By Brontë H. Lacsamana, Reporter

Ballet Review

Giselle

By Ballet Manila

FOR the final production of Ballet Manila’s 26th performance season, the ballet company welcomed renowned Russian dance couple Renata Shakirova and Alexei Timofeyev in a moving restaging of the love story Giselle.

“There are some ballets that one can watch again and again with many different casts and still not get enough of. I think Giselle is one of them,” said Ballet Manila Chief Executive Officer and artistic director Lisa Macuja-Elizalde in her opening notes at the Sept. 1 show.

“In presenting Renata and Alexei to the Philippine audience, I feel like a proud big sister — as we both consider our teacher at the Russian Ballet Academy, Tatiana Udalenkova, as our mentor and second mother,” she said.

While the season saw Ballet Manila successfully take on the classic Le Corsaire in February, and short stories by Lola Basyang in May, it is with Giselle that the company shines amid its gradual post-pandemic resurgence.

The two superstars from the Mariinsky Ballet bring their strong connection as a real-life couple to the charming attraction and eventual drama of Giselle and Albrecht’s story. It is a wonder to think that it is their first time performing it together (and what a privilege it is the Philippines that witnesses the result).

Giselle is a technically challenging ballet, requiring a high level of artistry and technique as the dancers perform numerous jumps and lifts, often at speed. In terms of stage and costume design, it is a full production but does not really require elaborate visuals — though the recently updated LED projections installed at Aliw Theater do give it a boost.

Ms. Shakirova is a true romantic ballerina, her movements full of poise and grace as the kind village girl Giselle’s heart is won by a dashing peasant man. Mr. Timofeyev as Albrecht conveys the sense of nobility that he is trying to hide, and when his identity as a count and betrothal to another lady is revealed, he quickly embodies remorse and sorrow.

As for Giselle, who dies of a broken heart, the Mariinsky Ballet prima ballerina fills the role with rueful madness, driving home the story’s tragic nature. Act 1, full of life and song and dance, has a jarring shift in tone as Act 2 opens at the graveyard where Giselle is buried.

The entire corps de ballet similarly undergoes a shift in atmosphere, as the colorful and lively villagers are replaced by a haunting horde of Wilis — ghosts of maidens who were betrayed by their lovers — decked in radiant white dresses. The entire stage, from the set to the costumes to the people themselves, suddenly appear to be pulled from a horror movie — a treat for fans of the gothic and macabre.

Stephanie Santiago as the Willis queen Myrtha adds an interesting dimension to the narrative. She plays up the harsh look on her face in contrast to the way she gracefully dances, as one would expect of a vengeful queen of maiden spirits. It is later announced that she is Ballet Manila’s newest soloist — deservedly so.

As Giselle and Albrecht are locked in a deadly pas de deux, their lovely dance from Act 1 now morphed into a somber yet moving conclusion in Act 2, one gets the impression that Ms. Shakirova and Mr. Timofeyev’s interpretation is likely one of the best put to stage.

Giselle is truly a fitting finale to Ballet Manila’s performance season, with superstar guests weaving their own romantic feelings into the powerful story. It’s a haunting production that leaves one wondering where Ballet Manila will go in its upcoming 30th year as a company.

Retail, F&B face cautious optimism for second half

By Revin Mikhael D. Ochave, Reporter

CONSUMER-RELATED companies, such as those in retail and food and beverage (F&B) sectors, are expected to perform well in the second half of the year with higher consumer spending anticipated during the holiday season, though potential risks remain, according to market analysts.

“We are cautiously optimistic for the second half as the Bangko Sentral ng Pilipinas’ (BSP) Consumer Expectations Survey still shows some pessimism on economic conditions moving forward. This is somewhat tempered on forecasts that are leaning towards easing inflationary pressures in the following months,” AP Securities, Inc. Research Analyst Jose Antonio B. Cipres told BusinessWorld in a Viber message.

“Alongside this, the P35 wage hike which took effect last July would increase spending power and should also translate to revenues primarily to companies exposed to the F&B industry,” he added.

According to Mr. Cipres, the revenue growth for retail and F&B companies last year was driven by price increases, but noted that their margins were tempered due to higher costs.

“This year however, we are slowly starting to see all-around volume driven revenue growth and better margins on a quarter-on-quarter basis,” he said.

The BSP’s recent Consumer Expectations Survey showed that Filipino consumers are a bit more optimistic for the next 12 months, with the index growing to 13.5% from 13.4% previously.

A BusinessWorld poll of 15 analysts forecasted a median estimate of 3.7% for the country’s inflation rate in August, within the 3.2-4% forecast of the BSP. August inflation data will be released on Sept. 5.

If realized, August inflation would also be slower than the 4.4% in July and the 5.3% print in the same month a year ago.

Stephen Gabriel Y. Oliveros, research associate at China Bank Securities Corp., said in an e-mail interview that consumer-oriented companies could perform beyond expectations on the back of stronger spending and easing interest rates.

“An acceleration in growth remains a possibility in the second half given the seasonal uptick from the holiday season, and prospects of a recovery in consumer purchasing power amid easing price pressures and policy rate cuts,” he said.

“We think growth trajectories of consumer-oriented firms in the second semester will largely mirror the pace of revenue expansion we’ve seen during the first semester as first half performance generally trended within respective company guidance,” he added.

The BSP’s Monetary Board on Aug. 15 reduced its policy rate by 25 basis points (bps) to 6.25% from a near 17-year high of 6.5%, marking its first easing move in nearly four years.

BSP Governor Eli M. Remolona, Jr. has said they could cut rates by another 25 bps within the year.

Unicapital Head of Research Wendy B. Estacio-Cruz said in a separate interview that retail and F&B companies are expected to have a modest growth this year.

“We came from high levels for last year. For this year, I think it is slightly up from last year but not as much as the growth from last year,” she said.

“There will be an influx of consumer spending over the next couple of months, especially the ‘ber’ months. There’s a slight or modest growth from last year,” she added.

Mr. Cipres said that listed retailers Puregold Price Club, Inc., San Miguel Food and Beverage, Inc., Universal Robina Corp., and Robinsons Retail Holdings, Inc. will benefit from increased consumer spending during the holiday season.

“These are poised to take advantage of consumer demand during the holidays through increased sales for groceries, supermarkets, and department stores,” he said.

He added that Jollibee Foods Corp. and Alliance Global Group, Inc. (AGI), which operates McDonalds’ Philippines through Golden Arches Development Corp. (GADC), will also benefit from increased number of gatherings.

“JFC would benefit from the parties and gatherings that typically occur during holidays. While AGI would benefit given their stake in GADC; lackluster performance from their other segments would temper this,” he said.

Unicapital’s Ms. Cruz said that listed operators SM Prime Holdings, Inc. and Robinsons Land Corp. will see a surge in performance during the holiday season.

She added that listed banks will also benefit from increased consumer spending amid expected rate cuts.

“We’re also expecting banks to benefit from the lowering interest rates. There will be a lot of consumer and retail spending. There will be a lot of mortgage as well as automotive loans,” she said.

For his part, China bank Securities’ Mr. Oliveros said that listed companies Century Pacific Food, Inc. (CNPF) and Monde Nissin Corp. will see a surge this holiday season.

“CNPF’s diversified product portfolio allows the company to remain the top-of-mind producer of accessible and value-for-money goods. The company also has new legs for growth as they continue to scale their emerging businesses like milk, pet food, and alternative meat,” he said.

“Monde Nissin is expected to continue benefitting from stable demand across its core categories (noodles, baked goods), complemented by their efforts to boost brand awareness. Meanwhile, more favorable economic conditions in the United Kingdom could also aid the demand recovery for its alternative meat business,” he added.

Mr. Oliveros also said that listed telecommunication companies Globe Telecom, Inc., PLDT Inc., and Converge Information and Communications Technology Solutions, Inc. will also benefit during the holiday season.

“We like telcos given expectations of steady demand for data services, alongside accelerating earnings contributions from non-telco services. Note these factors helped support earnings growth across major listed telco players over the past few quarters,” he said.

Meanwhile, SM Prime Executive Committee Chairman Hans T. Sy said in a separate ambush interview that the company has a positive outlook for its retail and mall businesses.

“Shopping and retail are always going to always be there. We’re very positive still. It depends on how you’re going to be able to sell, whether online or on the physical side,” he said.

“What we need to do is to adapt. Instead of expecting people to go to your place to shop, you have to make it experiential for them, make it interesting for them. A place to see or a place to be seen. That’s now the evolution of shopping,” he added.

inDrive PHL targets to grow driver network to 16,000 by yearend

INDRIVE, a global ride-hailing app operated by RL Soft Corp., plans to double its partner-drivers in the Philippines to 16,000 by the end of the year, signaling aggressive expansion that could intensify competition in the local ride-hailing market.

“We’re working hard together with our partners to enlarge our driver base because we understand that it’s not only for business development for us but also providing opportunities of income for drivers,” inDrive Marketing Director for Asia-Pacific (APAC) Natalia Makarenko said during a briefing on Tuesday.

The company reported a 96% increase in its active driver base, reaching 8,000 drivers, since resuming operations in the Philippines nearly three months ago.

“We’re still having a 0% commission to our driver-partners. And we don’t have precise plans that we can announce about the timings of introduction of the commission,” Ms. Makarenko said.

Further, once the company decides to collect commissions from its drivers, it will be up to 10% of their earnings, she said.

“We will be looking closely and closely at the situation of business growth and development. Of course, we have an open feedback communication with our drivers’ partners,” Ms. Makarenko said.

Mobility and urban services platform inDrive operates in 750 cities in 46 countries. In the Philippines, inDrive currently operates in six cities namely, Metro Manila, Bacolod, Baguio, Iloilo, Butuan, and Cagayan de Oro.

The company is planning to expand its operation in three key areas within this year, Ms. Makarenko said, adding that inDrive is eyeing to operate in Cebu, Davao, and Pampanga.

“Well, we are undergoing the review of our expansion plans until the end of the year and, of course, we are thinking about 2025 and further on. The Philippines is one of the key markets for us in APAC. We will have to prepare thoroughly for the business expansion,” she said.

Ms. Makarenko said inDrive is also planning to further expand its operations in more cities by 2025.

“For this year, we are thinking about launching two to three more cities and for the next year probably the number of cities will expand as well,” she said.

To recall, the company initially secured the approval of the Land Transportation Franchising and Regulatory Board to offer its services in the Philippines in December 2023 but was suspended a month after due to alleged fare haggling violations. — Ashley Erika O. Jose

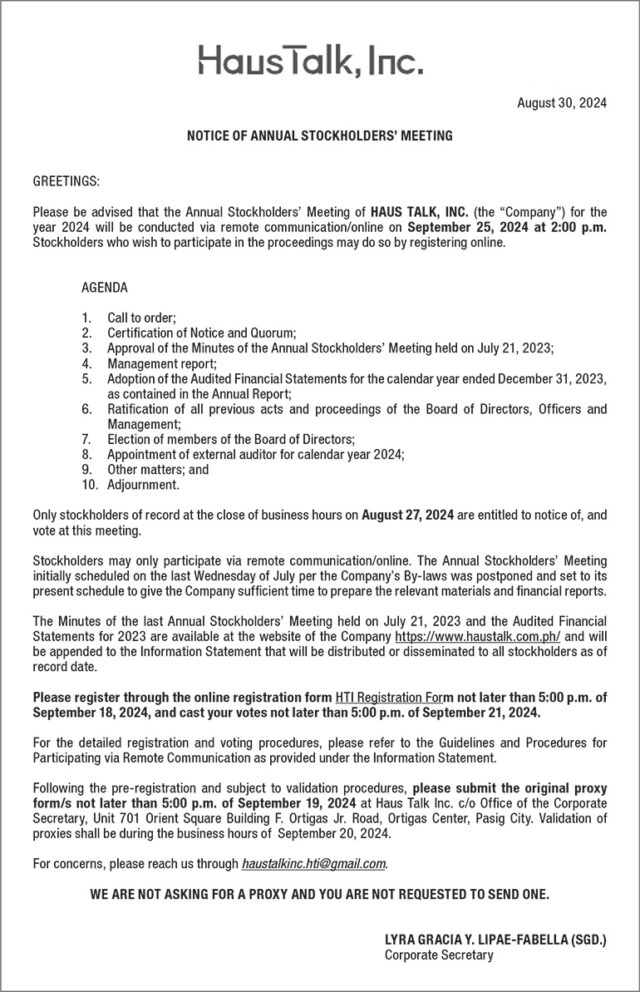

Haus Talk, Inc. to hold Annual Stockholders’ Meeting on Sept. 25 via remote communication

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.

Haul of ancient Roman coins discovered in Sicily

ROME — A rare haul of 27 silver Roman coins dated between 94 and 74 BC has been discovered on the remote island of Pantelleria, the Sicily region said on Monday.

The discovery was made during a cleaning and restoration project by a team led by archaeologist Thomas Schaefer from the University of Tuebingen in Germany.

It was found in the Acropolis, part of the Archaeological Park of Selinunte, Cave di Cusa, and Pantelleria, which is one of the largest such sites in the Mediterranean and includes the remains of an ancient Greek colony founded in the 7th century BC.

The discovery was on the same site where 107 Roman silver coins had been unearthed in 2010 and not far from where the three famous imperial statue heads of Caesar, Agrippina and Titus had been found a few years earlier.

The coins would have been minted in Rome and date back to the Republican age, the same period as the first find.

“This discovery … offers valuable information for the reconstruction of the events, trade contacts and political relations that marked the Mediterranean in the Republican age,” said Francesco Paolo Scarpinato, a regional councilor for cultural heritage.

Some coins appeared in the loose soil after recent heavy rains while the others were found under a rock during the excavations and have already been cleaned and inventoried.

The archaeologist Mr. Schaefer speculated that the treasure was hidden during a pirates’ attack and never retrieved. — Reuters