Make no mistake — the quality of Philippine education had been bad even before the pandemic crisis beginning March of 2020. In fact, in the Philippine Development Plan (PDP) 2023-2028, it was admitted that the country’s education system continues to be “in urgent need of transformation.”

What is so revolting is that this has been the dismal state of learning in the Philippines for over 30 years.

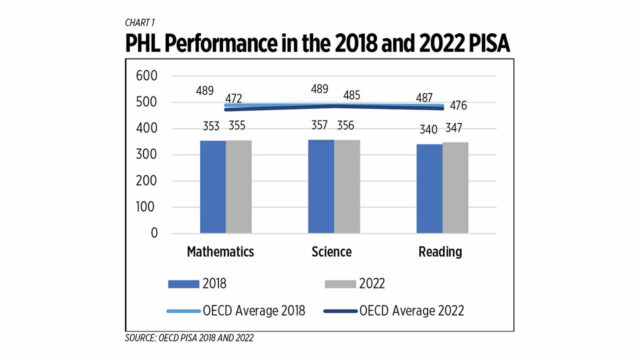

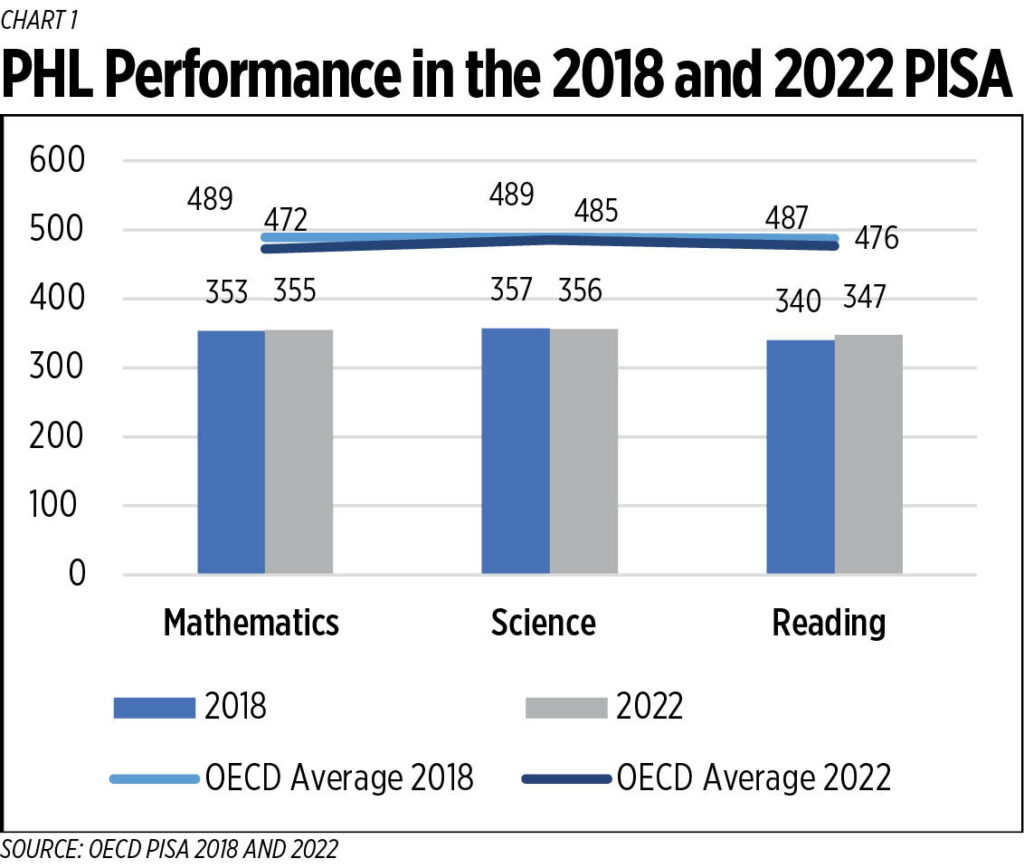

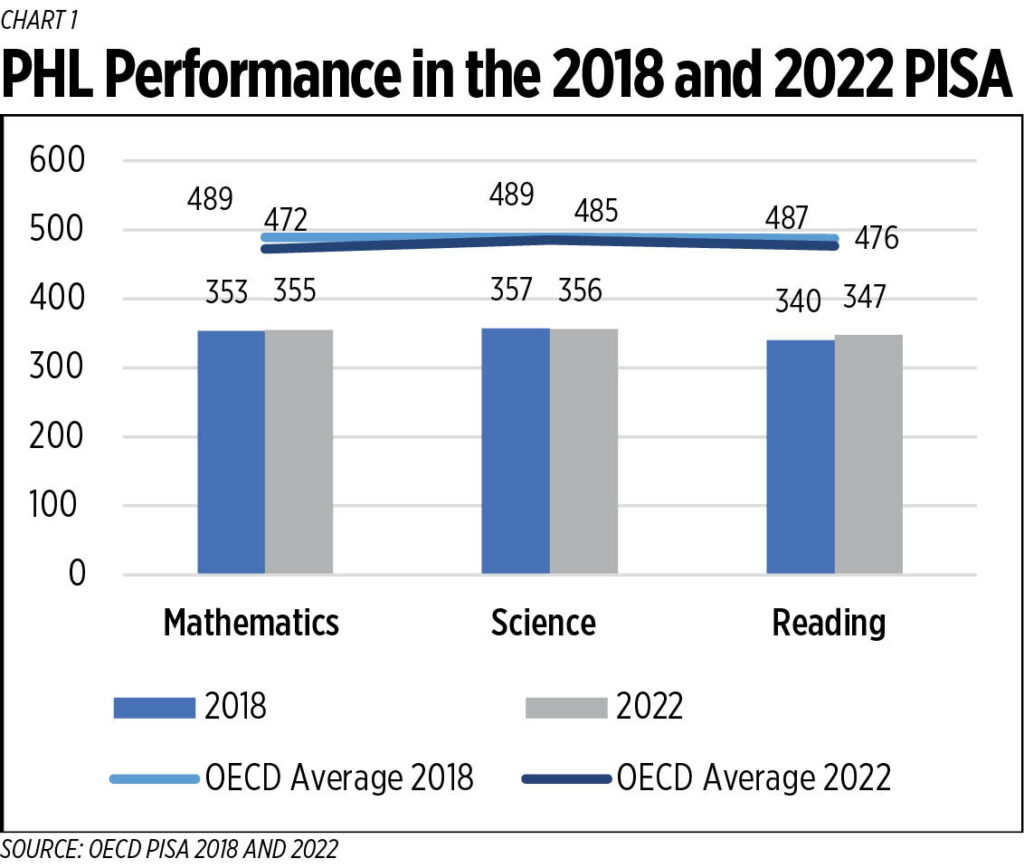

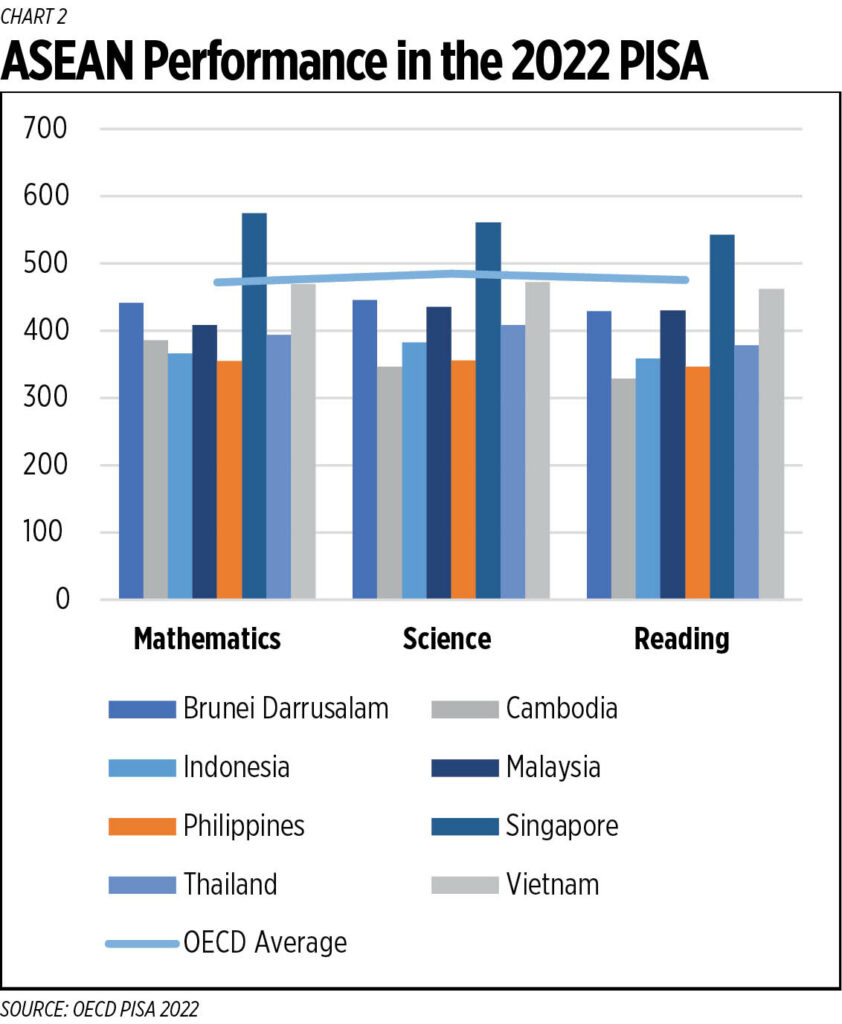

For baseline global comparison, the Philippines, though belatedly, joined the Programme for International Student Assessment (PISA) for the first time in 2018. Some 79 countries were covered during the year’s assessment of educational performance of 15-year-old high school students. Filipinos scored the lowest in reading and the second lowest in both mathematics and science. We stood so much lower than the Organization for Economic Cooperation and Development (OECD) average scores for the three subjects.

In response, the Department of Education (DepEd) in December 2019 assured the public that “the PISA results, along with our own assessments and studies will aid in policy formulation, planning and programming.” There was some honest admission that such results demonstrated in no uncertain terms the urgency of addressing issues and gaps in attaining quality basic education in the Philippines. As if to show its quick response capability, DepEd launched “Sulong Edukalidad” that would usher in “aggressive reforms” to achieve positive results in educational transformation.

The mantra was quite impressive: no student should be left behind in any part of the country. DepEd virtually called for a whole-of-society approach, especially in the areas of reviewing and updating of the K to 12 program, the improvement of learning facilities, upskilling and reskilling of teachers and school heads, and the engagement of stakeholders including parents and guardians of students.

The key challenge in the DepEd efforts to produce results is money.

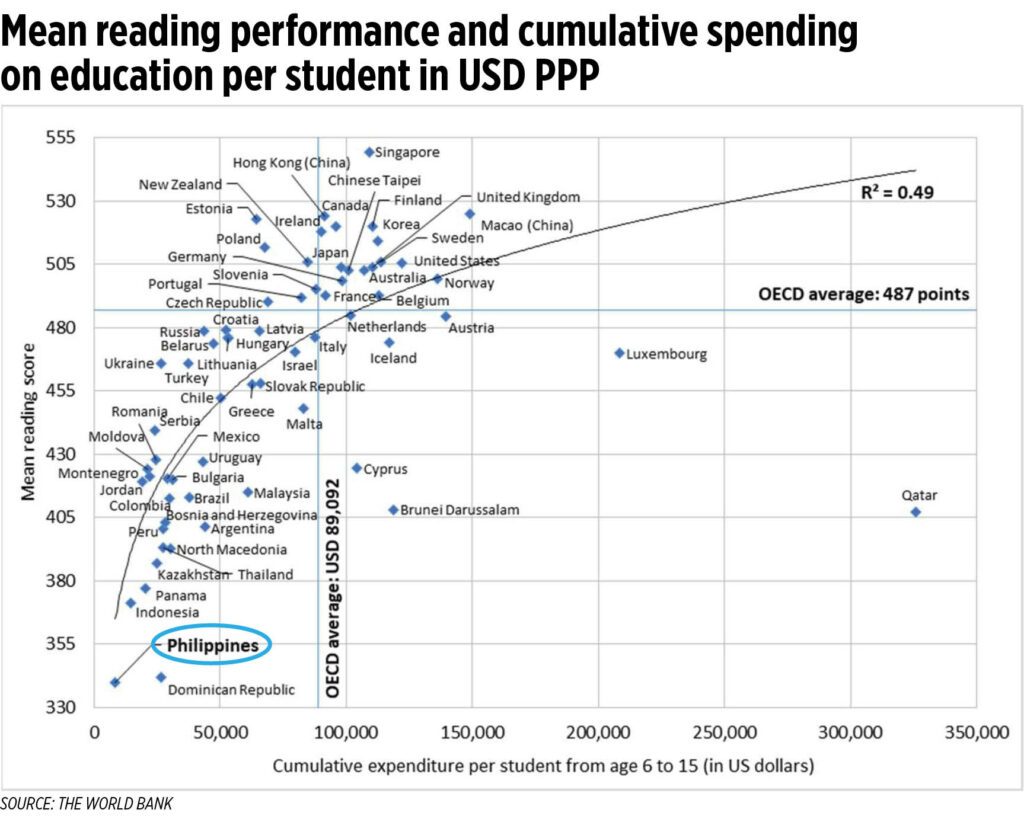

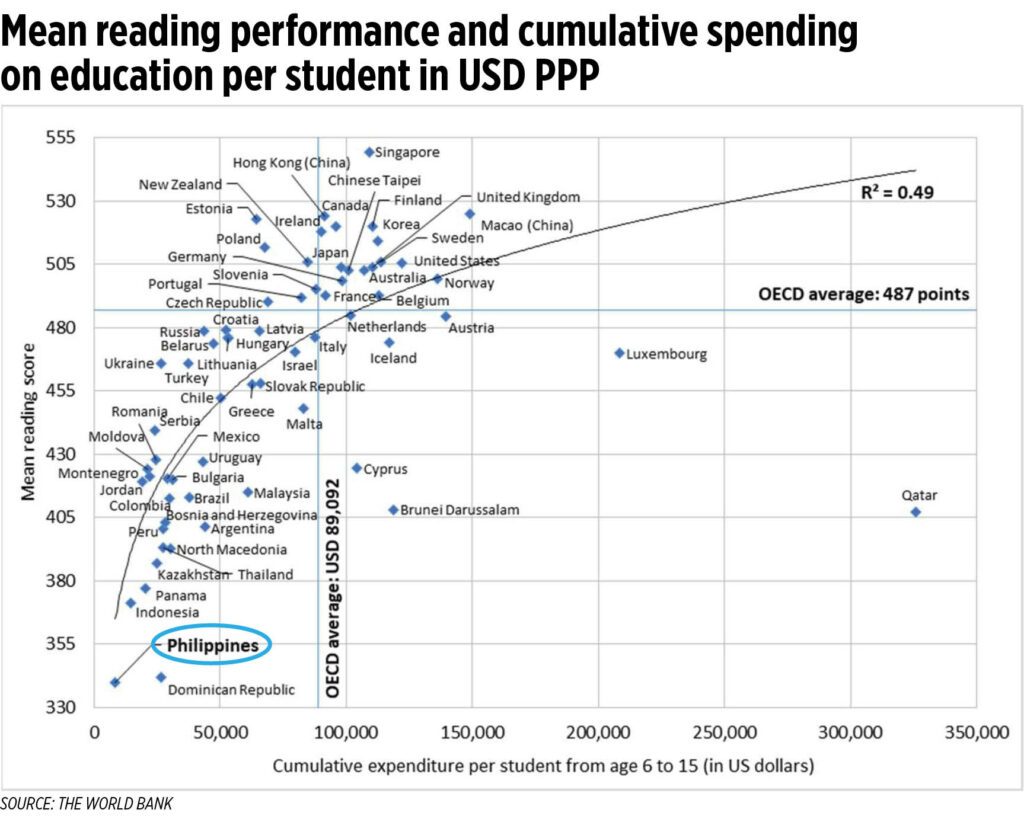

As a headline marker, one can argue that the Philippines is not putting its money where its mouth is. In June 2020, the World Bank, in its assessment of PISA’s 2018 country report on the Philippines, correlated the Filipino students’ performance in reading with public spending on education. The result is incontrovertible. The World Bank computed that the Philippines’ cumulative spending per student amounting to $8,474 (based on purchasing power parity) was the lowest among all the participating countries against the OECD average of $89,092!

We were outclassed both in public spending and students’ scores in reading even by such countries as Estonia, Croatia, Latvia, Malta, Peru, and Panama.

Congress should therefore at least sustain the 1987 Philippine Constitution’s provision that education should be top priority in the budget. Its lion’s share should continue to increase over time. As the PDP admitted, “the Philippines is in a learning crisis, and the COVID-19 pandemic will make it even worse.”

But the numbers don’t lie. We did not respond to the call.

As Macrotrends observed, general government spending on education — inclusive of current, capital, and transfers as a share of total general expenditures on all sectors namely health, education, social services, etc. — actually declined, rather than increased from 2019 through 2022. In 2019, the year after the 2018 PISA assessment, the ratio stood at 17.89%, down by 0.85% from 2018; it was 16.97% in 2020, down by 0.91% from 2019; 16.782% in 2021, down by 0.25% from 2020; and 15.7% in 2022, down by 1.02% from 2021.

The Department of Budget and Management (DBM) and Congress cannot by no means deny that in 2022 alone, while educational agencies like DepEd and state-owned universities and colleges received a total of P789 billion, that only represented a mere 5% increase over the previous year’s level. Public works, on the other hand, which cornered a little lower amount of P787 billion was actually given a higher allocation by more than 13%.

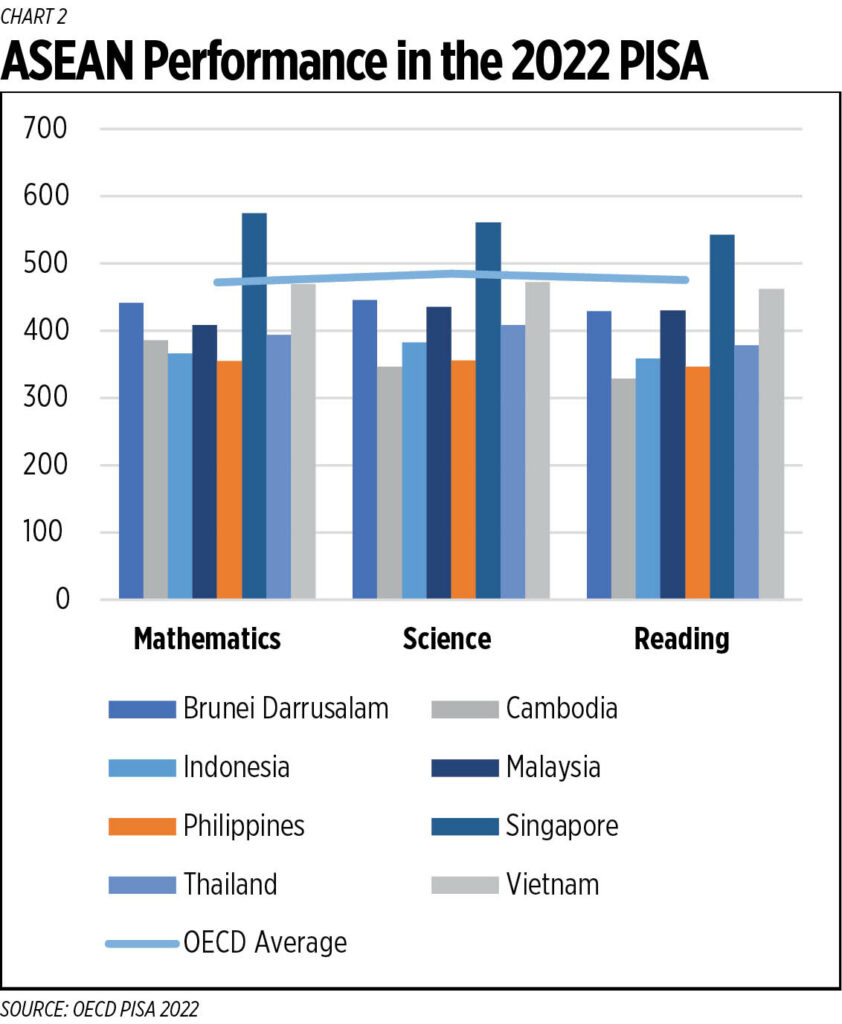

Should we be surprised that in 2022, four years after their initial assessment, Filipino students remained poor in learning? A pitiful less than a quarter of Filipino students who took the test hurdled the minimum level of proficiency in reading, mathematics, and science. The Philippines continued to score significantly lower than the OECD averages in all three subjects. We compared very poorly with our ASEAN peers, especially with Singapore, Malaysia, and Vietnam in all three subjects in 2022.

During the same assessment, Filipino students also ranked among the lowest globally in creative thinking. We were at par only with bottom dwellers from Albania, Uzbekistan, and Morocco. Our mean score was only 14 out of a possible 60 points, less than half of the OECD average of 33.

Those countries that allocated more public spending on education, like Singapore, Korea, Canada, Australia, and New Zealand, scored highest among those assessed.

PISA traced this weak proficiency in academics and critical thinking to equally weak support in technology and school facilities, which is equivalent to tracing the problem to the very feeble public spending by the Philippines in education. It comes down to the budget and governance.

This could not have been made more graphic than what the broadsheets reported the other day about the miserable shortage of classrooms in the Philippines. No less than Education Secretary Sonny Angara explained it: “Around 165,000 and growing because the current budget can’t support it — at this rate, it will take us 30 years to build if we stick to the existing budget!”

This means Congress should not only uphold the constitutional priority given to education, but it should also endeavor to increase its absolute size year after year. This is no different from what we need to do to make up for the large 9.5% decline in GDP in 2020 by growing much, much more than the official target of 6-8%. We need to do more to mitigate poverty incidence and income inequality in the Philippines by growing more than historical trends.

The DepEd is quite late in the game in raising the issue of the shortage of classrooms and the need to partner with the private sector. In the last several decades, this issue has always been on the agenda of the Government. DepEd admitted that in the 2025 budget, its allocation was indeed reduced. In the immediate future, when this issue is not addressed and addressed well, Filipino students will continue to “face overcrowded conditions, limited resources, and compromised learning environment.”

Against the PDP’s four desirable outcomes in the areas of educational attainment, student achievement, student wellbeing, and attitudes towards school and learning are four key foundations: quality instruction, learning time, inclusive environment, and family support.

DepEd’s call, however, addresses only the issue of educational infrastructure and facilities, perhaps learning time and conducive environment for learning. The other foundation of good quality education is, of course, the quality of instruction. Our public educational system is also hamstrung by the lack of teachers, competent teachers no less, and appropriate vetted teachings materials. The other week, the DBM approved 16,000 teaching posts for the coming school year. This should have been done yesterday, too! It’s not uncommon that when we combine the problems of lack of classrooms and teachers, we have many situations in many public schools where there are three shifts, instead of the previous two, and one teacher looking after over 50 students.

That brings us to the role of the private schools. In the 2018 PISA assessment, a scatter plot clearly showed that high achievers in the tests mostly came from independent private institutions. In these institutions, both the learning environment and quality of instructions are broadly and relatively higher. Public school students in general, buffeted by deficient infrastructure and weak instructional program, performed poorly in the tests.

Should we then direct more of our resources towards expanding access to education rather than to improving the quality of education?

In an article in the IMF’s Finance and Development Magazine of March 2025 (“The Power of Education Policy”), the World Bank’s Amory Gethin argued that education quantity drove global poverty reduction from 1980-2019. During the same period, the share of adults with no schooling declined while those with some schooling rose. On the other hand, education quality had stagnated.

Policy-wise, this should suggest that the National Government respond to DepEd’s appeal for more classrooms and trained teachers while providing some form of incentives for the private independent educational institutions to provide additional access for the rest of the school-going population in key areas throughout the Philippines. The quality of instruction can partly be managed by increased levels of technology use. The returns could in fact be much higher. This will be enhanced when better education outcome is linked to industry and services. Such synergy could many times increase productivity and efficiency, and mitigate social problems.

As Gethin quipped: “Failure to expand access to education would represent an enormous missed opportunity to enhance inclusive growth.”

Diwa C. Guinigundo is the former deputy governor for the Monetary and Economics Sector, the Bangko Sentral ng Pilipinas (BSP). He served the BSP for 41 years. In 2001-2003, he was alternate executive director at the International Monetary Fund in Washington, DC. He is the senior pastor of the Fullness of Christ International Ministries in Mandaluyong.