BSP seen to keep policy rates at record low — poll

By Luz Wendy T. Noble, Reporter

THE BANGKO SENTRAL ng Pilipinas (BSP) is widely expected to keep policy rates unchanged at its Thursday meeting, as the economy’s recovery is clouded by the spread of the Delta variant of the coronavirus disease 2019 (COVID-19).

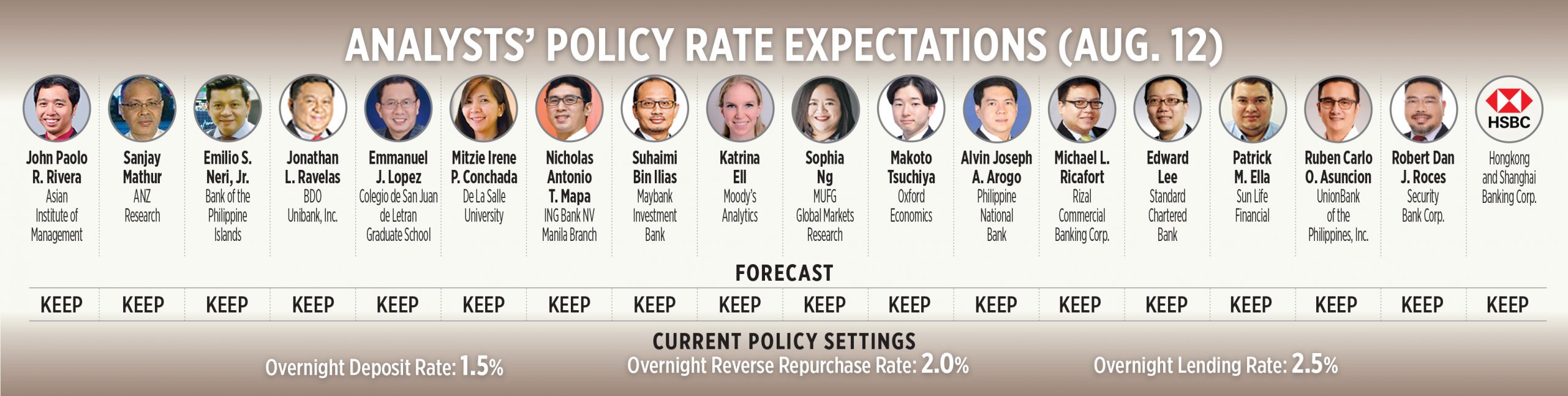

All 18 analysts polled by BusinessWorld expect the Monetary Board to maintain the key policy rate at an all-time low of 2% on Aug. 12.

Analysts said the Delta variant and the reimposition of strict lockdown measures strengthen the case for the BSP to retain policy support.

The Health department recorded 9,671 new infections on Sunday, bringing the active cases to 77,516. It reported 287 deaths, the biggest single-day increase in deaths since April 9, Reuters reported.

Metro Manila and some provinces are currently under an enhanced community quarantine (ECQ) until Aug. 20, as the government seeks to curb a Delta-driven surge in infections that threatens to overwhelm hospitals.

“The ongoing pandemic and mobility restrictions will remain the key factors to watch out for. The current weak credit growth may also be in focus. Inflation is already easing and should be less of a focus,” Standard Chartered Bank ASEAN and South Asia Chief Economist Edward Lee said.

Preliminary data from the BSP showed bank lending marked its seventh month of contraction in June.

Meanwhile, the consumer price index rose 4% in July, easing from 4.1% in June and marking the first time that inflation was within the BSP’s target range of 2-4%.

Makoto Tsuchiya, an economist at Oxford Economics, said that BSP is expected to “not proceed with any policy tightening yet” even though inflation could pick up in the coming months due to higher global commodity prices. Instead, he said the BSP will focus on economic growth concerns.

“Any possible threat of a resurgence of inflation will likely be met with the same response by monetary authorities with BSP Governor Benjamin E. Diokno looking past any supply side-oriented shocks to prices,” ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said.

Mr. Diokno in July acknowledged that recovery appears to be “slower-than-anticipated” despite some indications of improvement in business activities.

He reiterated that the BSP will maintain an accommodative policy “for as long as necessary” to support recovery, adding that higher prices caused by low supply “are best dealt with supply-side interventions.”

The central bank kept its prudent pause despite beyond-target inflation in the first half of the year. It stressed the need for non-monetary measures including the easing of import quotas and lower tariffs for meat products.

While the BSP is keeping a close eye on signals from the US Federal Reserve regarding its taper policy, analysts believe the central bank will give more importance to local developments for now.

“The Fed is yet to become a major factor in the policy calculus at this stage,” ANZ Research Chief Economist for Southeast Asia and India Sanjay Mathur said, noting there is still “considerable slack in the economy.”

The economy shrank by 4.2% in the first quarter following a record 9.6% contraction last year. A BusinessWorld poll of 20 economists expect second-quarter GDP to grow by 10.6% mainly due to base effects from the 17% decline in the same period of 2020.

The government will release second-quarter GDP data on Tuesday (Aug. 10).

Maybank Investment Bank Chief Economist Suhaimi Bin Ilias said he expects a rate hike only by the fourth quarter of 2022, when the Fed’s reduction of asset purchases nears completion and ahead of the expected Fed rate hike by 2023.

“Focus will be more on vaccination progress to speed up economic reopening and policy reforms to spur private investment and foreign direct investments,” Mr. Ilias said.

On the other hand, Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. said there may be a preemptive rate hike at the Sept. 23 policy meeting, noting the BSP may do this to “avoid the urgency of delivering bigger rate hikes in the future, preserve its dollar buffers as well as to help temper the peso’s depreciation.”

“Global fund managers are likely to continue rebalancing their portfolios away from emerging market currencies just as the Federal Open Market Committee starts to hint on policy normalization on or before their own September policy meeting,” Mr. Neri said.

The BSP has kept the overnight reverse repurchase, lending, and deposit rates at record lows of 2%, 2.5%, and 1.5% at its June 24 policy meeting. It last adjusted the policy rates on Nov. 20, 2020.

After Thursday, the Monetary Board will have three more policy reviews this year — on Sept. 23, Nov. 11, and Dec. 16.