Banks’ profit to improve in 2022 — analysts

THE BANKING SECTOR’s bottom line could further improve this year as the economy gradually loosens its pandemic movement curbs, analysts said.

THE BANKING SECTOR’s bottom line could further improve this year as the economy gradually loosens its pandemic movement curbs, analysts said.

Analysts expect the banking sector to continue its improvement on financial performance as the economy leads to recovery, however, risks are still apparent with the continuing coronavirus disease 2019 (COVID-19) and the Fed’s tightening monetary policy.

The barometer Philippine Stock Exchange index ended the fourth quarter at 7,122.63, increasing by 2.4% on a quarter-on-quarter basis from 6,952.88 in the previous quarter.

The financial subindex, which included the banks, rose by 14.4% to 1,606.17, reversing the 6.3% quarter-on-quarter drop seen in third quarter.

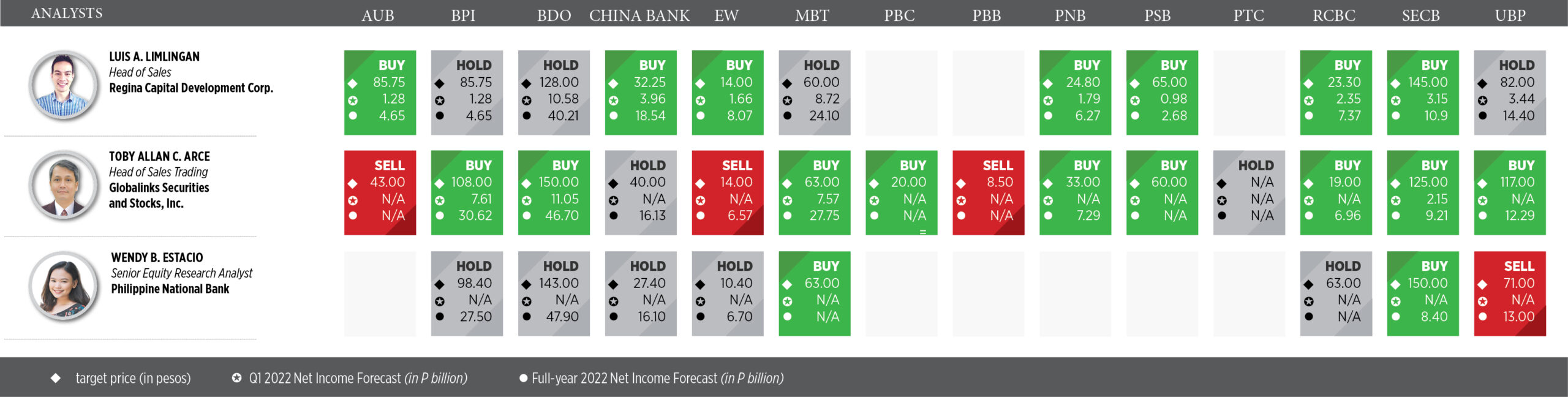

Twelve out of 15 listed banks posted growths in their share prices during the fourth quarter. Metropolitan Bank & Trust Co. (MBT) surged the most by 27.5% quarter on quarter. It was followed by Union Bank of the Philippines (UBP, 17.5%), Bank of the Philippine Islands (BPI, 13.1%), Philippine Trust Co. (PTC, 12.4%), and Security Bank Corp. (SBC, 12.3%).

Shares in Asia United Bank (AUB), meanwhile, fell by 3.9%. Philippine Bank of Communications (PBC, -1.1%) and Philippine National Bank (PNB, -0.5%) likewise decreased.

Regina Capital Development Corp. Head of Sales Luis A. Limlingan attributed the increases in share prices among most of the listed banks to lower loan loss provisions of banks stocks amid the economy’s gradual recovery.

“Those that logged strong [fourth quarter 2021] performance have likely booked much lower provisions amid credit risk normalization and saw a significant increase in their fee-based income,” he said.

PNB Senior Equity Research Analyst Wendy B. Estacio said that the increase in share prices of the listed banks was driven by its improvement in asset quality which resulted from lower loan loss provisions.

She also cited the banks’ improved cost-to-income ratios as lenders continued their shift to digitalization that expanded operation efficiency in response to strict movement restrictions.

“On asset quality side, nonperforming loans were lower as credit standing of retail and corporates improved. As a result, banks provided lower loan loss provisions which improved their bottom line during the period,” she added.

Provision for credit losses by the universal and commercial banks (U/KBs) was nearly halved to P93.27 billion in end-December last year from P192.71 billion in 2020, central bank data showed.

Total net income of the big banks jumped by 45.5% year on year to P207.45 billion in the fourth quarter.

Gross nonperforming loan ratio of big lenders, meanwhile, improved to 11-month low at 3.55% as of December last year.

First Metro Investment Corp. (FMIC) Research Head Cristina S. Ulang attributed banks positive performance for the period due to the parallel decline in COVID-19 cases as the economy reopened towards normalcy.

“Sharp drop in virus cases paved the way for economic reopening in [fourth quarter 2021], benefiting banks in terms of lending opportunities,” Ms. Ulang said.

She also noted the pickup in yield curve in 2021, which means lower trading income for government securities.

Looking at the current market climate, analysts recommended to look at the loan portfolio of banks as they start to become less conservative in lending.

“Market participants should still consider the composition of the loan portfolio of the bank, bank classification, prospects, and how eager these banks want to strengthen their digital framework amid the rising fraudulent activities,” Mr. Limlingan said.

Meanwhile, Globalinks Securities and Stocks, Inc. Head of Sales Trading Toby Allan C. Arce stressed that investors and traders should consider investing amid a high interest rate environment.

“Based on the Federal Reserve’s pivot at the end of 2021, it appears as though they may now be adopting a more hawkish stance to removing the stimulus provided during the COVID-19 pandemic while helping to combat non-transitory areas of inflation,” he added.

In December, the US central bank decided to unwind its monthly $120-billion bond-buying program after nearly two years into the pandemic starting this March. It turned hawkish after signaling it could raise its policy rate three times this year.

For the first time since 2018, the Fed hiked its policy rate by 25 basis points and signaled more increases to hit 1.75-2% range by the end of this year to combat highest inflation in four decades.

Meanwhile, Bangko Sentral ng Pilipinas (BSP) Governor Benjamin E. Diokno said the central bank will stick to its plan to raise its record-low key rate by the latter half of the year, factoring in the Russia-Ukraine crisis and the Fed’s hawkish moves.

“Rising interest rates will likely affect banks’ balance sheets, altering the values of liabilities and assets and reduce the net worth of banks,” Globalinks’ Mr. Arce said.

Meanwhile, Regina Capital’s Mr. Limlingan was confident that the Fed’s policy would not have a significant impact on the banking industry.

“In theory, this would lead to capital outflows, but the BSP gave a reassuring statement that it wouldn’t result in a sizable impact on the domestic economy and banking industry, citing that the country has sound fundamentals and a resilient banking system,” Mr. Limlingan said.

For PNB’s Ms. Estacio, banks efforts to adopt digital banking will likely increase its operating expenses, hence, a factor investors should look into.

“Investors should look into a possible rise in operating expenses of banks given the initiatives to improve their digital operations in line with the BSP’s target,” Ms. Estacio said.

The central bank aims to have 70% of Filipinos to have bank accounts by 2023. It also targets half of the country’s payments to be conducted online by the same year.

OUTLOOK

Analysts expressed optimism on the economic recovery despite uncertainties brought by the COVID-19 pandemic.

“Business conditions for banks are expected to be similar to those in 2021, as the global economy continues to recover, although at a slower pace,” Mr. Arce said.

“Overall, stable or improved bank financial performance can be expected for this year, driven by economic and loan growth despite an uneven path to full recovery,” he added.

FMIC’s Ms. Ulang noted the bank’s profitability is expected to remain resilient as the gross domestic product (GDP) growth accelerates to 6-7% this year as well as the loans pick up approaching double-digit.

The country’s economic managers forecast a growth of 7-9% for this year.

“For 2022, we estimate an average loan growth of 6.1% for banks under our coverage, which will likely be closer to the GDP growth forecast. We also project an average net interest income growth of 5.3% year on year due to a possible rate hike this year,” PNB’s Ms. Estacio said.

“We forecast earnings to increase by an average of 16.6% year on year on lower loan loss provisions (average -20.9%) attributable to the improving economic outlook,” she added.

Mr. Limlingan is also confident that the country’s banking sector will continue to improve as the government steps up its efforts to further economic recovery.

“So long as the pandemic persists, outlooks would likely remain clouded. However, with continued vaccination rollout, border reopening for tourism, and decline in daily infections, it’s possible to see the industry post a high single-digit growth, at least,” he said. — Mariedel Irish U. Catilogo