Debt yields rise as BSP easing cycle nears end

By Abigail Marie P. Yraola, Deputy Research Head

YIELDS on government securities (GS) traded in the secondary market mostly rose last week after the Bangko Sentral ng Pilipinas (BSP) signaled an imminent end to its easing cycle.

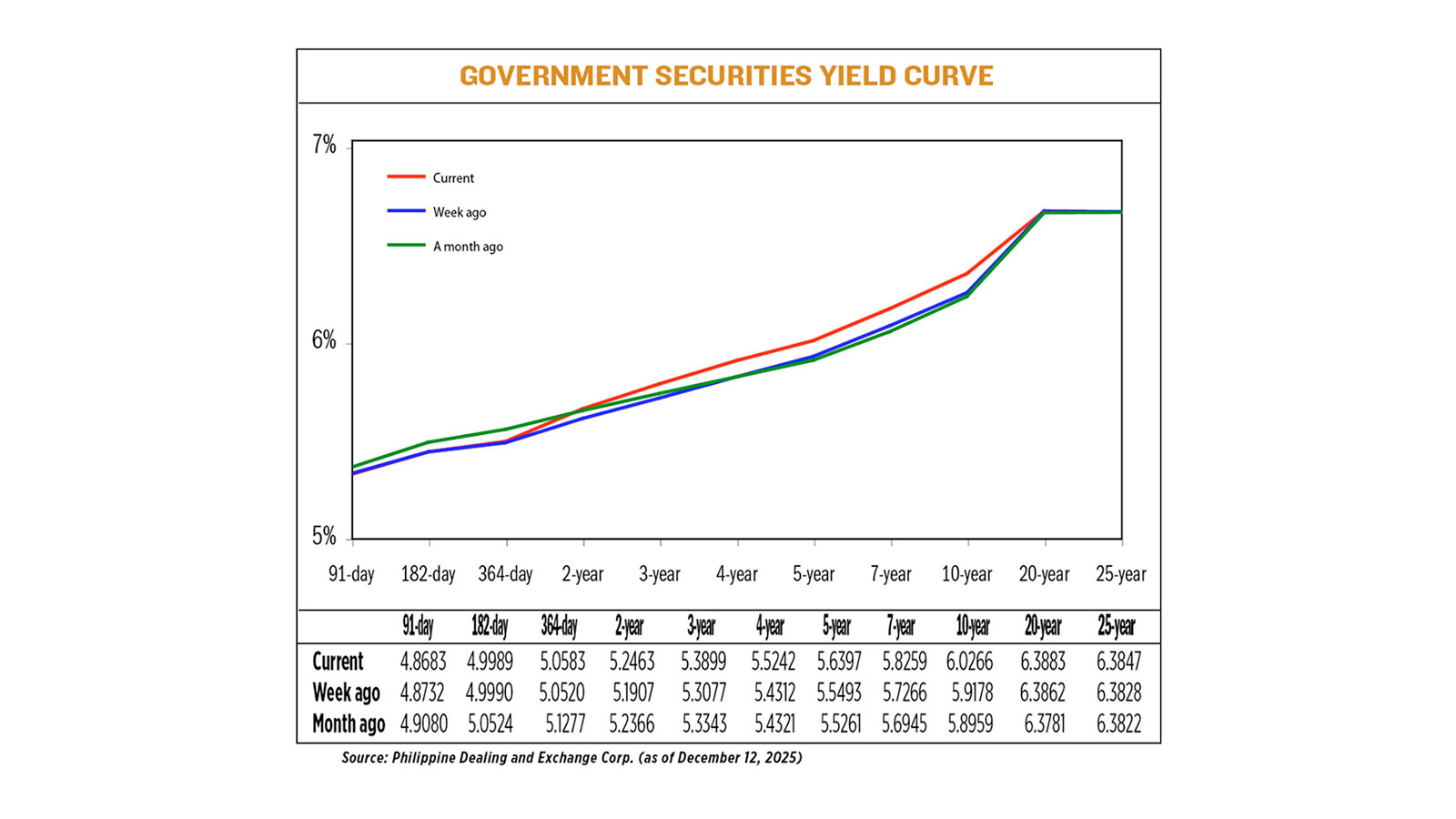

GS yields, which move opposite to prices, went up by 4.86 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates data as of Dec. 12 published on the Philippine Dealing System’s website.

Yields on the 91- and 182-day Treasury bills (T-bills) declined by 0.49 bp and 0.01 bp week on week to 4.863% and 4.9989%, respectively. Meanwhile, the 364-day T-bill inched up by 0.63 bp to yield 5.0583%.

At the belly, yields went up across all tenors. The two-, three-, four-, five-, and seven-year Treasury bonds (T-bond) saw their rates climb by 5.56 bps (to 5.2463%), 8.22 bps (5.3899%), 9.3 bps (5.5242%), 9.04 bps (5.6397%), and 9.93 bps (5.8259%), respectively.

At the long end, the 10-, 20-, and 25-year debt papers saw their rates increase by 10.88 bps (to 6.0266%), 0.21 bp (6.3883%), and 0.19 bp (6.3847%) respectively.

GS volume traded amounted to P89.79 billion on Friday, significantly higher than the P43.06 billion recorded a week earlier.

Bond yields went up week on week in reaction to policy guidance from the BSP chief following the Monetary Board’s meeting on Thursday last week, Alessandra P. Araullo, chief investment officer at ATRAM Trust Corp., said in a Viber message.

“The market largely anticipated the recent policy rate cut, but the BSP’s forward guidance came out slightly more hawkish compared to its tone in October. This shift prompted a sell-off in the local bond market, with both local and offshore accounts reducing risk. As a result, yields moved higher across the curve, particularly in the belly, which rose by 14-19 bps week on week. The 10-year benchmark reflected this weakness as well, closing at 6% after a 15 bps increase,” she said.

She, however, noted that in comments on Friday, BSP Governor Eli M. Remolona, Jr. somehow “softened” his tone to “a more neutral stance.”

“He mentioned that while the pace of easing will likely be slower, another rate cut remains a possibility at their next policy meeting.”

Michael L. Ricafort, chief economist at Rizal Commercial Banking Corp. said in an e-mail that these “more dovish” signals were welcomed by the market and helped cap the week-on-week rise in GS yields.

On Thursday, the BSP lowered benchmark rates by 25 bps for a fifth straight meeting to bring the policy rate to 4.5%, the lowest level in more than three years, as expected by 17 out of 18 analysts in a BusinessWorld poll.

The Monetary Board has now delivered 200 bps in reductions since August 2024.

Mr. Remolona said in a briefing after the meeting that benign inflation gives them room to help support weak domestic demand amid lingering governance concerns that have affected investor confidence, but said that they are nearing the end of their current easing cycle, with further cuts — if any — likely to be limited and dependent on data.

On Friday, he left the door open to one last 25-bp reduction, adding that they expect a gradual economic recovery following the BSP’s previous easing moves and as the government moves to resolve corruption issues.

Higher US Treasury yields recently amid bets on the US Federal Reserve’s policy path also affected GS rate movements last week, Mr. Ricafort added.

The Fed cut interest rates by a quarter-percentage point on Wednesday in an uncommonly divided vote, but signaled it would likely pause further reductions in borrowing costs as officials look for clearer signals about the direction of the job market and inflation that “remains somewhat elevated,” Reuters reported.

Wednesday’s cut brought the policy rate to a range of 3.5%-3.75%.

The Fed’s projection for a slower easing path contrasts with market expectations for two 0.25% cuts in 2026, which would bring the fed funds rate to about 3%. Policymakers see only one cut next year and one in 2027.

Investors face uncertainty over next year’s monetary policy as inflation trends and labor market strength remain unclear.

The Fed’s dual mandate — employment and price stability — is fueling internal debate at the Fed.

For this week, Ms. Araullo expects lighter trading activity as the year nears its close and with the Bureau of the Treasury (BTr) already done with its weekly bond auctions. The BTr will conduct its last Treasury bill offering on Monday.

“With the recent policy rate cut and the yield curve still relatively steep, there is room for yields in the mid to long end of the curve to drift lower as the market recalibrates.” — with Reuters