Debt yields end mixed after US-China truce

YIELDS on government securities (GS) traded on the secondary market ended mixed last week as appetite for other risk assets improved following the trade truce between the United States and China.

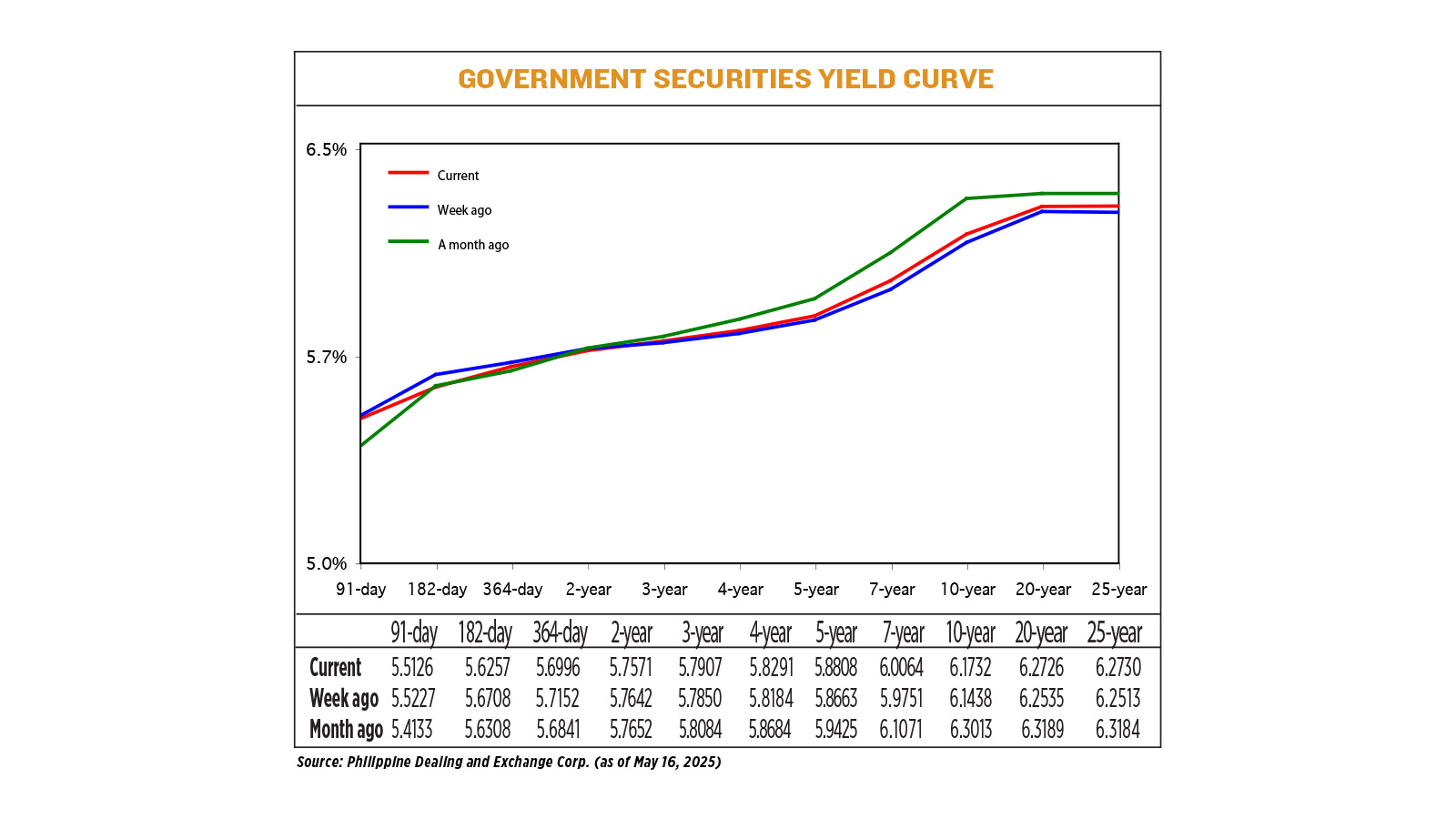

GS yields, which move opposite to prices, rose by an average of 0.5 basis point (bp) last week, based on PHP Bloomberg Valuation Service Reference Rates as of May 16 published on the Philippine Dealing System’s website.

The short end of the curve declined week on week, with the 91-, 182-, and 364-day Treasury bills inching down by 1.01 bps (to 5.5126%), 4.51 bps (5.6257%) and 1.56 bps (5.6996%), respectively.

At the belly, yields mostly went up. The three, four-, five-, and seven-year Treasury bonds (T-bonds) rose by 0.57 bp (to 5.7907%), 1.07 bps (5.8291%), 1.45 bps (5.8808%), and 3.13 bps (6.0064%), respectively. Only the two-year bond declined, inching down by 0.71 bp to yield 5.7571%.

Meanwhile, at the long end of the curve, rates went up across all tenors. The 10-, 20-, and 25-year papers climbed by 2.94 bps (to 6.1732%), 1.91 bps (6.2726%), and 2.17 bps (6.7230%), respectively.

GS volume traded amounted to P80.42 billion on Friday, slightly lower than the P81.85 billion recorded a week prior.

“The trade truce between the US and China helped reduce global risk sentiment and uncertainty. As investors unwound their positions in safe haven assets, such as government bonds, this triggered an outflow that pushed yields higher both globally and locally. The market interpreted the tariff concessions as a signal of easing tensions, thereby increasing risk appetite and rotating flows toward riskier assets,” ATRAM Trust Corp. Vice-President and Head of Fixed Income Lodevico M. Ulpo, Jr. said in a Viber message.

“Local bond market yields rose midweek as positive tariff-related headlines sent US Treasury yields higher,” a bond trader likewise said.

The United States will cut the low value “de minimis” tariff on China shipments, a White House executive order said on Monday, further de-escalating a potentially damaging trade war between the world’s two largest economies, Reuters reported.

The move comes several hours after Beijing and Washington announced a truce in their trade spat after weekend talks in Geneva, with both sides agreeing to unwind most of the tariffs imposed on each other’s goods since early April.

While their joint statement in Geneva didn’t mention the de minimis duties, the White House order released later said the levies will be reduced to 54% from 120%, with a flat fee of $100 to remain, starting from May 14.

Mr. Ulpo added that the result of last week’s T-bond auction also affected bond yield movements at the secondary market.

“One of the notable local developments was the weak reception to the 20-year Treasury bond auction. The lackluster demand reflected investor concerns about locking into long-term duration amidst a still-uncertain policy backdrop. This caused some selling pressure on long-dated securities, contributing to a steeper curve. Additionally, profit taking from previous bond rallies also exerted upward pressure on yields during the week,” he said.

On Wednesday, the Bureau of the Treasury raised P25 billion as planned from the reissued 20-year T-bonds it auctioned off, with total bids for the tenor reaching just P27.89 billion. This brought the total outstanding volume for the bond series to P192.7 billion.

The notes, which have a remaining life of 19 years and 13 days, were awarded at an average rate of 6.486%. Accepted yields ranged from 6.375% to 6.618%.

For this week, both the trader and Mr. Ulpo said yields could move sideways amid a lack of leads.

“We expect GS yields to move in a more range-bound manner in the coming week, with a relatively neutral bias. Market participants will closely monitor the results of the upcoming 10-year bond auction, which is expected to provide clearer guidance on appetite for duration. Additionally, any surprise data releases or shifts in global risk sentiment may influence short-term positioning,” Mr. Ulpo said.

On Tuesday, the BTr will offer P30 billion in reissued 10-year T-bonds with a remaining life of nine years and 11 months. — Matthew Miguel L. Castillo with Reuters