Incoming administration needs to ensure ‘investment efficiency’ — Fitch

A CONTINUED FOCUS on infrastructure under the next administration will help drive post-pandemic growth recovery, but the next administration should ensure it will continue governance standards and debt management, Fitch Ratings said.

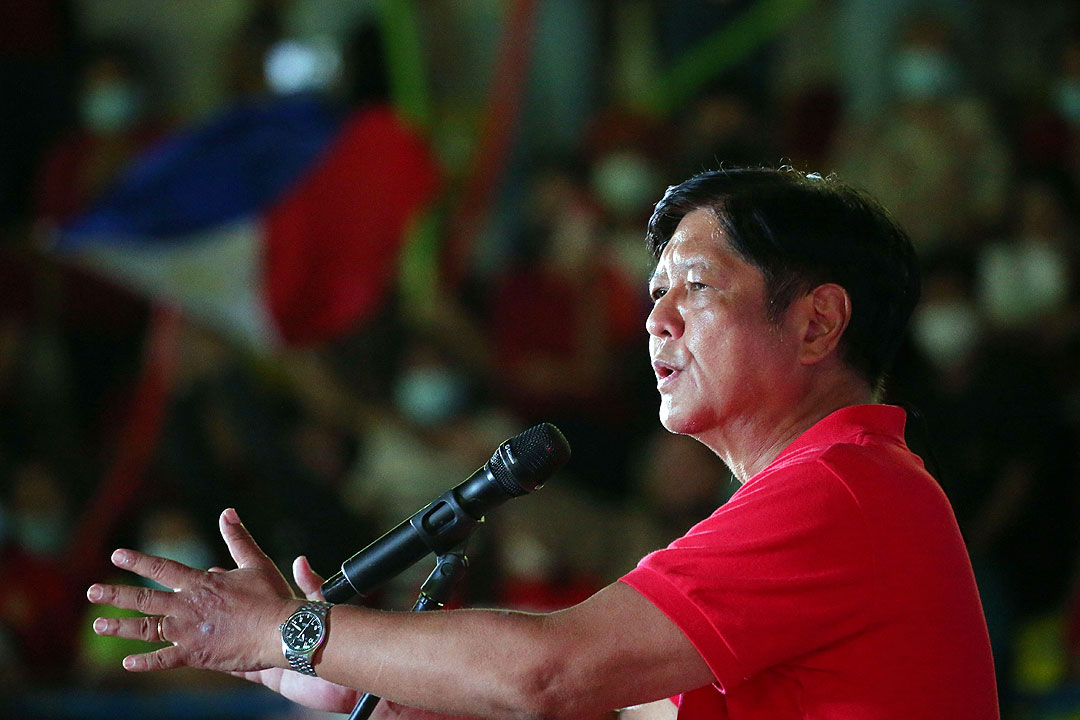

Under a government led by Ferdinand R. Marcos, Jr., investments that will address infrastructure gap in the Philippines could help offset pandemic scarring on the economy, the debt watcher said in a note on Thursday.

Fitch said it expects the Marcos administration to continue focusing on infrastructure, which is a key element for medium-term growth that supports the country’s investment grade “BBB+” rating.

“However, investment efficiency is critical. A deterioration of governance standards could, over time, dilute the positive effect of investment on productivity growth,” Fitch Ratings said.

“Poorly managed public infrastructure investment could also contribute to government debt rising faster than nominal gross domestic product (GDP) over the medium term, which would pressure the sovereign rating,” it added.

The Philippine economy grew by a stronger-than-expected 8.3% in the first quarter, rebounding from the 3.8% contraction in the same period in 2021, government data showed.

Data from the Bureau of the Treasury released Thursday showed the country’s debt-to-GDP ratio expanded to 63.5% as of end-March from 60.4% as of end-2021. (Related story)

This is already beyond the 60% threshold considered as manageable by multilateral lenders for developing economies.

“Our baseline assumption is for the Philippines to continue with its sound policy framework and return to strong medium-term growth following the coronavirus disease 2019 (COVID-19) pandemic, but the Negative Outlook on the Philippines’ rating, which we affirmed in February 2022, reflects the uncertainty around this outcome, as well as possible challenges in bringing down government debt after the pandemic policy response,” Fitch said.

On the fiscal side, the debt watcher noted some risks arising from the implementation of the Supreme Court ruling that expands the local government units’ (LGU) share of the National Government revenue this year.

“Poor execution could lead to underspending by local governments. If this adversely affects medium-term growth potential, the net credit effects are likely to be negative, even though public finances may improve in the near term,” Fitch said.

The ratings agency also warned a reversal in tax reforms could heighten the possibility of a ratings downgrade.

“If the new administration amends the Rice Tariffication Law, as it suggested during its campaign, this could curb rice imports and push up the cost of rice. Amending the law could also hurt tax revenue,” Fitch said.

“The low tax take is a credit weakness for the Philippines, and when we affirmed the rating in February, we noted that a reversal of tax reforms that leads to sustained higher fiscal deficits could result in a rating downgrade,” it said.

‘NEGATIVE PERCEPTION’

Meanwhile, economists said foreign investor confidence in the Philippines may remain shaky due to high debt, elevated inflation and uncertainty arising from Mr. Marcos’ lack of clear economic policies.

“It is unfortunate that because of the Martial Law years and the unresolved ill-gotten wealth issues, Mr. Marcos Jr. may bear the heavy burden of negative investor perception, specifically among the foreign investor community,” UnionBank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said in an e-mail.

Leonardo A. Lanzona, an economics professor at the Ateneo de Manila University, said in a Viber message he “would not be surprised if more investment firms drop the country in their investment lists.”

“Given the budget constraints we face and the complete silence in all these issues, the efficient allocation of these public goods is unlikely to be accomplished, and the administration will likely repeat the past mistakes. Even the indicated continuity of the Duterte programs is not clear,” Mr. Lanzona said.

Meanwhile, a spokesperson for JPMorgan claimed the media “mistakenly reported” it dropped the Philippines to the bottom of its investment list due to the election results.

“Our views on the Philippines are driven by long-term global and local macroeconomic fundamentals, and not by election results or outcomes in general,” Patricia Anne Javier-Gutierrez, JPMorgan Philippines head of communications, was quoted as saying in a statement released by Mr. Marcos’ camp.

“As stated in our May 8 Philippine Strategy report, we think the Philippines faces a challenging macroeconomic outlook post 2022 regardless of the outcome of the May 2022 presidential elections,” she said. — Luz Wendy T. Noble and Tobias Jared Tomas