By Mon Abrea, CPA, MBA, MPA

Chief Tax Advisor, Asian Consulting Group

The reforms under the Ease of Doing Business Act, TRAIN, CREATE and now the Ease of Paying Taxes Act have introduced significant changes in our tax system that are both necessary and important. However, there is still more that we can do to increase tax collections through voluntary compliance without adding new taxes.

There are certain ways that can make the tax system simpler and fairer for all, while also keeping in mind that the government must balance this goal with the need to collect more revenues. These proposals are not just intended to just be a strain on the government’s resources, but rather come with a benefit for both taxpayers and the government.

With the appointment of Secretary Frederick Go and Secretary Ralph Recto, I hope these proposals will be considered among other reforms they wish to introduce in improving ease of doing business and reducing the cost of doing business while increasing revenue collections from a broader taxpayer base: (1) adoption of pre-populated returns, (2) implementation of risk-based audit, (3) simplifying the tax regime for MSMEs, and (4) creation of a separate office to process VAT refund, among others.

One of the critical success factors here is the integration and full digitalization of our tax system with the capability to access information from other government agencies. Lifting of the bank secrecy law will also be indispensable if we want to prosecute big-time tax evaders and stop money laundering.

Adoption of pre-populated returns

Through the Ease of Paying Taxes Act, we have already further simplified tax returns for micro and small taxpayers by reducing the number of pages from four to two. However, we can further take this down by implementing pre-populated tax returns.

Pre-populated tax returns are essentially tax returns that have been partially filled-out by the government through a series of automated systems that gather data. This data can come from third parties or even data that the taxpayers provide themselves.

It has been aptly compared to turning tax returns into a “credit card bill.” What this means is that, just as a credit card holder receives a statement of account at the end of the month, a taxpayer would receive their tax return with the details already filled in. It would then be up to the taxpayer to confirm or inform the BIR if there is any additional or wrong information in the return. Thus, taxpayers would no longer have to repeat filling out data that the BIR should already have in its database or could easily get from third parties.

The implementation of this proposal would require more fine-tuning, but the basics are simple: since the BIR already has information on how much taxes are withheld from employees and/or self-employed and professionals, they can already generate returns automatically. If no sufficient data exists, the BIR can use a presumptive tax which the taxpayer could correct by providing more information and documents to pay less amount of taxes.

A study by Joe Bankman, a professor of tax law at Stanford University, showed that this generally makes taxpayers more honest since they are aware that the revenue collecting agency (in our case, the BIR) has already removed all the irrelevant questions and that whatever questions are left are important and tailored specifically for the taxpayer.

Utilizing pre-populated tax returns essentially combines the audit and the filing process into one since the BIR would already be conducting the audit at the point of filing. This would lead to less resources being used overall.

If adopted correctly, this will significantly increase collections from self-employed and professionals who are the least compliant with zero to less than P10,000 annual tax payments. It will also address any gap or discrepancy in the remittance of withholding tax on compensation since employees will have to confirm the pre-populated return issued by BIR, and not by their employers.

Implementation of risk-based audit

The next proposal is a measure that the government has already laid down the foundations for. Under the Ease of Paying Taxes Act, for purposes of VAT refund, the law has classified claims into low-risk, medium-risk, and high-risk based on the amount of the claim, the taxpayer’s tax compliance history, and their frequency of claiming VAT refunds, among others.

This classification-system can also be extended to the conduct of the BIR audit.

A risk-based audit, as its name implies, means that the BIR will be auditing taxpayers based on their assessment of the taxpayer’s risk level. To implement this, the BIR could set a benchmark for certain industries based on how these industries generally earn.

Businesses who pay below this benchmark would be considered high-risk or medium-risk, depending on how much below the threshold they have paid.

Presently, the BIR already has a system for the audit of priority cases as identified by the Internal Revenue Integrated System (IRIS), but this can further be expanded.

Implementing a risk-based audit would allow the BIR to focus on exerting efforts where it really matters instead of wasting resources auditing low-risk or same taxpayers every year. The current method of “random” audit should be discontinued. At best, a random audit allows the BIR to conduct a “shotgun” method and, at worst, it allows revenue officers unbridled discretion on who to audit (to the point that only the same taxpayers would be audited over and over again).

Thus, with this increased efficiency, the BIR would theoretically be able to increase its revenue collections and at the same time reduce expenses.

Simplifying the tax regime for MSMEs

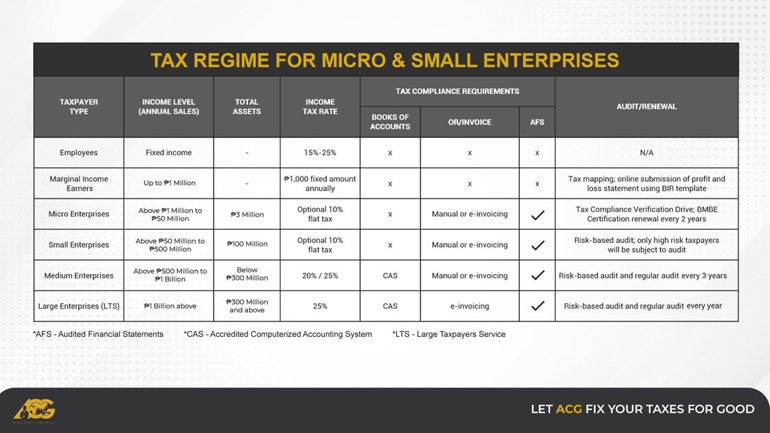

Similarly, the Ease of Paying Taxes Act has laid down the foundations for classifying taxpayers into micro, small, medium, and large taxpayers. This same metric has in fact been used in that very law to grant certain benefits to micro and small taxpayers such as reducing the number of pages in tax returns and reducing the penalties in select cases.

Another further benefit that we could extend to micro and small enterprises is simplifying their tax compliance by allowing them to opt for a flat tax system.

Instead of being taxed at the regular rate, micro and small enterprises could be granted the option to be taxed at 10 percent of their gross sales/revenues in lieu of all taxes. We could also remove non value-adding and compliance requirements that are very costly for micro and small enterprises, such as books of accounts. In exchange, these taxpayers could be required to implement electronic invoicing and do an online submission of profit and loss statements. This would then make it easier for the BIR to monitor their sales, allowing less strain on the government’s resources.

While it is true that the 10% flat tax would be significantly lower than what the government currently imposes, it is best to note that the flat tax would be imposed on gross sales/revenues. At present, even with our current tax rates, most companies pay barely 5% of their gross sales or revenues for both VAT and income tax. The current effective rate of 5% is definitely lower than the proposed 10% flat tax.

Creation of a separate office to process VAT refunds

In the last Senate Ways and Means Committee hearing I attended, the issue on VAT refund has surfaced again. Time and again, one of the most common complaints of those claiming for VAT refund is the long and tedious process, with no guarantee that they would get a refund (and not a tax assessment) from the BIR.

Of course, the BIR is blamed for this, but the BIR couldn’t care less since their mandate is to assess and collect taxes, not the processing of VAT refunds. This does not mean that the BIR is intentionally delaying the VAT refund process or, worse, does not process it at all. What this means is that the BIR faces a conflict as a tax collection agency. They are being required to audit the documents for VAT refund to make sure that they do not approve an undue refund because, otherwise, they will be legally liable.

While the regulation is clear and most documents have been submitted to the concerned Investment Promotion Agency (IPA), data-sharing among government agencies is still on the way. Thus, the burden of resubmitting all these documents rests on those who wish to claim for VAT refund.

At the very least, this should be fully automated so all information and documents are already in the system. That was actually my understanding of what the TRAIN law prescribes — the establishment and implementation of an enhanced VAT refund system and the establishment of a VAT refund center in the BIR and the BOC, but again, it might be best if it is outside or other than BIR and BOC. An independent and system-based tax refund center under the Department of Finance may address the issues on VAT refund.

Other proposals

By following the same principles in the development of pre-populated returns, we can also adopt a system of pre-registration. Through pre-registration, all licensed professionals and individuals doing business which register either with the DTI, the local government, or any other relevant government agency including the Professional Regulation Commission (PRC) for licensed professionals would automatically be registered with the BIR. From there, the taxpayer can update their details through an online platform.

Another proposal worth considering is offering incentives to taxpayers to register, or incentives to startups and small businesses. This would encourage taxpayers to register, thereby drawing them out of the underground economy and broadening the taxpayer base.

Finally, I deem it necessary to revisit the definition of what constitutes a marginal income earner to encourage them to register and formalize their businesses. Presently, under the Ease of Paying Taxes Act, all taxpayers earning under P3 million are considered micro taxpayers. However, there are distinct reasons as to why we should classify taxpayers as marginal income earners, since we could then use that classification to give them additional benefits. As it is, the threshold for marginal income earners is P100,000 annually, but this clearly does not match today’s economic realities. Instead, I propose that we amend the threshold instead to P1 million sales so all online sellers and even ambulant vendors will register to formalize their business. Furthermore, the MSME classification under EOPT may also be revisited to consider not just annual gross sales but also total assets and employees to distinguish one type of industry from another without undue prejudice on those with higher amounts of gross sales but lower margins such as manufacturing firms. (See table below.)

What all these proposals entail is simple: we need to make tax compliance easier and fairer for everyone, especially small taxpayers who may have smaller contributions but constitute a bigger share in terms of total number of taxpayers. Toward this end, we must rid our tax system of unnecessarily complicated processes and instead adopt data and tech-driven approaches to tax compliance.

I believe that governance is a shared responsibility. We need to work with the government to serve the people and to ease their burdens. In relation to taxation, one of these burdens is the complicated tax system. It is because of this belief that I am putting forward these proposals – so that we can all work together toward a simpler, fairer, and less complicated tax system that will benefit all of us.

To uphold our advocacy and commitment of working with our policymakers to have better and more efficient economic and fiscal policies, I am inviting our government and business leaders, especially our foreign investors, to join the 2024 International Tax and Investment Conference on February 27, 2024. Register now and join us as we break barriers in the digital economy.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by enabling them to publish their stories directly on the BusinessWorld website. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.