Fashion e-commerce platform Zalora is seeing an average quarterly increase of 50% in number of users in all its Southeast Asian markets following the April/May 2021 launch of its Buy Now, Pay Later (BNPL) payment option, which is proving popular among 30-to-35-year-olds.

The e-commerce platform has over 59 million user visits from Southeast Asia per month, according to a 2021 Trender report.

BNPL transactions accounted for more than 5% of total Zalora orders in 2021. Singapore and Malaysia are driving BNPL’s use in the region, with up to 12% of transactions paid via BNPL.

“Customers need to be able to pay however they want, so we have significantly expanded the available payment options on Zalora to lower any barrier to purchase and facilitate the process,” said Paulo L. Campos III, Zalora Philippines CEO, in an e-mail to BusinessWorld.

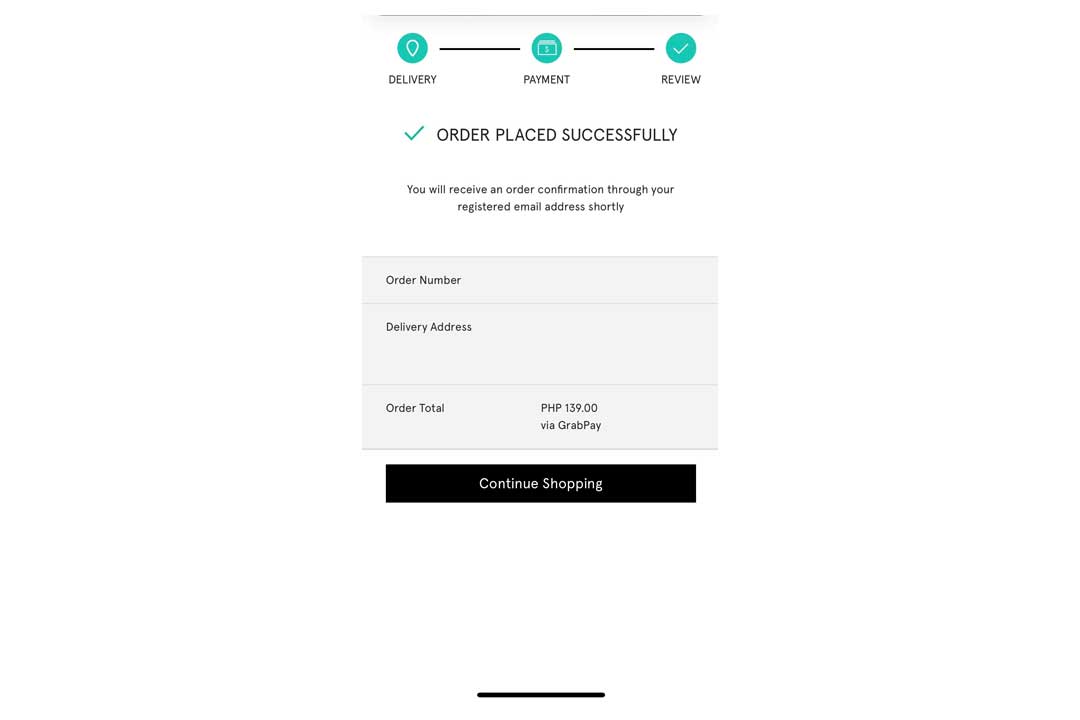

In the Philippines, Zalora offers BNPL through superapp Grab’s PayLater service, which allows customers to pay the following month for a small fee; and Atome, a Singapore-based BNPL brand, which allows customers to break down purchases into three payments at 0% interest.

UNEQUAL ACCESS

BNPL is gaining ground in Southeast Asia, wherein some 290 million individuals remain unbanked.

In Indonesia, where many do not own credit cards, the option is popular among 55% of new e-commerce users, according to a survey by Kredivo and the Katadata Insights Center, a market research firm.

A 2021 report by Worldpay from FIS, a global payment processing provider, expects BNPL’s share in the Asia Pacific to more than double from 2020 to 2024.

“These share gains will come at the expense of credit cards, bank transfers, cash on delivery, and prepaid cards, all of which will lose share through 2024,” the report said.

In the Philippines, factors like the unequal penetration rate of bank cards hamper the adoption of contactless payment methods, said Mr. Campos, who added that many customers continue to prefer COD (cash on delivery) because it is risk-free.

“They only pay upon receiving their goods, and it allows for faster order processing because banks or credit cards are bypassed,” he said.

The pandemic, which spurred the rise of e-commerce, has ripened the entry of payment platforms such as BNPL. Since partnering with Atome, Zalora has seen a 70% growth in the number of customers choosing BNPL in Singapore and Malaysia.

“As digital adoption across the region continues to accelerate, app-based services such as BNPL can make financial services straightforward to access despite the lack of robust tech or digital infrastructure,” Mr. Campos added. — Patricia B. Mirasol