High rates, geopolitical tensions dragged markets in Q4

THE COUNTRY’S financial markets swayed in the final quarter of 2023 as geopolitical tensions and interest rates pushed the market and policy makers to a waiting game in search of better economic conditions.

The Philippine Stock Exchange index (PSEi) closed the fourth quarter at 6,450.04, down 1.8% year on year from the 6,566.39 in the same period in 2022. On the other hand, the index was up by 2% from 6,321.24 in the July-to-September 2023 period.

In a Viber message, Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines (UnionBank), said that despite the “challenging environment,” PSEi rebounded from its lowest close last year at 5,961.99 last Oct. 27 as inflation eased further and the US Federal Reserve (US Fed) hinted at policy rate cuts this year.

However, other analysts said headwinds such as the breakout of the Israel–Hamas war in October last year contributed to the slower year-on-year growth.

“At a local level, investors continued to monitor and sat on the side watching over the rates for better investment opportunities given interest rate fluctuations, indicating risk for investors,” Mr. Asuncion added.

“Prospects for lower inflation rates and interest rates in many countries around the world made investors cautious to enter the market for fixed-income securities and more eager to explore the equities market,” Cid L. Terosa, senior economist at University of Asia and the Pacific (UA&P), said in an e-mail.

“The higher-than-average interest and inflation rates, however, continue to make the fixed-income securities market more attractive than the equities market,” he added.

Demand for Treasury bills reached P300.51 billion with only P112.30 billion total offered amount in the fourth quarter. This was lower than the P220.6 billion seen in the same quarter in 2022, and the P654.9 billion in the third quarter.

The oversubscription amount of P188.22 billion was lower than P384.8 billion in the third quarter.

Similarly, Treasury bonds eased to P461.69 billion from P642.2 billion in the previous quarter. This was higher than the aggregate offered amount of P210 billion in the last three months of last year.

At the secondary bond market, domestic yield went up by 97.5 basis points (bps) on average year on year, according to data from the PHP Bloomberg Valuation Service Reference Rates published on the Philippine Dealing System’s website.

On a quarterly basis, yields grew by 93.5 bps.

“There was growing expectation that the Fed could be winding down its tightening stance and eventually shifting to potential easing by [first half of] 2024. This helped drive a bit of a rally for bonds with US treasuries trading below 4% at one point in December. Local bond yields for [10-year papers] similarly also fell below 6%,” Nicholas Antonio T. Mapa, senior economist at ING Bank N.V. Manila, said in an e-mail.

Makoto Tsuchiya, an economist at Oxford Economics, attributed the rise in long term yields from the Bangko Sentral ng Pilipinas’ (BSP) move to hike rates by 25 bps as a preemptive move to control inflation in effect of the Israel–Hamas war.

“Following the start of the war, the rise in risk premium led long term yields to rise in the Philippines. In addition, flight to safe assets led to a broad-based appreciation of the US dollar, which exerted downward pressures on the peso,” Mr. Tsuchiya said in an e-mail.

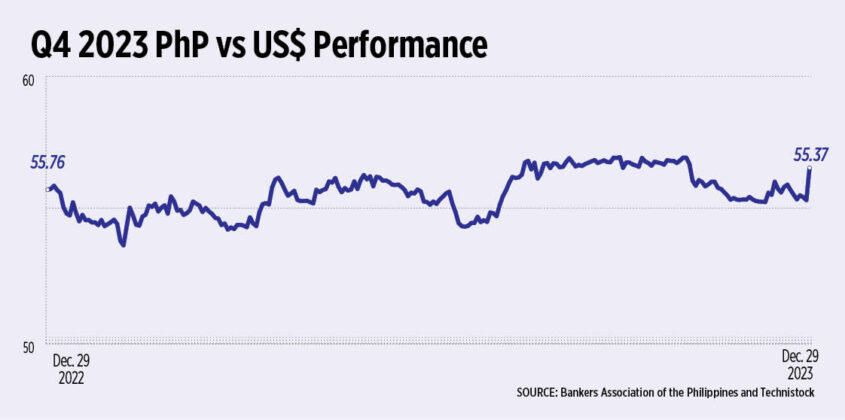

The peso kept at the P55 range as it closed at P55.370 against the dollar on the last trading day of December, according to the Bankers’ Association of the Philippines. This was stronger than the P55.755 finish on Dec. 29, 2022.

The BSP said in an e-mail that in the last quarter of 2023, the exchange rate was broadly manipulated by the uncertain monetary policy direction of the US Fed amid easing inflation rates.

“Despite the volatility in the peso-dollar rate, the peso closed the year stronger than the US [dollar] and became one of the better performing currencies in Asia and the ASEAN region,” Mr. Terosa said.

While the geopolitical tensions did not have a direct effect on the country’s financial market, analysts said that the market remained uneasy and cautious amid supply disruptions and price concerns arising from the Israel–Hamas war.

The central bank said that the heightened conflict in the Middle East moved the financial markets as outlook on international oil prices remain uncertain.

“With the volatility of the oil market, as a third world country who heavily relies on international market movements, spillovers are guaranteed to be felt. As a result, investor confidence was subdued toward the end of 2023,” Mr. Asuncion said.

The US Federal Open Market Committee (FOMC) retained their interest rates at the 5.25% to 5.5% range for the fourth straight meeting last January on a wait-and-see stance tracking inflation movements before cutting rates.

Similarly, the BSP kept its benchmark interest rate steady at 6.5% for the fourth consecutive meeting last Feb. 15 to keep watch on the US Fed’s move despite easing inflation.

Since May 2022, the BSP raised a total of 450 bps.

On the other hand, inflation eased further to 2.8% as of January this year, lowest in three years or since the 2.3% print in October 2020 during the height of the pandemic.

This was also an improvement from the 8.7%-high inflation recorded in January last year.

While analysts think the BSP’s move last year to hike interest rates by another 25 bps was “overstated” with inflation slowing, they said that they expect local interest rates to remain high until the US Fed makes a move to cut their policy rates.

INDICATORS TO WATCH OUT FOR

Analysts are pegging the central bank to continue to rein in policy rate cuts as long as the US Fed remains cautious. However, they are expecting policy rate cuts as early as mid-2024 should the US Fed strike a move to also cut rates.

UnionBank’s Mr. Asuncion said that any move by the BSP before the US Fed could add pressure to the peso-dollar rally.

“With a March cut out of the question for the US Fed, we may see a sliver of likelihood in June. Thus, a cut by the BSP may come in August, the only meeting of the Monetary Board in the [third quarter of 2024]. Inflation will continue to be front and center and how it is trending,” he added.

“We believe that the target RRP (reverse repurchase) rate of 6.5% is likely the peak and our baseline view for now is still 50 bps cut in 2024. We believe that inflation will re-accelerate anew before sustainably settling within the BSP’s 2-4% target in [fourth quarter 2024],” Alvin Joseph A. Arogo, economist at Philippine National Bank (PNB), said in an e-mail.

The central bank assured that they remain “forward-looking” when it comes to its monetary policy, keeping track of recent inflation data, their forecasts, and noting risks that could arise surrounding their forecasts.

“While our latest inflation forecasts are lower as risks to inflation have receded amid improved conditions, the BSP considers it appropriate to keep the BSP’s monetary policy settings unchanged in the near term as risks are still mostly skewed to the upside,” the central bank said.

“In view of lingering risks, the Monetary Board deems it necessary to keep monetary policy settings unchanged in the near term. Along with a sustained decline in headline and underlying/core inflation, we also want to see inflation expectations settling well within our inflation target range,” the central bank added.

Analysts are tracking several headwinds that could push the central bank to delay rate cuts until the last quarter of this year.

“We think the major risk remains in inflation, where risks are tilted to the upside. Continued weather-related disturbances, geopolitical tensions and possible related rise in commodity price and shipping rates, and possible minimum wage hikes could all lead to a reacceleration in inflation,” Mr. Tsuchiya said.

In addition to inflation, UA&P’s Mr. Terosa said to look out for the same external pressures felt back in 2022 with the Russia–Ukraine war to the breakout of the Israel–Hamas war last year.

“The possibility of tremendous wage increases this year as recommended by legislators can help pull up inflation beyond the range set by the BSP,” he added.

PNB’s Mr. Arogo said that should conditions improve in the coming months, rate cuts may happen earlier, and a reduction in the RRP rate and above 50-bps cut is possible.

“The Fed also has opened the door for a total 75 bps cut this year and investors believe that it should be more,” he added.

“The BSP has maintained a 100-bps interest rate differential from the Fed rates, and we think this will continue,” Mr. Asuncion said.

“The pursuit of price stability remains the BSP’s primary objective, and we remain committed to keeping inflation within the government’s target range while also ensuring inflation expectations remain anchored. That being said, the BSP continues to monitor current developments and the risks to inflation and remains ready to adjust monetary settings as necessary,” the BSP said.

FOREIGN EXCHANGE (FX) MARKET

BSP: Uncertainty over the path of US monetary policy amid potential upside risks to inflation as well as lingering geopolitical concerns are likely to remain key factors in regional currency movements in the near term. Nevertheless, the country’s improving current account outlook amid the expected increased growth in services exports and the business process outsourcing sector will provide support to the peso. Structural FX flows from overseas Filipino remittances, foreign direct investment inflows as well as recent recovery in travel receipts will likewise influence the domestic currency. The substantial gross international reserves also provide a level of comfort in the peso amid the current challenging global environment.

Mr. Arogo: We believe financial markets will remain volatile due to the possibility of inflation re-acceleration in [second quarter 2024] to [third quarter 2024]. Nevertheless, average inflation in 2024 and 2025 should generally be better. This is because we assume that supply shocks will not be as severe compared to 2022 (Russia-Ukraine war) and 2023 (State of Calamity from November 2022 to April 2023 due to Typhoon Paeng). As such, the USD/PHP trade at a range of P54.5-P57.5.

Mr. Asuncion: We expect the USD/PHP to rewind back to the P53-P54 trading range by year-end 2024. We trace this bullish year-end PHP outlook to the fundamental arguments of: 1) waning USD due to Fed rate cuts; 2) lower net external outflows—a reflection of a 2024 GDP (gross domestic product) growth below 6% that supports a gradual GIR (gross international reserves) buildup; and 3) a rate differential that would buck pressures to compress amid central bank rate cuts with the BSP on course to cut its policy rate in [fourth quarter 2024] and thus, trail the Fed’s rate easing schedule.

Escalating geopolitical risks that can spawn supply chain bottlenecks and higher logistical costs can throw a monkey wrench at this too-good-to-be-true year-end trajectory of a weaker USD/PHP. But as geopolitical risks and drought conditions dissipate at some point (including safe-haven demand), the fundamental backdrop depicted by a weaker USD and Fed easing rates would re-surface and conclude the unfinished business of a weaker USD/PHP.

Mr. Mapa: Local financial markets will once again take their cue from global developments with the Fed rate cut cycle (once called the pivot) still in question.

Mr. Terosa: The peso can become strong this year if the Fed cuts policy rates and inflation will continue to be tame. In the first quarter, the peso will continue to trade sideways as interest rates in the USA remain elevated and inflation remains within the BSP range.

Mr. Tsuchiya: We expect the peso to depreciate a bit in [the first half of] 2024, before strengthening later in the year. Relatively high prices, particularly given assumed reacceleration in prices in [second quarter] due to base effects, would likely keep investors cautious. But once the Fed and the BSP starts cutting rates and inflation rate declines, it should provide support to the peso.

EQUITIES MARKET

BSP: The robust economic growth outturn for 2023, easing inflation, and the positive growth outlook for 2024 are expected to support investor confidence.

Domestic economic activity is seen to remain intact over the medium term. The projected GDP growth path is supported by improved global GDP growth outlook and a projected decline in global crude oil prices, tempered in part by the lagged impact of the policy interest rate adjustments.

Inflation also eased further to 2.8% in January 2024 from 3.9% in December 2023, and the lowest since October 2020 when inflation was at 2.3 percent.

Various multilateral organizations expect the Philippines to be one of the fastest-growing economies in Asia in 2023 and 2024.

Risks to the macroeconomic outlook include a temporary rise in inflation in April to July 2024 due to possible price pressures from lower domestic supply of rice and corn as well as positive base effects. Downside risks to global economic growth include new commodity price spikes from geopolitical shocks — including continued attacks in the Middle East — and supply disruptions and concerns over the property sector in China.

Mr. Arogo: We believe financial markets will remain volatile due to the possibility of inflation reacceleration in [second quarter 2024] to [third quarter 2024]. Nevertheless, average inflation in 2024 and 2025 should generally be better. This is because we assume that supply shocks will not be as severe compared to 2022 (Russia-Ukraine war) and 2023 (State of Calamity from November 2022 to April 2023 due to Typhoon Paeng). As such, PSEi may reach 7,250 as a baseline (8,150 as bull case).

Mr. Asuncion: Our updated PSEi year-end 2024 forecasts using autoregressive distributed lag models (commonly known as ARDL models) yielded a range of 6,900 to 7,100. ARDL models are often used to analyze dynamic relationships with time series data in a single-equation framework. Using the same set of economic variables used previously (PISM, Inflation, RRP, USD/PHP, and Dow), we updated our PSEi using this top-down forecasting method.

Initially using the assumptions from our latest PSEi ARDL forecasting exercise, we update the assumptions looking at the following: 1) PISM or the local version of the S&P Global Philippines Manufacturing PMI (or simply the PMI) monitored by the BSP was assumed to gradually slowdown (as the PMI noted a December 2023 manufacturing growth slowdown, albeit still above the 50-level that indicates an expansionary environment within the manufacturing sector) that will eventually recover as the US Fed eventually embraces monetary policy rate cuts starting third quarter 2024 with an upside of earlier-than-expected cuts; 2) For the inflation trajectory, we assumed our current view seeing El Niño impacts as upside to CPI food especially in the summer months; 3) Consequently, we adopted our BSP monetary policy rate stance that sees the BSP tracking its US counterpart’s monetary policy movements throughout 2024 with a potential 100 bps cut that starts around November 2024; 4) For USD/PHP, we assumed steady currency movements between P55-P56 and an end-2024 a little over P56 to the USD; and 5) Finally, US Dow Jones is expected with a steady rise in [first half of 2024] until rate cuts in June that may propel the said stock market index between [44,000-45,000].

Mr. Mapa: Local financial markets will once again take their cue from global developments with the Fed rate cut cycle (once called the pivot) remains in question.

Mr. Terosa: Possible policy rate cuts in the second half of the year and lower inflation rates will shift greater activity to the equities market. Global and domestic optimism [regarding] economic growth and the slowing down of inflation this year bode well for investors in the equities market.

Mr. Tsuchiya: We think normalizing economic conditions and policy setting should help equity prices, after four consecutive years of poor performance. But with slower economic growth, the recovery will be very gradual, falling short of the pre-pandemic level even by the end of the year.

FIXED-INCOME MARKET

BSP: Bond yields particularly in the short-term are expected to be influenced by the BSP’s monetary policy signals on the back of easing domestic inflation and continued demand expansion. Risks to the outlook include possible spillovers from international bond markets, particularly from the US’ signal of maintaining higher for longer policy rate than what market expects and, as a consequence, a potential fall in asset prices. Continued conflict in Gaza and Israel, compounded by attacks in the Red Sea, ongoing war in Ukraine, and extreme weather shocks, could also result in another episode of supply shocks that could impact global recovery and hence influence trends in global financial markets.

Mr. Arogo: We believe financial markets will remain volatile due to the possibility of inflation re-acceleration in [second quarter 2024] to [third quarter 2024]. Nevertheless, average inflation in 2024 and 2025 should generally be better. This is because we assume that supply shocks will not be as severe compared to 2022 (Russia-Ukraine war) and 2023 (State of Calamity from November 2022 to April 2023 due to Typhoon Paeng). As such, we believe that benchmark BVAL rates by end-2024 will be lower compared to end-2023 levels.

Mr. Asuncion: Even with BSP’s average inflation for 2023 way off with its target range of 2%-4%, the December inflation went down to 3.9% which marked the lowest point for the whole year in 2023. With disinflation continuing and central banks likely to follow Fed’s preference of not rushing into a premature rate cut, the market play would be caution on long-term duration bonds.

Mr. Mapa: Local financial markets will once again take their cue from global developments with the Fed rate cut cycle (once called the pivot) remains in question.

Mr. Terosa: Fixed-income securities will continue to have a positive outlook as long as interest rates remain elevated in the first quarter.

Mr. Tsuchiya: We expect long term rates to rise over the course of the year, despite subsiding inflation and easing monetary policy. This is due to the widening term spread, which is now at a historic low. As monetary policy and economic conditions normalize, the spread should start to recover, exerting a small upward pressure on the long-term rates. — Bernadette Therese M. Gadon