Why banks should reconsider their lending approach to MSMEs

By Abigail Marie P. Yraola, Researcher

THE COUNTRY’S small enterprises have been the backbone of the economy but their access to credit to grow their business has been challenging.

A total of 1.11 million business enterprises were operating in the Philippines in 2022, Trade department data showed.

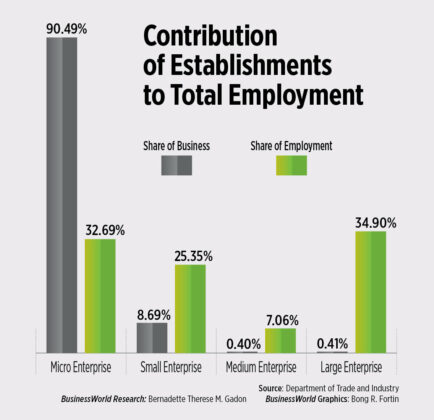

About 99.59% of these were MSMEs while 90.49% were micro enterprises. Additionally, of these establishments, 8.69% were small enterprises while 0.40% were medium enterprises.

Large enterprises, meanwhile, accounted for 0.41% of the businesses operating in the country.

Latest Bangko Sentral ng Pilipinas (BSP) data showed that as of June, banks in the country did not meet the mandatory credit allocation targets for small businesses.

As of June, the country’s banking industry’s loan portfolio reached P9.8 trillion, with loans to micro-, small-, and medium-sized enterprises (MSMEs) accounting for just 4.71% or P461.387 billion.

The compliance rate for micro and small enterprises (MSEs) is still under the mandated 8%, with only 1.93% of the required funds allocated to these businesses.

On the other hand, medium-sized enterprises (MEs) have exceeded the mandated 2% allocation with a compliance rate of 2.78%.

BSP data also showed that the rural and cooperative banks’ compliance rate with MSEs stood at 18.59% while for MEs at 9.32%.

The central bank has stated that they are aware of the importance of financial and digital infrastructure in reducing risks and costs associated with financing for MSMEs.

They also emphasized that they are continuously providing regulations that enable financial support for MSMEs and make it easier for them to access funds. The BSP is working towards bridging the information gap and addressing information asymmetry in the MSME market.

BSP reiterated that they are committed to providing a regulatory environment that addresses financial access barriers such as cost, lack of infrastructure, and information asymmetry, among others.

Karen L. Cua, senior vice-president at BDO Network Bank, said commercial banks struggle to meet the mandatory credit allocation targets for small business principally for two reasons.

They are either undocumented or under-documented so that traditional methods for credit evaluation would be challenged and the owners of these small business have little or no assets against which banks can secure their exposure.

BDO Network Bank, the rural banking arm of BDO Unibank, Inc., has invested in serving MSMEs over the last six years.

For Japhet Louis A. Tantiangco, senior research analyst at Philstocks Financial, Inc., the high interest rates on loans for MSMEs could be due to the high risk associated with lending to this group.

This makes it difficult for many in the MSME sector to afford these loans.

“There may also be capacity constraints wherein many of the MSEs are unable to comply with the loan application requirements of the banks,” Mr. Tantiangco said in an e-mail.

The MSME sector is “highly vital” not only for economic growth, but also for the livelihoods of the majority of the population, Rachelleen A. Rodriguez, head of research at Maybank Investment Banking Group – Philippines, said in an e-mail.

“Growth of the sector would raise per capita wealth and overall standard of living, and for the banking sector, would raise yields and profits,” she added.

For his part, Mr. Tantiangco said that if the productivity of these enterprises increases, it may then provide a significant boost in economic growth.

“MSMEs, especially the micro businesses, may also help in narrowing the income inequality in the country. Microenterprises are usually the path to go of individuals in lower quintile groups if they wish to pursue business,” he added.

These businesses are growth engine for the economy, said Ms. Cua.

In rural areas, MSMEs dominate the business landscape compared with medium to large companies.

Moreover, she explained that banks help MSMEs cover short-term cash flow gaps and fuel their growth and expansion.

THE FRAMEWORK

According to the Magna Carta for MSMEs, banks are required to allocate 10% of their credit portfolio to small businesses — 8% of it should be allotted to micro and small enterprises while 2% of it to medium enterprises.

Republic Act (RA) No. 6977 or the Magna Carta for Small Enterprises promotes, supports, strengthens, and encourages the growth and development of MSMEs in all productive sectors of the economy.

Additionally, RA 6977 sets the minimum percentage of banks’ loan portfolios to be allocated for MSME lending, which makes the process for MSMEs to operate and obtain financial support for their businesses easier.

BDO’s Ms. Cua said that the Magna Carta highlights the role of the private sector in serving MSMEs by participating in government programs for MSMEs.

She also added that the RA 6977 specifies the government assistance that must be made available and the proper government agencies who will be responsible in achieving the set objectives.

In the third quarter, the economy saw the continued rise in inflation rates alongside the rise in interest rates.

In hopes to stabilize and anchor inflation expectations, the BSP resumed hiking its policy rate by 25 basis points to 6.5% in an off-cycle meeting held in late October.

However, in its November meeting, the central bank decided to maintain its interest rate unchanged following the favorable ease in inflation that was seen in October.

Ms. Cua said that given these developments, corporate demand softened while consumer demand sustained loan growth.

“MSME growth is similarly affected as inflation has limited consumption and demand for goods [and] interest rate hike has increased the cost of funding,” she added.

For Ms. Rodriguez, she said that third-quarter market performance is largely impacted by the movement and expectation of hikes on both the Fed and BSP’s policy rates.

“As rates appear to be higher for a longer period of time, banks will benefit from higher margins for a few more quarters,” she said.

She further explained that policy rates, meanwhile, does not impact the MSME sector as interest rate movements for all consumer type loans are driven more by competition, rather than policy rate movements.

HURDLES

Though simply, one could not overlook that MSMEs in the country may have challenges or struggles they may be facing as well.

Ms. Cua noted that some key challenges that MSMEs may experience are limited access to reasonable bank financing, regulatory compliance, and insufficient financial education.

Other reasons are financial difficulties which include inadequate risk management to mitigate the impact of natural disasters, fire outbreaks, personal accidents, and illnesses.

Additionally, many people lack sufficient credit, capital, and savings to cope with short-term cash flow disruptions caused by supply chain shocks, collection delays, or large personal expenses like tuition fees.

For Ms. Rodriguez, rising inflation would still be the biggest hurdle MSME may face as this largely impacts their input costs and may result to reducing their margins.

“High commodity prices would force them to stock up more inventory, raising their need for leverage while their profits are actually shrinking.”

Meanwhile, Mr. Tantiangco believes that the MSME sector currently faces challenges in accessing financing, rising production costs, market competition, and productivity.

EFFORTS IN ACTION?

The central bank should continue its efforts in enabling institutions to better serve MSMEs, BDO’s Ms. Cua said.

The BSP has been actively promoting the digital landscape, with initiatives such as the implementation of the Basic Merchant Account (BMA) allowing MSMEs to accept and make digital payments.

Other initiatives include creating digital footprints for MSMEs which enables banks to do better credit assessments.

Ms. Cua believes that strengthening the credit bureaus will enable more institutions to serve MSMEs more effectively. She further explained that the central bank, along with the government and private sector, can develop and implement more risk-shared programs to reach other underserved segments within MSMEs such as the agricultural sector.

Ms. Rodriguez said that BSP assigns a lower risk weighting for MSME loans compared with other types of loans, which means that banks are incentivized to lend to the sector.

“It’s a win-win situation as banks could improve their yields through MSME lending at a lower capital charge,” she said.

Furthermore, she explained that the risk weight was reduced to 50% during the pandemic but was increased to 75% in 2023, coinciding with the BSP’s lowering of the reserve requirement to 9.5%.

She also said that implementing programs aimed at enhancing financial education would prove to be beneficial.

For his part, Mr. Tantiangco said that the government should increase the capacity of its agencies that provide financial aid to MSMEs and raise awareness about the availability of such aid.

Additionally, he emphasized the importance of helping MSMEs adopt digital means of conducting business, which could significantly improve their efficiency. Given this, the DTI is already executing efforts.

REVAMPING LENDING PRACTICES

What should banks do to rethink their lending practices to small businesses and bring about growth opportunities?

In a 2022 McKinsey and Co. report titled “How banks can reimagine lending to small business and medium-sized enterprises,” modernizing business-lending processes can help banks capture more growth.

McKinsey highlighted that while banks face both opportunities and challenges in the market for lending to small businesses, most of them are not reaching their full potential.

This failure to meet the needs of small businesses makes them miss out on certain opportunities that could be advantageous to them.

“There is no one-size-fits-all approach to suit every bank and market, but banks that rethink their SME-lending businesses can increase their market share and promote profitable growth,” the report said.

Furthermore, the report emphasized that lending to small- and medium-sized enterprises (SMEs) will be crucial for banks’ economic growth and profitability, especially after the economic impact the pandemic has left and scarred.

Despite the opportunities and trends laid out for them, the report also pointed out that banks often struggle to provide appropriate lending solutions to their SME customers and reduce the cost of serving them.

Banks, therefore, need to re-strategize their lending practices to small businesses and create credit offerings that will cater to the specific needs of SMEs. This, in turn, will help them to better serve their customers and increase their revenue growth.

Banks are primarily responsible for developing their business strategies, on the other hand, MSMEs constitute an untapped segment that can actively contribute to the country’s economic growth.

The central bank’s role is to create an enabling environment that will encourage banks to lend to viable and productive sectors and enterprises, including MSMEs.

“BSP has adopted a three-pronged approach to improve access of MSMEs to financing,” BSP said in an e-mail.

This approach includes strengthening credit infrastructure, enabling digital and bankable MSMEs and agriculture enterprises, and promoting innovative financing approaches which are all supported by financial literacy programs.

BDO’s Ms. Cua said that establishing a complete banking relationship is crucial for sustainable and rewarding lending to MSMEs.

She said that rethinking lending for MSMEs requires challenging conventional lending methods.

Ms. Cua also said that business loans are heavily reliant on financial statements, require collateral for security, and involve extensive write-ups and committee discussions for credit approval.

For Mr. Tantiangco, he believes that banks should incorporate more technological means in their dealings with SMEs, especially in their processes.

Additionally, they should rely more on data analytics when assessing SME loan applicants.

However, he also noted that there are no necessary changes needed in banks’ credit offerings for MSMEs. Instead, banks should focus on digitizing their processes and becoming more data analytics dependent in their dealings with these enterprises.

The rise of digitalization has led to a boom in e-commerce, Ms. Rodriguez said.

And as a result, banks are aggressively expanding their digital lending offerings and simplifying the borrowing process for even the non-tech savvy Filipinos.

“Data science and AI (artificial intelligence) can help identify lending opportunities based on borrowing patterns, enabling banks to offer personalized services that cater to clients’ specific funding needs,” she said.

Additionally, there is a huge untapped market in non-urban areas that banks can tap into, she said.

Banks are constantly enhancing their data mining capabilities to identify lending opportunities more effectively.

She also said that offering lending and other financial products to existing depositors is beneficial, as they represent a large pool of potential customers.