Reinforcing tailwinds: Cashing in on PHL hotel sector’s recovery

By Joey Roi Bondoc and Alfonso Martin Aguila

REVENGE spending, dining, and travel continue to lift the country’s tourism sector. The segment is a key job-generating sector and post-pandemic gains should help restore the sector’s contribution to the country’s national economic output.

Undeniably, more needs to be done to improve the sector’s competitiveness and ensure that the Philippines will stand out globally not just with its beaches but also with its quality infrastructure backbone. After all, we won’t be able to attract millions of tourists if we do not have airports capable of welcoming foreign visitors and an efficient road network that will allow local tourists to go around the country.

The return to normalcy has been a positive for the Philippine leisure sector. More face-to-face events across the country should boost the meetings, incentives, conferences, and exhibitions (MICE) segment. Developers are lining up major projects across the archipelago and these include foreign and homegrown brands, as they anticipate demand from business and leisure travelers. The recalibration of the Department of Tourism’s (DoT) strategy, including its branding, should entice more international travelers to visit the Philippines and raise tourism’s contribution to the economy.

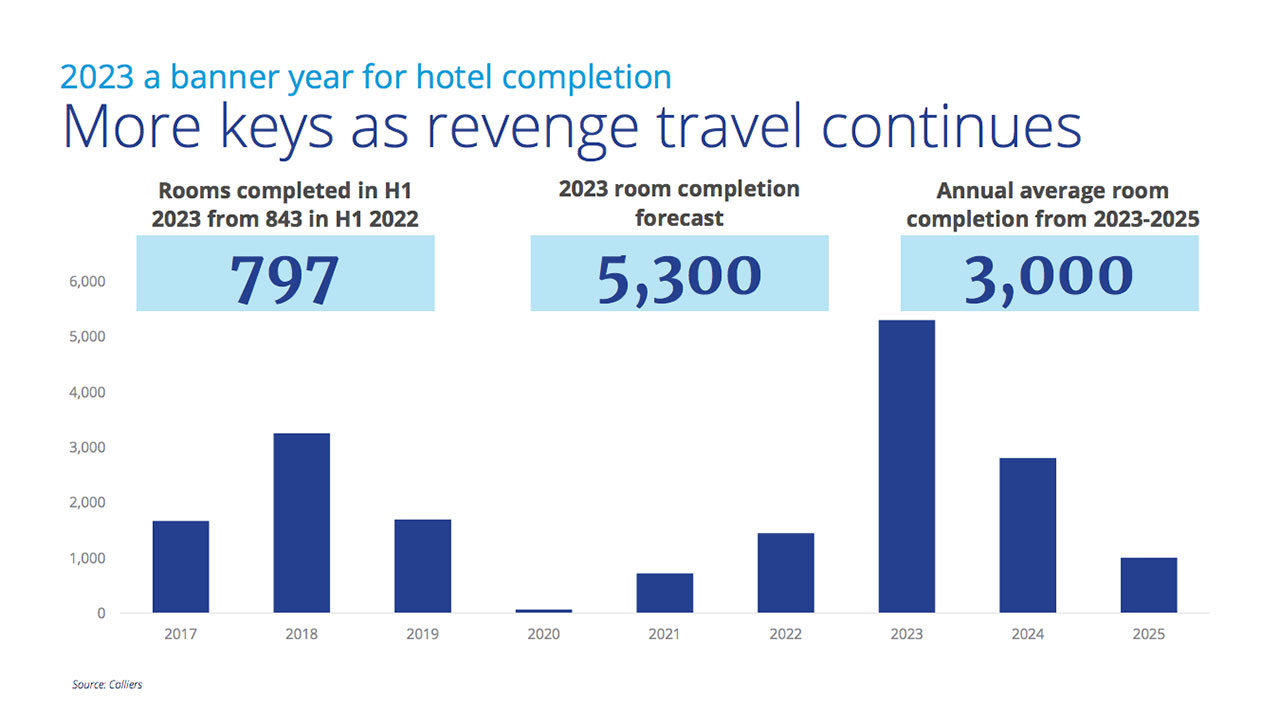

Colliers projects the completion of a record-high 5,300 new hotel rooms in 2023. This is a positive development for the Philippine tourism sector, especially now that the sector is rebounding. With the continued rise in international and domestic tourists as well as return of more in-person events, hotel developers are now lining up expansion plans for the near to medium term. Colliers sees more foreign brands opening while Filipino homegrown brands are also expanding.

Among the new hotels that will be completed include: Lansons Place Manila, Grand Westside Hotel, Red Planet Hotel The Fort, Hotel 101 The Fort and Ibis Styles Hotel. We project that more than a third (35%) of the new hotels that will open for the remainder of the year will be foreign brands. From 2023 to 2025, we estimate the completion of 3,000 new hotel rooms every year.

BREACHING THE DOT’S TARGET

The reinvigorated hotel sector remains one of the most vibrant property segments in the country. Foreign arrivals are likely to breach the Tourism department’s target for 2023 while the domestic market continues to lift occupancies and daily rates.

The return of business travelers and in-person corporate events have also been propping up the demand for MICE facilities.

MORE MICE FACILITIES

People are now more willing to attend face-to-face meetings.

Corporations, business groups, and even families have been holding in-person events, especially after the government relaxed restrictions on face-to-face meetings and dropped mask mandates.

In our view, these should be complemented by global sporting events that the Philippines will be hosting.

Colliers believes that hotel developers and operators should assess the future demand for MICE facilities given the segment’s potential for a strong rebound. This should also be aligned with the government’s thrust of modernizing existing and building new airports across the country.

The Tourism department is also priming the Philippines as a major MICE destination, and this should enable the country to corner major global MICE events and further boost tourist arrivals and spending across the archipelago.

HOMEGROWN, FOREIGN BRANDS

Colliers believes that developers need to strategically plan their expansion, especially now that the sector is gradually recovering. In fulfilling expansion plans, developers should carefully assess whether to launch or expand their own homegrown brands or partner with foreign hotel operators.

Colliers data show that about 42% of new hotels that will open in Metro Manila this year through 2024 are foreign brands. While we see more Metro Manila openings in the pipeline, Colliers believes that there are also opportunities to build more accommodation facilities in key destinations including Pampanga, Cebu, Bohol, Davao, Palawan and Bacolod.

Aside from the traditional growth areas, developers should also build hotels near major convention centers and newly modernized and expanded airports.

HOTEL OCCUPANCY TO REACH 65%

Data from the Philippine Statistics Authority showed that the share of the tourism industry to the country’s economy reached 6.2% in 2022, up from 5.2% in 2021. However, this is lower than the record-high 12.8% share in 2019.

Domestic tourism expenditure grew by 92.3% in 2022 to P1.5 trillion ($26.7 billion) from only P782.6 billion ($14 billion) in 2021. Meanwhile, employment in tourism-related industries rose by 9.3% in 2022 to 5.35 million jobs from 4.9 million in 2021.

In the first half of 2023, average hotel occupancies in Metro Manila reached 61%, higher than the 55% recorded in the second half of 2022. Colliers attributes the increase in occupancy to the continued rise in foreign tourists, return of in-person events and sustained demand from the local staycation market.

By the end of 2023, Colliers projects average occupancy in the capital region to reach 65%, partly driven by holiday spending as well as year-end MICE activities. Metro Manila occupancy is now near pre-coronavirus disease 2019 (COVID-19) level. In 2019, average occupancy peaked at 70%, before plummeting to 20% in 2020 due to COVID-19 disruptions arising from mobility restrictions. Note that the occupancy in 2019 was achieved on the back of record-high foreign visitors, which reached 8.26 million.

MORE REASONS TO LOVE PHL

There’s no doubt that the Philippines has a lot to offer to domestic and foreign travelers. Our beaches are recognized globally and Filipinos are known for their warm and genuine brand of hospitality. But these shouldn’t be trumped by dilapidated airports and unpaved roads.

Our global travel and tourism competitiveness needs to improve if we want to bag a greater slice of the global tourism pie and attract more long-haul and high-spending tourists.

The country is finally recovering from the pandemic, and we see tourism stakeholders — from hotel developers/operators to retailers of souvenir items — benefiting from this rebound.

Joey Roi Bondoc is the research director for Colliers Philippines, while Alfonso Martin Aguila is the senior research analyst for Colliers Philippines.