By Aliyya Sawadjaan

Features Writer, The Philippine STAR

On March 16, President Rodrigo R. Duterte declared a state of calamity throughout the country and imposed the Enhanced Community Quarantine (ECQ) in Luzon after the number of confirmed cases of coronavirus disease 2019 (COVID-19) increased.

Since the declaration, the number has continued to rise while businesses have stalled, disrupting economic activities and affecting the livelihood of Filipinos.

On March 25, the President signed into law the Bayanihan to Heal as One Act (RA 11469), which is valid for three months unless extended by Congress. For the better understanding of the new law, we should dissect each of the provisions to see how this will be enacted by the officials.

Special powers for the President

Under Section 4 of RA 11469, the law grants the President 30 special powers to address the COVID-19 outbreak in the country:

1. Adopt and implement these measures to prevent further spread of the coronavirus, following the World Health Organization (WHO) guidelines;

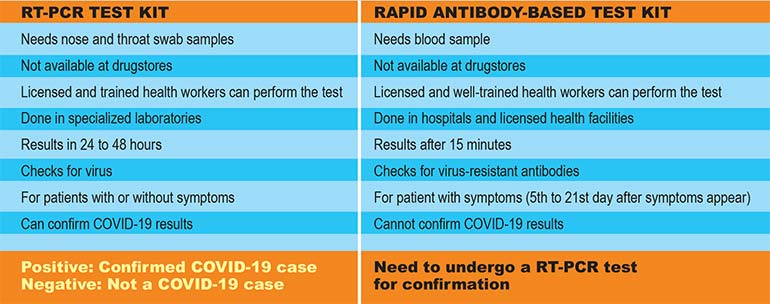

2. Expedite and streamline the accreditation of testing kits and facilitate the testing of PUIs and PUMs by public and private hospitals, as well as the immediate isolation and treatment of patients;

3. Ensure that all local government units (LGUs) are acting according to the regulations and directives issued by the national government while implementing the standards of the community quarantine to their respective locales. The LGUs are still allowed to exercise their autonomy in situations not defined by the national government;

4. The authority to give 18 million low-income families P5,000 to P8,000 a month in emergency cash aid — depending on the prevailing minimum wage in the region— for two months;

5. Give health workers a special risk allowance on top of their regular hazard pay;

6. Direct PhilHealth to shoulder all medical costs of workers exposed to the coronavirus for the duration of the emergency;

7. Mandate that public and private health workers who contract the virus will be given P100,000, and P1 million for the families of health workers who succumbed to the virus while in the line of duty;

8. Take over private medical facilities;

9. Discontinue appropriated programs or activities of agencies of the executive branch — including government-owned and controlled corporations — to save money. The savings will then be allocated for support operations and response measures in the fight against COVID-19;

10. Enforce protective measures against hoarding and profiteering of commodities such as food, fuel, medicine, and medical supplies;

11. Ensure that donation, acceptance, and distribution of health products are not delayed;

12. Secure goods such as protective laboratory and medical equipment, medical supplies, tools, testing kits, facilities and venues, and others in an efficient manner;

13. Partner with the Philippine Red Cross as the primary humanitarian agency;

14. Engage temporary Human Resources for Health (HRH) to complement or supplement the current workforce in hospitals and other facilities;

15. Ensure the availability of credit to the productive sectors of the economy by lowering the lending interest rates and reserve requirements of lending institutions;

16. Ease up grant incentives for the manufacture or importation of much-needed equipment or supplies, including medical equipment and supplies;

17. Ensure the availability of essential goods through measures that will reduce interference to the supply chain;

18. Require businesses to prioritize and accept contracts for services and materials necessary to promote the law;

19. Regulate and limit the operation of land, sea and air transportation, private or public;

20. Regulate traffic on all roads, streets, bridges, et al;

21. Continue to authorize alternative working arrangements for employees and workers in the executive branch, and if necessary, other independent branches of government and the private sector;

22. Regulate the distribution and use of energy, fuel, and water, and ensure sufficient supply of these;

23. Use unutilized funds to fight against the coronavirus. Any unutilized funds shall be considered abandoned during the State of Emergency;

24. Authorize to allocate funds — including unutilized or unreleased subsidiaries held by GOCCs — to address the COVID-19 emergency;

25. Move the deadline and timeline for the submission and filing of documents, taxes, fees, and others while in community quarantine;

26. Direct banks and other financial institutions — including GSIS, SSS and Pag-IBIG Fund — to implement a 30-day grace period for payments of loans and credit card bills;

27. Provide a 30-day grace period on residential rents within the period of the ECQ without incurring interests, penalties, et al;

28. Implement an expanded PantawidPamilya Pilipino Program to include persons working in informal economy (self-employed, construction, etc.) and those who are not recipients of the current PantawidPamilya Pilipino Program;

29. Lift the 30-percent cap on the amount appropriated for the quick response fund; and

30. Undertake other reasonable and necessary measures to carry out the law subject to the constitution.

Reporting to Congress and penalties for violators

Under Sec. 5 of the law, the President is required to submit a weekly report to Congress every Monday. The report will contain updates of actions that have been done, as well as the amount of funds used and for what purpose. For this particular section, the Congress will create a Joint Congressional Oversight Committee — consisting of four members appointed by the senate president and house speaker — to determine if such actions were done within the restrictions of the law.

Sec. 6 of the Bayanihan to Heal as One Act lists down the penalties and violationsof the law, including imprisonment of two months or a fine of P10,000 to P1 million or both.

Violators of these law include LGU officials disobeying national directives; owners of privately-owned hospitals and health facilities who do not comply to the order; those who hoard goods such as medicine, hygiene, and sanitation products and later profit from these at high prices; those who refuse to prioritize and accept contracts for materials and services needed to combat the coronavirus; those who refuse to give the 30-day grace period as per Sec. 4 of the law; groups or individuals who spread fake news and information on COVID-19 or take advantage of the current crisis, causing panic and chaos; those who fail to follow the limitations set for transportation sectors; and those who obstruct roads, streets, and bridges.

The President delivered his first report last March 30, and the following have been done since the effectivity of the Bayanihanto Heal as One Act:

The Department of Foreign Affairs has maintained close links with WHO and foreign governments to ensure timely exchanges of crucial information, as well as processed and assisted in the facilitation of donations from four foreign governments, an international organization, 12 private companies, individuals, and civil society organizations.

The Department of Public Works and Highways Task Force has prepared for the conversions of 110 evacuation centers and is looking at the conversion of public buildings and open spaces to be used as treatment facilities and isolation centers. The agency is also exploring the installation of prototype tents for the same purpose.

The Department of Science and Technology –Philippine Textile Research Institute is overseeing the production of 500,000 reusable, washable, and reusable facial masks as protective face wear, in cooperation with the local government of Taytay and the private sector.

In addition, two of the 30 special powers will be reserved and will only be used when absolutely necessary. These are the powers to take over and direct the operations of privately-owned hospitals, and to require businesses to prioritize contracts for materials and services necessary for the crisis.

For more #COVID19WATCH contents, visit www.bworldonline.com/covid19watch.