Agri dep’t finalizing MAV allocation for pork

THE Department of Agriculture (DA) is finalizing the minimum access volume (MAV) quota for pork imports this month amid pressure from meat importers and traders.

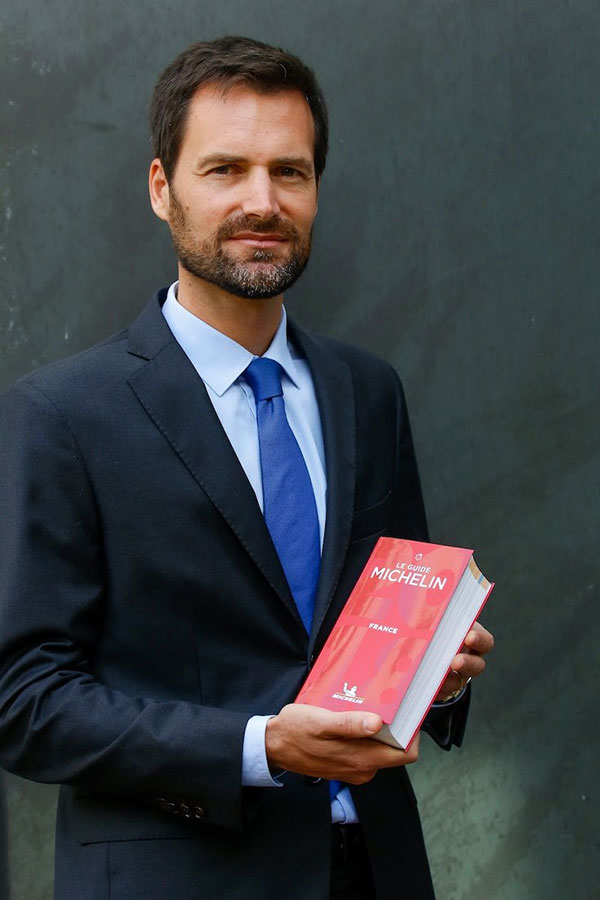

“The general direction for MAV will be 55,000 metric tons (MT), although not yet finalized,” Agriculture Secretary Francisco P. Tiu Laurel, Jr. said on the sidelines of an event in Valenzuela City.

Of the 55,000 MT, Mr. Laurel said 30,000 MT will be allocated for meat processors and 10,000 MT will be “equally distributed” among traders.

The DA will be given an allocation of 15,000 MT to address any potential spike in pork prices.

Under Executive Order No. 50, pork tariffs are at 15% for shipments within the MAV and 25% for those exceeding the quota.

Meat traders have been calling on the DA to issue the MAV allocation for 2025 as soon as possible to avoid supply disruptions. They claimed that the MAV quotas should have been released in the first week of January.

In a Viber message to BusinessWorld, Meat Importers and Traders Association (MITA) President Jess C. Cham said the DA is tweaking the MAV guidelines to favor processors over traders, a move that the group called a “2-class distinction.”

“It is unfair and unjust to licensees who are not processors,” he said.

“They have acquired quota legally and fairly following the MAV guidelines. Other sectors will be deprived of affordable pork and rendered uncompetitive.”

In a letter addressed to Mr. Laurel, the MITA expressed concern that the quotas for the MAV have not been distributed. The group noted that last year, the full pork quota was only released in September.

“We do not think the outcome was good for the consumers or the economy,” it said.

MITA also opposed a proposed amendment to the guidelines that only processors would be eligible to file an application either as a regular licensee or entrant.

Under the amendment, public and private entities may also qualify to secure license for the purpose of participating in the government’s food security programs.

The existing guidelines state there are only “licensees” and new entrants, and the only way to retain and acquire quota is by the licensees’ utilization or performance.

“The reemergence of ‘class distinctions’ is obviously contrary to existing guidelines and very problematic — classifying the licensees only as trader or processor,” MITA said.

“What about the producers and commercial food service providers? What are they entitled to?”

MITA noted that a two-class distinction is “very shallow and superficial.”

“After nearly three decades of MAV, the licensees have developed and established their unique characteristics. They are no longer confined to the four classes of the initial year. We now see the emergence of licensees with meat shops, meat cutting plants, cold storage facilities and logistics, serving across different trade channels and not merely confined to any solitary one,” it added.

MITA said licensees have acquired and retained quota in accordance with the guidelines.

“Hence any reallocation not in accordance with current guidelines is in fact an ‘appropriation’ and that is unfair and unjust,” it said, adding that the move will affect small processors who are unable to import and will render them uncompetitive against the larger establishments that have access to MAV.

“Some meat processors have also engaged in meat trading, while others have established meat trading companies. While MDM (mechanically deboned meat) is the major poultry item, there are ‘processors’ that currently import chicken meat that are used in food service,” MITA said.

“Will these processors be deprived of quota as well? How about rice, corn, sugar, and coffee? Or will this rule apply only to pork, making it a ‘special’ commodity?”

MITA said taking away MAV quotas from all licensees except processors will deprive direct consumers of affordable pork and poultry meat.

“Currently MAV pork and poultry are sold in wet markets, supermarkets, meat shops, restaurants, and canteens. They can easily be sold in the Kadiwa stores too.”

National Federation of Hog Farmers, Inc. (NatFed) Vice-Chairman Alfred Ng said Mr. Laurel’s MAV pronouncement was discussed during a meeting with stakeholders on Tuesday.

“Giving more to the processors is a prudent move because they are directly involved in the manufacturing of our processed meats,” he said in a Viber message.

“Before, more was taken by the traders who enjoyed the much lower tariffs with not much risks unlike processors who have facility and machine investments,” he added.

British Chamber of Commerce of the Philippines Executive Director Chris Nelson welcomed the expected issuance of the MAV allocation.

“But what I would say is we want to see a smooth issuing. We would want that the MAV be issued as before, and that we have supply coming to the country,” he said in a Viber call.

He said the original system has benefited both the United Kingdom and the Philippines.

The Philippines is still the United Kingdom’s second-largest export market for pork.

Pork prices have surged in the country, prompting the DA to consider the imposition of a maximum suggested retail price (MSRP) for the commodity.

The DA has said the reasonable price for pork is P380 per kilo, given that the farmgate price is at P250 plus a profit margin of P100.

Mr. Laurel said the DA is eyeing to buy pork from producers and to sell the commodity directly to retailers to avoid any “layering.”

The government “will be forced to intervene” if pork prices remain high, he noted.

“I am skeptical about DA directly engaging in the sale of pork to lower prices,” Federation of Free Farmers National Director Raul Q. Montemayor said in a Viber message.

He noted DA’s role is to ensure that the market runs smoothly and is not distorted by profiteers and price manipulators.

“They have powers under the Price Act and the Anti-Economic Sabotage Law to run after these criminals,” he said. “If there is excessive layering, why not find a way to reduce these layers without having to buy and sell pork directly?” — K.A.T. Atienza