Central Luzon reopens economy amid COVID-19

Around 80,000 employees have returned to work

By Mariel Alison L. Aguinaldo

Companies across various industries have restarted their operations in Central Luzon amid the COVID-19 (coronavirus disease 2019) pandemic.

“We can no longer stay in this prolonged lockdown because the economy is reeling from the effects not only of COVID-19 but of the lockdown. We have to start easing up slowly but surely,” said Vince Dizon, president and chief executive officer of the Bases Conversion and Development Authority (BCDA), during the Asia CEO Clark Online Forum held on July 16.

As of July 15, there were 766 active cases of COVID-19 in Central Luzon, making it the region with the fourth-highest number of active cases after the National Capital Region (15,947 cases), Central Visayas (7,488 cases), and CALABARZON (2,387 cases), according to data from the Department of Health.

Mr. Dizon reported that around 80,000 employees or 65% of Clark’s total workforce, across industries such as manufacturing, leisure, and business process outsourcing (BPO), have returned to work.

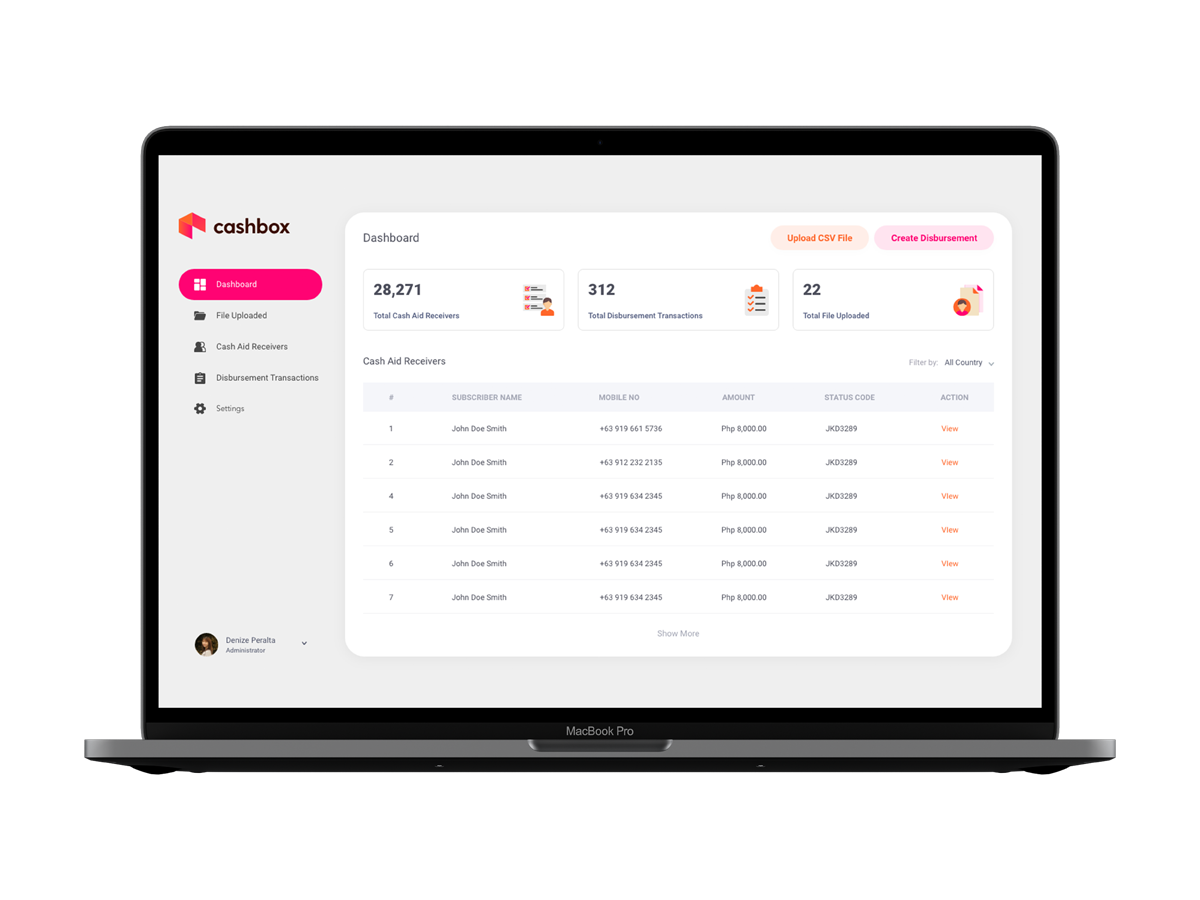

Dennis Magbatoc, industry head of One Luzon at PLDT Enterprise, shared that businesses in Clark Freeport Zone have been utilizing PLDT and Smart’s internet network for online selling and payment transactions. He cited Home2Home, Mekeni Food Corporation’s own delivery service for their products, which was launched in April during the lockdown.

PLDT also partnered with the Department of Education (DepEd), Commission on Higher Education (CHED), and other academic institutions in the region. For instance, ePLDT, the company’s information and communications technology (ICT) arm, is helping students and teachers of Holy Cross Colleges in Pampanga to access school systems and records from home through Microsoft Azure, an enterprise-grade cloud computing platform.

Other experts in the forum said the pandemic has actually floated new opportunities. Cathy Saldana, managing director of architecture firm PDP Architects, discussed how health concerns are influencing design.

“We are seeing new communities now that are being remaster-planned and repurposed to accommodate a way of living that practices social distancing, that allows for people to still interact and yet create a whole new way of living where there is that element of safety, where health and wellness is a priority,” she said.

Mr. Dizon likewise believes in the economic benefits of infrastructure. He shared how construction has resumed at Clark International Airport, in the hopes of re-opening by the end of the year or the beginning of 2021.

“It’s meant not only to create jobs but to create all the necessary multiplier effects that infrastructure provides… Having a new airport makes it easier for tourism to kickstart and makes it easier for businesses to kickstart, knowing that there is a new gateway to the country,” he said.

While the kickstarting of the economy is vital, participants emphasized that this should not make the pandemic any less of a threat or priority. As more people return to on-site work, local government units (LGUs), the private sector, and citizens must be even more vigilant and disciplined in following health and safety protocols, they said.

“That’s what I wanted to talk about: how each and every LGU, each and every company, and most importantly, each and every individual, needs to pitch in to this effort. Because the national government cannot do this alone,” said Mr. Dizon.