Globe-supported KonsultaMD meets medical concerns of both consumers, LGUs

As the coronavirus disease 2019 (COVID-19) disrupted many medical appointments that take place physically, the perks of telehealth have been further realized. Nowadays, these services greatly help not only individuals, but also organizations and communities.

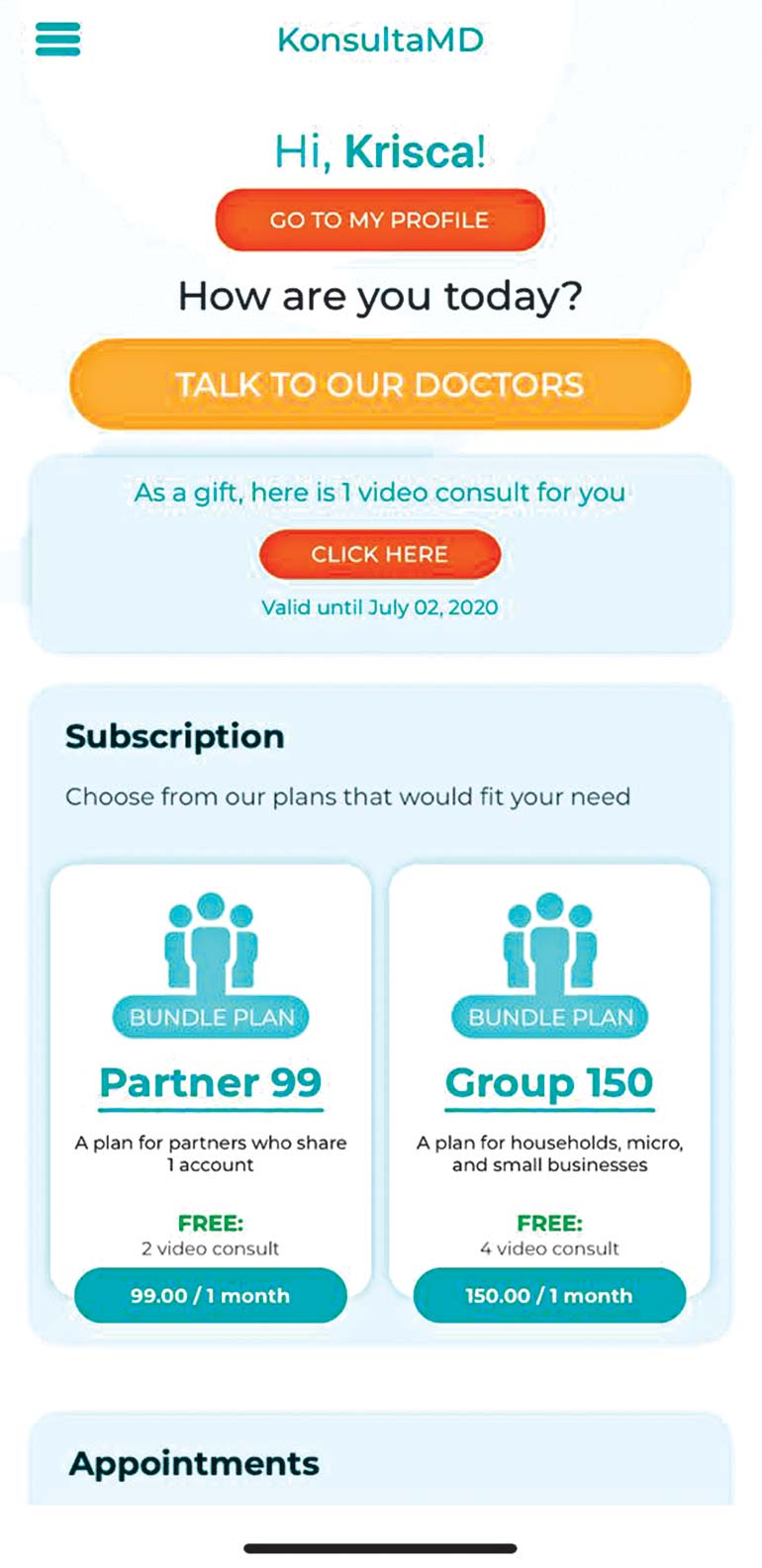

KonsultaMD (KMD), a local subscription-based telehealth service that has been running for around five years, offers a comprehensive set of solutions that not only caters to individual patients, but also to companies and local government units (LGUs).

KMD provides Filipinos access to skilled and licensed Filipino doctors for medical advice, general health information, and proper medication. KMD can also dispense e-prescription, e-laboratory request, and e-medical certificate for its users. Aside from these basic services, KMD offers mental health services as well.

KonsultaMD can be accessed via its mobile app, its website, or even through a hotline. These various channels, coupled with the service’s availability anytime, enable KonsultaMD to attend to medical concerns fast.

“We’re the only telehealth service that provides immediate access to Doctors. No appointment needed. Call the KMD hotline and it’s the doctor that answers you immediately. And you can call anytime. 24/7,” Cholo Tagaysay, Chief Operating Officer of KonsultaMD, shared during an online forum organized by Liveable Cities Philippines and the League of Cities of the Philippines, in partnership with Globe Telecom and KonsultaMD.

While telehealth should not replace face-to-face doctor appointments, Tagaysay added it is the next best thing amidst the situation; and that is where most Filipinos find themselves at present.

Aside from providing service fast, KonsultaMD is affordable. P1,000 is the average for a doctor’s consultation fee, yet with KMD one can consult a doctor for as low as P15, which can cover unlimited access to the doctor for a week.

Aside from providing service fast, KonsultaMD is affordable. P1,000 is the average for a doctor’s consultation fee, yet with KMD one can consult a doctor for as low as P15, which can cover unlimited access to the doctor for a week.

While telehealth, in its essence, provides no option for cash payments and instead offers credit card or online banking payment, Konsulta MD enables users to pay using their mobile phone load.

In addition, KonsultaMD has full-time doctors that are deployed around the clock (7 a.m.-3 p.m., 3 p.m.-11 p.m., and 11 p.m.-7 a.m.). KonsultaMD is operated by Global Telehealth, Inc., a joint venture of 917Ventures, a wholly-owned subsidiary of Globe Telecom, and Mexico’s Salud Interactiva. For Tagaysay, its link with Globe highly empowers the service’s capability to meet the telehealth needs of various clients.

Empowering communities with telehealth

Beyond serving consumers, KonsultaMD also partners with companies, the national government, and LGUs, the COO added.

Over its five years, many companies — among them leaders in insurance, banking, retail & convenience, and realty industries — have entrusted their healthcare with KonsultaMD.

“KMD is provided as an additional layer to their HMO. This is particularly relevant because most employees are working from home. So, telehealth is really the most relevant benefit an employee can receive,” Tagaysay said.

KonsultaMD has also been working closely with government agencies, the COO added. With its partnership with the Department of Health, the telehealth service provided free consultation with the department’s volunteer-doctors on the platform. It also partnered with Overseas Workers Welfare Administration, providing free consultation to quarantined Overseas Filipino Workers.

Moreover, KonsultaMD is also helping LGUs improve their healthcare services by providing telemedicine options for constituents, augmenting health centers, and enabling appointments with local doctors in local hospitals.

KonsultaMD is helpful in areas where there is a lack of smartphones and internet connection. As shared by Tagaysay in the online forum, which was attended by numerous city and municipal officials, Konsulta MD provided certain areas in the province of Sorsogon access to ‘virtual doctors’.

Powered by Globe’s duo-enabled handset, plus KonsultaMD’s basic diagnostic equipment, those virtual doctors have filled in those times when there are no local doctors present in health centers.

“It’s a full end-to-end solution that KMD can provide uniquely because we’re part of the Globe family,” KonsultaMD’s COO noted.

Get unlimited access to comprehensive healthcare with KonsultaMD. You can download the KonsultaMD app on Google Play or Apple AppStore, call their hotline at (02) 7798-8000, or visit their website at www.konsulta.md.

For partnerships with KonsultaMD, send an email to info@globaltelehealth.com.ph.

Aside from providing service fast, KonsultaMD is affordable. P1,000 is the average for a doctor’s consultation fee, yet with KMD one can consult a doctor for as low as P15, which can cover unlimited access to the doctor for a week.

Aside from providing service fast, KonsultaMD is affordable. P1,000 is the average for a doctor’s consultation fee, yet with KMD one can consult a doctor for as low as P15, which can cover unlimited access to the doctor for a week.