Find out your risk appetite

As COVID-19 continues to spread and mutate in many parts of the world, some investors have opted to remain on the sidelines for fear of losing the shirt off their backs. Some, however, look at “crisis” and “opportunity” as a pair, much like “risk” and “rewards.” Fear may hold them back from taking on risks, but it is only when they dare that they get to reap the rewards.

Or as some put it, “It’s better to be a lion for a day than a sheep all your life.”

When it comes to investing in the stock market, how do you know if you are a lion or a sheep? How would you know if your “risk appetite” — the amount of risk you are willing to accept to pursue your investment goal — is high or low?

Financial advisers use psychometric tests to assess their clients’ attitudes towards risk and their risk tolerance. This is in addition to profiling their income, expenditure, assets, liabilities, and investment timeframe to work out the clients’ capacity for loss.

There is no golden rule or global standard when it comes to evaluating an investor’s risk tolerance. Still, it is best to know your risk appetite first before you put your hard-earned money on an investment. An accurate assessment of your risk profile is important to determine if the investment you choose matches your investment horizon, financial goals, and willingness to secure investment rewards versus risk.

If you don’t have a financial adviser, you can still find out your risk appetite by answering these five basic questions:

What am I investing for? (Your investment goal)

When do I need the money? (Your timeframe or investment horizon)

Do I understand the investment I am making?

How much am I willing to invest to achieve my goal?

Do I want to be an active or passive investor?

Active vs Passive Investing

To answer Question No. 5, you need to know the difference between active and passive investing.

Active investing demands a hands-on approach to making buy-sell decisions on your stock investment. You may need to tap a professional portfolio manager who knows how to beat the stock market’s average returns, take full advantage of short-term price fluctuations, and seize the opportunity in information flows. You will benefit from their in-depth analysis and expertise in knowing exactly the right time to buy or sell.

Passive investing, on the other hand, means investing for the long haul. You only have to adopt two strategies: to buy or to hold. You resist every temptation to react to or anticipate every move or development in the stock. Some passive investors buy an index fund that tracks the movement of major indices or mutual funds (more on this in our next issue). Compared with actively managed funds, investing in index funds is more cost-effective as it entails lower expenses and fees.

For the Lionhearted

Choosing to be an aggressive investor means you are willing to risk more money for the possibility of better returns. This makes sense only if you have the luxury of time or have a long investment horizon. But if you need the money very soon, take caution. As you move closer to your investment goal, you need to adjust your strategy to protect your gains.

If you are an investment newbie, it also helps to build an emergency fund before you start investing. Make sure you have set aside cash for unexpected events such as for medical emergencies or job loss. The last thing you need is being forced to sell your assets in a down market like in this pandemic.

For those with a high-risk appetite, First Metro Asset Management (FAMI) recommends its balanced fund and equity-laced funds. “These funds provide returns that beat inflation and are ideal for meeting long-term goals such as retirement, funding children’s education, or business capital,” said Sheila Limon, head of Sales at FAMI.

For the Conservative Sheep

For those who opt to stay on the conservative side, there is no harm in starting out as a sheep. But if you have many years ahead of your investment goal, you may want to overcome your fear and be a little bit more aggressive. Being too conservative can be damaging if it prevents you from growing your portfolio fast enough to beat inflation over time.

If you have more cash to spare than what you need for emergency or daily use, you may want to invest more to make your money work harder for you. Focus on your long-term goal and ride out the short-term peaks and troughs in the market.

For those with low-risk appetites, Ms. Limon recommended money market, fixed income, and dollar bond funds. “These provide prudent price appreciation without the high volatility of the stock market. They are also perfect for goals that are in the short- to medium-term as they give investors returns that is potentially higher than the usual time deposits, government bonds, and even corporate papers,” she explained.

From Sheep to Lion

While conservativism has its merits, you cannot become rich by staying meek as a sheep forever. Investors with a low-risk appetite can still improve their risk appetite.

One way is to determine where your financial goals are in your time horizon. One or two years of a down market would not matter if your financial goal is still 20 years down the road. Long-term goals (10 years or more) can be funded with equity-laced investments that beat inflation and significantly increase in value over time. These investments also require less money to fund these goals, as they provide more returns for the long term. This means you will have more resources available to meet other needs and financial goals.

Take courage to step outside of your comfort zone. Educate yourself and read up on investing before you move forward. Then start by making a small investment in a riskier asset, then grow it slowly over time. You will learn how to do things as you go. Every small win will boost your confidence and every loss will teach you important lessons that will help you get it right the next time. Either way, you build the confidence that comes with experience.

If you want to undergo training, take advantage of the many options available in the market. First Metro Securities (FirstMetroSec) offers free online seminars, as well as resources on YouTube and Spotify. Its podcast, Philippine Stock Market Weekly, is one of the most popular Filipino business podcasts on Spotify and serves as a go-to source for timely economic and market insights.

All these mean that a conservative investor can still invest in riskier investments if they are clear with their financial goals and investment horizon. History, after all, has shown that the stock market always rises.

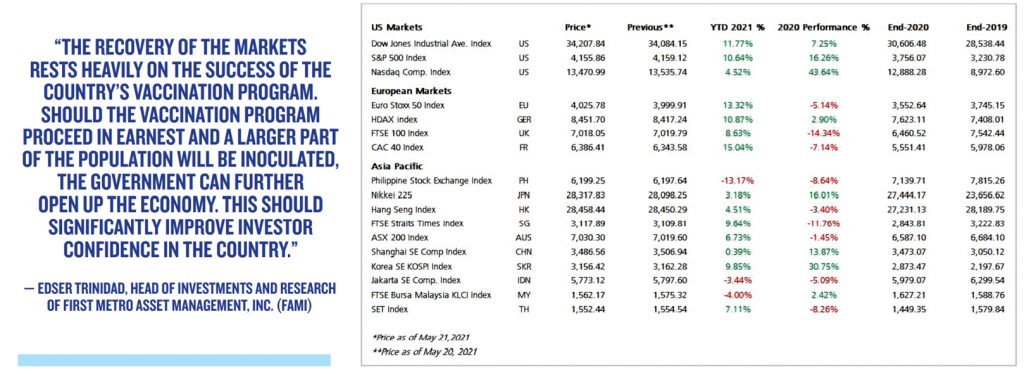

“Current stock market levels are even much higher than before the 2008 Global Financial Crises. These would be the best time to buy as prices are cheaper,” said Mark Angeles, head of Research of FirstMetroSec.