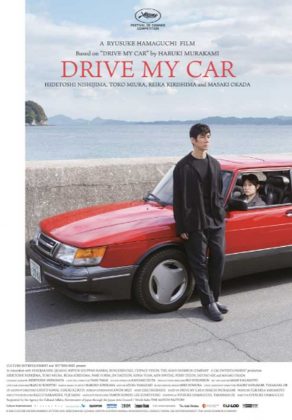

CANNES — Japanese director Ryusuke Hamaguchi unveiled his awards contender at the Cannes Film Festival on Sunday, a tale of heartbreak and regrets which emerges in almost road movie-style over the course of several car journeys.

Drive My Car was adapted from a short story by Haruki Murakami. Mr. Hamaguchi, who has notched up distinctions on the film circuit including in Berlin, said he was drawn by the potential of the enclosed space enveloping the characters.

“What I found fascinating was how the intimacy is brought into the car through the long conversations between the characters,” Mr. Hamaguchi told Reuters in Cannes shortly before the film’s red carpet premiere.

The Cannes Film Festival, which runs until July 17, is back after its 2020 hiatus due to the coronavirus pandemic.

Drive My Car centers on a theater actor and director played by Hidetoshi Nishijima, who is forced to confront the demons beneath the seemingly perfect surface of his marriage after it is rocked by infidelity and his wife dies. Two years later, and still struggling to overcome his loss, he travels to Hiroshima to produce a multilingual version of Uncle Vanya and is assigned a driver, Misaki (Miura Toko), and the two start conversing about their journeys.

The Japanese film earned early praise from critics, in particular for its lead actors.

CANNES ANIMATED FILM REVIVES ANNE FRANK STORY FOR NEW GENERATION

Featuring Anne Frank’s imaginary friend Kitty as its guiding force, a new animated film presented at the Cannes Film Festival seeks to reconnect one of the defining stories of the World War Two Holocaust against the Jews to the present day — and a new audience.

By Waltz with Bashir creator Ari Folman, Where is Anne Frank goes beyond the narrative of Frank’s diary, written by the teenager when she hid with her family during the Nazi occupation of the Netherlands.

Through Kitty, who leaps out of the pages into contemporary Holland, Folman connects the story to a generation of teens wearing torn jeans and baseball caps, against the backdrop of a refugee crisis in Europe that provokes fresh dilemmas for the characters and viewers.

“I had to invent something new. I couldn’t do the diary as it was,” Folman told Reuters in an interview, adding that it was “important for me to reach a younger audience as I can get … to see what do we take from the Anne Frank story to our lives today.”

The animated film — lavishly drawn in shifting styles, including as Anne and Kitty let their imagination run riot and fight off a Nazi army — was years in the making, and was influenced by current affairs.

The film also uses humour to connect to its audience, highlighting funny passages from Anne’s own diary — like a fart-prone house guest — or modern-day winks, like an appearance by US singer Justin Bieber at the Anne Frank museum.

SEAN PENN EXPLORES FAMILY TIES IN CANNES FILM

Actor Sean Penn said on Sunday he nearly passed up the chance to act opposite his daughter Dylan for the first time in Flag Day, his latest movie which is vying for awards at the Cannes Film Festival — until actor Matt Damon egged him on.

Oscar-winning Mr. Penn plays John Vogel, a real-life wheeler-dealer who lurched from one failed business venture to another, causing heartbreak for daughter Jennifer, who reveres him.

Based on a book by journalist Jennifer Vogel, Mr. Penn told a news conference in Cannes that he had an image of daughter Dylan when reading the script — but took some convincing to step into Jennifer’s father’s shoes, when he was already down to direct.

“The last effort I made to not play it was when I sent the script about a month and a half before shooting started to Matt Damon, who called me, not to say that he could do it, not to say that he can’t do it, but to say that I was a stupid schmuck not to do it,” Mr. Penn said.

Vogel was a notorious petty criminal who ended up involved in counterfeiting, although Flag Day is more interested in how he dupes those he loves and lies to himself.

The Into The Wild director’s latest effort behind the camera has so far earned him mixed reviews, with critics at Screendaily pointing to holes in the way the characters are presented, including Jennifer’s transition from an angst-ridden teenager to a budding journalist.

Most reviewers praised the acting duo at its center, however, including Dylan’s performance, and Sean Penn as the exuberant, fun-loving father who tries to keep up his great illusion as his American dream goes awry. — Reuters