CDO Foodsphere celebrates its 46th year

CDO Foodsphere stands out as one of the enterprises that have been actively helping the country during the COVID-19 pandemic. The company serves as a beacon of hope and an example of how an organization can turn challenges into opportunities and reap the rewards along the way.

CONQUERING CHALLENGES

CDO Foodsphere is not new to challenges. Part of its history is how it has risen from the ashes after its original factory was totally gutted down by fire in 1987. “The fire happened when CDO was still in its fragile stage” shares Jerome Ong, Foodsphere President & CEO, “The little business that our parents built with their hard-earned savings, along with the livelihood of our workers seemed impossible to bring back to life. But they were determined to pick up the pieces, rise from the ashes, and in just two days, the factory started humming again.”

“The wonderful thing about my parents is that they always had a heart for people, more than anything. It was not just about making a profit. If they were daunted with the difficulties of starting up again, the thought of people losing their jobs overshadowed any fear they had. In the same way, they endured all the sacrifices to provide a better future for their own children, they wanted to make sure our employees work and be able to provide a better life to their family.” Jerome said.

SETTING PRIORITIES

The company faced many challenges such as the Taal volcano eruption, the effects of the African Swine Fever (ASF), continuing challenges in raw materials, & the grave continuing impact of the pandemic. To be more efficient, President & CEO Jerome Ong simplified things by identifying key priorities for the company, which were their employees, their customers & business continuity.

CDO Foodsphere knew the importance of timely and accurate information, especially during a crisis. “From the top and across the leadership team, we made sure we all communicated effectively. “During the lockdowns when our mobility and physical presence were hampered, we saw it as an opportunity rather than a hindrance. We used all available technology – virtual meetings, social media channels, and messaging apps – to keep on talking to our people. I addressed the whole organization every week and as often as needed. More than providing means to keep the business going, it was a shining moment for us to show our people to know how much we care for them, and that we got their backs. We told our leaders that this pandemic is a rare opportunity for us to earn the highest level of trust and respect from our people. Let us not waste it. ”

Constant communication led to programs that helped Foodsphere thrive. Crisis management plans were updated, health protocols were established early on and strictly observed, and support was provided by the management to their teams like temporary living quarters, free meals and vitamins, shuttle services, bike loans, and even daily allowances to augment additional expenses.

“All told, the costs were staggering. But we have a mission to serve, to continue making our products available, and we can only do it with driven and committed people who know that they are taken care of.”

Aside from the thousands of employees, who were fondly called “Ka-Republikas” by Foodsphere co-founder and long-time Chairman, the late Jose J. Ong, Jerome credits the stellar business performance to the Leadership team. “Our family is truly blessed to have a very talented & hardworking management team. To begin with, they’re very good, a combination of homegrown talents and professional managers who truly work as a Team. In the midst of the pandemic, they took their game a notch further and really delivered. We are extremely grateful.”

STRONGER PARTNERSHIPS

The company’s business partners have proven to be strong allies to CDO Foodsphere during the past year. They made it possible for the food processing giant to keep its commitment of ensuring ample food supply. The partners also allowed for help to be extended to those who need them.

One of these is the Million Meats Program where one million cans of meatloaf was produced by the company combining the donations of their trade partners and suppliers both here and abroad. It has benefited thousands of families in the past month and helped to make sure that there was food on the family table during meal times.

The CanDO project is a feeding program done with several food communities in social media, who cooked and delivered to front liners, organizations, and families in need in various locations the food donations given to them by CDO Foodsphere. It has served more than 800,000 meals since the pandemic began.

To date, the company continues to extend help and support to communities through Odyssey Foundation, Inc. which serves as its humanitarian arm. OFI has launched projects in solid waste management, community vegetable gardens and soon will be once again kicking off its annual nutrition programs.

REAPING REWARDS

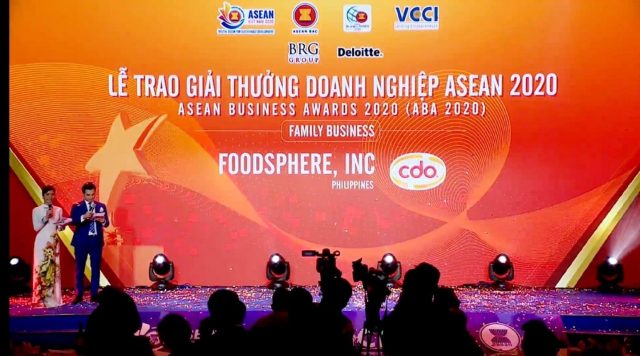

CDO Foodsphere is the recipient of the ASEAN Category award for the Large Family Business Enterprise in the 2020 ASEAN Business Awards which happened in Vietnam in November last year. This recognition affirms the sustainability and strength of the business in the years to come.

They also became the first recipient of the Safety Seal Certification to be awarded by the Department of Labor & Employment (DOLE), and the seal was personally installed by Secretary Silvestre H. Bello III.

Foodsphere is a strong advocate of vaccination. In collaboration with GoNegosyo, the company was part of the first multilateral agreement for the private sector to procure COVID-19 vaccines for its employees. “Aside from continuously practicing the minimum health standards, vaccination is the key in protecting our people and their families, and allow them to soon enjoy their normal lives”, Ong said.

It is a promising future for CDO Foodsphere and brighter days are expected ahead. As they celebrate their 46th year this month, under the leadership of Jerome D. Ong, together with siblings Charmaine & Jason and the guidance of its founder Corazon D. Ong, the company reaffirms its commitment to provide food that brings people home.

Happy 46th anniversary, Foodsphere.