Weak demand to push up rates of T-bills, bonds

RATES OF government securities on offer this week may inch higher after the peso hit the P50-per-dollar level and as demand for safe-haven assets wanes as economic recovery picks up.

The Bureau of the Treasury (BTr) will auction off P15 billion in Treasury bills (T-bills) on Monday, broken down into P5 billion each in 91-, 182- and 364-day debt papers.

On Tuesday, the BTr will offer P35 billion in fresh 20-year Treasury bonds (T-bonds).

Two bond traders interviewed on Friday said they expect T-bill rates to move sideways with a slight upward bias from the yields fetched at last week’s auction.

For the 20-year bonds, the first trader sees its coupon rate ranging from 4.875% to 5.125%, while the second trader gave a higher forecast range of 5% to 5.25%.

“The market has put on a defensive stance this past week due to relatively elevated USD/PHP levels and breaching the P50 psychological handle,” the first trader said.

The peso depreciated to P50.08 against the greenback on Friday from its P49.875 close on Thursday. This was its weakest finish in more than a year or since its P50.19-per-dollar close on June 23, 2020.

Meanwhile, the second trader said demand for government securities has been tapering off recently as investors are starting to shift to other high-yielding assets on signs of economic recovery here and abroad.

The Philippines’ exports and imports of goods continued to grow in May, albeit at a slower pace than April, latest Philippine Statistics Authority data showed.

Exports rose 29.8% year on year to $5.89 billion in May to bounce back from the 27% contraction a year ago, while imports increased by 47.7% to $8.65 billion from the 41% decline in the same month last year. However, analysts noted that the rebound was lower than expected and the surge may have been largely due to base effects.

Local manufacturers also reported improving conditions in June after IHS Markit’s Philippine Manufacturing Purchasing Managers’ Index (PMI) grew to 50.8 last month from 49.9 in May, the first time since March that the index breached the 50 neutral mark that separates contraction from expansion.

The BTr last week made a full award of its offer of P15 billion in T-bills, with total tenders reaching P49.323 billion.

Broken down, the Treasury raised P5 billion as programmed via the 91-day debt papers. The three-month papers fetched an average rate of 1.044%, up from the 1.031% quoted at the June 28 auction.

It also borrowed the planned P5 billion from the 182-day T-bills at an average rate of 1.351%, up from 1.332% previously.

Lastly, the BTr made a full P5-billion award of the 364-day securities it offered, as the average yield inched up to 1.568% from 1.562% seen the week prior.

Meanwhile, the last time the Treasury offered the 20-year tenor was on June 29, when it raised P35 billion as planned via reissued papers which have a remaining life of 11 years and eight months. The offer attracted P65.265 billion in bids.

The reissued bonds fetched an average rate of 4.187%, higher than the 3.635% coupon quoted for the series.

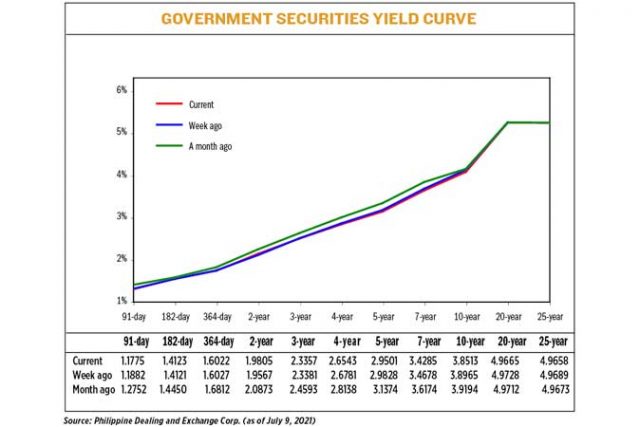

At the secondary market on Friday, the 91-, 182- and 364-day T-bills were quoted at 1.178%, 1.412% and 1.602%, respectively based on the PHL Bloomberg Valuation Reference Rates published on the Philippine Dealing System’s website. Meanwhile, the 20-year note fetched a rate of 4.967%.

The Treasury is looking to raise P235 billion from the local market this month: P60 billion via weekly offers of T-bills and P175 billion from weekly auctions of T-bonds.

The government wants to borrow P3 trillion from domestic and external sources this year to help fund a budget deficit seen to hit 9.3% of gross domestic product. — Beatrice M. Laforga