Uniqlo marks 3rd anniversary with new collection, promo

THE UNIQLO Manila Global Flagship Store is celebrating its third anniversary with the latest 2021 Fall/Winter LifeWear collection, updated store designs, exclusive offers, and local community collaborations. From Oct. 1 to 7, Uniqlo Manila customers can enjoy exclusive limited offers on select LifeWear pieces for men’s, women’s, and children. Additionally, for every P3,000 purchase, they will get a free gift from Uniqlo and its community partners. Available at the store this month are the new LifeWear 2021 Fall/Winter Collection, the UT Collaboration Collection with the manga and animé series Jujutsu Kaisen (featuring exclusive designs from the animé television series, including battle scenes), the Musée du Louvre UT Collection 2021 Autumn/Winter T-shirts with graphics focusing on historical masterpieces such as the Mona Lisa and the Winged Victory of Samothrace, and the Uniqlo x Theory Fall/Winter 2021 Collection of sophisticated everyday wear which expands the boundaries of gender and sensibility. Uniqlo LifeWear is simple, high-quality everyday wear that enhances the lives of all people with a practical sense of beauty and sophisticated design. Installations have been created on each floor to convey the appeal of this concept at a glance. For its third anniversary, Uniqlo Manila collaborated with local artist Manix Abrera to capture the concept of Neighborhood Living in his designs. His special art style allows customers to create their own one-of-a-kind T-shirt using photos, text, and stickers they can choose in-store. Mr. Abrera is best known for Kikomachine, a series of comics that have since been turned into bestselling books. For more updates, visit Uniqlo Philippines’ social media accounts, Facebook (facebook.com/uniqlo.ph), Twitter (twitter.com/uniqloph) and Instagram (instagram.com/uniqlophofficial) and the Uniqlo Philippines’ website at uniqlo.com/ph.

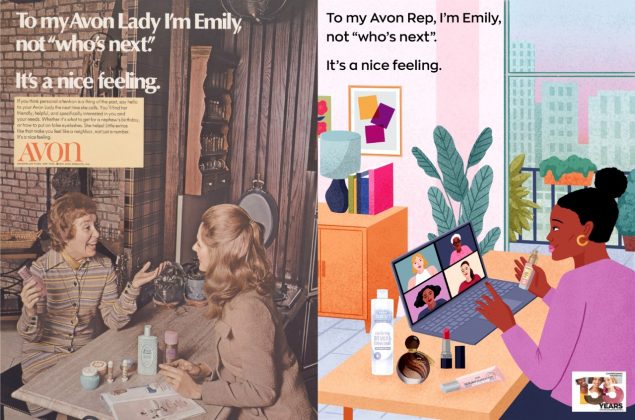

Vintage Avon posters get a 2021 makeover

IN CELEBRATION of its 135 years, direct selling company Avon has collaborated with British illustrator Bett Norris to reimagine a series of its iconic posters, showcasing a variety of people who have embodied and built the company throughout its history. Taking a selection of advertising assets from Avon’s archive, Norris has given the visuals a modern twist, reimaging the people and the products in a contemporary perspective. Throughout the evolution of selling and distribution with a more diverse representation of the market, these posters retain the core values of Avon — creating a better world for women while doing beauty differently. Visit www.avon.ph or like and check out Avon Philippines on Facebook to find out more.

ShopSM’s first October Super Month

SHOPSM is the online shopping platform of the largest retail chain in the Philippines, SM. With its massive selection of brands from every department — men, women, and kids’ fashion, bestselling beauty products, and cosmetics, to home essentials, plus groceries, customers can easily shop in just a few taps. During ShopSM’s first October Super Month, customers can avail themselves of a number of deals. Get an extra 10% on orders when one checks out from 8 to 11:59 p.m. daily on Oct. 8-14. No minimum spend is required and the customer can get a daily discount of up to P2,000 when they use the code SUPERMONTH19 from Oct. 8 to 14, and SUPERMONTHALLDAY from Oct. 15 to 17. There are also freebies thanks to “10 Days of Gifts.” Customers can choose which gift to receive including Viu and iflix premium subscriptions, Grab vouchers, and more from SM Markets. There will be discounts of up to 70% on selected items during the Super Month. Payment options include Cash on Delivery, credit and debit cards, GrabPay, and GCash, and the shopper can earn SMAC points even when shopping online. SMAC members can also get exclusive discounts and vouchers for their ShopSM haul. Visit ShopSM’s official Facebook, Instagram, and TikTok to stay updated and score deals at ShopSM’s October Super Month. The ShopSM app is available on the App Store or Google Play Store.

Gap’s Fall 2021 collection focuses on ‘individuals’

GAP continues to champion modern American optimism by celebrating individuals who represent the positive impact of being their true self. Gap’s Fall 2021 INDIVIDUALS adult platform is fueled by nostalgic fashion, with Gap essentials made iconic in the 1990s, reinvented for today, including new loose, relaxed fits in denim and khakis, hoodies, crisp white and plaid button-downs, and transitional outerwear. Fall 2021’s denims offer jeans that fit and flatter every body. The women’s line reintroduces the Vintage slim, formerly known as the cigarette. Fitted through the hip and thigh with ankle-skimming that hits above or at the ankle, it’s sleek and slim but not as tight as jegging and skinny fits. Also available in High Rise Fit. The men’s line has the Relax Taper Fit with five-pocket styling in stretch denim for extra flexibility and comfort. These denims are part of Gap’s water-saving Washwell program that uses at least 20% less water than conventional wash methods. Fan favorite Fit Tech for Men’s shirts now are loaded with cool details and innovations such as hidden pockets and more. Created with recycled poly and organic cotton, this season’s performance pieces are made with moisture-wicking fabric and dissolvable mesh, making them breathable. As an added extra, pieces are also made of ionic plus fabrication to help fight odor. Men’s Gap Fit is exclusive at gap.com.ph. Meanwhile, VIP customers can enjoy an extra 10% off on top of primary promos. Plus, Welcome and Milestone vouchers can also be used on regular-priced and promo items. Customers get P10 off when they bring their own paper bag when shopping at Gap. For more information on the new collection including teens and children’s clothing, visit www.gapinc.com.

Havaianas launches the Rainbow Walkway

HAVAIANAS Philippines has launched the Rainbow Walkway in Bonifacio High Street. Inspired by Pride March, the Rainbow Walkway aims to serve as a creative alley and safe space for the LGBTQIA+ community and their allies. People strut down the PRIDE Catwalk or chill on the socially distanced Rainbow Benches. There’s a Charging Station for mobile phones or e-bikes, as well as vibrant #AllLoveWelcome String Art. Havaianas Philippines introduced its first-ever Pride Squad earlier this year with the hopes of creating a welcoming environment during the month-long Pride celebration. To further support the community, a percentage of every purchase from the Pride Collection is donated to All Out (a global LGBTQIA+ non-profit organization) and the Metro Manila Pride Organization (a local LGBTQIA+ non-profit organization), non-profit organizations that are focused on empowering the LGBTQIA+ community and defending their rights.

Shopee intros new endorser Kim Chiu, 10.10 Brands Fest

E-COMMERCE platform Shopee introduces its newest brand ambassador, Kim Chiu, alongside the launch of the 10.10 Brands Festival, its biggest brands sale of the year. The actress will feature in Shopee’s new TV commercial and many in-app activities. Among other appearances, Ms. Chiu will be found on in-app games such as Spin & Win and Guess It Right. This October, users can join the #10BrandFaves contest featuring Ms. Chiu for a chance to win 1,000 Shopee coins. There will be behind-the-scenes videos on Shopee’s official YouTube and TikTok channels, and Kim Chiu-themed Instagram stickers. Users can also interact with the actress herself during her Twitter takeover on Shopee’s official Twitter account on Oct. 9. Until Oct. 10, shoppers can enjoy free shipping with no minimum spend, big brand giveaways, and up to ₱1,000 off brand vouchers at Shopee’s 10.10 Brands Festival. Lucky shoppers can win ₱430,000 worth of prizes, such as vouchers, bundles, newly launched items, and even a lifetime supply of products, from over 30 participating brands. Leading up to 10.10, shoppers can also look forward to Nestle, Deerma, GoMO!, Lactum, Colgate Palmolive, Shigetsu, P&G Beauty, Garnier, and Belo Brand Days on Shopee Mall, where they can get discounts up to 80% off, branded items as low as ₱179, and a free gift with every purchase. Shoppers can check out different themed sales on Shopee including the Mom & Baby Fair on Oct. 4, Work From Home Fair on Oct. 5, Gadgets and Gizmo Fair on Oct. 6-7, and Beauty and Wellness Fair on Oct. 8-9. At the 10.10 Brands Festival, shoppers can use ShopeePay to buy load, pay bills, and scan to pay. They can activate their ShopeePay wallet and top up through online banking, debit card, and over-the-counter partners to get up to 50% discount on load from Globe, Smart, Sun, and TNT; 50% cashback from Maynilad, PLDT, and a growing list of partner billers; and ShopeePay ₱1 Deals from Puregold, Ultramega Supermarket, Potato Corner, and other partner merchants. For more information, visit https://shopee.ph/.