5 films tackle current issues on Women’s Month

TO CELEBRATE and commemorate March as Women’s Month, five films that touch on the issues, concerns, challenges, struggles and realities of women will be screened for free each Wednesday. The Museum of Contemporary Art and Design (MCAD) of the De La Salle-College of Saint Benilde has selected several full-length films to explore and highlight the individuality and the solidarity that create nuances and resonances in the different narratives of women. Roma (2018) by Mexican filmmaker Alfonso Cuarón, set in the 1970s Mexico City, introduced Cleo, an indigenous Mixteco live-in housekeeper who worked for a middle-class household with four children. She finds herself trying to support what’s left of the family, all while preparing for her own unexpected motherhood. The drama will be on view on March 2. Rocks (2019), a coming-of-age piece by British filmmaker Sarah Gavron, follows the lively yet heartbreaking journey of a Black British teenager girl who struggles to take care of herself and her younger brother as they are abandoned by their depression-prone mother. It screens on March 9. Body of Truth (2020), directed by Evelyn Schels, studies the influence of violence, oppression and war in art. It profiles contemporary Iranian visual artist Shirin Nesha, Serbian conceptual performance artist Marina Abramović, Israeli sculptor, video and installation artist Sigalit Landau, and German photographer Katharina Sieverding as they explore their histories for art. It is slated on March 16. A Thousand Women (2018), directed by Brazilian screenwriter Rita Toledo, is a documentary focused on female artists Lena Chen (USA), Florencia Duran (Uruguay), Bia Ferreira (Brazil) and Ana Luisa Santos (Brazil) as they transform their experiences into meaningful representations of feminism today. It is scheduled on March 23. The final film is The Flowering of the Crone: Leonora Carrington, Another Reality (2015), directed by American filmmaker, poet, author, and historian Ally Acker. The motion picture covered British-born artist Carrington full oeuvre with rare personal footage from the 1940s through the 21st Century. It contains a fanciful depiction of her famous 1939 short story “The Debutante.” It will be shown on March 30. The film screenings will be conducted via Zoom at noon on the scheduled dates. All shows are free and open to the public. Interested participants may register through https://forms.gle/3AUP8tbMVPFoaPfQ8. For more information, e-mail mcad@benilde.edu.ph.

Isang Harding Papel opens Dokyu Power fest

THE DOKYU Power film festival opens with Isang Harding Papel, A Martial Law Musical by Palanca-awarded writer Augie Rivera. Based on a true story, the film is about a child, Jenny, age seven, and her mother, Chit, an actress imprisoned for staging a street play critical of the dictatorship of President Ferdinand Marcos. Jenny’s visits are peppered with stories she collects and saves to share with her mother. During each visit, her Mom gives her a paper flower she made. Eventually, Jenny’s collection of paper flowers resembles a lush garden. Directed by Nor Domingo, is a filmed version of the musical of the same title, adapted from the Adarna House children’s book illustrated by Rommel Joson. The film and others like The Kingmaker by Lauren Greenfield are streaming for free. The Dokyu Power fest is streaming until April 9. It is organized by DAKILA and its Active Vista Center, and the Filipino Documentary Society or FilDocs, the same group behind the 2020 documentary film festival Daang Dokyu. For updates, log on to Daang Doryu’s Facebook Page, www.facebook.com/DaangDokyu.

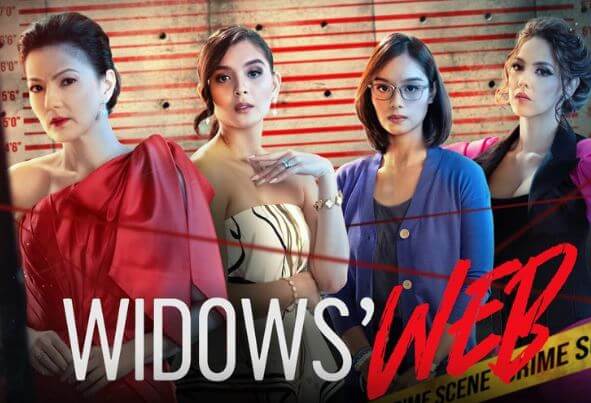

GMA Network’s first horror series Widows’ Web

GMA NETWORK has launched its first horror series, Widows’ Web, which follows four women caught up in a twisted murder case and are entangled in a web of secrets, mysteries, and lies. Directed by Jerry Lopez-Sineneng, it stars Carmina Villarroel, Vaness Del Moral, Ashley Ortega, and Pauline Mendoza. The series also features Ryan Eigenmann as the murder victim. It also introduces Vanessa Pena and Anjay Anson. Widows’ Web airs weeknights after First Lady on GMA Telebabad.

City of Dreams’ Dreamplay reopens

AS METRO Manila eases its quarantine restrictions, DreamPlay, the world’s first DreamWorks-inspired family entertainment center at City of Dreams Manila, reopens its doors at a limited capacity to welcome back families in a fun and safe environment. One of the safest play spaces for children with a fully vaccinated staff at a Safety Seal-certified venue, the interactive play and creativity center once again shares the stories of DreamWorks through an engaging, immersive, and technologically rich experience for families and children. Currently open from Wednesday to Sunday from 11 a.m. to 8 p.m., DreamPlay can entertain about 100 guests, both children and adults, or at 20% total capacity of the venue at a given time. Tickets with access to all the play space’s attractions are available at P1,500, while non-participating tickets can be purchased for P250. Entry will be on a first come, first serve basis. DreamPlay is located at The Shops at the Boulevard, upper ground floor of City of Dreams Manila. For inquiries and reservations, call 8800-8080 or e-mail guestservices@cod-manila.com or visit www.cityofdreamsmanila.com.

Tala Gil releases live sessions EP

SINGER-songwriter Tala Gil has released her new EP, call me when you wake up (Live Session). Drawn from her latest EP of the same name which was released in Nov. 2021, the Live Session release allows listeners to enjoy her songs in a new light. In the EP, she also gives insights into how she worked on each song through earnest voice memos that give details about each track. The EP is available on all streaming platforms under Universal Records Philippines.

Mezzaluna releases new single

FOLLOWING her debut single, “In Situ,” the 20-year-old Indonesian singer-songwriter Mezzaluna offers another peek into her personal life with her signature storytelling style. “I wrote this song based on a personal experience that I went through back in high school,” Mezzaluna said in a statement. The ballad tackles disappointment and hopelessness. “I Beg” marks Mezzaluna’s second collaboration with Indonesian industry veterans, producer Gio Wibowo and creative director Deby Sucha. Wibowo, who had previously worked with her on “In Situ.” “I Beg” is available on all digital streaming platforms.