Mercedes-Benz Cebu kicks off VisMin service caravan today

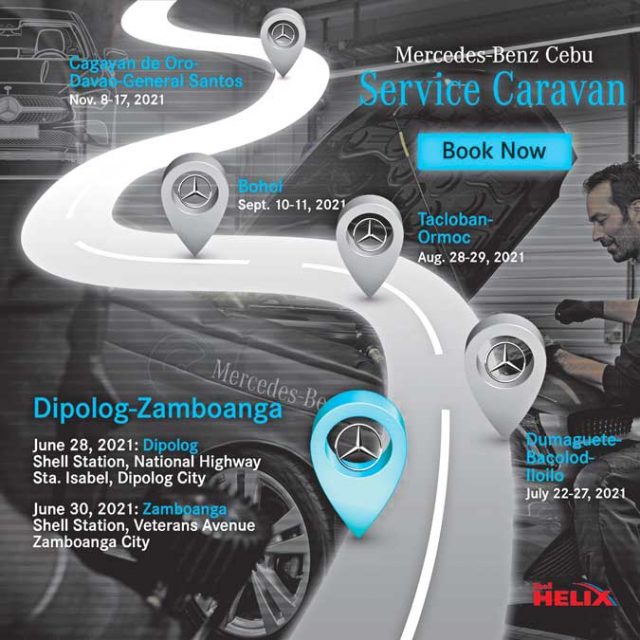

GLOBAL STAR Motors (GSM) Corp., the official dealer of Mercedes-Benz vehicles in Cebu City, begins a service caravan today which will wind its way to select locations in Visayas and Mindanao. It is said to be an exclusive opportunity for all Mercedes-Benz owners in Dumaguete, Bacolod, Iloilo, Bohol, Cagayan De Oro, Davao, General Santos, Dipolog, Zamboanga, Tacloban and Ormoc cities to have their vehicles examined by professionally trained service advisors and technicians.

This follows an initial sales and service caravan in Western Visayas that happened in January, then another in Bohol and some cities of Mindanao in March and May.

The next series of service caravans starts today at the Dipolog Shell Station on the National Highway, Sta. Isabela, Dipolog City.

“We implemented this sales and service caravan as our way to reach our clients in the Visayas and Mindanao regions. We want to come to you as we always aim to deliver the best or nothing, and ensure that our clients continue to rely on us to maintain their Mercedes-Benz vehicles in the best condition,” said Mercedes-Benz Cebu General Manager Kenneth Huan.

Mercedes-Benz Philippines reminded its customers to never compromise on service and parts. “Our service and genuine parts provide safety and comfort to our customers. With the Mercedes-Benz service caravan, our team is here to perform first-rate maintenance to keep our customers’ Mercedes safe to drive and peace of mind when on the road. That’s because safety has a home with Mercedes-Benz service,” it maintained in a release.

To book an appointment and for more details, visit the Mercedes-Benz showroom on Cebu Veterans Drive, Nivel Hills, Cebu City or contact the customer relations department at 0917-703-0620 or service manager at 0917-322-6201. Dates may be changed, depending on the community quarantine guidelines of each municipality.