GOVERNMENT SECURITIES (GS) continued to be sold off last week, pushing yields higher, as investors turned cautious after Russia moved to invade Ukraine.

GS yields, which move opposite to prices, went down by a week-on-week average of 17.82 basis points (bps), according to the PHP Bloomberg Valuation Service Reference Rates as of Feb. 24 published on the Philippine Dealing System’s website

Local financial markets were closed on Friday in commemoration of the People Power Revolution anniversary.

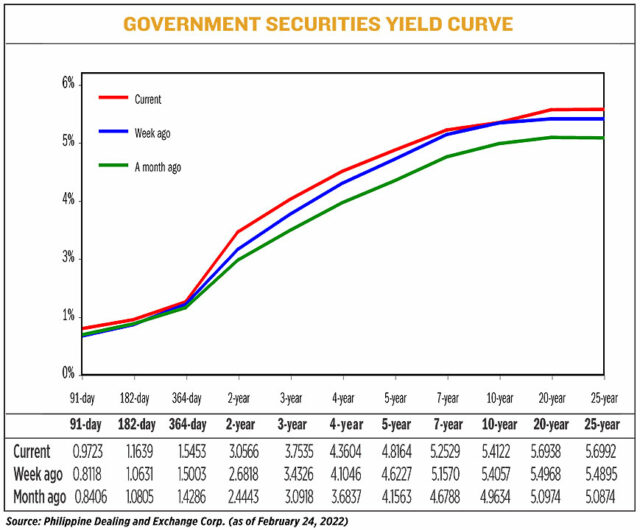

Yields went up across the board at the secondary market on Thursday from their Feb. 18 finish. At the short end of the curve, yields on the 91-, 182-, and 364-day Treasury bills (T-bill) rose by 16.05 bps, 10.08 bps, and 4.5 bps, respectively, to 0.9723%, 1.1639%, and 1.5453%.

The belly of the curve similarly increased as the rates of the two-, three-, four-, five- and seven-year Treasury bonds (T-bonds) climbed by 37.48 bps (to 3.0566%), 32.09 bps (3.7535%), 25.58 bps (4.3604%), 19.37 bps (4.8164%), and 9.59 bps (5.2529%), respectively.

At the long end, yields on the 10-, 20- and 25-year debt rose by 0.65 bp (to 5.4122%), 19.70 bps (5.6938%), and 20.97 bps (5.6992%).

“Traders are looking at how FOMC (Federal Open Market Committee) and US Treasuries (UST) will react to CPI (consumer price index) pressures given the backdrop of risk aversion due to the ongoing invasion in Ukraine,” a bond trader said in a Viber message on Thursday.

The bond trader added that the Bureau of the Treasury’s (BTr) announcement of its March borrowing plan moved the market last week.

“Markets saw a rout as rising global inflation pressures took precedence over local drivers. The market tracked surges in USTs when US inflation printed 7.5%, while news of the five-year RTB (retail Treasury bonds) added on to the selloff when it was announced,” Security Bank Corp. Chief Economist Robert Dan J. Roces said in an e-mail.

Expectations of the US Federal Reserve tightening by next month has been weighing on economies worldwide recently as US inflation rose at its fastest pace in nearly four decades at 7.5% annually in January.

Meanwhile, Russia’s invasion of Ukraine sent stock markets around the world falling on Thursday while prices of commodities such as oil rose, Reuters reported.

The conflict pushed Brent oil past $100 a barrel for the first time since 2014. Russia is the world’ second-largest crude oil producer.

Back home, the BTr announced last Tuesday it plans to borrow P250 billion from the domestic debt market in March, higher than the P200 billion programmed in February.

Broken down, it targets to borrow P75 billion from its weekly T-bill auctions and P175 billion via T-bonds.

The government taps domestic and foreign lenders to help fund its budget deficit capped at 7.7% of the economy this year.

The Treasury raised an initial P120.76 billion from its sale of five-year RTBs at its rate-setting auction on Feb. 15, more than four times the P30-billion issue size. The market flocked the offering as total bids amounted to more than six times the offer at P183.44 billion.

The RTBs, targeted at small investors who want low-risk, higher-yielding savings instruments backed by the government, fetched a coupon rate of 4.875%, higher than the 4.625% set for the same RTB in November last year.

The offer period runs from Feb. 15 to 28 and the bonds will be settled on March 4.

This week, the bond trader expects continued upward pressure on rates especially if the Russia-Ukraine news will help oil prices remain elevated as higher oil prices lead to higher inflation expectations.

“On the domestic end, we have the three-year auction on Tuesday, on top of the ongoing RTB and the February CPI data which will be known on March 4,” the bond trader added.

The Treasury will offer fresh three-year papers worth P35 billion on Tuesday.

Meanwhile, the Philippine Statistics Authority is scheduled to release February inflation data on March 4.

A BusinessWorld poll of 15 economists last week bared a February inflation median estimate of 3.3%. This is higher than 3% print in January but lower than the 4.2% print in February last year. — Lourdes O. Pilar with Reuters

![marestella-torres-2009-11-10-23-10-0-[www.feu.edu.ph]](https://www.bworldonline.com/wp-content/uploads/2022/02/marestella-torres-2009-11-10-23-10-0-www.feu_.edu_.ph_-640x427.jpg)

![palaro4-micaela-jasmine-mojdeh-joey-mendoza_2019-07-23_23-37-19-[philippine-star-Joey-Mendoza]](https://www.bworldonline.com/wp-content/uploads/2022/02/palaro4-micaela-jasmine-mojdeh-joey-mendoza_2019-07-23_23-37-19-philippine-star-Joey-Mendoza-640x427.jpg)