Pretty soon, we will be looking at the COVID pandemic in the rear-view mirror. COVID may still be around, debilitating people and even causing deaths, but it won’t be the unknown and fearsome menace it once was. Not only has mankind developed vaccines and lessened its sting, but also doctors now know how to treat it, with old and new medicines. Down the road, there will be nasal vaccines, omni-variant vaccines, more anti-inflammatories, and antibody treatments, as well as protease inhibitors.

It’s time to have a new worry, and that is inflation. Unlike COVID, which strikes only a certain percentage of people, inflation harms everybody, rich or poor, healthy or unwell, young or old.

How much should we worry? Well, like the pandemic, the menace is global. The US hit a 7.8% inflation rate, the highest in 25 years. Europe, which had been struggling against deflation for years, experienced 5.1% inflation in January. The rise in oil prices on top of supply chain issues compounds the worldwide problem of inflation.

While the Philippine headline inflation rate eased to 3.2% in January, it’s no reason not to worry.

Firstly, the inflation rate is a measure of the rate of increase, but the higher base may already be embedded in the economy. Effective February, the Department of Trade and Industry (DTI) has approved higher SRPs or suggested retail prices for several basic goods, including sardines, bread, processed meat, and bottled water.

Due to higher input costs, the DTI had no choice but to allow manufacturers to raise prices for several SKUs or self-keeping units for essentials like milk, bread, batteries, detergents, and soaps.

With higher oil prices due to limited production imposed by OPEC and a geo-political disruption caused by the war in Ukraine, there’s increasing concern about another spike in domestic inflation.

However, most of the inflation is currently coming from higher food costs, which hurt the poor the most. According to Dr. Bruce Tolentino, an agricultural economist and member of the Monetary Board, food contributes to 47% of inflation. Since the RTL or Rice Tariffication Law, rice has been a net zero contributor to inflation. On the other hand, meat and fish prices have become major drivers of inflation.

SWS surveys reveal that inflation is the number one problem identified by respondents.

However, our fight against inflation is different from that of the US and advanced countries. In the case of the US, the government adopted both hyper-expansionary monetary and fiscal policies at the same time in response to the pandemic. The result has been the US’ highest inflation in 47 years.

In our case, fiscal spending has been disciplined although monetary policy had been loose to counter the recessionary effects of the pandemic. Inflation has been mostly supply-driven. Data shows that meat and fish prices have been the main drivers of inflation in recent periods. Supply has often fallen short of demand. Therefore, in this scenario, a tight monetary stance or higher interest rates may be the wrong prescription and may prolong the damage wrought by the pandemic.

What is causing the supply constraints of meat and fish?

In the case of pork, the African Swine Fever outbreak has decimated hog populations and caused the spike in pork prices. Small hog producers are especially vulnerable to the virus as they don’t have the management and technology to adopt biosecurity protocols.

However, another factor is in play in both chicken and pork prices: the high cost of domestic yellow corn. The Philippines has the highest domestic corn prices in the ASEAN. Since corn is the major ingredient in the feedstock for poultry and hogs, accounting for about 60% of the cost, domestic chicken and pork cost more.

According to Dr. Karlo Adriano, an agricultural economist, Filipinos are paying more than double for pork compared to Thailand and 70% more compared to Vietnam. We are also paying more than double for chicken compared to Thailand and 40% more compared to Vietnam.

The high domestic prices for meat lead to tremendous welfare losses. The biggest negative effect is on children and teenagers, where protein malnutrition is most pronounced. Citing studies by nutrition scientists, Dr. Adriano says that 47% of Filipino teenagers suffer from inadequate protein intake. He says this is probably the reason why Filipino teenagers perform poorly on the PISA (Program for International Student Assessment) test compared to their global peers. Studies show a high correlation between poor performance and meat prices.

We can’t import more corn to alleviate the supply shortage and reduce prices because importation is tightly controlled by the government. Corn imports are subject to quantitative restrictions. Under the MAV (minimum access volume) system, in-quota tariff is set at 35% while out-quota tariff is set at 50%.

Farmer groups oppose more importation because they say they can’t compete with imports. However, the status quo is untenable. Food-caused inflation exacerbates protein malnutrition in children and teenagers and makes the economy uncompetitive. If our workers pay more for food, then naturally their wages will have to be higher than that of their regional peers. Industries, from fast food retailers to food manufacturers, will also suffer from higher cost structures.

The way forward is to adopt the RTL model, i.e., liberalize the importation of corn and impose tariffs where the revenue from the tariffs can be channeled to increasing productivity. Contrary to the zombie scenario peddled by the protectionists, the RTL didn’t result in many farmers going bankrupt. On the other hand, productivity increased, and domestic rice prices stabilized, leading to rice prices being a zero contributor to inflation.

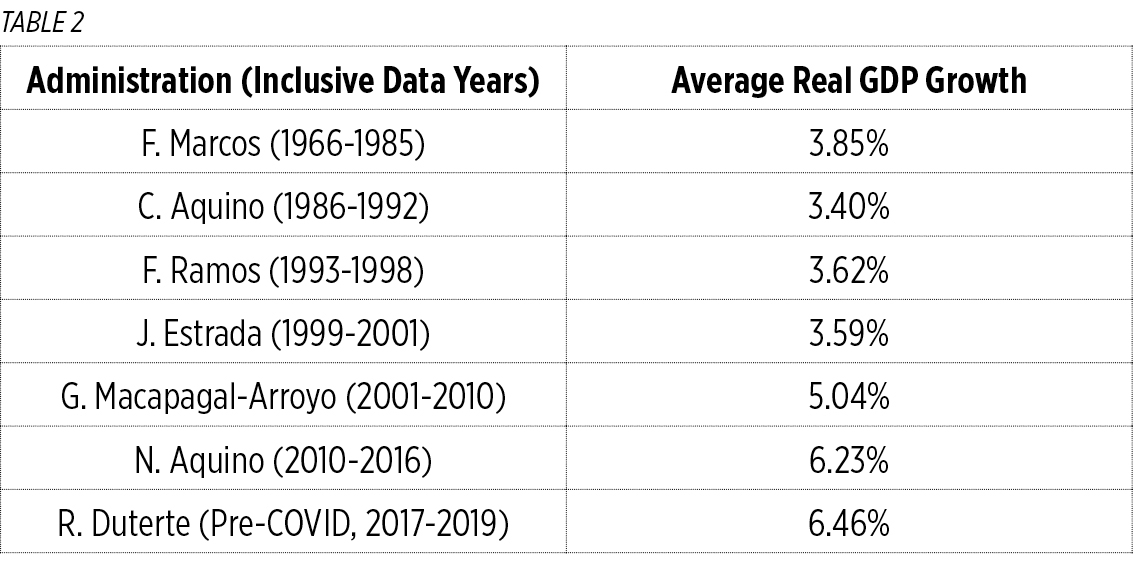

Incidentally, perhaps one reason why President Rodrigo Duterte enjoys high popularity ratings compared to his predecessors, is because of the decisive action he took to dismantle the NFA (National Food Authority) rice import monopoly and thereby stabilized rice prices. Politicians, therefore, should take note: pandering to the protectionist crowd is not being politically smart.

Being politically smart is lowering the prices of food, which the country can do if it just liberalizes corn importation and reduces the tariff to 5%. (Vietnam’s corn tariff is 4%.) Dr. Adriano calculates that if the price of corn were like that of Thailand, pork prices would fall by 15% and chicken prices by 36%. I can’t think of a political winner more than that of reducing the price of food.

The country, being a net importer of oil, can’t do anything about the surging high oil prices. Instead of reducing oil taxes, which will widen our fiscal deficit and do great damage to the economy, the government can offset the sting of high oil prices by lowering the price of food. It has the power to do so by liberalizing corn importation.

What will happen to our corn farmers then? Instead of coddling them, the government must prepare them to compete as it has with the Rice Tariffication Law. But throwing money at the problem isn’t going to solve the issue because the biggest structural problem is still land fragmentation.

We must deal with this reality: the average farm size is one hectare. The average age of farmers is 54. The average educational level is Grade 5. Most of them can’t make enough from their farms and therefore must do off-farm work. In other words, they are just part-time farmers. Unless the structure of our agricultural sector is changed, food productivity and security will not be attainable. We must change the structure toward bigger, more modern commercial farms operated by professional managers or family members.

What should be the safety net for displaced farmers? The only sustainable safety net for unproductive farmers is to move them to paid farm or food processing work in bigger, more productive farms or agro-industrial estates. They can then receive fair, stable wages with social security benefits. They will be better off than if they were earning an average gross income of P24,000 a year with all the risks, from weather-related events to pest infestation, that comes from being a small farmer.

What is clear is that the status quo is unsustainable. The high food costs act as a drag to growth, impose generational welfare losses, and are probably seeding the persistent insurgency. We should start worrying more about food inflation now than we do about COVID. Inflation is the new pandemic.

Calixto V. Chikiamco is a member of the board of IDEA (Institute for Development and Econometric Analysis).

totivchiki@yahoo.com