DITO Telecommunity Corp. saw its stock price go down on a week-on-week basis as negative market sentiment due to the persisting coronavirus pandemic offset any positive development from the telecommunications firm.

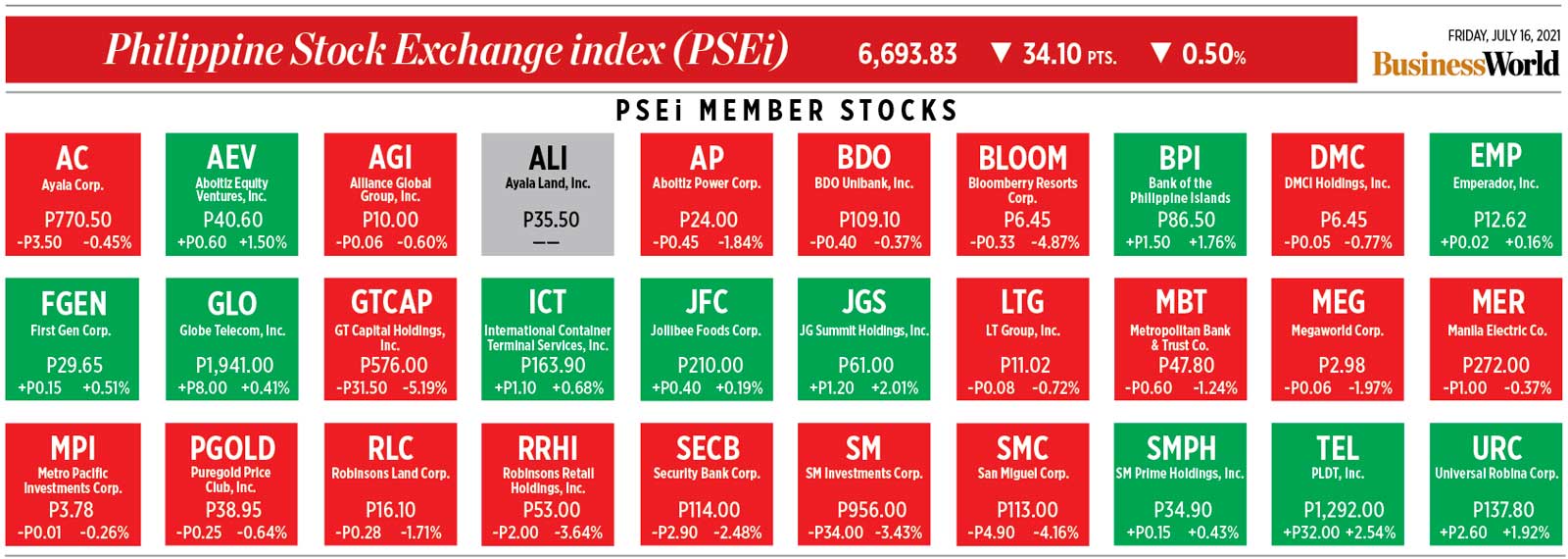

DITO’s stock price settled at P8.21 per share to end the trading week last Friday, down 7.3% from its stock price of P8.86 per share last July 9, Philippine Stock Exchange (PSE) data showed.

For the year, the company’s share price has gone down by 36.9%.

“[DITO] was mainly dragged down by the cautious sentiment on the overall market,” AAA Southeast Equities, Inc. Research Head Christopher John J. Mangun said in an e-mail.

Mr. Mangun said the news on the company’s expansion “was already factored into the price.” He also noted the company’s strategy on building its infrastructure in the provinces where there is not much demand for mobile data services, but said its transition to compete with incumbent telco players in Metro Manila and other major cities “will determine its long-term success.”

Mercantile Securities Corp. Analyst Jeff Radley C. See shared the same assessment on DITO building up market share, but nevertheless described the stock’s price movement last week as bearish.

“Volume traded grew but price is going down. It entails market sentiment,” Mr. See said in a Viber message.

A total of 33.80 million shares worth P290.47 million exchanged hands between July 12 and 16. The stock’s value and volume turnover figures last week were higher by 18.1% and 23.2% compared with those the week prior.

In a statement last week, the telecommunications firm announced its mobile services are now available “starting July 15” in 18 more areas, bringing the number to 158 cities and municipalities nationwide. DITO is targeting to complete 4,500 cell towers by December as part of its nationwide expansion. It has built over 3,000 towers as of July 1.

On the other hand, the same week saw the Philippine government announced a travel ban on Indonesia from July 16 to 31 after the latter overtook India in daily infections.

Meanwhile, the Philippines has extended its travel ban on India and six other countries, where a coronavirus variant has caused a surge in infections, until July 30. Also covered by the ban that was supposed to end on July 15 was Pakistan, Sri Lanka, Bangladesh, Nepal, Oman and the United Arab Emirates.

Last Friday, the Health department reported 16 new coronavirus cases of the more transmissible Delta variant. Of these, 11 were detected in Mindanao, Metro Manila, Central Luzon, and the Visayas while the remaining five are in Filipinos who returned from Qatar, the United Arab Emirates, and the United Kingdom.

Last Thursday, the presidential palace announced Manila and nearby cities would remain under a general lockdown until July 31 after some cities in the capital region experienced a spike in coronavirus infections. Other areas saw their respective quarantine levels extended during the same period.

“The market is waiting for earnings and good network to compete with the other two telcos,” Mercantile Securities’ Mr. See said, referring to the two incumbent firms PLDT, Inc. and Globe Telecom, Inc.

“There would not be much of a fundamental side for now since they are just expanding and building everything,” he added.

Mr. See placed the stock’s support levels at P8.15 and P7.00 per share, and resistance levels at P8.75 and P9.30 apiece.

For AAA Southeast Equities’ Mr. Mangun, DITO may “bottom out” and hold support between P7.50-7.80 and major resistance between P10-10.20. — Ana Olivia A. Tirona