The growing adoption of digital tools in public services becomes prevalent since the start of the coronavirus disease 2019 (COVID-19) pandemic. Among the enablers in this digital transformation of the sector is cloud computing technology.

Cloud computing seems helpful for the government operations and services as the Department of Information and Communication Technologies (DICT) has already released a circular regarding the country’s cloud-first policy back in 2017, which then underwent some amendments for the shift towards the new normal in 2020.

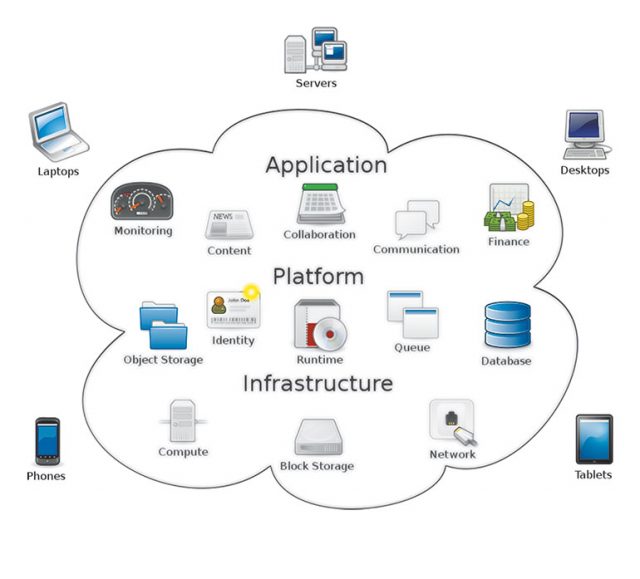

“Cloud computing is a model for enabling ubiquitous, convenient, on-demand network access to a shared pool of configurable computing resources (e.g. networks, servers, storage, applications, and services) that can be rapidly provisioned and released with minimal management effort or service provider interaction,” DICT defined in the circular.

The purpose of the policy, as the department stated, is to reduce the cost of government information and communications technology, increase employee productivity, and further develop citizen online services by utilizing cloud computing technology.

The policy also promotes cloud computing as the preferred technology in government administration and online services.

As such, DICT noted on the circular some benefits that cloud computing could bring in the government’s services and budget.

The technology makes the sharing of resources easier, thus enabling more effective collaboration among the agencies. This connection can make the delivery of public online services with “greater efficiency, entrepreneurship, and creativity,” the department noted.

As shared in a working paper on cloud computing published by Asian Development Bank (ADB), DICT may have seen this benefit in 2017 when it used a cloud-based solution to automate its business permits and licensing system. Since the technology enabled the process of business permit applications and renewals online by local government units (LGUs), it reduced the duration of the process from two to three days to just 30 minutes to half a day.

Online services can also be delivered faster, DICT’s circular added. This is because the testing and deployment of public ICT facilities and services would be quicker and maintained more cost-effectively, compared if the government agencies possess and operate unique computing facilities themselves.

“Reducing the amounts of infostructures required to be built and owned by government agencies reduces overall deployment times and shifts the focus from management of infrastructure to delivery of online services,” DICT said.

The department further highlighted how such technology makes greater budget control for the government agencies. This utility-based “pay for what you use” model, according to the department, means that the agencies can acquire as much or as little resources as they need.

“Cloud scalability results in systems usage being dialed up or down throughout the year as it is required. Transparency of the utility-based pricing structure means that spending caps and alerts can be implemented to further assist in budget control,” it explained.

Additionally, cloud infrastructure, as the means to deploy online government services, can result in an immediate decrease of large capital costs for infostructure and maintenance.

As mentioned in ADB’s working paper, the Bureau of Customs in 2016, for instance, estimated that the rehabilitation of its aging internal data center would need about ₱200 million; whereas if it used cloud computing infrastructure, it would be able to get the required computing power for less than one-tenth the cost.

Cloud provisioning can also make more commodity solutions available to the agencies; and since a cloud service provider manages the version upgrades to both hardware and software, the cloud-first model can augment the government ICT resilience and security, the department added.

Having such centralized data storage, management, and backups, the technology hence also allows the data retrieval and business recovery in a faster, easier, and more cost-effective way even at times of crisis.

Apparently, cloud computing, like several technologies, proves itself efficient when the pandemic hit the country and disrupted operations. The DICT, in fact, recently amended the Cloud First Policy to make the instructions on coverage, data classification, and data security clearer upon recognizing the vital role of ICT in the transition to the new normal.

The amendments last year clarified which institutions that the policy shall cover. This includes the departments, bureaus, offices, and agencies of the Executive Branch; government-owned and/or controlled corporations (GOCCs) and their subsidiaries; state universities and colleges (SUCs); and LGUs. It also covers cloud service providers and private entities that render services to the government.

The Congress, the Judiciary, the Independent Constitutional Commissions, and the Office of the Ombudsman, meanwhile, are merely encouraged to adopt the policy, which the amendments also made clear.

Data classifications were updated as well, now comprising highly sensitive government data; above-sensitive government data; sensitive government data; and non-sensitive government data. With this amendment, there is a more consistent structure to guide the application of safety protocols on the access, storage, processing, and transmission of data in the cloud.

Moreover, the amendments stated provisions on ICT capacity building and essential skills development to meet local and international standards.

The department’s policy on sovereignty, residency, and ownership were also amended.

According to Gregorio B. Honasan II, secretary of DICT, these amendments to the Cloud First policy are expected to further enable the government agencies in serving the public more efficiently. Through these clearer instructions, the agencies can thus employ cloud-based services that are at par with global standards.

“We are continuously updating our policies to adapt to the present times. With the amended Cloud First Policy, we are paving the way to an ICT policy environment that is more responsive to current needs, further filling gaps in our country’s digitalization efforts,” Mr. Honasan said in a statement.

“The shift to a truly digital government is much more pressing today,” he added. “As a member of IATF-MEID and lead agency in promoting the National ICT agenda, the DICT is committed to cover all aspects of this, primarily policies that would enable government digital transformation to ensure that we maximize ICT during this transition to the new normal.” — Chelsey Keith P. Ignacio