YIELDS on government securities (GS) were mixed last week following the latest signal from the Bangko Sentral ng Pilipinas (BSP) to increase borrowing cost anew next month and the higher June borrowing plan.

Debt yields, which move opposite to prices, increased by 3.23 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates as of May 27 published on the Philippine Dealing System’s website.

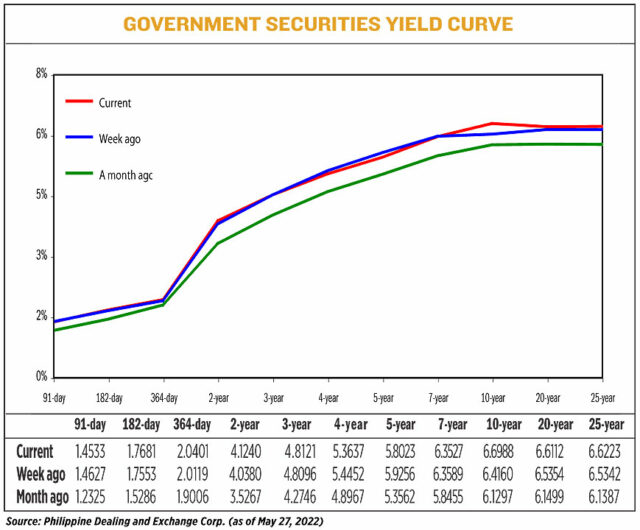

Yields across the board ended mixed. At the short-end of the curve, the 91-day papers dipped by 0.94 basis point (bp) to 1.4533%, while the 182- and 364-day Treasury bills (T-bills) went up by 1.28 bps and 2.82 bps to fetch 1.7681% and 2.0401%, respectively.

Rates at the belly of the curve saw mixed results as the two- and three-year Treasury bonds (T-bonds) edged up by 8.60 bps (to 4.1240%) and 0.25 bp (4.8121%), respectively. Meanwhile, the four-, five- and seven-year T-bonds dropped by 8.15 bps (to 5.3637%), 12.33 bps (5.8023%), and 0.62 bp (6.3527%).

On the other hand, the long end of the curve moved upwards as yields on 10-, 20- and 25-years debt papers rose by 28.28 bps (to 6.6988%), 7.58 bps (to 6.6112%), and 8.81 bps (to 6.6223%), respectively.

Total GS volume reached P13.677 billion on Friday, higher than P7.105 billion seen last May 20.

“Bid/offer spread remains very wide [last week]. Aggressive debt supply kept speculators at bay, limiting secondary market action,” a bond trader said in an e-mail.

“To some extent, portfolio demand provided support at these attractive levels. Hints of incumbent BSP Governor [Benjamin E.] Diokno that a rate hike is possible next June was shrugged off as this was fully priced in,” the bond trader added.

“It is still better to load up on auctions as the BTr (Bureau of the Treasury) seems aggressive enough to award higher this June.”

On May 19, the Monetary Board increased the benchmark rate by 25 basis points (bps) to 2.25%. The BSP hiked its key interest rate to control soaring inflation.

Rates on the overnight deposit and lending facilities were also hiked by 25 bps to 1.75% and 2.75%, respectively.

Last Thursday, the central bank chief signaled that he was inclined to hike key rates by another quarter percentage point at the next policy meeting on June 23.

The BTr plans to borrow P250 billion from domestic debt market in June, 25% more than the P200 billion it programed for May. The government just borrowed P141.31 billion this month.

Broken down, the Treasury will offer P15 billion and P35 billion in its weekly auctions of T-bills and T-bonds in June.

“There were some downward movements in the belly of the curve [last week] due to some market positioning ahead of next week’s BTr auctions on those tenors,” another bond trader said in an e-mail.

The second bond trader added that the increase in the GS volume traded last week compared with two weeks ago could be attributed to investors staying on the sidelines prior to the noted market developments.

For this week’s trading session, the first bond trader sees weak GS yields on the three-year and five-year area due to incoming debt supply.

“The 10-year area will trade sideways and will be well bid, 5 bps lower. Yields to consolidate, probably a little higher on the three-year to five-year area. BTr borrowing behavior for June and May inflation spiking above 5% is already priced in.”

For the second bond trader, domestic yields might move higher as likely upbeat US labor data could further support hawkish US monetary policy views and ease global growth worries.

“However, the increase in local yields might be capped by policy uncertainties by the next Philippine administration,” the second bond trader added. — A. M. P. Yraola