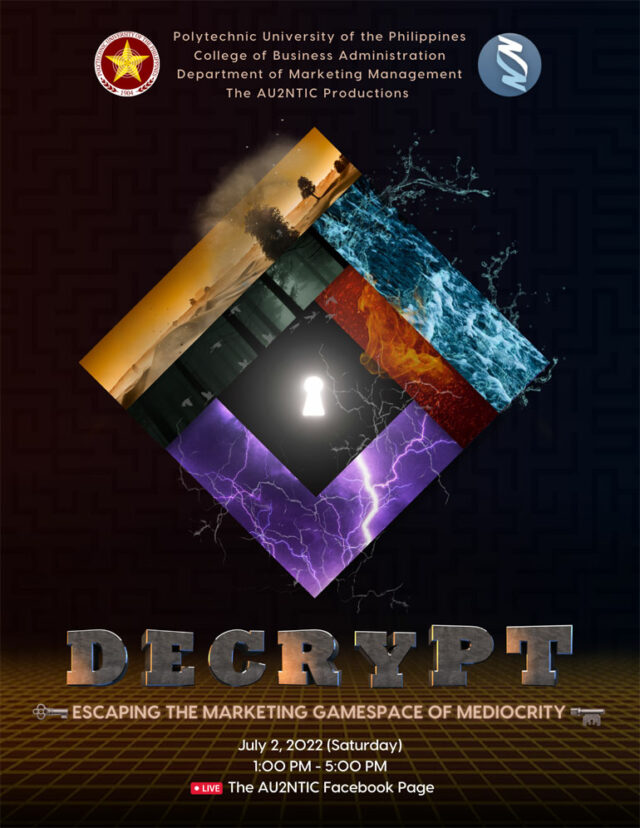

DECRYPT: Escaping the Marketing Gamespace of Mediocrity

The AU2NTIC Productions is a nonprofit academic organization composed of students taking up Bachelor of Science in Marketing Management (BSBA-MM) Section 4-2N in Polytechnic University of the Philippines (PUP) — Sta. Mesa, Manila. It aims to deliver the latest and authentic marketing contents that will inform, entertain, and uplift marketing students.

Its upcoming event entitled, “DECRYPT: Escaping the Marketing Gamespace of Mediocrity,” aims to focus on interconnecting marketing and analytics in the present-day state of pandemic and post-pandemic.

DECRYPT is a free admission webinar of The AU2NTIC Productions to be held online via Zoom and Facebook Live on July 2, 2022 from 1:00 p.m. to 5:00 p.m. It will cater to Marketing students from PUP, including PUP SHS and OUS, as well as partner schools. It has a three-part discussion consisting of three topics with respective subtopics and real-life case studies.

The event will have high-caliber and top-of-the-line speakers, to be called as the gamemasters, to discuss the chosen topics:

1) The Emerging Importance of Value Creation Process for Startup Businesses in the New Normal;

2) Identifying Brand DNA to Develop a Killer Brand Strategy; and

3) Utilizing Marketing Analytics and Data Science in Creating Trends

The topics are bound to represent the life of a business — from creating a value for a startup business, to creating a brand identity and developing a killer brand strategy, up to reaching the end result of being the best-in-class by creating data-driven trends. While value creation and brand identity are strong needs of a business, life does not end from being known and differentiated from competitors. Businesses’ blood is customers — the paying ones. Hence, they will want to create a campaign trend that is important in conversion that can be done through marketing data science. The topics and theme of this webinar are formed in the aim of delivering the message of ‘escaping the mediocrity in the current state of the market’ and dare to be a brand that stands out.

Other much-awaited things for this event are the guest performers, freebies to every student from brand partners, and competitions where the students can join and share their skills and creativity, be recognized for their wits, and win exciting prizes as they attend and participate.

Line up with the bravest players by filling out this pre-registration form: https://forms.gle/ryMpP4GkueX4i5zh7.

Get ready to fearlessly play your own game!

HIGHLIGHTS OF THE EVENT: High-caliber speakers, upskill in marketing and analytics, real-life cases and application of topics, learning at their own convenience, e-certificates, guest performers, pre-event competitions, the announcement of games and raffle winners, freebies, and vouchers

While effective, such a therapy is expensive. Early clinical trials also saw the therapy “killed so many leukemia cells all at once; when [the leukemia cells] died in the body, they release a lot of the toxic stuff inside the cells, and that overwhelmed certain patients,” Dr. Diong said.

While effective, such a therapy is expensive. Early clinical trials also saw the therapy “killed so many leukemia cells all at once; when [the leukemia cells] died in the body, they release a lot of the toxic stuff inside the cells, and that overwhelmed certain patients,” Dr. Diong said. Dr. Dawn Mya discussed multiple myeloma, a cancer originating from plasma cells. Since multiple myeloma remains incurable, she said that they concentrate on achieving remission with treatment.

Dr. Dawn Mya discussed multiple myeloma, a cancer originating from plasma cells. Since multiple myeloma remains incurable, she said that they concentrate on achieving remission with treatment.