If there’s a credit rating analysis that best sums up the fiscal challenge for the Marcos Jr. administration, it has to be the February 2022 Fitch Ratings’ explanation of the negative outlook it assigned to the Philippines while affirming its triple B investment grade.

“The negative outlook reflects uncertainty about medium-term growth prospects as well as possible challenges in unwinding policy response to the health crisis and bringing government debt on a firm downward path.”

The Philippine Government as represented by Department of Finance (DoF) Secretary Ben Diokno is quite bullish about the recovery of business activities with the lifting of pandemic restrictions and normalization of people’s mobility. During the BSP-UP School of Economics Distinguished Lectures Series on July 18, the chief economic manager expressed his confidence that the economy could weather the implications of current geopolitical events and post-pandemic changes in the international financial system.

Three days earlier, on July 15, he assured the Group of 20 countries plus the European Union Finance Ministers and Central Bank Governors meeting that “we have a comprehensive set of interventions to effectively balance the need to sustain the growth momentum while containing inflationary pressures and their cascading effects on the economy.”

A day before that, on July 14, Secretary Diokno defended the aggressive monetary tightening by the Bangko Sentral ng Pilipinas (BSP) on the ground that the local economy remains robust enough “to absorb” it.

Trust for more traction was placed in the recent initiatives such as the Corporate Recovery and Tax Incentives for Enterprises Act, the Financial Institutions Strategic Transfer Act, Rice Tariffication Act and other initiatives.

RESILIENT GROWTH AND ECONOMIC SCARRING

The Philippine economy remains resilient due largely to more than 30 years of policy and structural reforms that have allowed the country to reap gains in both economic efficiency and total factor productivity. But it is hysteresis, or economic scarring of the pandemic, that could be the biggest hurdle to both economic growth and fiscal consolidation.

As AMRO’s (ASEAN + 3 Macroeconomic Research Office) Annual Consultation Report, released July 20, stressed, the prolonged closure of schools and the sub-par quality of online classes dependent on weak internet connection would have serious implications on the quality of the labor force in the years ahead. Upgrading and upskilling are imperative to attain an effective switch to digital, technology-driven economy. Labor market mismatches could be a costly drag to the new normal forced by the pandemic.

The closure of many micro, small and medium enterprises would also require substantial but focused support. It is the driving force behind the unprecedented rise in both unemployment and underemployment in the last two years. As a result, poverty has worsened.

This is the major reason why the new medium-term fiscal program 2022-2028 should be deliberate in calling for priority expenditure on health, disaster risk management, social security, digital economy, and growth-inducing shovel-ready infrastructure projects. Prioritization should thus be the buzzword particularly today because this government’s fiscal space might continue to shrink.

PUBLIC REVENUES

But we find the medium-term growth in revenues to be quite modest, unambitious in fact.

It is programmed to grow from an estimated 15.2% of GDP in 2022 to 17.6% of GDP in 2028. The programmed average ratio for 2022-2024 of 15.4% actually comes out even lower than the average ratio of 15.7% during the two-year pandemic when the economy severely contracted. In fact, the actual first quarter 2022 ratio had already reached nearly 16%.

This must be based on Secretary Diokno’s stand that tax administration, rather than new taxes, is the first priority to raise government revenue which would be reflected in the new fiscal consolidation plan.

Experience tells us that the path of tax administration, though paved with good intention, could lead to nowhere. Improving real property valuation and simplifying financial taxation will all depend on good implementation. It’s good the DoF has indicated its support for taxing digital services and transactions, but perhaps there should be more. As DoF chief economist Gil Beltran pointed out recently, there’s room for raising excise taxes on sin products like tobacco, vapes, and alcoholic drinks.

PUBLIC SPENDING

On the spending side, we find some disconnect with the medium-term growth targets. For 2022, the Development Budget Coordination Committee (DBCC) is envisioning a 6.5-7.5% and for next year through 2028, 6.5-8%. But ironically, public spending is programmed to decline from 22.9% in 2022 to only 20.6% by 2028.

Trimming the deficit from 7.6% in 2022 to only 3% by 2028 can only be done by increasing the revenues and real GDP. But the government, in adhering to an ambitious growth target, should also keep public spending very much engaged, rather than reduced as programmed, because private sector spending is yet to be self-sustaining. In short, as long as revenues are raised at a higher margin than the expansion of expenditure, we can have a situation of robust growth and sustainable public finance.

Otherwise, as AMRO warned, “it would take longer time to mitigate scarring effects” that have become more visible, and growth prospects might therefore be compromised.

FISCAL SPACE

Some fiscal space could be realized from a possible budget reassessment by individual agencies and realignment across departments and offices.

We find the Department of Budget and Management’s (DBM) previous issuance to revisit 2023 budget proposals relevant.

National Budget Memorandum No. 144 calls for both existing and new programs to be reassessed to ensure they are responsive to strategic direction for the year, implementation-ready, consistent with each agency’s absorptive capacity and aligned with the plans and priorities of the Marcos administration. These are a mouthful, and require serious thought and compliance.

DBM should truly commit to ensure the national budget allocation is prudent and judicial. The Commission on Audit (CoA) has time and again qualified its findings on many public agencies with respect to their use of public money. It’s not enough that the government takes pride in its ability to increase the release of notices of cash allocation (NCAs), the utilization of such funds should be intensified especially in the first half of the year when the weather is conducive to undertaking public works projects.

For instance, it was reported by CoA that because of implementation issues surrounding 14 foreign-assisted projects of the Department of Transportation worth P1.61 trillion in 2021, the government was forced to pay P128.42 million in additional fees.

CoA also found the Department of Social Welfare and Development failed to distribute P1.9 billion worth of Social Amelioration Program funds during the pandemic. In addition, it was only recently that the Department realized that some 1.3 families should have been dropped from the cash program because they have transitioned from extreme poverty. Some 600,000 more are expected to be delisted.

Some disbursements worth P33.446 million, CoA found, remains unliquidated by the Office of the President for the National Task Force to End Local Communist Armed Conflict. Whether some cash distribution was done for each local government unit remains to be seen.

On a bigger scale, some infra experts are of the view that many big Build, Build, Build projects could hardly be justified in terms of their economic value. Interest rates charged by bilateral sources have been found to be above market. Giving these flagship projects a second look could save the Republic billions of pesos that would otherwise have to be raised from additional taxes or borrowings, something that could bloat the debt to GDP ratio again.

Therefore, DBM’s directive for government agencies to rationalize their individual budget proposal should result in lower overall amounts. If needed, some realignments between and among agencies should also be done. In the congressional hearings, we should see the CoA representatives do due diligence to each agency’s goals and spending capacity. Special sessions should also be conducted to ascertain big infra projects’ economic values against their total costs and source of funding. Media coverage should be encouraged.

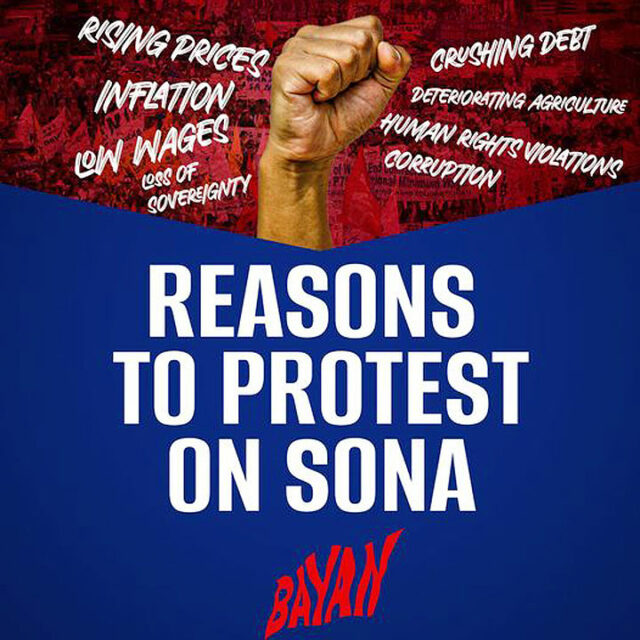

STATE OF THE NATION ADDRESS

We expect to hear President Bongbong Marcos explain the details of his government’s fiscal program to achieve speedy economic recovery, mitigation of the pandemic, and a return to fiscal sustainability on Monday during the State of the Nation Address. If market confidence is boosted and investments start streaming in, growth is likely to be sustained.

Going back to Fitch’s assessment, one can see the weight it assigns to government effectiveness, one that is inclusive of good and smart governance, rule of law and control of corruption. If we fail to reduce government debt to GDP ratio, it could be rating-negative while broadening the revenue base is rating-positive. Putting public finance on an even keel ensures a good trajectory of economic growth and promotes poverty reduction.

While we are way above Sri Lanka’s woes, this is one strategy of avoiding a descent to its level.

Diwa C. Guinigundo is the former deputy governor for the Monetary and Economics Sector, the Bangko Sentral ng Pilipinas (BSP). He served the BSP for 41 years. In 2001-2003, he was alternate executive director at the International Monetary Fund in Washington, DC. He is the senior pastor of the Fullness of Christ International Ministries in Mandaluyong.