The government is ramping up preparations for coronavirus disease 2019 (COVID-19) vaccinations for children aged 5 to 11 years old starting Feb. 4.

This comes after the government allowed vaccination for children 12 to 17 years old in efforts to also protect them from getting seriously ill from highly infectious and potentially fatal SARS-CoV-2 variants.

Children are as likely to be infected with COVID-19 as adults, the Centers for Disease Control and Prevention (CDC) said. It added that before the vaccination recommendation for children was given, scientists conducted clinical trials with thousands of children, and no serious safety concerns were identified.

The CDC explained that a vaccinated child can be protected from the short and long-effects of COVID-19. It can also help protect family members who are not yet eligible for vaccination like siblings who are below the age of 5. Others who are expected to benefit are people who may be at increased risk of getting very sick if they were infected. If a vaccinated child still gets infected, the vaccine can also help him or her from getting seriously sick.

The Philippine Pediatric Society (PPS) and Pediatric Infectious Disease Society of the Philippines (PIDSP) fully support vaccinating children ages 5 to 11 years old. “Although cases of COVID-19 in the pediatric age group remain less severe compared to older adults, children can still be hospitalized and even require admission to an intensive care unit,” the statement said.

It added that in the Philippines, around 3% of cases and 0.5% of mortalities of COVID-19 are among children aged 5–11 years old, a trend similar to that seen worldwide.

Immunization is indeed one of the most successful and cost-effective health interventions known. Unfortunately, the COVID-19 pandemic has disrupted the provision of vital health services including immunization for other vaccine-preventable diseases. The Omicron-driven surge that the country is experiencing is adding to this disruption.

Global immunization coverage dropped from 86% in 2019 to 83% in 2020, according to the World Health Organization (WHO). An estimated 23 million children under the age of one year did not receive basic vaccines in 2020, around 3.7 million more than in 2019 and the highest number since 2009. In 2020, the number of completely unvaccinated children increased by 3.4 million. Only 19 vaccine introductions were reported in 2020, less than half of any year in the past two decades. The WHO predicts that this slowdown is likely to continue as countries focus on ongoing efforts to control the COVID-19 pandemic, and on the introduction of COVID-19 vaccines.

According to the WHO, the disruption in immunization services as a result of the pandemic may lead to more outbreaks of vaccine-preventable diseases. Moreover, the WHO warns that, if not addressed quickly, the disruption will add further strain to healthcare systems already overburdened because of COVID-19. In addition, the potential for co-circulation of influenza, or any other epidemic pathogens (for example, measles, respiratory syncytial virus, and meningitis), and COVID-19 could further burden healthcare systems in the upcoming months.

Data from the Department of Health (DoH) showed that our country’s immunization rate dropped from 69% in 2019 to 65% in 2020. The DoH has reiterated its appeal to all parents to bring their children to health centers for free vaccines that protect against life-threatening diseases.

To broaden access to immunization services amid the pandemic, DoH health workers are conducting house-to-house immunization, while others ride tricycles or boats to vaccinate children in far-flung areas. Community-based immunizations are also being implemented in targeted hard-to-reach communities.

While emphasis is placed on pediatric immunization coverage, vaccination can also prevent an overall great number of deaths in older adults, and is essential to living healthier lives. Taking a life-course approach to immunization — vaccination given through all phases of life — will not only help individuals maintain good health throughout their life, but also has the potential for enormous public health and socioeconomic benefits, according to Health Policy Partnership.

“Through herd immunity, widespread vaccination can reduce rates of illness in our societies, including among people who are not vaccinated. This is crucial for vulnerable people, such as young infants or people with certain illnesses, who cannot be vaccinated themselves. High vaccination rates can also help to reduce our reliance on antibiotics, which contributes to antimicrobial resistance — one of the most pressing challenges facing healthcare in the 21st century,” Health Policy Partnership explained.

To support a successful implementation of life-course immunization, the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA) recommends that governments and other stakeholders expand vaccine delivery channels to include pharmacy-based, community-based, employer-based, residential-care-based, and school-based delivery of vaccinations.

Teodoro B. Padilla is the executive director of Pharmaceutical and Healthcare Association of the Philippines (PHAP), which represents the biopharmaceutical medicines and vaccines industry in the country. Its members are at the forefront of research and development efforts for COVID-19 and other diseases that affect Filipinos.

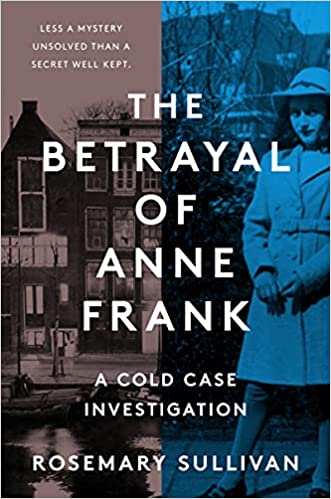

AMSTERDAM — A Dutch publisher has suspended printing of a book that suggested a Jewish notary betrayed Anne Frank, saying there were questions about the research behind it, according to an internal e-mail seen by Reuters. The Betrayal of Anne Frank, released on Jan. 18, caused a sensation when it said investigators had named Arnold van den Bergh as the main suspect. Other researchers later criticized the findings, saying they were “full of errors.”

AMSTERDAM — A Dutch publisher has suspended printing of a book that suggested a Jewish notary betrayed Anne Frank, saying there were questions about the research behind it, according to an internal e-mail seen by Reuters. The Betrayal of Anne Frank, released on Jan. 18, caused a sensation when it said investigators had named Arnold van den Bergh as the main suspect. Other researchers later criticized the findings, saying they were “full of errors.”