Smart’s Giga Play app revolutionizes the Filipino’s online live viewing experience, brings the biggest acts on Dec. 11 live

Mobile services provider Smart Communications, Inc. is pulling out all the stops to give Filipinos access to highly anticipated international events featuring Ed Sheeran, Dua Lipa, the Jonas Brothers, and your favorite K-Pop stars ENHYPEN, TXT, aespa, ATEEZ, and more with the back-to-back livestreaming of iHeart Jingle Ball and the 2021 Mnet Asian Music Awards (MAMA) on December 11.

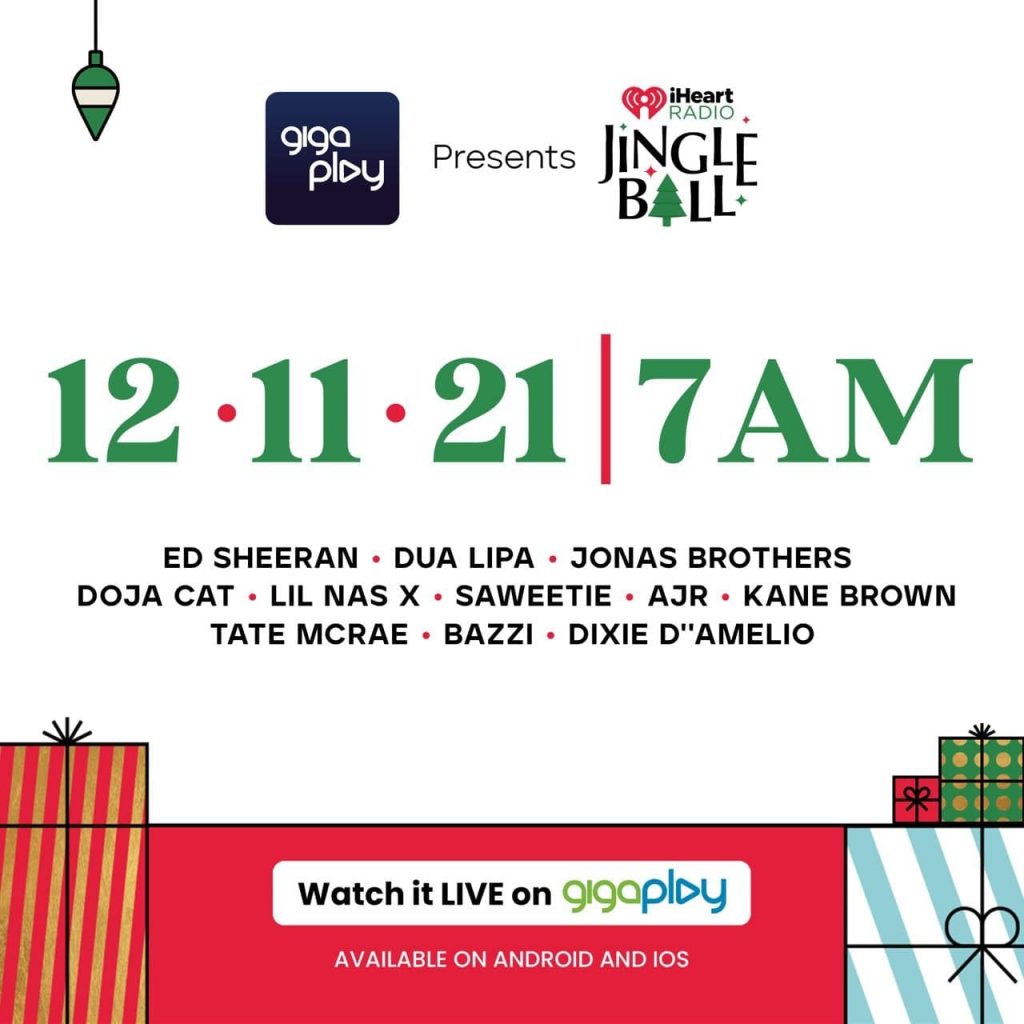

Catch these exclusive livestreams on Smart’s GigaPlay App with the annual iHeart Radio Jingle Ball Tour at 7 a.m. and MAMA at 3 p.m. through your Smart-connected device.

“A couple of months ago, the GigaPlay App was just a dream, so you can just imagine how happy we are to give our customers exclusive access to some of the world’s most anticipated live events. And we’re just starting. If you can’t travel to see the concerts and experience events physically, then we bring them to you digitally—right at your fingertips,” said Jane J. Basas, SVP and Head of Consumer Wireless Business at Smart.

“This December, we’re excited to bring back the iHeart Jingle Ball and 2021 MAMA awards, this time on GigaPlay. Allow us to transport you to New York City and Paju in Seoul, through our convenient mobile app and enjoy watching the biggest international events as they happen in real-time,” added Basas.

From New York to Seoul in one day

Watch the biggest music acts including Ed Sheeran, Dua Lipa, Jonas Brothers, Doja Cat, Lil Nas X, Saweetie, AJR, Kane Brown, Tate Mcrae, Bazzi, and Dixie D’Amelo as they heat up New York city’s Madison Square Garden with their performances of their hits as well as some renditions of beloved holiday tunes.

Later in the day, see who among the hottest K-Pop artists will take home this year’s biggest awards at the 2021 Mnet Asian Music Awards straight from Seoul, South Korea. Catch Wanna One, aespa, Ateez, Brave Girls, Enhypen, INI, and more. Global superstar Ed Sheeran will have a special performance as well.

Expect other big groups to drop by and perform during this year’s Mnet ceremonies. Start watching at 3 p.m. for the red carpet arrivals before the main show kicks off at 5 p.m. Korean celebrities Song Joong Ki, Rain, Ahn Bo Hyun, Lee Sun Bin, Yeo Jin Goo, Lee Do Hyun, and Choi Si Won among others will also join the program as presenters.

Don’t miss all the exclusive live and on-demand shows and content on GigaPlay! Download the app now on the Apple App Store and Google Play Store or click on this link: smrt.ph/gigaplay.

Fastest 5G mobile network

GigaPlay is powered by Smart, the country’s fastest and most reliable 5G mobile network as reported by Ookla, the global leader in mobile and broadband network intelligence. To date, Smart has already fired up 4,400 5G sites nationwide making it the country’s first, fastest, and widest 5G network.

Smart has also reasserted its dominance as the Philippines’ fastest mobile network for the fourth year in a row, based on analysis by Ookla of tests taken with Speedtest® covering the first half of 2021.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by enabling them to publish their stories directly on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber to get more updates from BusinessWorld: https://bit.ly/3hv6bLA.