There are as usual four topics in this column and we go straight to them.

There are as usual four topics in this column and we go straight to them.

ASSESSMENT OF DUTERTE’S BUILD-BUILD-BUILD

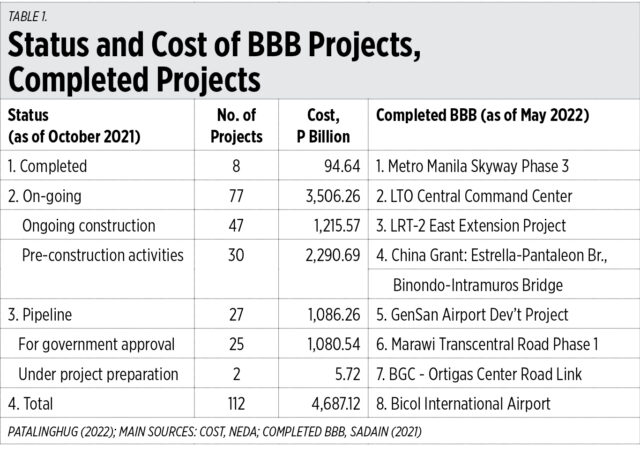

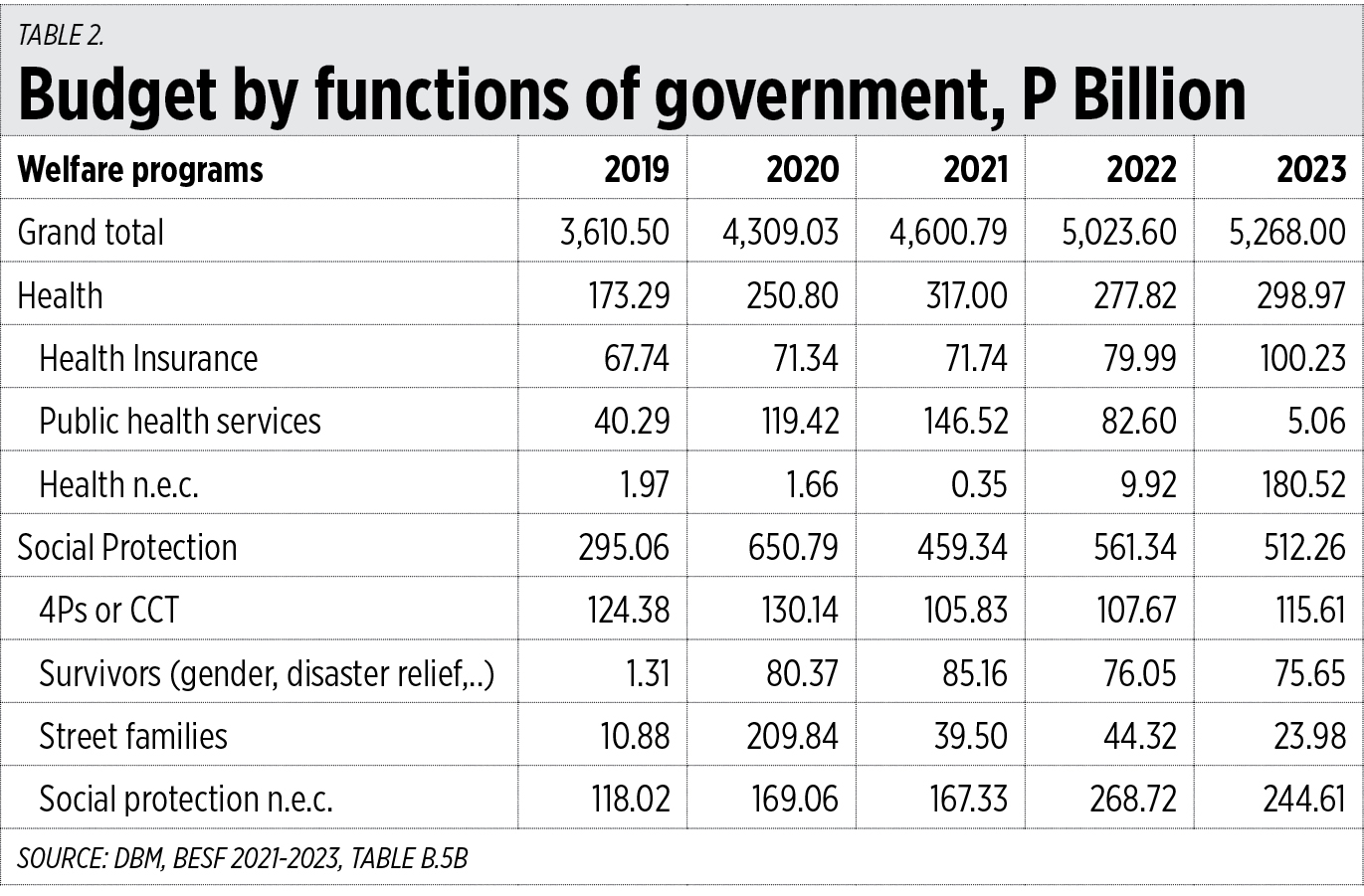

Dr. Epictetus E. Patalinghug, Professor Emeritus of UP Diliman (and my former undergrad Economics teacher in the 1980s), wrote a good paper: “An Assessment of the Infrastructure Program of the Duterte Administration” (funded by the UP Professor Emeritus Research Program, published August 2022).

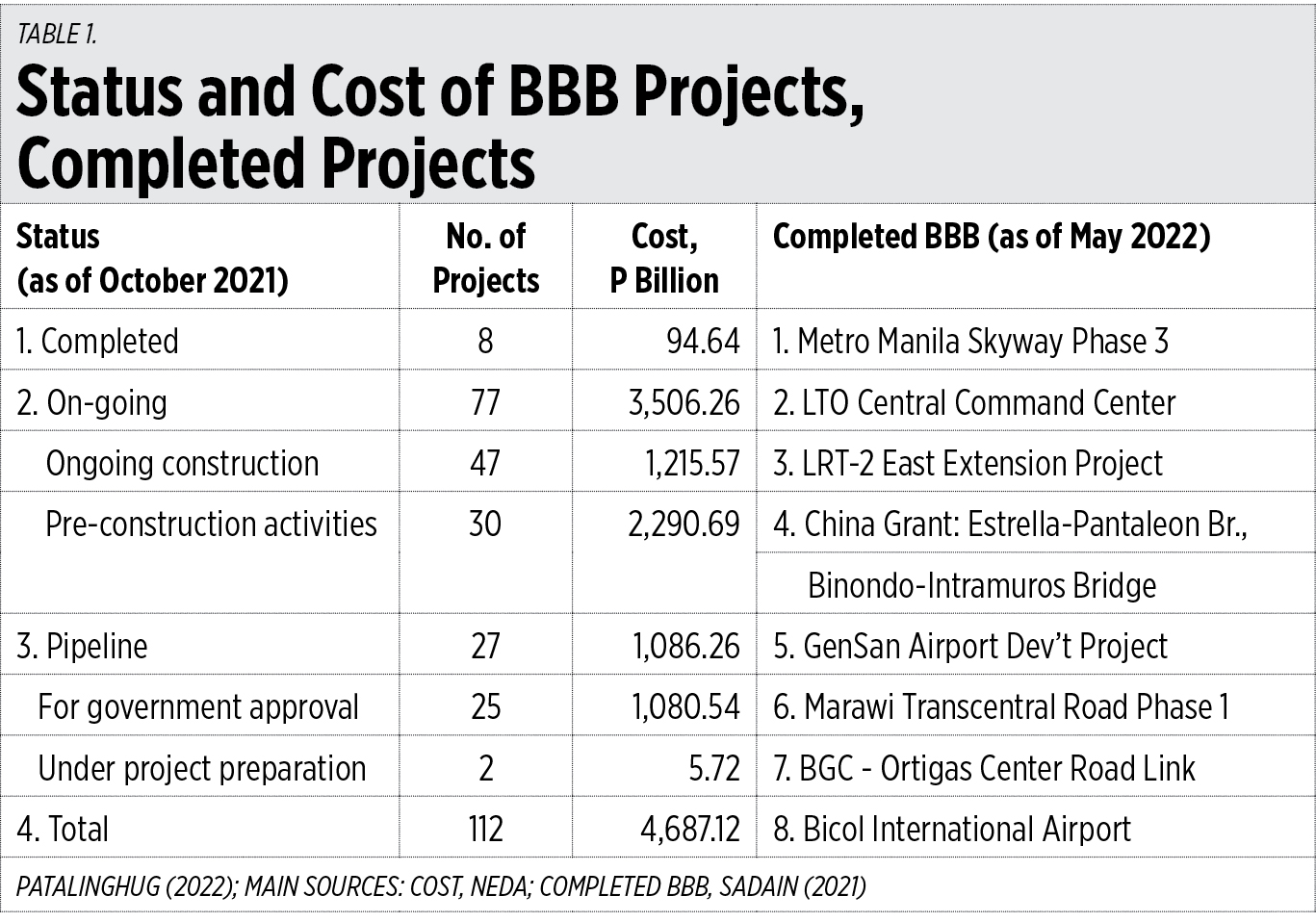

The paper assesses the end-of-term performance (2016-2022) of the previous Administration’s Build, Build, Build (BBB) Program. It observed that the scope of BBB changed from 75 big-ticket projects to 112 less ambitious and more doable projects. The huge gap between the actual and targeted infrastructure expenditures in the early years of the program was a manifestation of the weak absorptive capacity of the implementing agencies.

Among the 15 railway projects examined by the study, only two were completed, and among the 10 unsolicited airport public-private partnership (PPP) projects, none was completed. While Duterte’s BBB saw an all-time high in infrastructure spending vis-à-vis previous administrations, still its performance was low compared to its targets.

The Marcos Jr. administration should go back to the conventional PPP scheme in building huge infrastructure. The private sector bears most, if not all, of the financial and technical aspects while government arranges right of way and other property rights related issues.

ENDLESS WELFARE SPENDING CONTRIBUTES TO ENDLESS BORROWING

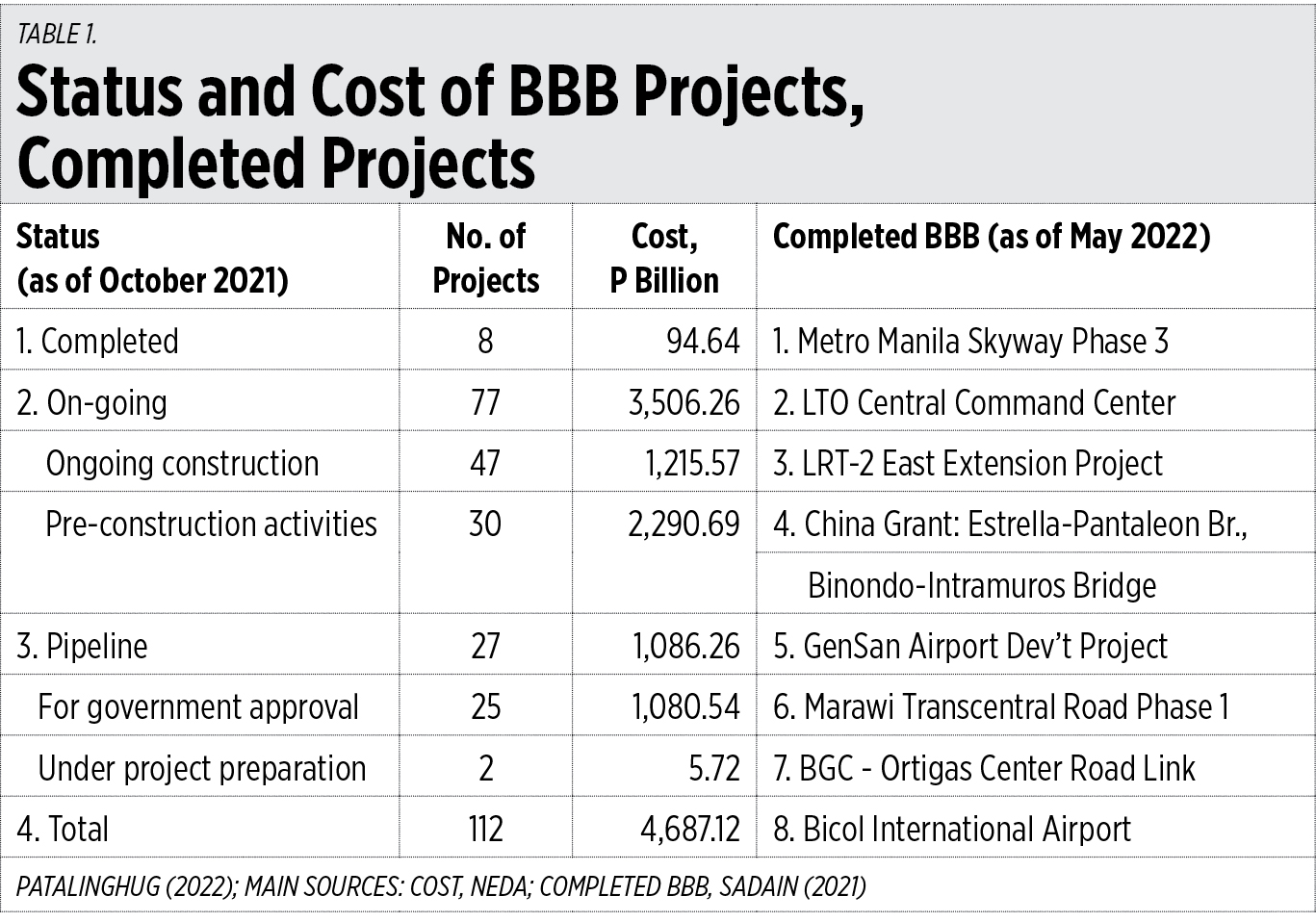

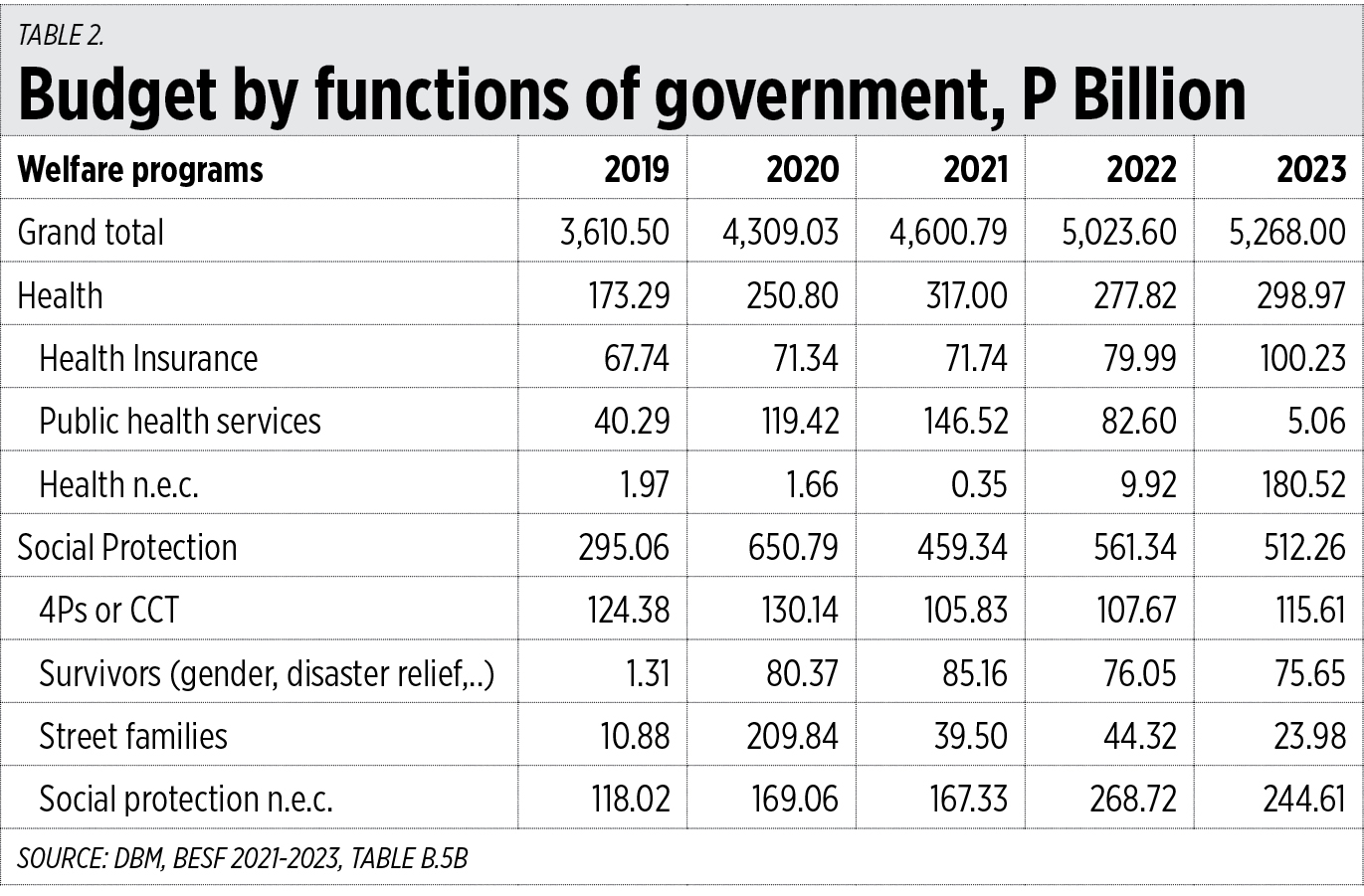

The heavy government-imposed lockdowns of 2020-2021 resulted in the large-scale displacement of labor and businesses. Government borrowed heavily, averaging P2 trillion a year, to fund new welfare programs on top of existing ones. We look at health welfare and social protection. Health insurance (via PhilHealth) continues to rise while public health services jumped big time in 2020-2021, and there is a new health program not elsewhere classified (n.e.c.) of P180 billion next year.

Social protection spending more than doubled in 2020 over the 2019 level, led by spending on survivors, street families, and protection n.e.c. The problem is that lockdowns have ended this year and yet the huge social spending continues in 2022-2023 (see Table 2).

“We should measure welfare’s success by how many people leave welfare, not by how many are added… No government ever voluntarily reduces itself in size. Government programs, once launched, never disappear.” — Ronald Reagan, former US President

May President Marcos Jr. and the economic team heed this advice from Mr. Reagan.

CONTINUING COVID VAX DISCRIMINATION

An unvaccinated Grade 11 student in one private school in Metro Manila was prohibited from attending classes for two weeks because one member of her choir group, who was vaccinated, tested positive. The school’s protocol for “Quarantine of asymptomatic close contacts of individuals with symptoms, suspect, probable, or confirmed cases: (a) Fully vaccinated asymptomatic shall quarantine for at least five days, (b) Partially vaccinated or unvaccinated asymptomatic shall quarantine for at least 14 days, from the date of the last exposure.”

This continuing vaccine discrimination by schools and offices is instigated by old, alarmist, scare-mongering, and heavy vax-pushing policies of the Department of Health (DoH) and the Inter-Agency Task Force for the Management of Emerging Infectious Diseases (IATF). A vaxxed student tested positive and the unvaxxed one who is not sick is penalized. This is typical of a riddle with an obvious answer, “What product on earth blames its failure to protect on those who do not use it?”

The parents are hesitant to have their child vaccinated for at least two reasons. One, a trend of declining births and fertility in many countries especially in 2022 after the mass vaccination rollout in 2021. In the Philippines for instance, the average births per month were: 139,494 in 2019, 127,390 in 2020, 113,728 in 2021, and 93,430 in January-February 2022.

Birth rates in Q1 2022 vs. Q1 2021 were as follows: Taiwan -27%, Germany -12%, Netherlands, Estonia, Lithuania, and the Czech Republic -11%, Finland and Greece -10% (see https://petersweden.substack.com/p/birthrates-down).

Two, rising cases of heart- and thrombotic-related diseases post vaccination. There is one compilation that is regularly updated of about 1,000 studies and reports. For 1.) Myocarditis 226 studies, 2.) Thrombosis 150 studies, 3.) Thrombocytopenia 115 studies, and so on (see https://www.informedchoiceaustralia.com/post/1000-peer-reviewed-studies-questioning-covid-19-vaccine-safety).

These plus continuing reports of unexplained child deaths post vaccination should shake the DoH, the Department of Education, the Commission on Higher Education, President Ferdinand Marcos, Jr., and Vice-President Sara Duterte, to stop the continuing vaccine discrimination, explicit and implicit.

Back to the school and the student. The school officials explained that they have to follow existing DoH and IATF protocols. They bent backwards and will provide one-on-one make up classes for the unvaxxed student who has been prevented from going to school even if she has zero symptoms, and was not sick the entire year. Good move by the school but continuing bad policies by the government.

ASIA LIBERTY FORUM, TAXPAYERS FORUM, ILLICIT TRADE FORUM

There are three international fora in Manila that I will attend: the Asia Liberty Forum (ALF) on Sept. 29-30 at Shangri-La BGC, sponsored by the Atlas Network and its local partner Foundation for Economic Freedom (FEF); the Asian Taxpayers Regional Forum on Sept. 27-28, also at Shangri-La BGC, sponsored by the World Taxpayers Association (WTA); and, the Global Anti-Illicit Trade Summit, South-East Asia on Oct. 13, organized by The Economist.

The ALF is an annual event sponsored by Atlas that started around 2013 in Delhi. I attended only the ALF 2015 in Kathmandu, Nepal; ALF 2016 in Kuala Lumpur, Malaysia; ALF 2017 in Mumbai, India; ALF 2018 in Jakarta, Indonesia; and ALF 2019 in Colombo, Sri Lanka. The Friedrich Naumann Foundation for Freedom (FNF) sponsored all my participation in those events except in 2015, when Media 9 and Business 360 magazine (Kathmandu) sponsored me. Thanks again, FNF and Media 9. The last time that Atlas sponsored me was for the Atlas Liberty Forum 2008 in Atlanta, and 2009 in Los Angeles, USA, when Jo Kwong was still the Atlas Vice-President and she would look for funding so I could fly and attend the events. After Jo left Atlas in 2010, there was no sponsorship for me from their organization.

WTA’s main advocacies are low flat tax and limited government. I have been an observer-ally of WTA since 2006 when it co-organized with the Korea Taxpayers Association (KTA) the regional meeting in Seoul, South Korea and they sponsored my trip. I attended other WTA regional meetings after that and my last participation were the meetings in Bangkok in 2017 and in Sydney in 2019.

This will be my first time attending the Anti-Illicit Trade conference. More illicit trade means a country is becoming more corrupt because the smugglers, criminal groups, and their protectors in government are having their way. Weak rule of law, high taxes, and weakening brand protection are among the major contributors to more illicit trade. In October 2019, I wrote a chapter in the International Property Rights Index (IPRI) 2019 entitled “Banning brand: Consumer and economic impact of plain packaging.” I presented it at the IPRI 2019 global launch in Manila, then in IPRI presentations in Kuala Lumpur, Singapore, and Jakarta, all in one week.

The global lockdowns of 2020-2021 were a triumph of Big Governments and a retreat for individual freedom. The irony is that many free-market groups have supported the global narratives that: 1.) Government-imposed lockdowns and government-mandated vaccinations are necessary; 2.) Only the virus evolves and humans do not evolve to deal with it; and, 3.) natural immunity from natural infection should be distrusted and only vax immunity should be trusted.

May the liberty forum and taxpayers’ forum awaken many people from a long slumber to realize that individual freedom should not be sacrificed on the altar of global advances of Big Government.

Bienvenido S. Oplas, Jr. is the president of Minimal Government Thinkers.

minimalgovernment@gmail.com