By Bernadette Therese M. Gadon, Researcher

WITH THE EXITING of retail banks in the country that offers digital banking services, Filipinos have been looking for other banks to transfer to.

The rebranding of one of the largest digital wallets in the country to combine both e-wallet and banking all in one app, Maya Bank is a new addition to make finance easier and accessible to Filipinos around the world.

Maya, formerly called PayMaya, started in 2007 and was the financial and digital payments app used for ease of money remittance across the country under Smart Money.

The use of sending money via phone was an introduction to easier process compared with going to physical payment centers.

Over the past years, Maya has been improving in e-wallet services when the coronavirus disease 2019 (COVID-19) pandemic forced Filipinos to stay at home. This gave opportunity to rising digital banks and e-wallet apps to be introduced and for Filipinos to adapt to cashless transactions.

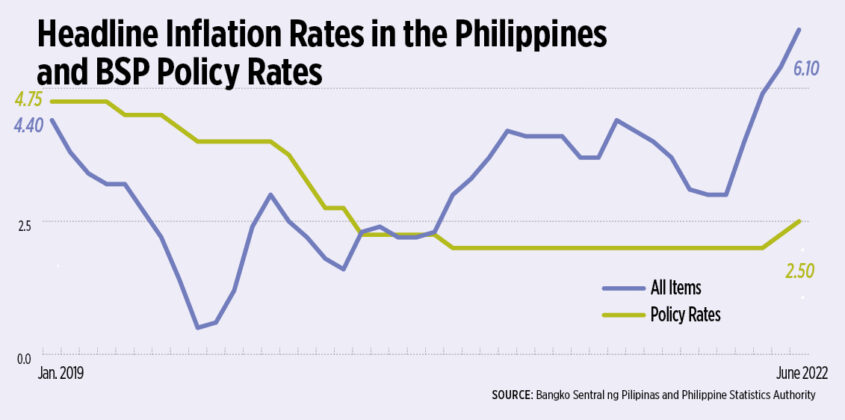

According to the Bangko Sentral ng Pilipinas (BSP), electronic payments have reached P8.45 billion and financial transactions have reached 1.4 million in the first half of 2022.

In the latest Financial Inclusions Survey, the number of banked Filipinos reached more than half of the population with 36% having digital wallet accounts, up from the 8% in 2019. Majority came from the low- to middle-income population putting 27.5 million Filipinos having digital wallet accounts.

Online financial transactions also surged by 60% in 2021 from 17% in 2019. According to the survey, the lack of awareness and weak mobile signal and slow internet connection were the main reasons for why other Filipinos are still not transacting online.

Last April 29, Maya announced its digital banking services via app. As one of the six digital bank licensees under the BSP, Maya’s edge against other banks is its all-in-one service from e-wallet, to banking, to investments via cryptocurrency with their upgraded app.

To know more about the new and improved Maya, BusinessWorld reached out to Shailesh Baidwan, PayMaya Group President and Maya Bank Co-founder, via e-mail interview.

Here’s the excerpt of the interview:

What are the new additions in the rebranding of PayMaya to Maya? How is the performance of the e-wallet and the banking of Maya since its reopening? How many users does Maya Bank have before and after its reopening?

Mr. Baidwan: Maya is the only all-in-one money app in the country and the response has been overwhelmingly positive. Today, Maya remains the highest-rated local finance app in both Google Play and App Store. As of end-June, Maya had over 50 million registered users across its consumer platforms. In less than three months after the new Maya app launched, more than 650,000 customers had opened a Maya Save account, making it the fastest-growing digital banking service in the country.

We seamlessly combined the power of our feature-rich wallet with digital banking services such as savings and credit powered by Maya Bank. Some of the features of Maya include:

• Maya Savings is a high-yield savings account with a 6% introductory interest rate, one of the highest offered by a local bank today.

• Personal Goals allows users to set up to 5 goals with a timeline while enjoying a 6% interest rate.

• Maya Credit is an instant credit line that lets customers borrow up to P15,000 within the app.

• Maya Crypto where customers can buy, hold, and sell 15 coins, including the most popular ones like Bitcoin, Ethereum, and many more, for as low as P1.

• Maya Wallet, the most reliable payments wallet with a 99.94% uptime and a refreshed customer experience.

What specific services/promotions has Maya made to be an inclusive digital bank to Filipinos?

Mr. Baidwan: We’re significantly changing financial services for Filipinos. A key value we’re providing is easier access. In an instant, you can have an interest earning financial account. All you need to do is register to the Maya app and upgrade your account with just one government ID. You can open a savings account with just P1 and there is no maintaining balance.

On the credit side, we’re able to offer instant loans to both our consumers and MSME (micro, small, and medium enterprises) partners all within our apps because we have a view of their payment transaction history.

We also made the experience seamless. Because the Maya has banking, payments, and e-wallet all in one money app, we’re making it hassle-free for consumers to deposit, withdraw, and maximize their earnings for credit, payments, and crypto investment. Moreover, our savings and credit are powered by Maya Bank, our own digital bank, so you don’t need to submit new requirements to another third-party provider.

We’re also offering the best rates. The Maya Save is a high-yield savings account, with up to 6% interest rate that can be enjoyed until September 2022.

We introduce digital finance features through groundbreaking campaigns that are both rewarding and educational. We were the first to offer an Early Access Challenge with gamified missions, allowing customers to earn cashback as they discover and use the Maya app features. We are making investments more exciting, starting with easy and seamless crypto. We did the country’s first Bitcoin millionaire promo and we have embedded educational tutorials and how to’s in our Maya crypto feature. Today, our promos are not just rewarding, they also promote financial fitness and digital adoption.

As one of the six license holders of digital banking in the Philippines, what is the difference of Maya Bank compared with other digital banks? How many Filipinos have opened a bank account through Maya? And how does Maya make digital banking easier for its customers?

Mr. Baidwan: What makes Maya so powerful and unique is the all-in-one money experience we provide customers. Apart from offering progressive digital banking services like high-yield savings and credit, we also have a feature-rich wallet that they can use for convenient cashless payments, and even to start their crypto journey. No other fintech in the Philippines can offer all these services in one platform.

Another important key differentiator for Maya is our on-ground touchpoints, boosted by our agent network Maya Center (formerly known as Smart Padala), with over 65,000 touchpoints all over the country. With this, cashing in and out of Maya is as easy as going to your neighborhood sari-sari store, with Maya Center.

Because we’re also the leading payments processor for all types of businesses, customers can pay in over 760,000 registered merchants nationwide — whether via QR (quick response code), their Maya card at all Visa and Mastercard-accepting stores worldwide, or via their mobile number online. Even customers of other banks integrated with QR Ph, the national standard for QR payments, can pay merchants using our Maya QR as we lead in the deployment nationwide.

Maya has introduced cryptocurrency services. Given this, how is the performance and reception of customers to cryptocurrency for the past two months? Has cryptocurrency been booming for e-wallet consumers?

Mr. Baidwan: Three months since launching our crypto feature, we’ve registered an outstanding surge in crypto usage and volume, exceeding our initial goals. It’s because Maya Crypto offers an all-in-one experience with low barrier to entry. All you need is an upgraded account, and you can start buying crypto with just P1.00. We’re changing the game with exciting features and more coins soon.

How do you promote cryptocurrency for those who have no knowledge about it? Does your learning guides for cryptocurrency in the app been helpful for your customers? And what promotions do you currently have to convince your customers to try crypto?

Mr. Baidwan: While there is a lot of interest on crypto among Filipinos, it remains to be a daunting subject for many, so we made sure that Maya Crypto includes a Learn tab. Maya is the only app with this helpful guide. We also produce educational content via our own social media channels and via content partnerships with finance experts.

The pandemic has been tough to most businesses and banks, a few retail banks moved out of the country this year. How is Maya Bank handling pressures and the current economic landscape to avoid ending up like other digital banks stopping operations while also continuing to promote digital banking?

Mr. Baidwan: The opportunity for Maya is big as the Philippines still has a large population of underserved and unbanked consumers and MSMEs. We have moved beyond payments with digital banking. We pursued our own digital banking license because we have a deep understanding of the market that we want to serve. At the same time, Maya offers much more than digital banking because of our unique payment ecosystem.

We have set up Maya with customers at the front and center. Thanks to our digital payments business, we have a ready base of 50 million customers and over 760,000 merchant touchpoints ready to leap forward into digital banking. We are using insights and data from the payment transactions to create the next level of relevant products for the customers.

Second, we are a digital-first company, so this gives us a way to innovate very fast and roll out very quickly. For example, we do app releases every two to three weeks as our standard sprint. This gives us extraordinary agility, even among banks and other fintechs.

Third, we are used to a very high frequency of transactions, and our digital capability enables us to handle micro transactions on a broad scale. Because we’re digital, it also gives us the ability to offer innovative products with higher margin and more extensive use cases.

Lastly, we’re leveraging on our existing nationwide ecosystem that we built over the years to sustain and accelerate our digital banking system. We’re bringing digital banking closer to our Maya app customers, Maya Business partner merchants, and Maya Center agents. On top of that, we are scaling our efforts faster as we leverage our key partnerships with various conglomerates, starting with the MVP group of companies and key large merchants.

What are your plans for the rest of the year, as well as the medium- and long-term goals of the rebranded Maya? Are there other products/services Maya is planning to make banking easier for its customers and to include other unbanked Filipinos in the digital banking landscape?

Mr. Baidwan: We’re extremely pleased with our fast growth and progress. Over the next months, expect more exciting services and a better experience from Maya. On the consumer side, we’re expanding the use cases for our wallet as we introduce new digital banking services, including more investment and lending products. On the enterprise side, we’re going heavy on new offers for MSMEs as we also strengthen our payment acceptance presence nationwide.

Maya has separate offers for businesses such as Maya Business and loaning through Maya Credit. How affordable is this? What specific offers do these have to help businesses and borrowers and how are you making the process easier compared with other banks?

Mr. Baidwan: Through our Maya Business, we’re making it much easier for all types of merchants to grow their businesses. We enable them to accept digital payments with our end-to-end omnichannel solutions. We offer the most competitive rates as we’re a direct acquirer of major payment schemes like Visa, Mastercard, JCB, Bancnet, and QR Ph.

We are also offering a fully digital business deposit account that offers free PESONet transfers and a 1.5% interest rate, four times higher than traditional banks. We’re already providing credit lines for MSMEs, starting with our agent networks and soon, we’re going to offer more lending products.

Businesses can also easily disburse employee payroll, settle taxes, and pay their suppliers with our platform. With our all-in-one platform, merchants can efficiently run their day-to-day operations so they can focus on growing their business.

Any advice you want to give to Filipinos using e-wallet and digital banks for the rest of the year and the coming years?

Mr. Baidwan: Choose a simple and seamless money experience. For instance, with Maya, you just need one app to save, spend, invest, and more.

Use it for everyday transactions. As you earn more rewards, you’re also building your digital credit footprint and providers like Maya can offer you the most relevant offers.

Safeguard your account. Securing your finances starts with basic principles — don’t share your account passwords with anyone else, be careful with sharing personal information, and review carefully any transactions.

Have a money maker mindset. Start saving money so you can earn from your interest, which you can maximize for savings, credit, insurance, and more.

What other products or services you are planning to launch in the near term? Anything else you would like to share with us?

Mr. Baidwan: We’re very excited about Maya and how we’re creating the end-to-end digital financials services platform of the Philippines. We’re going big on our ‘personalized finance’ thrust with game-changing offerings. We have our Dark Mode feature –— ideal to reduce eye strain that comes with prolonged screen time. We will also introduce a feature that will allow users to send or receive money just by typing a username, instead of a mobile number. We’re bringing more innovative lending and investment products to consumers and we’re changing the game for crypto with our retail payments ecosystem.

For Maya Business clients, we’re offering a business deposit account that offers free PESONet transfers and a 1.5% interest rate, four times higher than traditional banks. Soon, we will also introduce more credit products to our merchant partners and to their customers.