[B-SIDE Podcast] The danger of dynasties

Follow us on Spotify BusinessWorld B-Side

Antonio G. M. La Viña, a constitutional law professor at the University of the Philippines, thinks that the Philippine Constitutional Commission of 1986 made a mistake in giving Congress the power to decide on the prohibition of political dynasties instead of imposing limitations right then and there.

In this B-Side episode, Mr. La Viña talks to BusinessWorld reporter Patricia B. Mirasol about family dynasties, federalism, and structural change.

This is third and final episode in an Explainer series that previously featured Bernardo M. Villegas, an economist and one of the framers of the 1987 Constitution, and Norberto B. Gonzales, a former National Defense Secretary and National Security Adviser who ran for president in the 2022 elections.

TAKEAWAYS

Since congress has no incentive to amend the Constitution, a constitutional convention is a better option.

“Congress cannot be trusted to change the Constitution, because there’s self-interest there,” Mr. La Viña said, noting that 60%–70% of the lawmaking body is controlled by political families. “We have all of these husbands and wives and daughters and sons in multiple positions. It’s scandalous.”

The better avenue, he pointed out, is a constitutional convention or a body composed of elected representatives created solely to propose amendments or revisions.

Meanwhile, the Supreme Court ruled that a people’s initiative — in which 12% of the total registered voters with every legislative district represented by at least 3% of registered voters therein — can only be used for purposes of amendments, and not a wholesale revision of the constitution.

There is a ‘right time’ for changing the Constitution.

First is when a country is in a serious crisis, such as when the president is sick or there is a budget deadlock, Mr. La Viña said.

The second is a matter of timing.

“Our experience is that we can only change the Constitution during the first two years of the presidency,” he told BusinessWorld. “After that, it’s all about politics going into the presidential elections … Nobody’s interested anymore in good structural change; it’s all about positioning of families and individuals.”

Federalism is dangerous without prohibiting political dynasties.

Federalism is dangerous without an anti-dynasty provision as it will allow families to control each region, thereby dividing the Philippines even more, Mr. La Viña said.

A shift to a mixed presidential-parliamentary system like what France has would also be good, he added.

“I would like more limits in the powers of the president. I would like more powers for the legislature and the Supreme Court. I would like stronger positions on graft and corruption,” he said. “I would like to run away from a system that’s celebrity-based, that’s family-based.”

This episode was recorded in September 2022 at the Manila Observatory in Ateneo de Manila University in Quezon City. Produced by Joseph Emmanuel L. Garcia and Sam L. Marcelo.

Follow us on Spotify BusinessWorld B-Side

SM Supermalls begins 100 Days of Happiness

Officially starts the Christmas countdown by creating a circle of happiness among Filipinos

To kickstart the Christmas countdown, SM Supermalls began its 100 Days of Happiness last September 16, where they aim to create a circle of happiness with 76 participating malls, shoppers, the marginalized communities of women, persons deprived of liberty, artisans, cause-oriented organizations, and select local government units.

“We want to create a circle of happiness in all our SM malls by featuring products of cause-oriented programs which we will offer to our shoppers who, in turn, give them to friends and family, and ultimately, benefit the communities that created these products,” said SM Supermalls President Steven T. Tan.

Through the campaign, SM Supermalls encourages Filipinos to support the advocacies of individuals and organizations that provide opportunities and create livelihood for their communities. For this year, SM partnered with bag designer Zarah Juan, Spark PH, the Girl Scouts of the Philippines (GSP), the Association of Foot and Mouth Artists of the Philippines, UNICEF, and the Quezon City LGU for its Vote to Tote initiative, among others.

The launch event held at SM North EDSA The Block was attended by SM Supermalls President Steven Tan and SVP for Marketing Joaquin San Agustin; Quezon City Mayor Joy Belmonte, Vice Mayor Gian Sotto, and select councilors of the city; Spark PH Founder Mica Teves; GSP President Dr. Nina Lim-Yuson; designer Zarah Juan; and Brownies Unlimited Marketing head Dustin Ngo.

Equipping young girls to lead and build the future, one box of brownies at a time

For this year’s 100 Days campaign, SM Megamall, along with 9 other SM malls, is collaborating with Brownies Unlimited and the Girl Scouts of the Philippines. For every purchase of a special GSP-themed box of brownies in-mall and via the SM Malls Online App, one girl will be sponsored with a GSP membership for a year.

“We have a lot of young girls across the country and they’ve had such difficult times during the pandemic. Our membership dropped significantly. By buying a box, you can sponsor a girl for one year and she can learn so many things like being independent, loving her country more, and helping her community,” said GSP President Nina Lim-Yuson.

Recently, SM Supermalls helped the GSP vaccinate all its 70,000 members nationwide. By providing them with convenient and safe COVID-19 vaccines, SM Supermalls was able to ensure that the GSP members have access to quality healthcare services.

SM shoppers can purchase a box of brownies from 46 Brownies Unlimited branches nationwide and the SM Malls Online App.

Giving marginalized women and persons deprived of liberty hope for the future

Apart from the GSP partnership, SM Supermalls also partnered with the local government of Quezon City for its Vote to Tote program, Spark PH, and bag designer Zarah Juan to sell upcycled tarpaulin handmade tote bags sewn by marginalized women and female persons deprived of liberty.

“Christmas is all about giving. We are very happy that this year, the communities of Quezon City are included as beneficiaries in this program. And apart from helping the women in our communities, we are also able to help the environment by upcycling 70 tons of election tarpaulins that we’ve collected.” said Mayor Belmonte.

Juan, the designer, was the brainchild of the upcycling initiative. “During the elections, there were tons of election campaign wastes. I wanted to do something and I thought I have my platform– my designs. If my designs can actually solve this problem, then it’s worthwhile. Then I pitched the idea to Maica Teves, the founder of Spark PH. From there, we gathered all the help we can– from the Quezon City LGU who will help us collect tarpaulins, the women communities that can help us create, and SM Supermalls who can provide us the platform to distribute.”

A Happiness Walk was done to showcase the upcycled tote bags that shoppers can buy in SM malls. Joining the Happiness Walk were men and women of substance including select Girl Scouts members, Jeremy Lapena and Bernce Sevilla of the Downs Syndrome Association of the Phils, Mylene Abiva of WomenBiz, media celebrities Ces Oreña Drilon, and Gina Pareño among others.

The proceeds of the upcycled tote bags will be given to the women PDLs in Camp Karingal, and the marginalized women of Barangays Sto. Cristo, Greater Lagro, and Pinyahan in Quezon City. The tote bags will be sold in the following SM malls:

- SM Aura Premier

- SM Southmall

- SM City Fairview

- SM City North EDSA

- SM Megamall

Helping a community of artists

And in the south of Metro Manila, the SM Mall of Asia family will be partnering with the Association of Foot and Mouth Artists in selling painted Christmas cards to the shoppers.

“All these and more will start to unfold in the coming days as we continue spreading happiness across all SM malls around the country. Let us not waste our next 100 days and use it to make one another happy by giving. Today, let the countdown begin to a hundred days of happiness!” Tan closed.

This is the second time SM Supermalls has started a holiday countdown campaign. In 2021, the biggest mall network in the Philippines showed the world more than a hundred ways of giving through 100 Days of Caring. Underserved communities surrounding the 76 SM malls were provided with their urgent needs through in-kind and monetary donations by the malls, its various business units, and the employees.

For the list of all partner institutions and their beneficiaries visit www.smsupermalls.com and follow @smsupermalls on all social media accounts.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by enabling them to publish their stories directly on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber to get more updates from BusinessWorld: https://bit.ly/3hv6bLA.

Huawei offers technical support and a platform for developers to shine in Apps UP 2022

App developers can still join Huawei’s global app innovation contest, Apps UP 2022, where they can enjoy access to technical support and Huawei Mobile Services (HMS) core capabilities to fast-track their app development and gain global exposure in the hundreds of millions.

Intending to inspire developers to innovate, Apps UP gathers developers from all over the world to create an app ecosystem that delivers high-level user experiences and build a connected and smart future. Launched on 24 June, Apps UP registration will run until 9 October 2022 (UTC +8).

In the Asia-Pacific (APAC) region, Apps UP developers stand a chance to win from an attractive prize pool of US $200,000 (more than PHP11 million) across nine award categories such as the ‘Best HMS Innovation Award’ and ‘Best Social Impact App’.

Participating Apps UP developers also have the opportunity to enter the global market as they can onboard their applications on HUAWEI’s AppGallery and gain exposure to 730,000 million users on the platform. To accelerate the launch of their apps, developers will receive support in the form of technical advice, online tutorials, and expert coaching from Huawei. Developers with existing applications will also be eligible for the contest by integrating their apps with at least one HMS open capability to enhance their apps.

Enhancing apps with HMS

HMS Core’s open device and cloud capabilities allow developers to deliver enhanced user experiences and pursue groundbreaking innovation of their apps. The array of HMS core kits can help developers deliver a diverse, multi-scenario, and multi-functional experience for their users with kits in seven technical domains such as app services, media, graphics, security, system, smart device, and Artificial Intelligence.

Huawei has 5.75 million registered developers as of June, and over 216,000 apps globally have been integrated with HMS Core.

Among the many apps that HMS Core has helped enhance is Blood Bank, developed by a team from Malaysia, who won the ‘Tech Women’s Award’ in Apps UP 2021.

Acutely aware of the problem of blood supply shortage, three computer-science undergraduates set out to transform existing methods of the blood donation process by developing a mobile app to increase accessibility to information and to connect blood donors and seekers with each other.

They integrated the app with the Location kit, Map kit, Ads kit, and Account kit from the HMS Core. With the location and map kits applied in the app, users are able to locate nearby hospitals easily and have a more precise location indicated on the map.

“The process of integrating HMS Core kits have been easy. We were able to integrate the kits with ready-made codes and user-friendly APIs,” the developers shared.

Another app integrated with HMS Core kits is Land of Calm. Developed by Team Alpha, which consists of two members, Supuni D. Jayasinghe and Krishalika Dilani from Sri Lanka, the app helps users achieve their sleep goals, practise meditation, self-monitor their anxiety levels, and access calm audio playlists and stories.

Team Alpha utilised the Analytics Kit, Account Kit, Audio Kit, and ML Kit to develop Land of Calm, which won the ‘Best HMS Core Innovation Award’ in Apps UP 2021.

“These kits provide a unique experience to our app users. The kit integration was easy with the provided documentation support, guidance from experts and advice we received via HUAWEI Developer Forum,” the team said.

Apart from the support through HMS core kits, the Apps UP experience itself has been beneficial for both Blood Bank and Land of Calm developers.

For the developers of Blood Bank, participating in Apps UP has helped opened up doors for them. “After participating in Apps UP and winning an award from the competition, we believe that it has helped us in our career. It has given us greater exposure on a global stage and increased our presence even on social media platforms like LinkedIn. Our participation in AppsUp 2021 has attracted employers and head-hunters, giving us more promising prospects in the future,” they shared.

“An absolute beginners in app development, Apps UP was a wonderful experience for Team Alpha,” the Land of Calm developers said. “Participants will be well-equipped with the latest knowledge of app development and gain exciting experience and knowledge throughout the contest period. This is an opportunity no app developer should miss.”

Registration for Apps UP

Apps UP is open for developers, whether you are a student, hobbyist, or professional with an existing app or an idea to create a new one, you can join the competition individually or as a team of no more than four members. The app must integrate at least one HMS open capability or service, and run seamlessly on devices with HMS installed.

Evaluation of the works will be done through a review by judges composed of industry leaders, followed by a public voting exercise.

App developers who want to participate in the Apps UP can submit their entries by 6 p.m. on 9 October 2022 (UTC +8).

To register for Huawei’s Apps UP 2022, visit the website here.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by enabling them to publish their stories directly on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber to get more updates from BusinessWorld: https://bit.ly/3hv6bLA.

Okada Manila is truly back to business as usual

Last Sept. 2, 2022, the Philippine Amusement and Gaming Corp. (PAGCOR) issued a resolution that ordered the Dindo Espeleta and Tonyboy Cojuangco-led group to cease and desist from involving themselves in connection with Okada Manila’s operations.

PAGCOR, with the assistance of the Philippine National Police (PNP), enforced the order and commanded their group to peacefully and immediately vacate the premises. This allowed the casino resort’s parent company, Tiger Resort Asia Ltd. (TRAL) of Hong Kong, and the Tiger Resort board to reassume exercising normal operational and management control of Okada Manila, just as they have been doing for the last five years.

This decisive government-led action eliminates the possibility of further disruptions and ensures for our guests full enjoyment of the Okada Manila experience.

To alleviate any lingering guest or employee concerns, security in the Okada Manila premises and immediate vicinity has been enhanced.

This, along with the always extraordinary service from Okada Manila personnel, will allow our guests to continue to fully enjoy Okada Manila in the same manner that they have come to expect.

This, along with the always extraordinary service from Okada Manila personnel, will allow our guests to continue to fully enjoy Okada Manila in the same manner that they have come to expect.

Thank you and we look forward to continue welcoming our guests and business partners in Okada Manila!

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by enabling them to publish their stories directly on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber to get more updates from BusinessWorld: https://bit.ly/3hv6bLA.

BSP to hike rates by 50 bps — poll

By Keisha B. Ta-asan

THE BANGKO SENTRAL ng Pilipinas (BSP) is likely to continue its rate hike cycle on Thursday, with several analysts forecasting a 50-basis-point (bp) increase as the US Federal Reserve is also expected to further tighten policy this week.

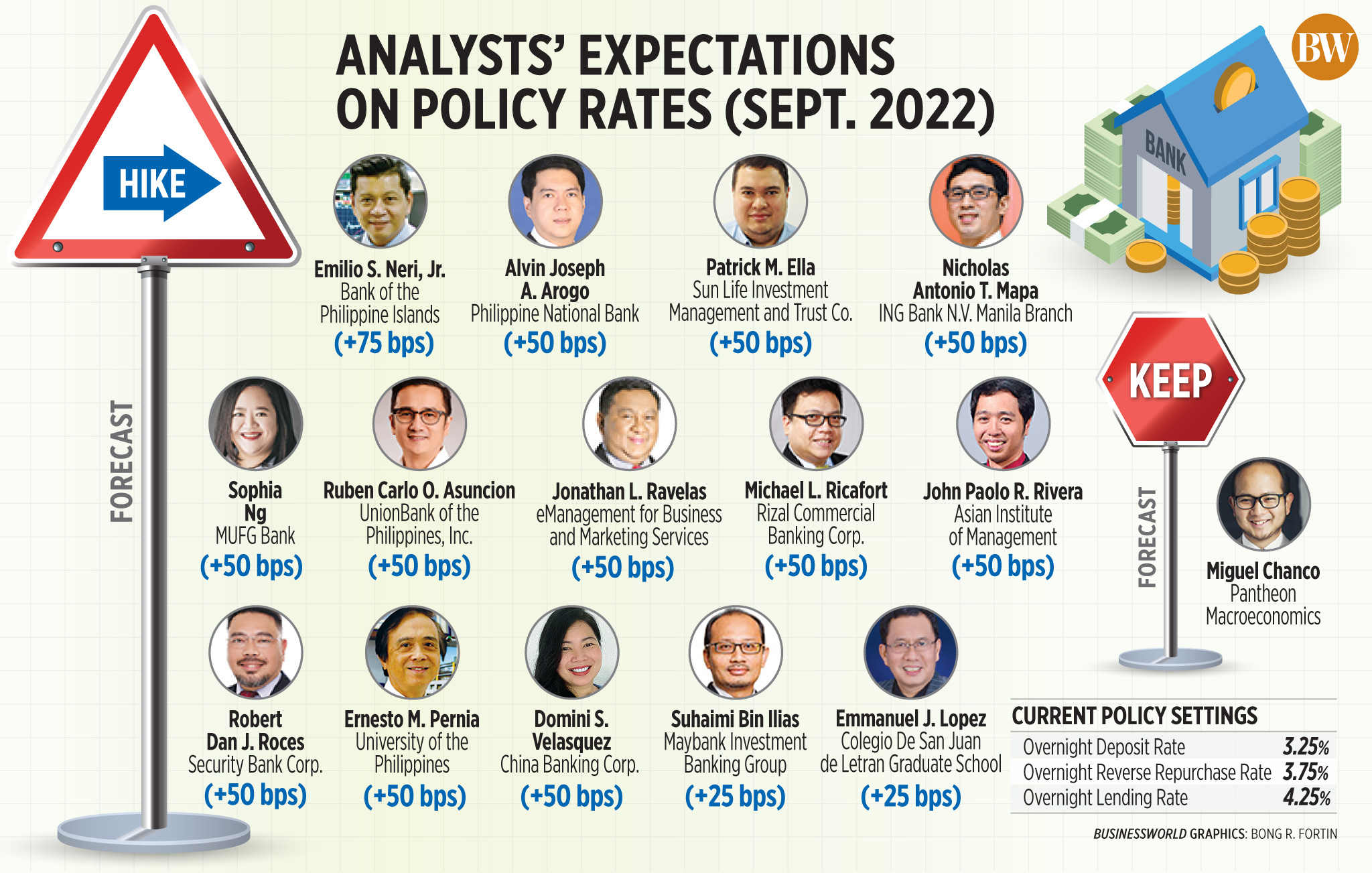

A BusinessWorld poll last week showed 14 out of 15 analysts expect the Monetary Board (MB) to raise its benchmark interest rate at its Sept. 22 meeting.

Eleven analysts believe the central bank will deliver a hike of 50 bps, while two analysts see a 25-bp increase. One analyst expects a 75-bp hike, while another sees the BSP keeping rates unchanged.

“Inflation and peso weakness will remain the key consideration in the upcoming Monetary Board meeting, and we expect it to raise interest rates by 50 bps to bring the RRP (reverse repurchase rate) to 4.25%,” Security Bank Corp. Chief Economist Robert Dan J. Roces said in an e-mail.

Latest data from the Philippine Statistics Authority (PSA) showed the consumer price index (CPI) climbed 6.3% year on year in August, from the nearly four-year high of 6.4% in July. It remained significantly higher than the 4.4% seen in August 2021.

August marked the fifth consecutive month that inflation exceeded the BSP’s 2-4% target range for the year.

“Inflation may have eased slightly to 6.3% year on year but core CPI accelerated, and the (Philippine peso) fell to new record lows against the (US dollar) in recent weeks which would raise imported inflationary pressures,” MUFG Bank currency analyst Sophia Ng said in an e-mail.

The local unit closed at a new all-time low of P57.43 on Friday, dropping by 27 centavos from its P57.16 finish on Thursday, data from the Bankers Association of the Philippines showed.

For the year so far, the peso has weakened by P6.43 or 12.6% from its Dec. 31, 2021 close of P51 per dollar.

“Further, the (Federal Open Market Committee) is likely to signal a more aggressive pace of tightening in its updated dot plot at the September meeting. A more aggressive Fed means the BSP may have to hike more. Hence, a 50-bp hike at the upcoming meeting seems to be a more likely scenario rather than a modest 25-bp increase,” Ms. Ng added.

The US Federal Reserve is expected to announce a third consecutive 75-bp hike at its meeting this week.

Bank of the Philippine Islands (BPI) Lead Economist Emilio S. Neri, Jr. anticipates a 75-bp hike from the BSP this week.

“We are also revising our end 2022 RRP forecast from 4.25% to 5.25% on stubbornly elevated US core inflation,” Mr. Neri said.

As US inflation unexpectedly quickened to 8.3% year on year in August, market players are now expecting another large rate increase from the US central bank at its Sept. 20-21 meeting.

“The BSP will likely raise the RRP rate by 50 bps assuming the FOMC raises the Fed funds rate by 75 bps,” Philippine National Bank economist Alvin Joseph A. Arogo said in an e-mail.

The FOMC raised the target range for the federal funds rate by 75 bps in July. The US central bank’s overnight interest rate is now at a level between 2.25% and 2.5%.

“As the peso breached its all-time low, we expect BSP to be more mindful of further depreciation pressures as a cheap peso will add on to inflation for the rest of the year and in 2023,” China Banking Corp. Chief Economist Domini S. Velasquez said in an e-mail.

“The impact is especially more pronounced as the government is stepping up importation of essential goods to address domestic shortages,” Ms. Velasquez said.

The Sugar Regulatory Administration (SRA) issued Sugar Order (SO) No. 2 which authorized the import of 150,000 metric tons (MT) of refined sugar for the current crop year “to ensure domestic supply and manage sugar prices.”

Earlier this month as well, President Ferdinand R. Marcos, Jr. said he discussed the possibility of securing coal and fertilizer supply from Indonesia during his meeting with President Joko Widodo.

“Growth momentum, though slowing, remains strong and as such will be able to absorb the hike. This move will also put a premium over the expected 75-bp hike by the US Fed before the MB meeting,” Mr. Roces said.

“The economy is in full recovery and can handle tightening and we expect BSP to do so, taking the policy rate to 4.75% by yearend with follow-up rate hikes at the last two meetings for the year,” ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in an e-mail.

The Philippine economy expanded by 7.4% in the second quarter as rising inflation weighed on consumer spending, based on preliminary data released by the PSA. To date, gross domestic product (GDP) grew by 7.8%, slightly above the 6.5-7.5% government target.

“However, to support the relatively smooth flow of the economy and investment including employment, the BSP is expected to keep policy rates to a minimum,” Colegio de San Juan de Letran Graduate School Associate Professor Emmanuel J. Lopez said, adding that he expects the BSP to raise by 25 bps on Thursday.

“We are looking at a 25-bp hike to 4% as BSP eases the rate hike quantum after the 75-bp hike in July and 50-bp hike in Aug. At this juncture we expect BSP rate to settle at 4%,” Maybank Investment Bank Chief Economist Suhaimi Bin Ilias said.

The Monetary Board has increased borrowing costs by 175 bps so far this year, bringing the overnight repurchase rate to 3.75%.

“The risk to our view is BSP decides to be more hawkish in response to US Fed rate hike which is expected to be another 75-bp hike at the Sept. 20-21 FOMC meeting, mainly to stabilize Philippines peso vs US dollar,” Mr. Ilias added.

After Thursday, there are two more Monetary Board meetings scheduled this year — Nov. 11, and Dec. 15.

IT-BPM firms’ move to BoI will be seamless, says Trade department

By Revin Mikhael D. Ochave, Reporter

TRADE SECRETARY Alfredo E. Pascual vowed a seamless transfer of the registration of information technology and business process management (IT-BPM) firms from the Philippine Economic Zone Authority (PEZA) to the Board of Investments (BoI).

“The procedure for transfer of registration from PEZA to BoI will be seamless — to be carried out expeditiously,” Mr. Pascual said in a statement sent to reporters over the weekend.

Mr. Pascual, who is also the chair of both PEZA and BoI, said up to 100% work-from-home (WFH) arrangements would also be available to IT-BPM firms that will be registered for tax incentives in the future.

“From the beginning, our priority has been to secure a solution for the sector’s WFH setup, which has become the new normal post-pandemic,” Mr. Pascual said.

His assurance comes after the Fiscal Incentives Review Board (FIRB) announced last week that registered IT-BPM firms in economic zones (ecozones) can implement full WFH arrangements and still enjoy fiscal incentives by transferring their registration to the BoI, in a bid to address the issue without violating existing laws.

Republic Act No. 11534 or the Corporate Recovery and Tax Incentives for Enterprises (CREATE) mandates registered business enterprises (RBEs), including IT-BPM firms, to conduct activities within the ecozone in order to avail of fiscal incentives.

The FIRB earlier announced that the 70% on-site work and 30% WFH arrangement ratio currently enjoyed by IT-BPM firms has been extended until Dec. 31 this year to give time for the transfer. This is also in accordance with the state of calamity extension under Proclamation No. 57 recently signed by President Ferdinand R. Marcos, Jr.

Registered IT-BPM firms should inform the PEZA of their intention to transfer registration, the Department of Trade and Industry (DTI) said.

“The PEZA will then endorse the request to the BoI for the issuance of a Certificate of Registration, which will indicate the remaining incentives. PEZA shall administer the incentives and continue monitoring the transferee firms’ compliance,” the DTI said.

Tereso O. Panga, PEZA officer-in-charge and deputy director-general for policy and planning, said that a law should be passed to make this permanent.

“The paper transfer is just an interim arrangement to preserve the incentives of the IT locators while availing of WFH arrangement in their designated IT centers,” Mr. Panga said in a Viber message.

“A more permanent solution is the bill that will allow the PEZA IT locators to avail of WFH with incentives that will put them on an equal footing with the BoI RBEs and following the lead of India to make the Philippines more attractive especially to global ICT investors,” he added.

Mr. Panga cited pending measures such as Senate Bill (SB) No. 135 filed by Senator Emmanuel Joel J. Villanueva and SB No. 643 filed by Senator Maria Imelda “Imee” R. Marcos that seek to amend Section 309 of the CREATE Act to allow WFH while allowing IT-BPM firms to enjoy tax incentives.

He also mentioned SB No. 175 filed by Senator Francis N. Tolentino which seeks to amend Republic Act No. 11165 or the Telecommuting Act to expand the law’s coverage and to require employers to provide a P1,000 nontaxable allowance per month to employees.

Both the PEZA and the BoI offer the same incentives for interested locators, according to Mr. Panga.

“Under CREATE, all investment promotion agencies including PEZA and BoI offer the same incentives. For export enterprises in the case [of] IT-BPM firms, their qualified projects will enjoy four to seven years of income tax holiday, plus 10 years of special corporate income tax or enhanced deduction,” Mr. Panga said.

But the BoI does not have a one-stop shop center for registration, he noted.

“Under the paper transfer scheme, PEZA will continue to provide the BoI RBEs operating in IT centers the same one-stop service. BoI registration will simply allow the IT locators to keep their incentives while doing WFH,” he added.

Further, Mr. Panga urged the FIRB to consider the previous PEZA proposal to extend the 30% WFH for IT-BPMs until March 2023.

“We will abide by the FIRB decision and support any initiative that will keep, expand and grow our IT sector,” he said, adding that the agency is working closely with FIRB “as we align to our current policies and the best interest of our industries that will keep, expand and grow our IT sector in the country.”

Emman D. David, Alliance of Call Center Workers co-convenor, said that the extension of the 30% WFH arrangement until end-December is a “small victory.”

“It proves that when workers speak with one voice, their employers and the government should listen,” Mr. David said in a Facebook chat.

“While we are concerned that employers might be hassled by this transfer and find it easier to have their employees to report on-site, we hope that the pertinent government agencies would make this process seamless,” he added.

Jack Madrid, IT and Business Process Association of the Philippines (IBPAP) president, said that the FIRB’s recent pronouncement is a welcome development for the industry.

“IBPAP enthusiastically welcomes this FIRB resolution and thanks DTI for advocating the WFH scheme as a new business reality, and the FIRB for approving the recommendation. The association and its members vow to work even more closely with the government in bringing in more BPO investments, particularly in the higher value-added segments,” Mr. Madrid said in a statement.

In Philippines, tingi thrives amid COVID pandemic, spiraling prices

By Diego Gabriel C. Robles

MA. MICHELLINE L. REYES, 55, operates a mom-and-pop store that sells shampoo in sachets, coffee in packets and other odds and ends in Marikina City near the Philippine capital.

For most of her neighbors with a limited budget, buying small amounts of just about anything is a big help amid spiraling prices and a looming global food crisis.

“Smokers typically buy five sticks of cigarettes, not the whole pack,” Ms. Reyes said in a text message. “It’s the same with eggs. Nobody buys a tray.”

The practice of buying tingi, or in really small amounts, shows just how little money Filipinos have in their pockets, hence the saying “Isang kahig, isang tuka” (One scratch, one peck).

“It’s not an exclusively Filipino thing since it’s essentially borne of poverty and poverty is certainly a universal experience,” Louie C. Montemar, a professor of sociology and political science and a fellow at the Stratbase ADR Institute said in an e-mail.

“It just so happens that we have a rather ‘cute’ and specific term in our national language for what could be roughly translated to English as ‘retail culture,’” he added.

“It just so happens that we have a rather ‘cute’ and specific term in our national language for what could be roughly translated to English as ‘retail culture,’” he added.

“The term ‘tingi culture’ was apparently coined by Filipino author Nicomedes ‘Nick’ M. Joaquin, who saw it rather condescendingly as a ‘heritage of smallness.’”

In his book Culture and History, the late author faulted the Filipino’s habit of buying and selling small as an indication of a nation’s humble economic and commercial ambitions.

“What most astonishes foreigners in the Philippines is that this is a country, perhaps the only one in the world, where people buy and sell one stick of cigarette, half a head of garlic, a dab of pomade, part of the contents of a can or bottle, one single egg, one single banana,” he said.

“I would rather see it as a manifestation of our people’s ability to adapt to poverty,” Mr. Montemar said. “It shows Filipino resilience, innovativeness, creativity and entrepreneurship.”

The lack of income forces households to buy things in small packets especially amid spiraling prices, according to Ateneo de Manila University economics professor Leonardo A. Lanzona.

Filipinos’ retail culture “can be considered a coping mechanism for poor individuals and households, as well as a marketing strategy of companies to tap the latent purchasing power of the bottom of the pyramid,” Cid L. Terosa, a senior economist at the University of Asia and the Pacific, said in an e-mail.

“It became more intense and apparent in 2020 to 2021 because the coronavirus pandemic gravely decapitated their purchasing power,” he added.

The average income of Filipino households fell by 2% year on year to P307,190 in 2021 from three years earlier, according to data from the local statistics agency. About 20 million Filipinos or 18% of the population were living in poverty as of end-2021.

Between 2018 and 2021, the income of 2.32 million more people fell below the per capita threshold, with many of them having been forced to work fewer hours amid coronavirus lockdowns. About 3.5 million Filipinos from 492,000 families fell into poverty.

The amount needed by an average Filipino to meet his monthly basic needs increased to P2,406 last year from P2,151 in 2018. For a family of five, the amount rose to P12,030 from P10,756 a month.

Small entrepreneurs are also suffering amid rising prices. An Asian Development Bank (ADB) study found that the sales of 82.7% of informal businesses dove, though more than three-quarters of these managed to stay open.

Ms. Reyes said her sales were halved at the height of the pandemic after she was forced to close amid strict lockdowns that were one of the longest and strictest in the world.

Filipinos are unlikely to shake off buying sachets — blamed for pollution caused by plastic wastes — any time soon, said Samuel Cabbuag, assistant professor at the University of the Philippines Department of Sociology.

“They will not go to supermarkets and wholesale stores to buy the bigger version of those goods because many of them still could not afford it,” he said. “While prices of these sachet goods are increasing, many people still buy them. At the end of the day, consumption is social.”

Inflation eased to 6.3% in August, bringing the eight-month average to 4.9%, still above the Philippine central bank’s 2-4% target.

The index for food and nonalcoholic beverages that accounts for 38% of the consumer price index slowed to 6.3% from 6.4% a month earlier. While the food index eased to 6.5% from 7.1%, the inflation in sugar, confectionary and desserts quickened to 26% from 17.6%.

Ms. Reyes said small bottled soft drinks, whose prices have risen amid tight sugar supply, are the most popular among her customers.

Core inflation, which disregards the prices of food and fuel, rose to 4.6% last months from 3.9% in July and 2.8% a year earlier.

“The fact that even prices of sachet items increased due to inflation speaks a lot about how limited the resources can be for those who are struggling,” Mr. Cabbuag said.

FINTECH

Ms. Reyes said she only needed P10,000 in capital when she started her mom-and-pop store in 2009. “Before, P10,000 meant more stocks for my store. Now, with the same amount, the supply is lacking.”

Like most sellers, she also had to raise her prices to survive, while making use of digital payment platforms such as GCash to adapt to the times.

“Many customers have been asking if I accept GCash,” she said. “As many as five of 10 customers prefer to pay through that.”

The ADB study found that one of 10 informal businesses in Philippine cities used digital payments in 2020 at the height of the pandemic, when online shopping became the norm.

It added that 17.3% of unregistered household-based businesses accepted digital payments, while 5.8% paid their suppliers digitally. Both were higher than household-based registered companies at 14.3% and 3.6%.

Still, financial technology adoption by these Philippine businesses was lower than their peers in the region at about a quarter for both registered and unregistered household-based companies for customer payments, and between 13.8% and 18.1% when it came to paying their suppliers.

“The key point here is that the sari-sari store links the formal sector to the informal sector, which in turn is linked to poor households,” Mr. Lanzona said. “It plays an important role in the economy.”

The practice of buying and selling products in sachets may not be unique to the Philippines as a developing country, Mr. Montemar said. “But clearly, multinational corporations have adjusted to our tingi culture by developing more products in smaller packages.”

“It is a sign of inefficiency for the whole economy,” Mr. Lanzona said. “For a country that’s aiming to achieve a higher middle-income status, the prevalence of this practice is a clear sign that the goal is a long way off.”

Ms. Reyes, the mom-and-pop store owner, said her business is a big help to her family.

“I managed to eventually invest in a water station,” she said. “I pay the household bills and buying maintenance medicines is not a problem.”

ERC to NGCP: Explain failure to comply with reserve power rules

THE ENERGY Regulatory Commission (ERC) has directed the National Grid Corp. of the Philippines (NGCP) to explain its failure to procure sufficient ancillary services or reserve power to ensure grid security and stability.

In a media release over the weekend, the energy regulatory body said that it issued a show-cause order on Sept. 16 to NGCP due to the power transmission firm’s failure to comply with the Department of Energy’s (DoE) circular issued in October 2021.

The ERC cited three sections of the DoE’s department circular which it said NGCP failed to comply.

Section 4.2 requires NGCP to seek approval from the DoE on its ancillary service agreement procurement plan; Sections 7.4 and 7.5 mandate NGCP to seek the approval of the DoE on the terms of reference of the ancillary service competitive selection process (AS CSP); and Sections 7.1 and 7.11 require NGCP to complete the AS CSP within six months from the effectivity of the circular, the ERC said in the release.

NGCP was given 15 days upon the receipt of the show-cause order to give its explanation, electronically, while it was given another five days to send its explanation through personal service as to why no administrative penalty should be imposed on the cited violations.

“The submission shall also include necessary proof that will support all the allegations in its verified explanation,” the regulator said.

Privately owned NGCP has yet to respond to BusinessWorld’s request for comments.

The DoE issued the department circular last year after power reserves became deficient, resulting in outages.

The ERC said ancillary services “are necessary to support the transmission of capacity and energy from resources to loads, while maintaining reliable operation of the grid in accordance with good utility practice and existing rules.”

The competitive selection of ancillary services providers is required before the awarding of contracts.

The ERC said that while NGCP issued a schedule and terms of reference for the conduct of the AS CSP, it has yet to comply with the existing policies set by the DoE. — Ashley Erika O. Jose

Automakers want pickup trucks to stay tax-exempt

THE excise tax exemption being enjoyed by pickup trucks should remain as it helps local businesses, according to the Chamber of Automotive Manufacturers of the Philippines, Inc. (CAMPI).

“The current setup for excise tax should be maintained because this is very helpful for small businesses,” CAMPI President Rommel R. Gutierrez said during an interview on the sidelines of the 8th Philippine International Motor Show (PIMS) in Pasay City last week.

Further, he said that the proposal to remove the excise tax exemption would not only affect the local automotive industry, but also local businesses.

“This excise tax is not just about the auto industry. It’s about the multiplier effect of these things because micro, small, and medium enterprises (MSMEs) are using these (pickups) for their businesses,” Mr. Gutierrez said.

However, Trade Secretary Alfredo E. Pascual told reporters in a Viber message over the weekend that he is in favor of a review of the excise tax exemption on double-cab pickup trucks.

Mr. Pascual said that a review is needed since the imported double-cab pickup truck is “often a fully accessorized passenger unit” and a “lifestyle vehicle.”

“The regular single-cab and chassis pickup, the real utility workhorse vehicle, has always been exempted from excise tax even before Republic Act No. 10963 or the Tax Reform for Acceleration and Inclusion (TRAIN) Law. The TRAIN Law extended the exemption to the double-cab pickup ostensibly to support the cargo mobility requirement of the MSME sector,” Mr. Pascual said, adding that the imported double-cab pickup is “far from the need and reach of MSMEs.”

“Since the excise tax exemption applies to the whole vehicle, the double-cab pickup accessories also get exempted from the excise tax,” he said about favoring a review of the excise tax exemption on double-cab pickup trucks.

In August, the House Ways and Means Committee approved an expanded bill containing the fourth package of the Comprehensive Tax Reform Program, which also provided for the removal of the excise tax exemption on pickup trucks.

According to the Finance department, the elimination of the excise tax exemption is projected to generate P52.6 billion worth of additional revenues from 2022 to 2026.

Meanwhile, Mr. Gutierrez said that CAMPI is still preparing its position paper regarding the proposed removal of the excise tax exemption for pickup trucks.

“It is good that we have supporters from the Senate and House. We will discuss with them as soon as possible,” he said.

Mr. Gutierrez previously said that the proposal is a concern for the industry since it is expected to affect prices and sales.

He added that removing the excise tax exemption would hinder the recovery of the local automotive industry.

The Latest CAMPI data showed that industry sales from January to August 2022 increased by 25.1% to 212,872 sold units versus 170,112 units in the same period last year. — Revin Mikhael D. Ochave

Saving the planet while saving one’s skin

By Joseph L. Garcia, Reporter

MORE than helping the face, Garnier is helping the planet.

A newly launched serum from the L’Oreal-owned brand Garnier — the Bright Complete Anti-Acne Serum — claims to be able to clear acne marks and dark spots in a matter of three days to about a week. The formulation containing 4% Vitamin C reduces dark spots, while Niacinamide soothes the skin and fades acne marks. Salicylic acid reduces acne and controls oil production, while Alpha Hydroxy Acid (AHA), a popular ingredient in beauty products, exfoliates skin and decreases inflammation, tightens pores, and helps prevent acne. It’s recommended to be used with the Garnier Ant-Acne Foam.

More than that, however, it’s part of a thrust for Garnier’s overall Green Beauty campaign.

“Globally, we’re fixing all of our manufacturing plans to be carbon-neutral,” Garnier Philippines Marketing Director Josteen Vega told BusinessWorld during the Garnier Green Gala on Sept. 5 in Quezon City. “We’re really making sure that by 2025 or 2026, we don’t use any virgin plastic anymore.”

Locally, they’re concentrating on more “Filipino-relevant” initiatives. These include plastic collecting efforts with its partner, Watsons, and donating a mangrove seedling to Communities Organized for Resource Allocation (CORA) to plant in Leyte for every purchase of the Garnier All-Star kit. Finally, for its online store on Lazada and Shopee, it has shifted packaging from plastic to recyclable paper.

The packaging itself has also been made more sustainable. Its makeup-removing Micellar Water’s bottle is made of post-consumer recycled plastic; while its serums come in recyclable glass bottles. Plastic waste is still an issue, but Mr. Vega says they’ve been working on it. “To be very honest with you, we have sachets. Globally, we’re moving towards moving away from sachets by 2025. For the meantime, we’re influencing from within.”

The ingredients for the products are also largely sustainably derived: “We partner with communities around the world. We pick communities that actually produce these ingredients, and we source it from them.”

Garnier was acquired by French cosmetics giant L’Oreal in the 1970s. With the push of its Green Beauty campaign, it would seem that only Garnier is vocal in its environmental advocacies. However, L’Oreal has not tested products on animals for about 30 years. “The whole company is green,” said Mr. Vega. “It’s just that with Garnier, it’s always been its core; it’s always been its essence.”

He cites that L’Oreal Paris has advocacies for women empowerment, while Maybelline (another L’Oreal owned-brand) advocates for self-confidence and expression. “There’s a mouthpiece [brand] for each advocacy,” he said.

One wonders sometimes what the whole point and benefit is for a conglomerate to have to be caring about the environment, when for business purposes, it’s usually easier for companies to turn a blind eye.

“It actually does cost us more,” said Mr. Vega. “The production of renewable materials and ingredients is not that scaled yet. But it’s a matter of starting it. As we start this, and as the big conglomerate that we are, we have the bets that will trigger the change,” he said.

It should be noted that Garnier is relatively inexpensive, this new serum costing P649 for 30mL. “Usually, sustainable products are very expensive. The fact that Garnier is priced accessibly, I think that’s a big thing as well,” said Mr. Vega.

“Right now, we’re bearing that cost, but what matters is really how we’ll be able to impact the environment moving forward,” he said. “We understand that corporations and manufacturing have been a culprit in previous years, and it’s about owning up to that and saying that now is time for us to change,” he admitted.

“It’s about really trying to make a difference and making sure that this planet is still around for future generations.”

The Garnier Bright Complete Anti Acne Serum is available on Lazada and Shopee and leading stores.

Villars’ PremiereREIT files P3.2-billion IPO

VILLAR-led Premiere Island Power REIT Corp. filed the registration statement of its P3.2-billion initial public offering (IPO) with the Securities and Exchange Commission.

Led by Manuel Paolo A. Villar, the company also known as PremiereREIT is a power and infrastructure real estate investment trust sponsored by Prime Asset Venture, Inc. (PAVI) subsidiaries.

It plans to offer up to 1.4 billion secondary common shares at a maximum offer price of P2.00 per share, with an over-allotment option of up to 210 million secondary common shares.

The offer shares will be sold by PAVI subsidiaries such as S.I. Power Corp. and Camotes Island Power Generation Corp.

“The company is looking to list in November 2022,” the company said in a press release on Friday.

To date, the portfolio of PremiereREIT includes land, land rights, key power plant assets, and other ancillary infrastructure that are leased to and utilized by its sponsors for power generation operations.

Its weighted average lease expiry is 9.24 years while its total generating capacity is at 21.27 megawatts.

“PremiereREIT aims to be among the leading diversified power and infrastructure REITs in the Philippines in terms of portfolio, profitability, growth, sustainability and dividend yield,” the company said.

It is also planning to venture into renewable energy.

“PremiereREIT plans to engage in greener, renewable and sustainable energy as part of ensuring different asset classes with continued capital appreciation and social accountability,” it said.

PremiereREIT has tapped China Bank Capital Corp., as the listing’s sole issue manager and underwriter.

Mr. Villar is the eldest son of business tycoon Manuel “Manny” B. Villar, Jr., and is also the president and chief executive officer of Vista Land & Lifescapes, Inc.

On Friday, shares in Vista Land lost 10 centavos or 5.08% to finish at P1.87 apiece. — Justine Irish D. Tabile